The property and casualty (P&C) insurance process transformation market is undergoing rapid change as insurers adapt to rising regulatory complexity, climate-related risks, and evolving customer expectations. Advanced technologies such as AI, machine learning, and IoT are increasingly being deployed to strengthen underwriting accuracy, accelerate claims processing, and enhance fraud detection. The growing frequency of natural catastrophes is pushing insurers to invest in predictive analytics and scenario modeling for better risk management.

Both state of the market and supply-side trends are covered in Property and Casualty Insurance Business Process Transformation 2025 Market Insights™ and Property and Casualty Insurance Business Process Transformation 2025 RadarView™, respectively. These reports present a comprehensive study of P&C insurance outsourcing service providers and closely examine the market leaders, innovators, disruptors, and challengers.

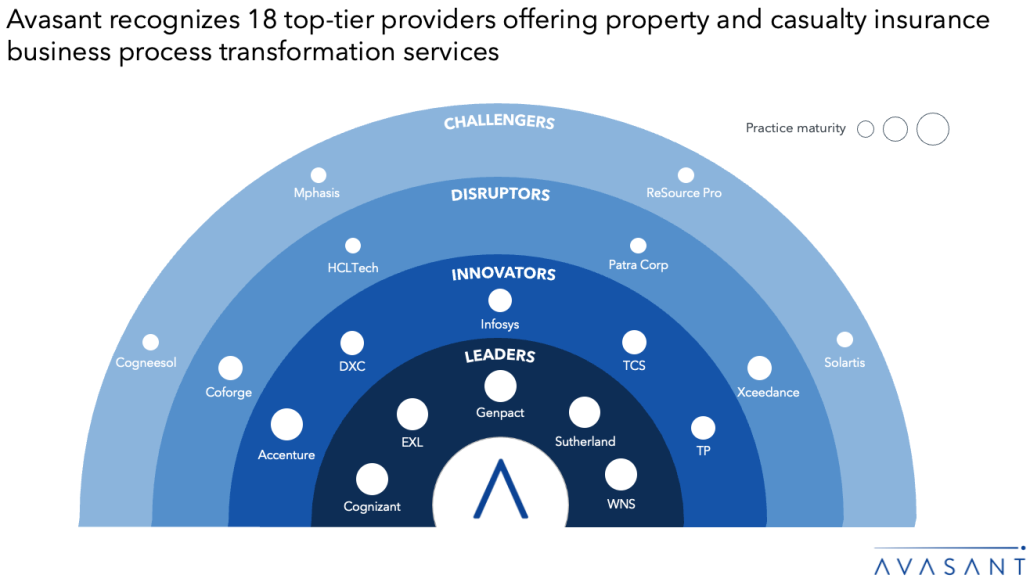

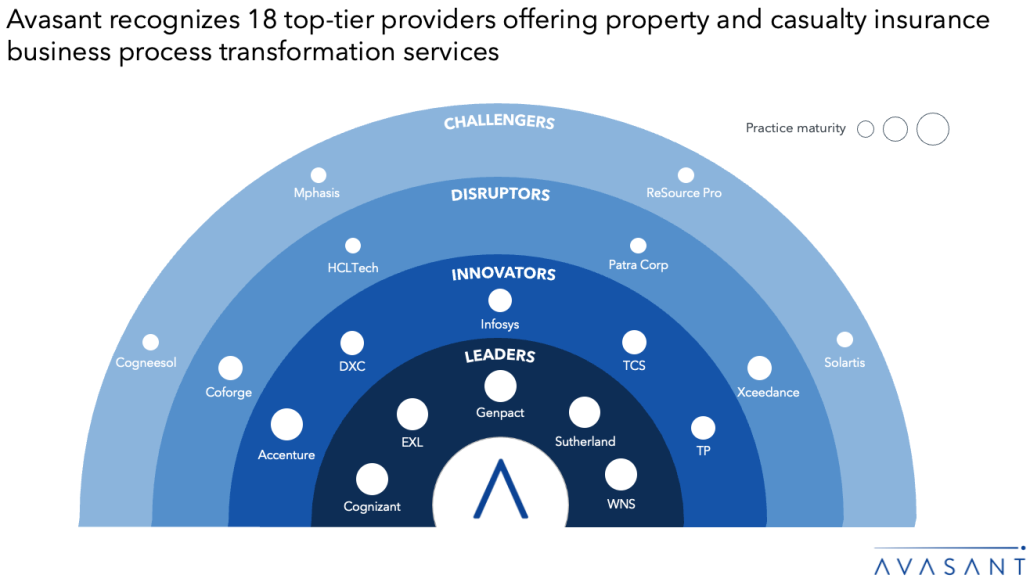

Avasant evaluated 46 providers using three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of these providers, we recognized 18 that brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Cognizant, EXL, Genpact, Sutherland, and WNS

- Innovators: Accenture, DXC, Infosys, TCS, and TP

- Disruptors: Coforge, HCLTech, Patra Corporation, and Xceedance

- Challengers: Cogneesol, Mphasis, ReSource Pro, and Solartis

The following figure from the full report illustrates these categories:

“Regulatory pressures, natural disasters, and growth in digital distribution are redefining P&C insurance,” said Robert Joslin, partner at Avasant. “Insurers must use service providers to modernize policy administration, integrate analytics-driven claims management, and build scalable operations that enhance efficiency and resilience.”

The full report provides several findings and recommendations, including the following:

Premium growth in P&C insurance is up 16% from January 2020 to July 2025, driven by inflation, catastrophe losses, and structural risks such as climate change and litigation, with a sharp index jump in early 2025 due to reinsurance renewals.

-

- Climate intelligence and parametric insurance are building resilience as regulators mandate climate risk integration, while 61% of global losses remain uninsured, highlighting a major market opportunity.

- Cyber insurance is becoming essential due to systemic AI-powered cyber risks. The cyber insurance market is projected to grow more rapidly than the overall insurance industry and shift toward prevention-plus-indemnity models.

- Claims management continues to be the most resource-intensive process, rising from 37% to 40% of head count between March 2024 and March 2025, while North America leads in revenue contribution with a 46% share.

- Hybrid pricing models remain dominant with a steady 70% share due to their flexibility, while outcome-based models declined from 9% to 7% amid regulatory and market uncertainties.

“As insurers modernize operations, there is increased focus on intelligent automation and contextual customer engagement,” said Aditya Jain, research leader at Avasant. “Service providers are using AI-driven platforms to streamline claims triage, personalize policy servicing, and embed climate and cyber risk intelligence into core workflows.”

The RadarView also features detailed profiles of the top 18 service providers, including their solutions, offerings, and experience assisting enterprises in their P&C insurance process transformation journeys.

Research Byte briefly overviews Avasant’s Property and Casualty Insurance Business Process Transformation 2025 Market Insights™ and Property and Casualty Insurance Business Process Transformation 2025 RadarView™. (Click for pricing)