This RadarView helps enterprises define their approach for Oracle Cloud ERP adoption and to identify the right implementation partner to support them. It begins with a summary of key trends shaping the market and Avasant’s viewpoint on the road ahead for organizations adopting Oracle Cloud ERP over the next 12 to 18 months.

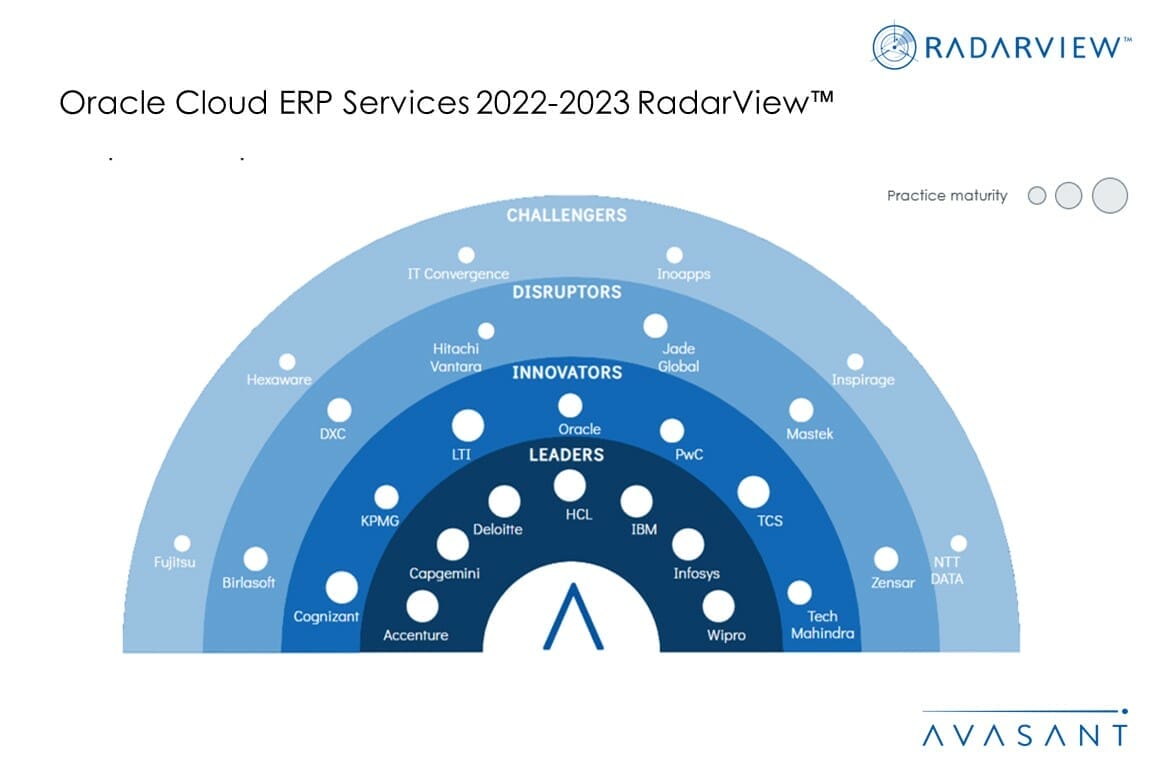

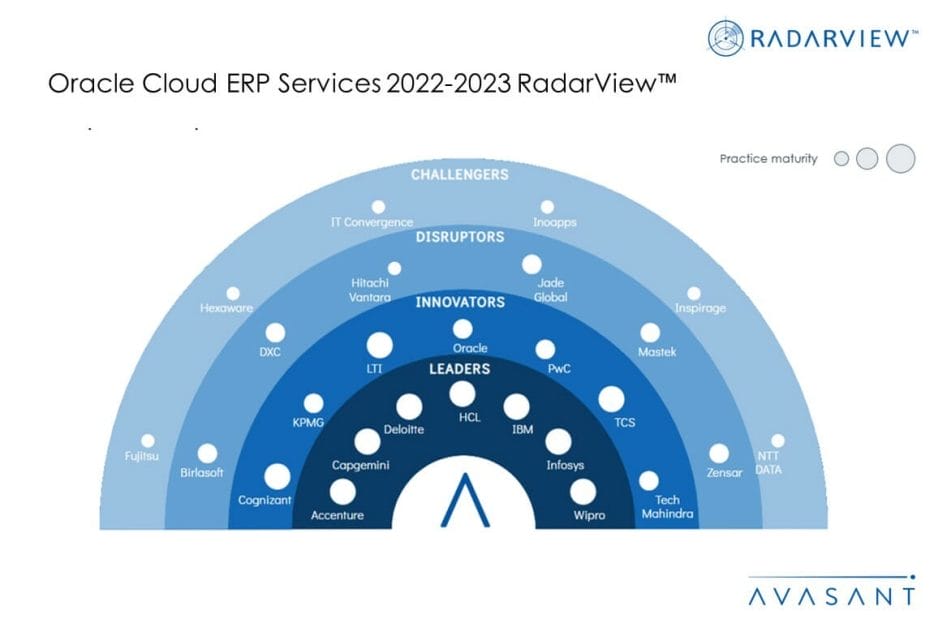

We continue with a detailed assessment of 26 top-tier providers supporting the enterprise adoption of Oracle Cloud ERP. Each profile provides an overview of the service provider, its Oracle Cloud ERP services offering, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

Oracle Cloud ERP helps businesses achieve process efficiencies. It enables organizational transformation, improves data security, enhances reporting capabilities, automates financial processes, and supports growth initiatives. It also helps companies improve their customer offerings. Thus, identifying the right Oracle Cloud ERP implementation provider based on business requirements is crucial.

This report assesses implementation services providers based on their ability to offer services with limited disruption.

Featured providers

This RadarView includes a detailed analysis of the following Oracle Cloud ERP service providers: Accenture, Birlasoft, Capgemini, Cognizant, Deloitte, DXC, Fujitsu, HCL, Hexaware, Hitachi Vantara, IBM, Infosys, Inoapps, Inspirage, IT Convergence, Jade Global, KPMG, LTI, Mastek, NTT DATA, Oracle, PwC, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

The industry insights and recommendations are based on our ongoing interactions with enterprise CXOs and other key executives, targeted discussions with service providers, subject matter experts, and Avasant Fellows, and lessons learned from consulting engagements.

Our evaluation of Oracle Cloud ERP services is based on primary input from the service providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those Oracle Cloud ERP service providers that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Defining Oracle Cloud ERP

- Key Oracle Cloud ERP trends shaping the market

- Avasant recognizes 26 top-tier providers supporting the enterprise adoption of Oracle Cloud ERP

Lay of the land (Pages 9–16)

