The National Retail Foundation (NRF) 2026 event showcased that retail is no longer focused on debating disruption. It has shifted to building what works at scale. Retail advantage is being rebuilt around one outcome: helping customers reach the right purchase faster, while protecting profitability across the full journey, including returns. AI is accelerating this shift, with the most credible strategies using AI to support people, improve decisions, and strengthen execution at scale.

What stood out at the event was how practical the conversation has become. Retailers are no longer debating whether AI, new store concepts, or creator-led marketing will work. They are focused on what can be rolled out at scale, what improves the customer experience, and what protects margins in a market where shoppers have endless options and very low patience. Across NRF’s official sessions, three priorities were emphasized: improving digital discovery so customers find the right item faster; redesigning stores as destinations built on community and immersive engagement; and strengthening the profit engine through marketplaces and modern returns. While AI is the central driver, the strongest messages emphasize combining AI with human expertise.

Key Retail Signals and Enterprise Implications

1) Ecosystems are becoming a model for growth and resilience.

One of the clearest signals came from the CVS Health and Magazine Luiza (Magalu) session, which showed how retailers are expanding beyond traditional retail into broader ecosystem businesses. CVS Health shared that its shift was powered by a deliberate M&A-led strategy, using acquisitions to build stronger anchors across the customer journey. CVS framed its ecosystem around care, coverage, and community, supported by capabilities such as Aetna, MinuteClinic, and its pharmacy network, moving from one-time transactions toward longer-term customer relationships.

This reflects a trend we highlighted in our report, From Complexity to Clarity: Divestitures Reshaping the Future of Retail & CPG, where portfolio actions are being increasingly used to reshape business models and unlock new growth paths.

Why this matters?

Ecosystems reduce dependence on a single channel or product category by creating multiple ways to serve customers and create room for new revenue streams beyond core retail transactions.

CVS also reinforces how M&A can accelerate ecosystem building, helping retailers add capabilities faster and connect them into one more integrated experience, strengthening both customer stickiness and business resilience.

2) Creativity and community are now central to Gen Z engagement.

Retailers continue to prioritize Gen Z as a growth segment. Pacsun highlighted creativity, community, and commerce as the foundation for Gen Z connection. The focus was on building authentic engagement and participation rather than relying only on traditional campaigns, the message emphasized building connection through cultural relevance and community-led engagement.

Why this matters?

As customer attention becomes harder to earn, retailers are increasingly building repeatable creator and community programs instead of one-off influencer activations. Creator-led engagement helps brands stay present in the moments that shape consumer behavior, especially as audiences face constant digital overload. This approach also reflects a broader NRF message: relevance today comes from staying closely connected to communities and evolving audience expectations over time.

3) Digital shopping is shifting from “ranking” to “relevance.”

As digital commerce matures, retailers are trying to reduce friction in product discovery and improve confidence in purchasing decisions.

The NRF session “The shift from ranking to relevance” featured executives from Lowe’s and Abercrombie & Fitch, who emphasized delivering experiences built around context and trusted insight. This signals a shift in how retailers define digital success. Instead of pushing more choices, retailers are trying to help customers arrive at the right choice faster through relevance, clarity, and confidence.

Why this matters?

As customer attention becomes harder to earn, discovery experiences must work better. Retailers that improve relevance can reduce drop-off, improve conversion, and potentially reduce returns caused by poor purchase decisions.

4) Stores are being repositioned as community destinations and immersive experiences.

Physical stores are integrating dynamic content and experience zones to stay as engaging as the fast-moving culture customers see on social media. Barnes & Noble was featured for creating community-focused store environments built around “discovery and delight,” with an emphasis on making customers feel welcome and comfortable.

This shift moves store strategy beyond convenience and availability. Stores are being designed as places that build connection, not just complete transactions. In parallel, NRF highlighted immersive and interactive retail experiences through Dick’s House of Sport, showing how store layout, content, and interactive elements can deepen engagement, strengthen visual merchandising, and improve customer interaction.

Why this matters?

Stores are becoming storytelling platforms. Retailers are moving from static shelves and signage to immersive product narratives, where visual appeal, technical specs, and even sustainability credentials can be presented through contextual digital content. Packaging alone is no longer enough; dynamic layers such as QR-linked videos, interactive screens, and AR-style experiences are becoming the new standard for engagement. Community-led environments build loyalty because they transform the store from a purchase destination to a relationship destination. Stores designed around discovery and comfort encourage customers to spend more time, revisit more often, and form a stronger emotional connection with the brand, thereby driving higher engagement, more consistent traffic, and long-term customer retention. Experience becomes a competitive advantage. Immersive formats help brands stand out in product categories, turning the store visit into a reason to choose one retailer over another.

