This RadarView™ helps retail enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 23 providers offering digital services in the retail industry. Each profile gives an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights into the provider’s practice maturity, investments and innovation, and partner ecosystem.

Why read this RadarView?

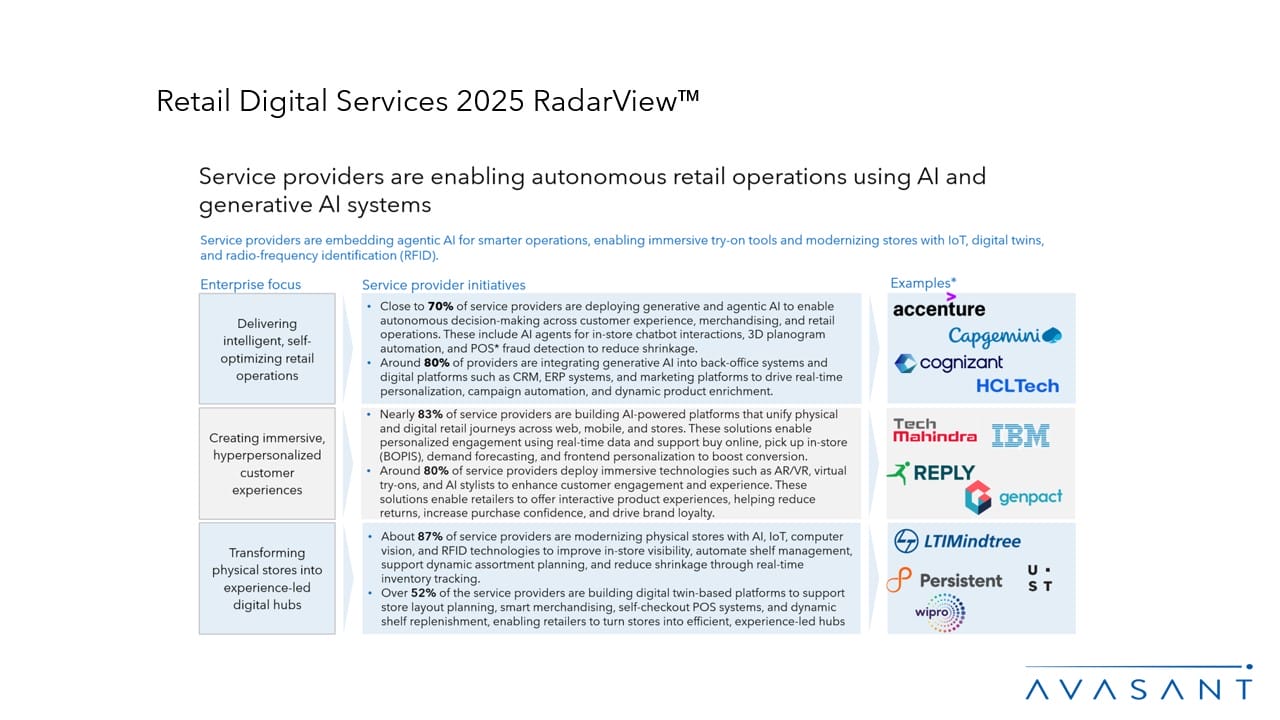

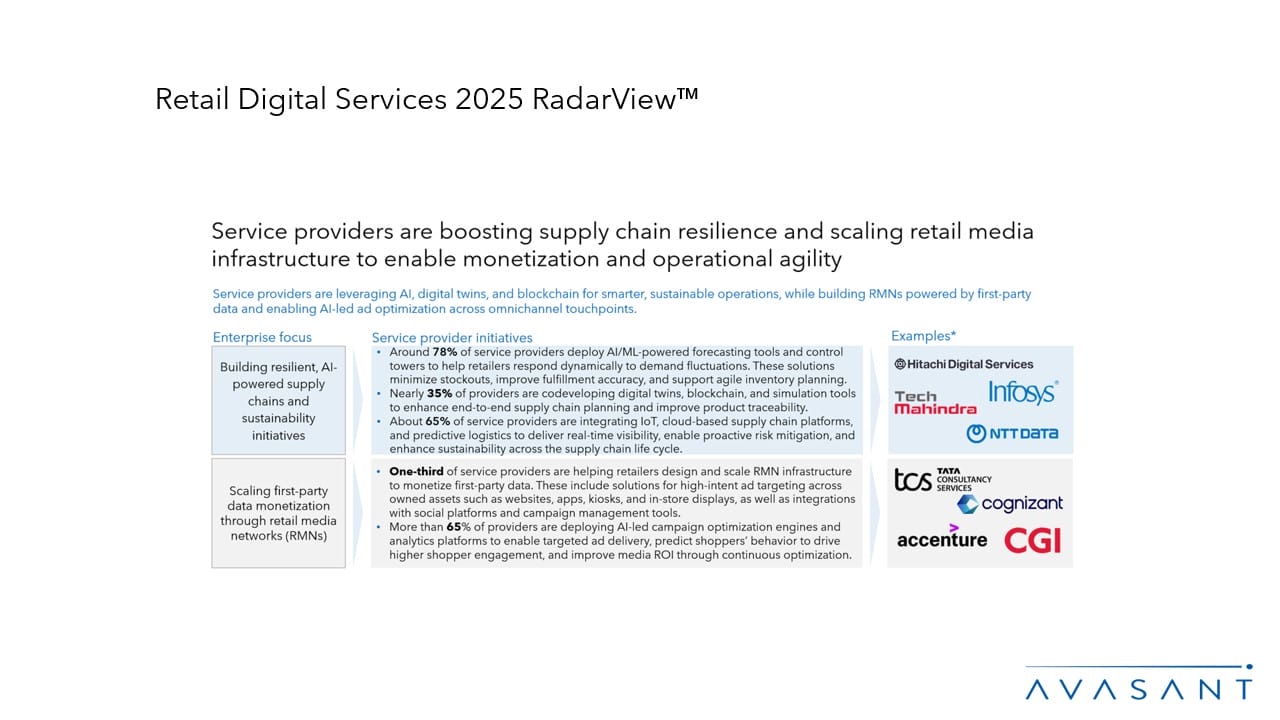

Retail enterprises are reimagining operational intelligence by integrating generative and agentic AI that can autonomously generate insights, make context-aware decisions, and take adaptive actions across the retail value chain. They are using geofencing, embracing avatars and immersive technologies to deliver hyper-personalized engagement, and modernizing physical stores into intelligent, experience-led environments. As consumer expectations shift toward more relevant and personalized advertising, retailers are scaling retail media networks (RMNs) to harness first-party data, enabling brands to deliver targeted campaigns that maximize ROI and drive deeper shopper engagement.

