The adoption of managed SD-WAN services has steadily increased in the past couple of years across geographies and industries, driven by a rise in remote work. SD-WAN managed services outsourcing grew by about 40% from 2021 to 2022. Additionally, the enterprise need for network security, effective application, and user and policy optimization is driving joint SD-WAN and SASE implementations. However, businesses still face challenges, such as migration from existing legacy networks, vendor management, and lack of skilled resources, while implementing SD-WAN.

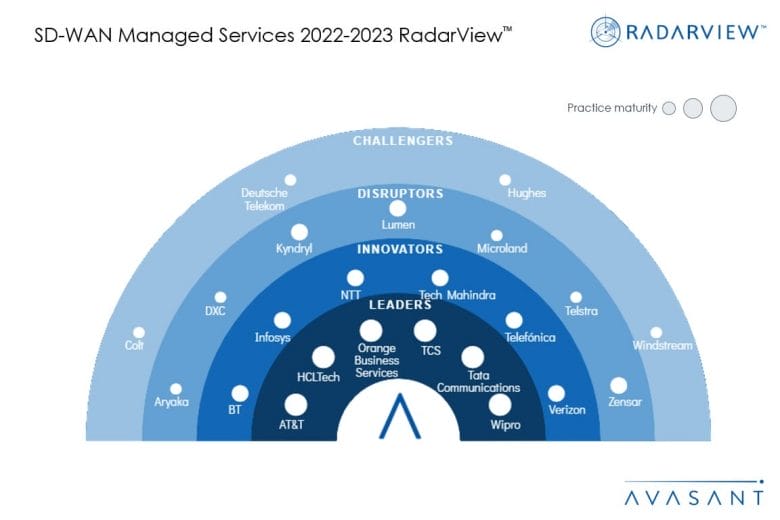

These trends, and others, are covered in Avasant’s SD-WAN Managed Services 2022–2023 RadarView™. The report provides a comprehensive study of leading managed SD-WAN service providers and a view of the current landscape and top trends. It also takes a close look at the leaders, innovators, disruptors, and challengers in this market.

Avasant evaluated over 40 providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these, we recognized 23 that brought the most value to the market during the past 12 months.

The report recognizes providers in four categories:

-

- Leaders: AT&T, HCLTech, Orange Business Services, TCS, Tata Communications, and Wipro

- Innovators: BT, Infosys, NTT, Tech Mahindra, Telefónica, and Verizon

- Disruptors: Aryaka, DXC, Kyndryl, Lumen, Microland, Telstra, and Zensar

- Challengers: Colt, Deutsche Telekom, Hughes, and Windstream

Figure 1 from the full report illustrates these categories:

“With enterprises returning to the office at a variable pace, hybrid work models are becoming the new normal,” said Mark Gaffney, Avasant senior director. “For long-term success, enterprises should consider flexible network and security solutions.”

The full report provides a number of findings, including the following:

-

- Despite organizations now showing a preference for a return to the office for their employees, remote work still retains a lot of traction, compared to pre-pandemic levels.

- Remote work will continue to be a key work model for employees in companies driven by several business drivers such as improvement of employee experience and productivity, management of an agile workforce, and reduction in the cost of operations.

- Industries such as high-tech, manufacturing, and healthcare and life sciences are witnessing traction in managed SD-WAN services — they account for almost half of the managed SD-WAN services engagements.

- Although North America leads the adoption of managed SD-WAN services, followed by Europe, emerging geographies such as LATAM and MEA are seeing an increase in the acceptance of these services.

“Managed SD-WAN services have seen a continued enterprise adoption supported by the need to integrate networking and security,” said Shwetank Saini, associate research director at Avasant. “Enterprises are finally understanding the importance of secure and agile networks, which not only help reduce costs but also deliver value to their clientele.”

The full report also features detailed profiles of 23 service providers, along with their solutions, offerings, and experience in assisting enterprises with the adoption of SD-WAN services.

This Research Byte is a brief overview of the SD-WAN Managed Services 2022-2023 RadarView™ (click for pricing).