5) Marketplace expansion is becoming a mainstream growth lever for large retailers.

NRF highlighted how Best Buy, Nordstrom, and Target are using marketplaces to expand their digital shelf, adding more SKUs and widening assortment through third-party sellers. Marketplaces are becoming a practical way to grow selection without taking on the full burden of inventory ownership, warehousing, and demand risk. Retailers can offer broader choice on their platforms while still benefiting from customer trust tied to the retail brand and shopping experience. In October 2025, Ulta Beauty also launched its UB Marketplace, showing how marketplaces are expanding beyond general merchandise into category-led formats. Its approach is invite-only and curated, focused on bringing in new beauty and wellness brands while maintaining a consistent Ulta customer experience.

Why this matters?

Marketplace-led growth can unlock new revenue and improve customer retention, but it only works if retailers maintain strong controls on product quality, fulfillment speed, returns, and customer support. It also signals a broader shift toward multichannel distribution, where products reach consumers through a mix of direct brand channels, retail partnerships, and marketplace networks at the same time. For CPG manufacturers, this increases the importance of supply chain flexibility and consistent product availability across these parallel routes to market.

6) The next step in AI-powered shopping journey is the rise of agent-led commerce.

Google introduced the Universal Commerce Protocol (UCP), an open-source standard designed to help AI assistants complete shopping journeys end-to-end, from discovery to checkout and post-purchase support. The goal is to enable agent-led shopping where customers can search, compare, personalize, and purchase without switching apps. UCP creates a common way for AI systems such as Google Search and Gemini to connect with retailer platforms, reducing the need for one-off integrations across every agent or channel. Google is working with partners such as Shopify and Target to drive broader adoption. It also teamed up with Walmart to integrate shopping from Walmart and Sam’s Club directly into Gemini in the US, enabling conversational, AI-assisted purchases within Walmart’s shopping environment.

Why this matters?

UCP signals retail’s shift toward agent-led commerce, where AI agents handle end-to-end shopping autonomously. Retailers that adopt these standards early can reduce friction in the shopping journey while still controlling pricing, checkout, and the customer relationship. It also raises the bar on retail readiness. Product data, availability, and offers must be accurate and structured so AI can recommend and complete purchases with confidence.

7) Reverse logistics and circular retail are moving from cost management to value recovery.

Reverse logistics is increasingly being treated as a growth and profitability lever rather than a back–end cost. Retailers are strengthening their reverse supply chains to move returned and excess inventory through inspection, sorting, refurbishment, repackaging, and resale more efficiently. This enables circular retail models that support reuse, repair, resale, and recycling while improving recovery rates and reducing waste. NRF also highlights retailers are using data, analytics, and AI to improve recovery rates and create additional revenue streams through recommerce and B2B resale channels. They are applying decision rules to determine the next best action for each item based on condition, demand, recovery value, and cost-to-process. This helps retailers route products to the right outcome quickly, such as restock, refurbish, resale, or recycle. This reduces processing time and handling costs, limits write-offs, and increases the percentage of inventory recovered at a higher value, making returns a measurable margin lever rather than margin leakage.

Why this matters?

Returns and overstocks are rising across retail, making value recovery critical for protecting margins. Strong reverse logistics improves the customer experience, increases value recovered per item, and creates new revenue streams through resale and recommerce, while supporting circularity targets.