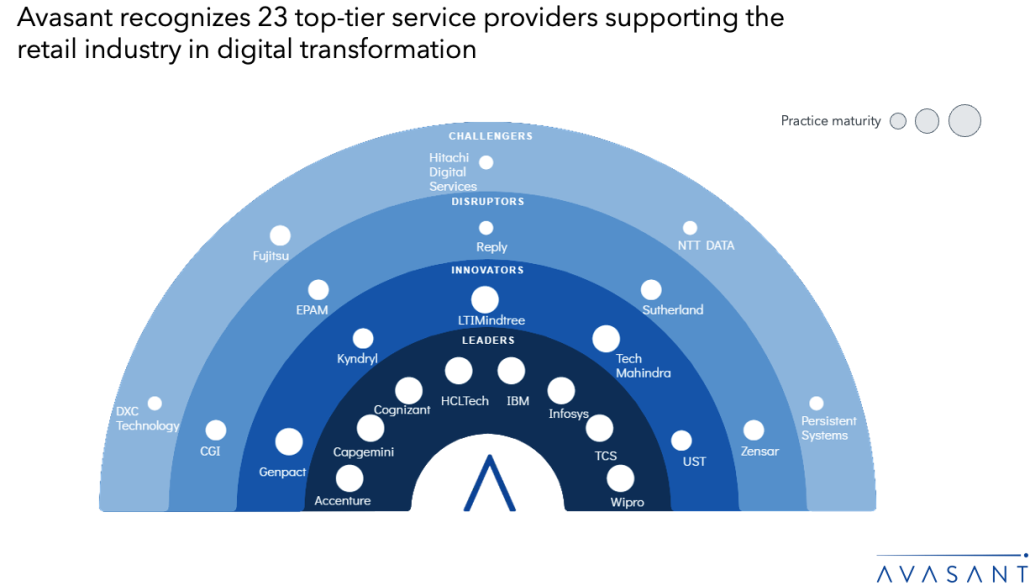

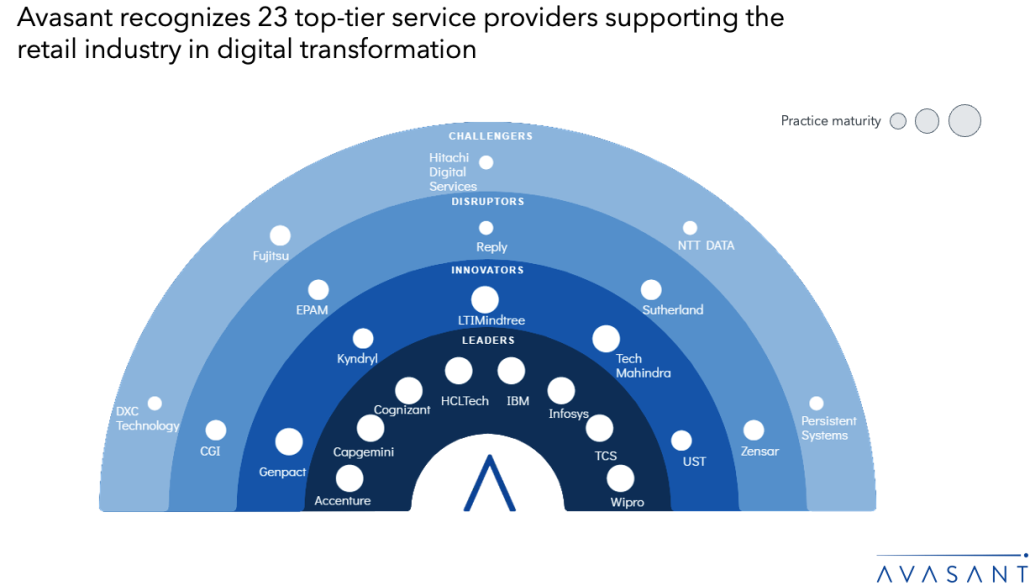

The Retail Digital Services 2025 RadarView™ highlights key supply-side trends in the retail space and Avasant’s viewpoint on them. It aids retail companies in identifying top service providers to assist them in the digital transformation of their services. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for the retail industry.

Featured providers