-

- Organizations shift from legacy systems to Oracle Cloud ERP

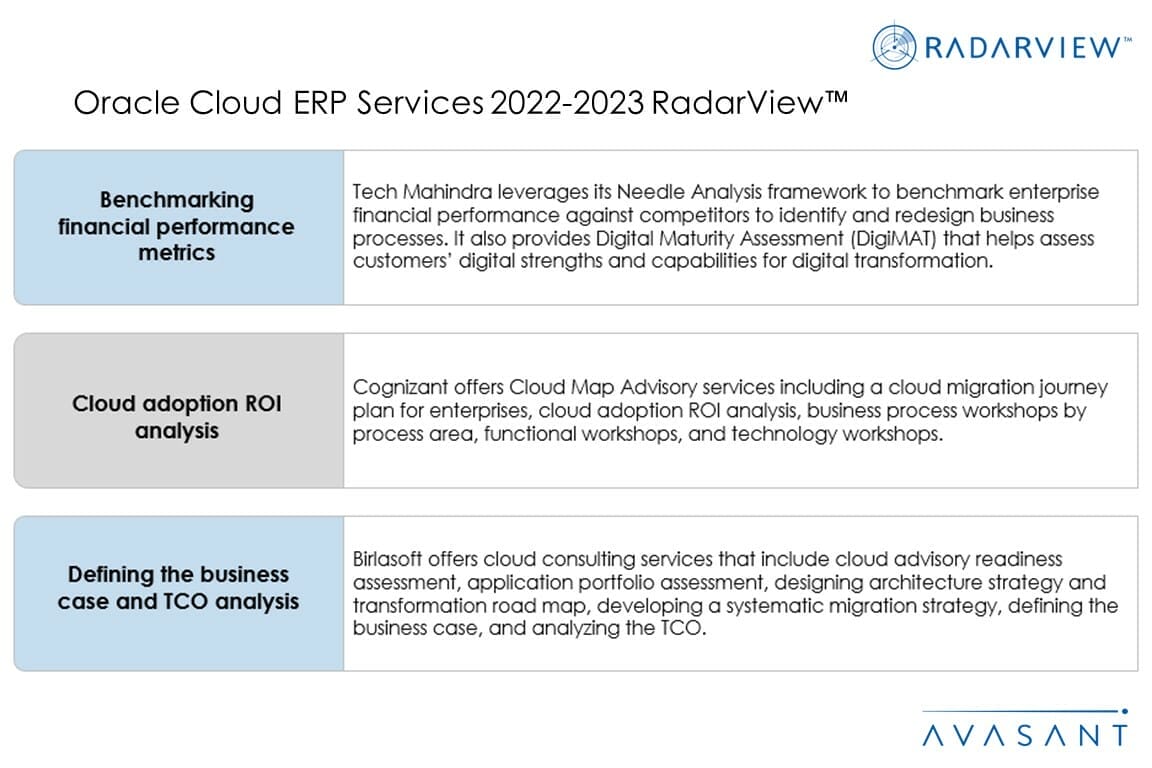

- Enterprises look out for independent assessment of the ERP environment

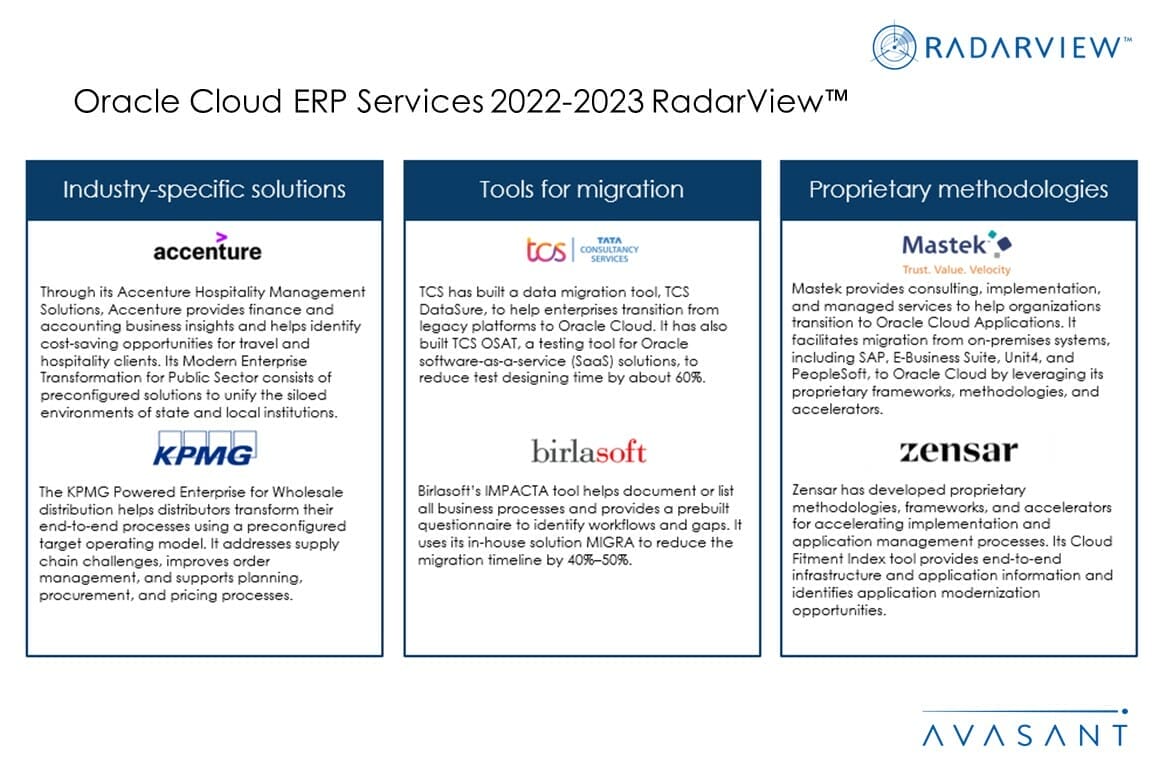

- Service providers leverage proprietary tools, industry-specific solutions, and methodologies for Oracle Cloud ERP migration