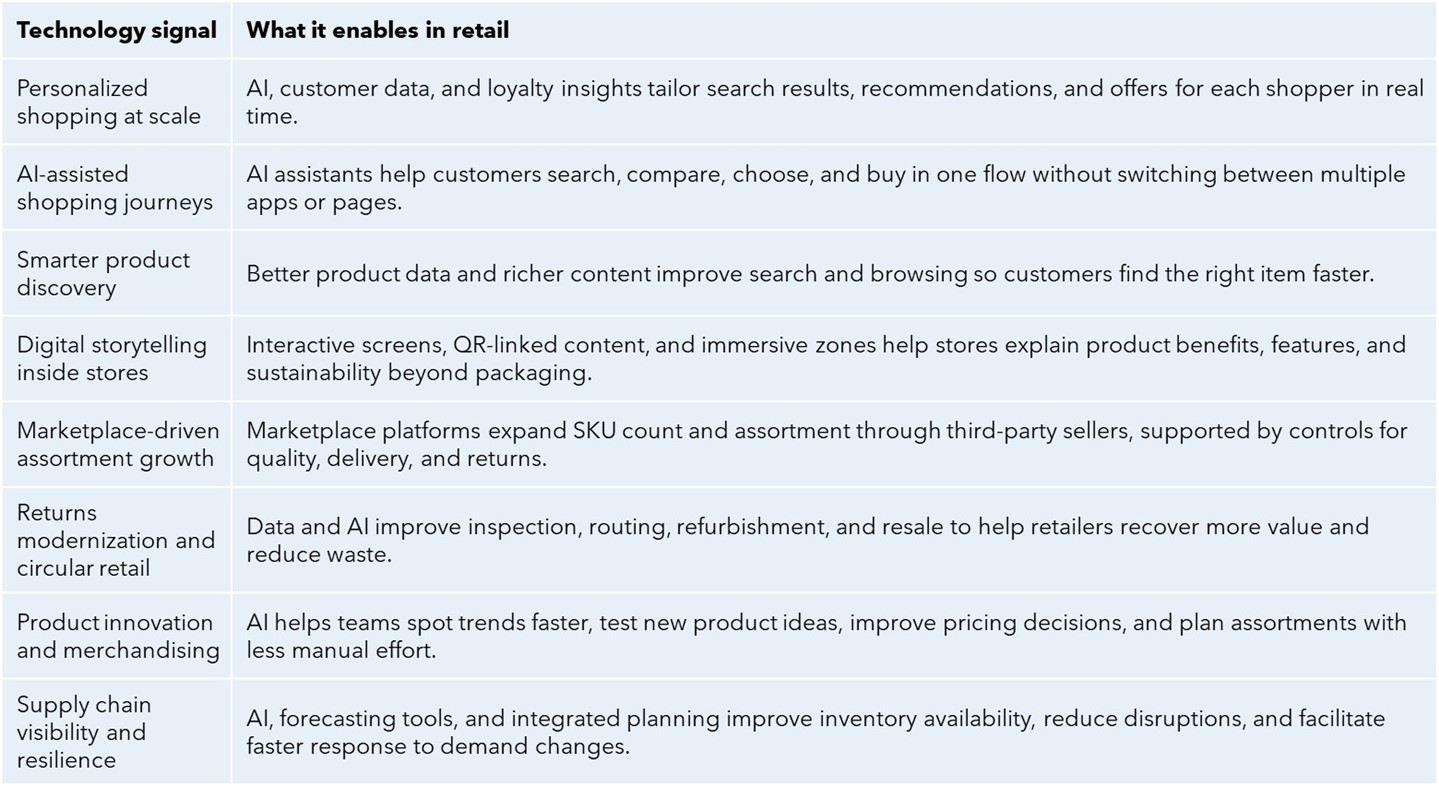

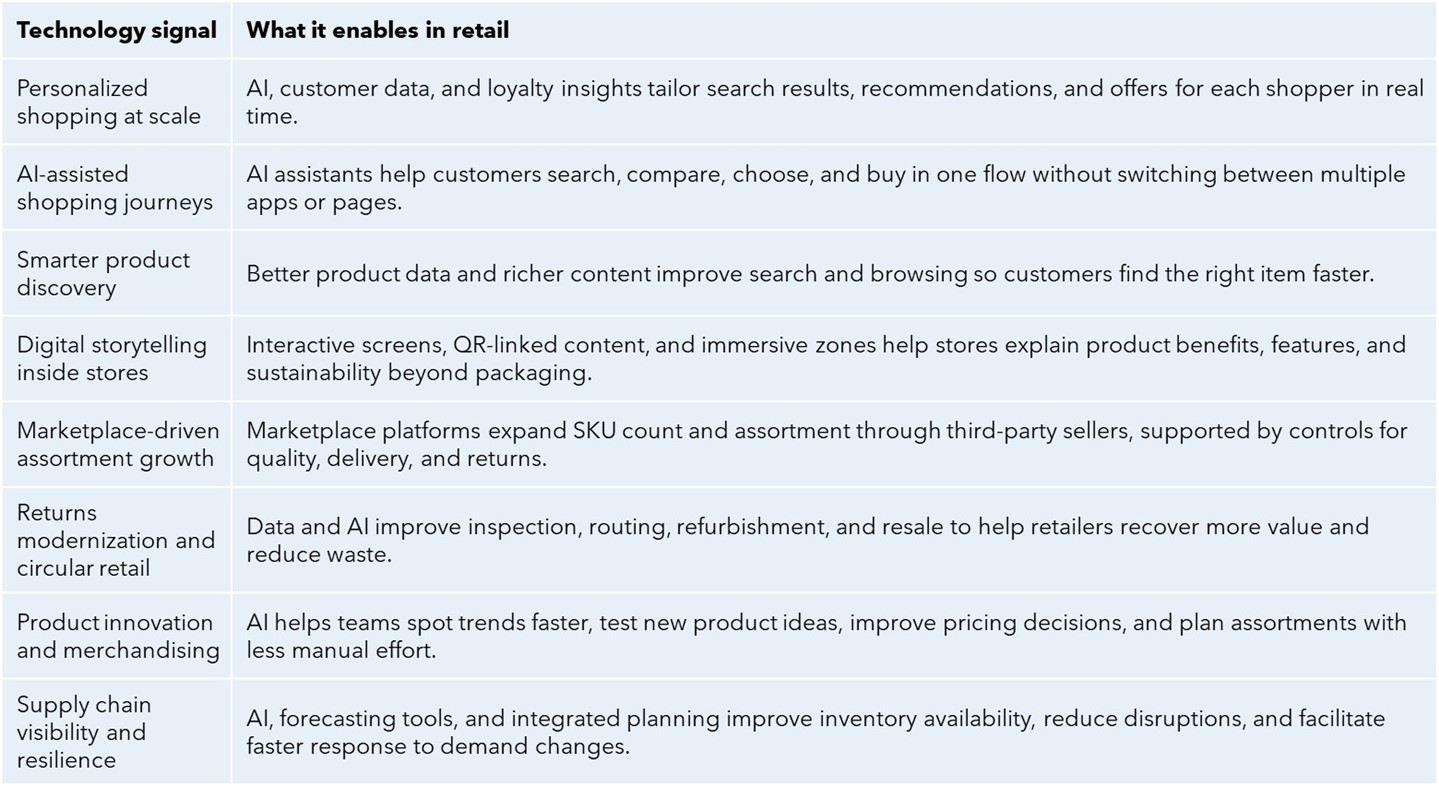

Key Technology Signals from NRF 2026

Key Takeaways and Strategic Recommendations

NRF 2026 indicated that competitive advantage in retail is no longer determined by launching new digital features. It is increasingly determined by how well retailers connect the end-to-end journey across relevance, experience, and value recovery. Retailers are building models that keep customers engaged across channels, improve shopping confidence through better discovery, and protect margins through marketplace expansion, AI-supported workflows, and stronger post-purchase economics.

For enterprises, the immediate actions are clear:

- Design for relevance-first commerce:

Search, navigation, and product content must help customers reach the right choice faster, with fewer steps and higher confidence.

- Prepare for AI-assisted shopping journeys:

Retailers should treat AI as a new entry point to commerce and ensure product data, availability, and offers are structured so AI can guide and complete purchases reliably.

- Rebuild stores as destinations:

Store formats should prioritize community, comfort, and interactive engagement, turning physical retail into a loyalty engine rather than only a fulfillment node.

- Scale marketplaces with governance:

Assortment growth through third-party sellers must be matched with clear standards for quality, fulfillment performance, returns, and customer support accountability.

- Turn returns into value recovery:

Reverse logistics needs to shift from cost control to structured recovery through smarter routing, refurbishment, resale, and circular pathways.

- Invest in workforce enablement alongside technology:

The best retail outcomes will come from combining automation with frontline expertise, supported by the right training, tools, and operating changes that improve execution on the floor and across service channels.

NRF 2026 didn’t position retail as an industry waiting for disruption. It showed an industry actively rebuilding itself. It highlighted that retail’s pivot from digitization to intelligent orchestration, powered by agentic AI, human expertise, and ecosystem unification. For CPG manufacturers, the implications demand actions such as supply chain digitization, manufacturing AI adoption, ecosystem retail readiness, and cultural speed matching creator and consumer trends. Retailers embracing human-AI synergy while controlling first-party data will capture lifetime customer value. Technology providers packaging modular, ROI-focused solutions will enable rapid scaling among mid-market competitors.

NRF 2026 made one thing clear: retail enterprises are no longer asking what’s possible, they are prioritizing what works, what scales, and what protects the business.

By Norkit Lepcha, Lead Analyst, Avasant, and Sahaj Kumar, Research Director, Avasant