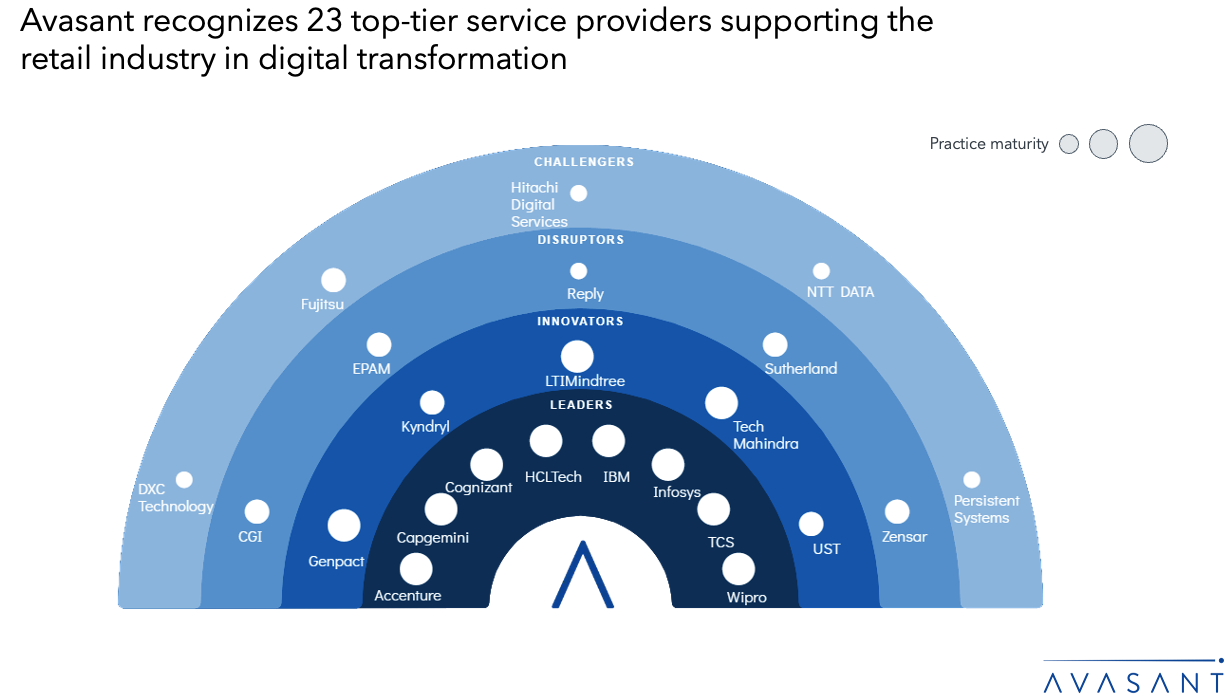

This RadarView includes a detailed analysis of the following service providers: Accenture, Capgemini, CGI, Cognizant, DXC Technologies, Epam, Fujitsu, Genpact, HCLTech, Hitachi Digital Services, IBM, Infosys, Kyndryl, LTIMindtree, NTT DATA, Persistent Systems, Reply, Sutherland, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary inputs from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