- Service providers help businesses with change management strategies

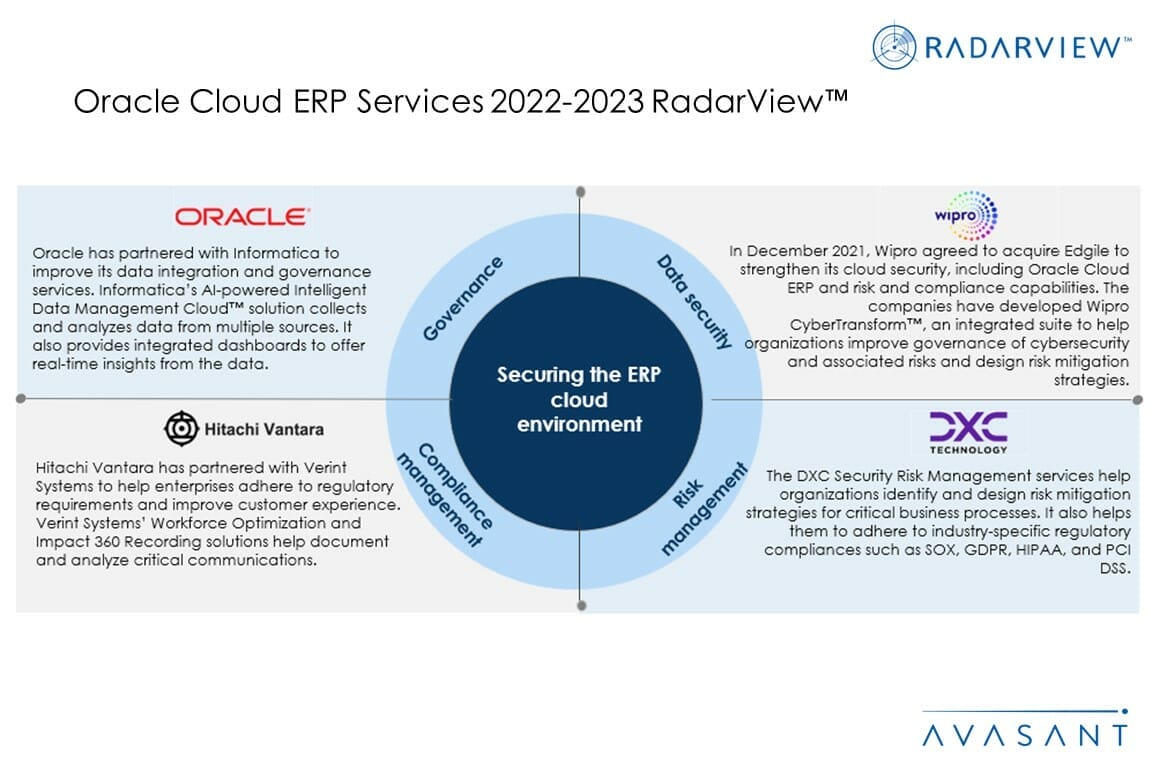

- Service providers focus on data security to secure the cloud ERP environment

- Companies rely on service providers for application managed services

- Oracle Cloud ERP service providers offer key capabilities

RadarView overview (Pages 17–22)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 23–76)

-

- Featured service providers: Accenture, Birlasoft, Capgemini, Cognizant, Deloitte, DXC, Fujitsu, HCL, Hexaware, Hitachi Vantara, IBM, Infosys, Inoapps, Inspirage, IT Convergence, Jade Global, KPMG, LTI, Mastek, NTT DATA, Oracle, PwC, TCS, Tech Mahindra, Wipro, and Zensar.

Key contacts (Page 77)

Read the Research Byte based on this report.