This RadarView™ helps enterprises in the Nordics craft a robust strategy based on regional outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 20 providers offering digital services in the Nordics. Each profile provides an overview of the service provider, its key digital solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovation, and ecosystem development.

Why read this RadarView?

Nordic enterprises are accelerating digital transformation by rapidly adopting AI, cloud, and automation to enhance efficiency, resilience, and innovation amid rising cost pressures and talent shortages. They are strengthening cybersecurity and sovereign cloud capabilities in response to increasing cyberattacks and stricter EU/Nordic regulations. Enterprises are also expanding global competency centers (GCCs) to scale digital engineering and modernize legacy systems. Governments and companies are jointly addressing advanced skills gaps through large-scale upskilling, academic partnerships, and AI-enabled workforce tools. With strong regional commitments to sustainability, Nordic enterprises are deploying digital solutions to reduce emissions, improve energy efficiency, and advance green innovation across sectors.

The Nordics Digital Services 2025–2026 RadarView™ highlights key supply-side trends in the Nordics and Avasant’s viewpoint on them. It aids Nordic-based companies in identifying top service providers to assist them in their digital transformation initiatives. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to identify the right strategic partners.

Featured providers

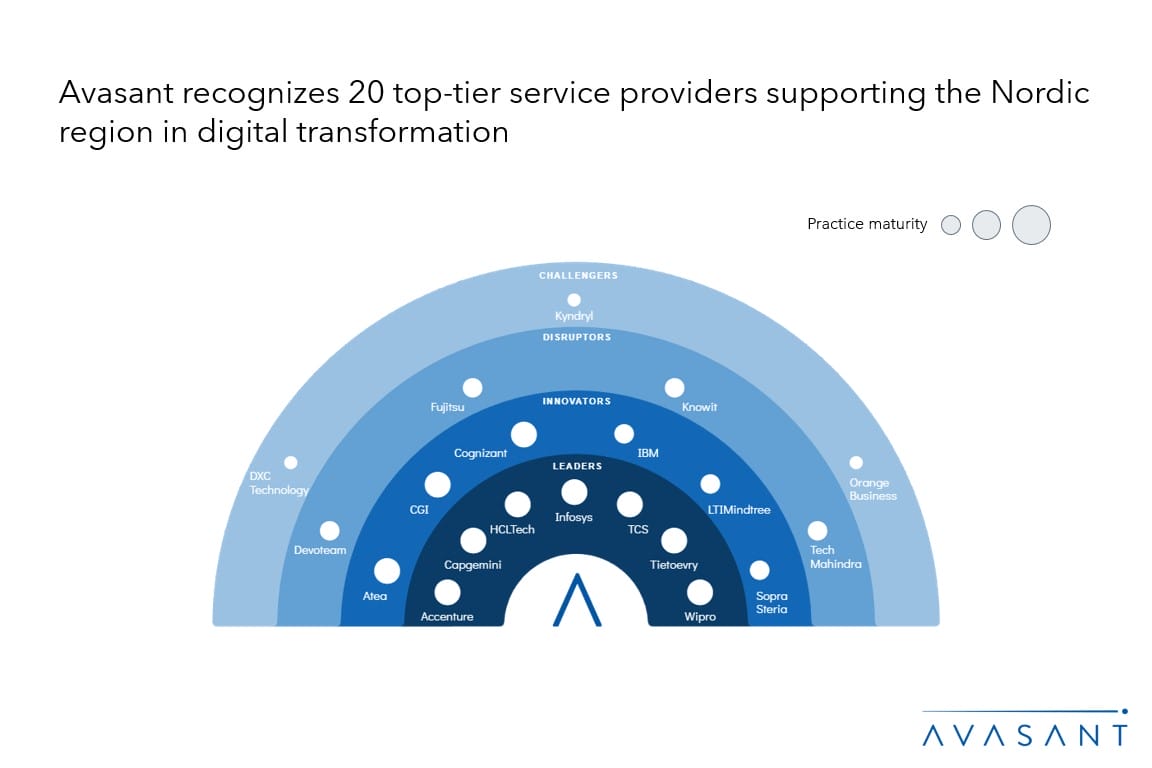

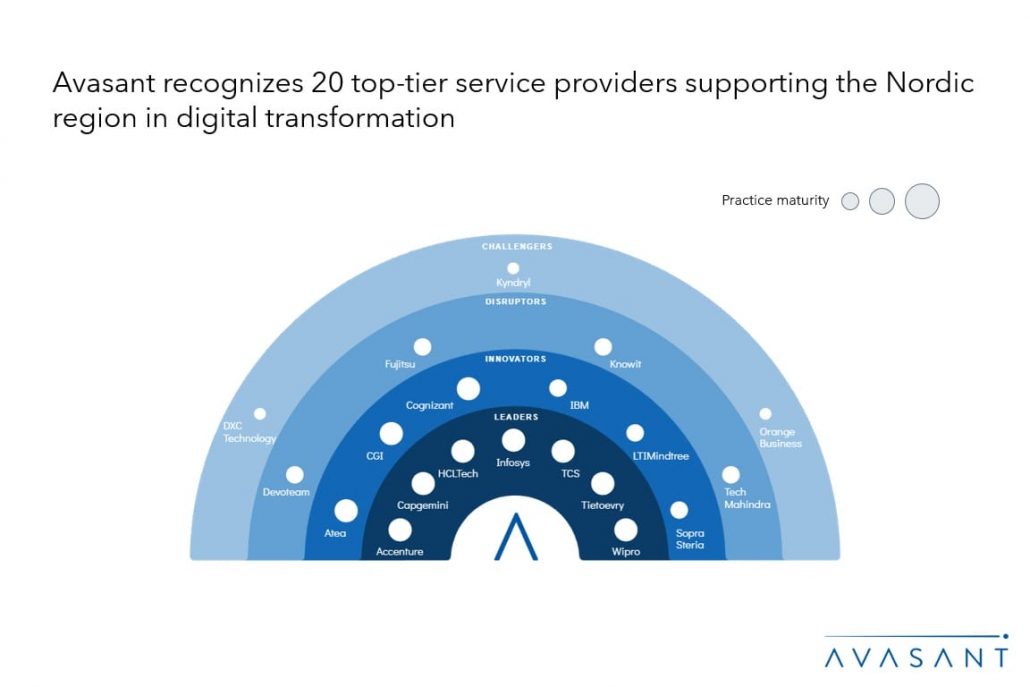

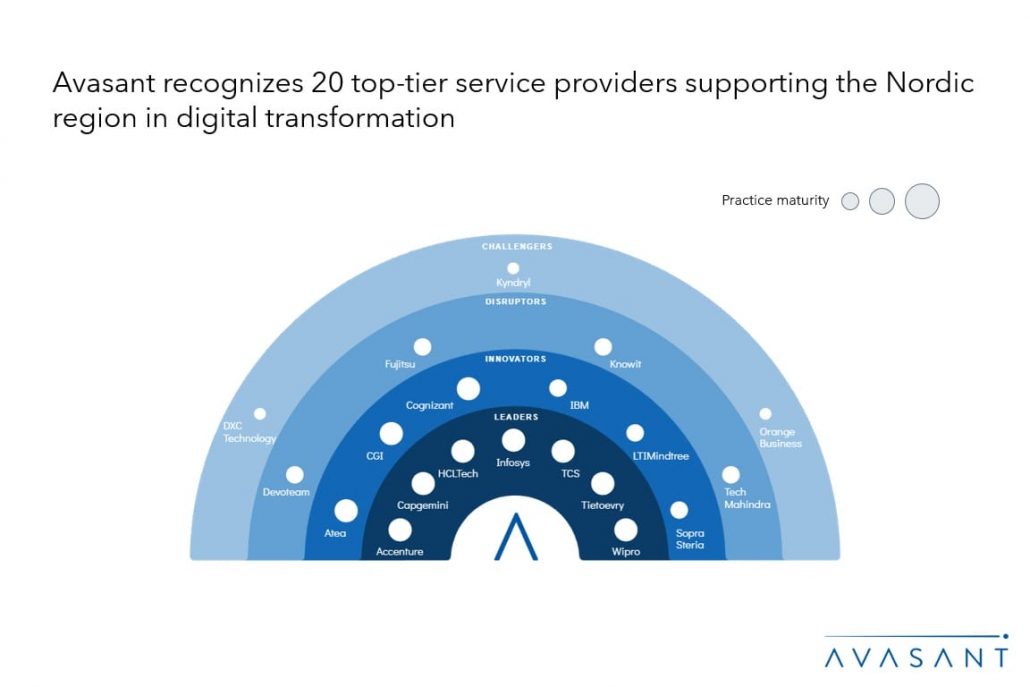

This RadarView includes a detailed analysis of the following service providers: Accenture, Atea, Capgemini, CGI, Cognizant, Devoteam, DXC Technology, Fujitsu, HCLTech, IBM, Infosys, Knowit, Kyndryl, LTIMindtree, Orange Business, Sopra Steria, TCS, Tech Mahindra, Tietoevry, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 6–11)

-

- Regional scope of the report

- Avasant recognizes 20 top-tier service providers supporting the Nordic region in digital transformation

- Provider comparison

Supply-side trends (Pages 12–17)

-

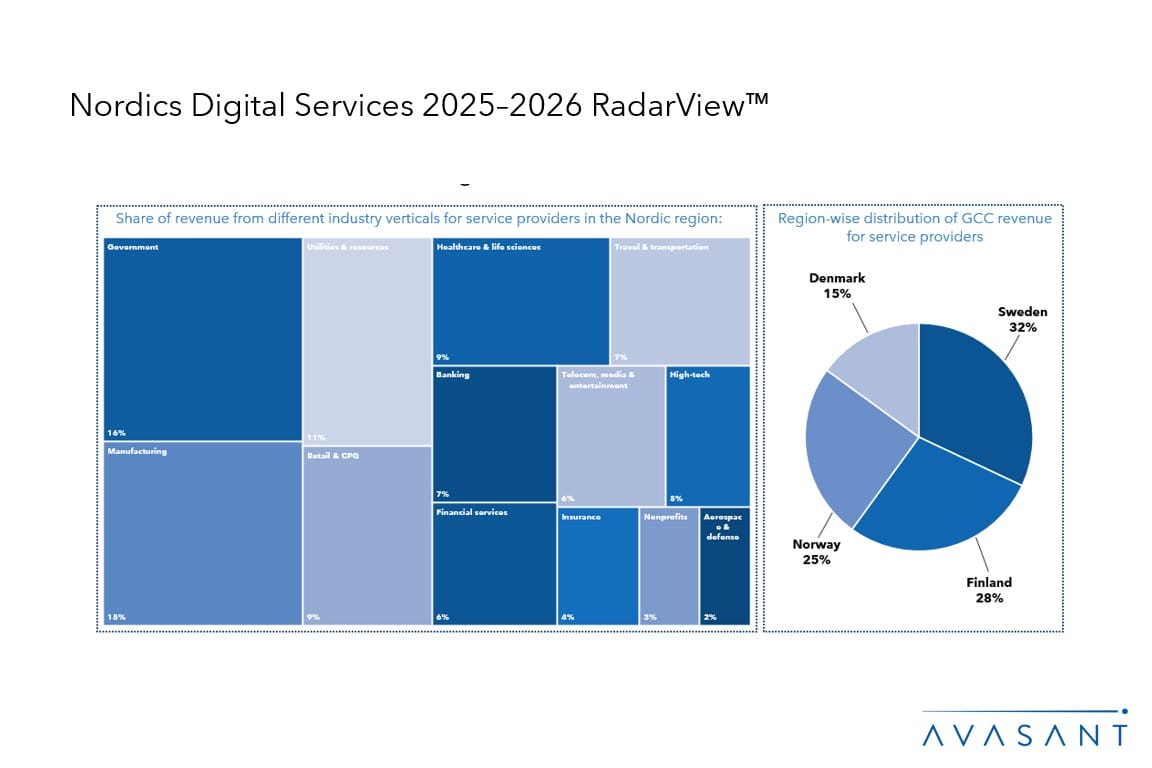

- Government, manufacturing, and utilities and resources sectors are driving digital transformation in the Nordic region