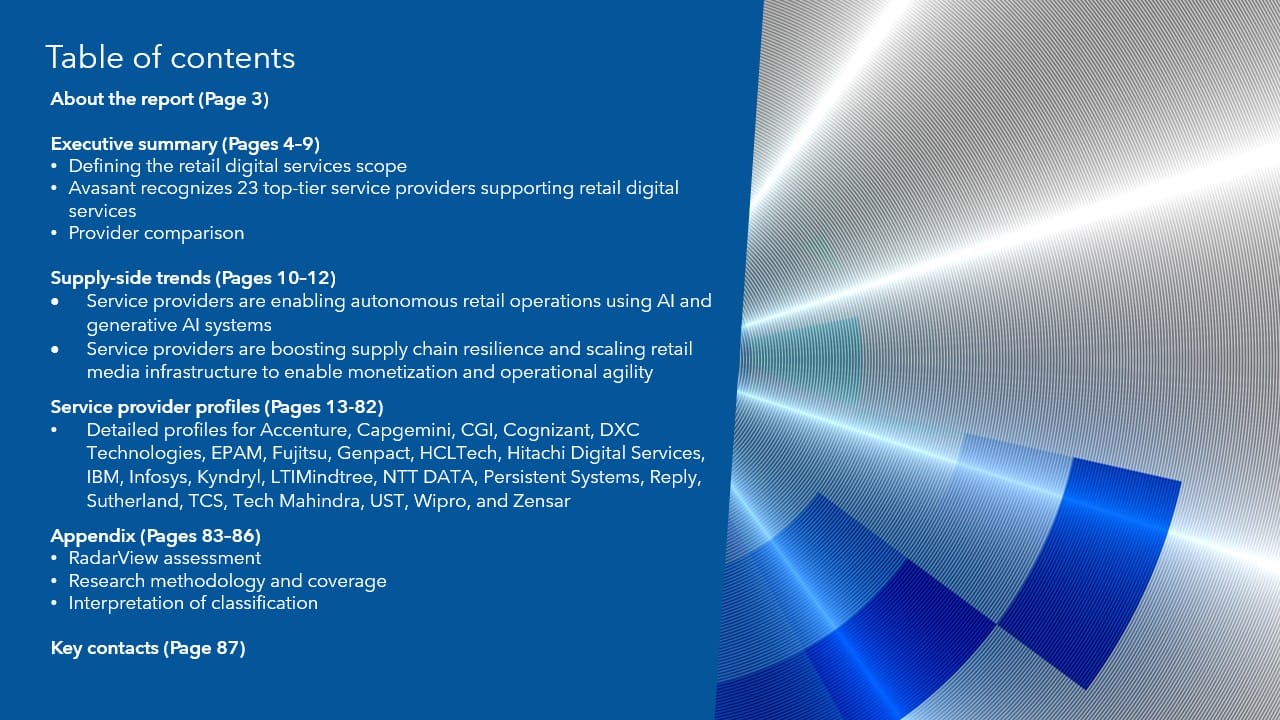

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining the retail digital services scope

- Avasant recognizes 23 top-tier providers supporting the retail industry in digital transformation

- Provider comparison

Supply-side trends (Pages 10–12)

-

- Service providers are enabling autonomous retail operations using AI and generative AI systems

- Service providers are boosting supply chain resilience and scaling retail media infrastructure to enable monetization and operational agility

Service provider profiles (Pages 13–82)

-

- Detailed profiles for Accenture, Capgemini, CGI, Cognizant, DXC Technologies, EPAM, Fujitsu, Genpact, HCLTech, Hitachi Digital Services, IBM, Infosys, Kyndryl, LTIMindtree, NTT DATA, Persistent Systems, Reply, Sutherland, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Appendix (Pages 83–86)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 87)

Read the Research Byte based on this report. Please refer to Avasant’s Retail Digital Services 2025 Market Insights™ for demand-side trends.