Property and casualty (P&C) insurers are working to meet growing customer expectations amid the increasing cost of claims, intense competition from new entrants, and a changing regulatory environment. They are leveraging digital technologies to settle claims faster, improve underwriting, and detect fraud. Leading service providers support these efforts by providing insurance domain knowledge and technological expertise.

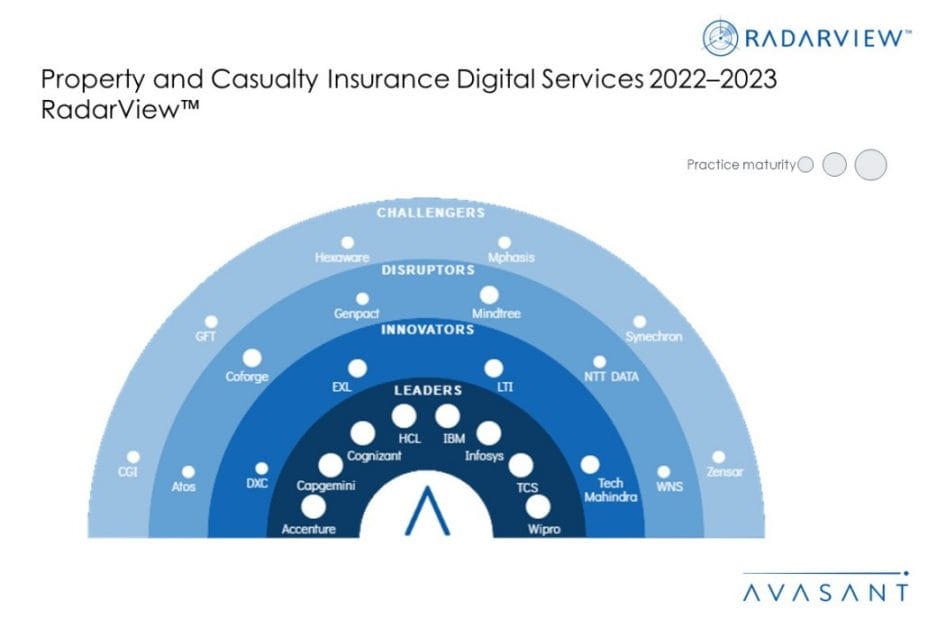

These emerging trends are covered in Avasant’s Property and Casualty Insurance Digital Services 2022–2023 RadarView™. The report is a comprehensive study of property and casualty insurance digital service providers, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

Avasant evaluated 32 providers using three dimensions: practice maturity, investments and innovation, and partner ecosystem. Of the 32 providers, we recognized 24 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCL, IBM, Infosys, TCS, and Wipro

- Innovators: DXC, EXL, LTI, and Tech Mahindra

- Disruptors: Atos, Coforge, Genpact, Mindtree, NTT Data, and WNS

- Challengers: CGI, GFT, Hexaware, Mphasis, Synechron, and Zensar

Figure 1 below from the full report illustrates these categories:

“Customer experience is the focal point for property and casualty insurance providers”, said Robert Joslin, Avasant partner. “They are being forced to improve their digital capabilities by either acquiring technology or partnering with insurtechs to provide automated and digital solutions for self-service.”

The full report provides a number of findings and recommendations, including the following:

-

- Increasing cost of raw materials, the high inflation rate in the labor market, and a recent increase in natural disasters are putting pressure on P&C profit margins.

- Major P&C insurance firms are making acquisitions to bring new technology and cover more regions worldwide. Insurtechs, electric vehicle manufacturers, house rental firms, and other new, nontraditional entrants are making the market more competitive. Changing regulations continue to present challenges.

- P&C insurers should invest in new technologies and leverage service providers to transform the customer experience. Where appropriate, they should partner with insurtechs to meet the challenge of new market entrants.

“Insurance customers are demanding a seamless, Uber-like experience, and that calls for digital technologies,” said Anupam Govil, partner with Avasant. “P&C insurers are increasingly working with insurtechs to use automation, AI, and analytics to settle claims faster, create custom pricing models, and remotely assess damages.”

The full report also features detailed RadarView profiles of 24 service providers, along with their solutions, offerings, and experience in assisting property and casualty insurers in digital transformation.

This Research Byte is a brief overview of the Avasant Property and Casualty Insurance Digital Services 2022–2023 RadarView™ (click for pricing).