- Service providers in the Nordics are expanding AI offerings tailored to local clients, driving enterprise adoption of advanced technologies

- Service providers are leveraging AI and investing in acquisitions and partnerships with specialists to enhance security offerings for their Nordic clients

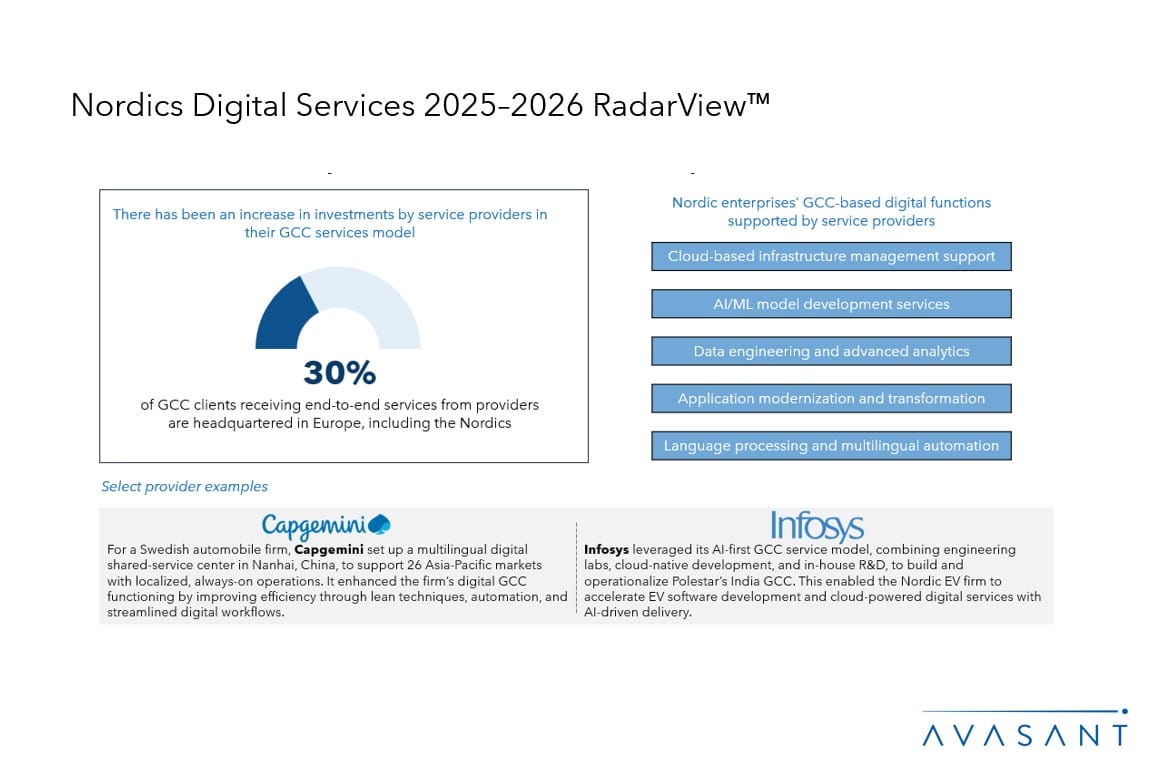

- Providers are helping Nordic enterprises modernize their GCC operations through AI, cloud, data analytics, and innovation-led delivery models

- Service providers are leading the charge in empowering Nordic talent and advancing regional skill development in AI/Gen AI and cloud

Service provider profiles (Pages 18–78)

-

- Detailed profiles for Accenture, Atea, Capgemini, CGI, Cognizant, Devoteam, DXC Technology, Fujitsu, HCLTech, IBM, Infosys, Knowit, Kyndryl, LTIMindtree, Orange Business, Sopra Steria, TCS, Tech Mahindra, Tietoevry, and Wipro.

Appendix (Pages 79–82)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 83)

Read the Research Byte based on this report. Please refer to Avasant’s Nordics Digital Services 2025–2026 Market Insights™ for insights on the demand side trends.