Over the past several years, Radio Frequency Identification (RFID) has been promoted as the next big thing in supply chain and asset management. The promised benefits of RFID include productivity gains in the warehouse, better product visibility in the distribution channel, improved inventory accuracy, less shrinkage, a reduced number of transaction errors, better asset tracking and utilization, and easier detection of counterfeit products, such as fashion items. Mandates from the U.S. Department of Defense and major players such as Wal-Mart now require their suppliers to label shipments with RFID tags, which forces adoption of the technology.

Despite these factors, the adoption rate of RFID technology has stalled significantly in the last year. This slow-down is not being publicized by suppliers of RFID equipment and systems, since their success depends on continued promotion of the technology. Some reports of an RFID slow-down, however, are beginning to appear in the business press. For example, the Wall Street Journal recently reported that Wal-Mart has only installed RFID in five of its distribution centers, which is well behind its plan two years ago that called for 12 of its distribution centers to be up and running by now. The same article reports that apparel maker VF Corp. has curbed its RFID program, citing an absence of payback for its efforts in the foreseeable future.

This Research Byte is an executive summary of our full report, Radio Frequency Identification (RFID) Adoption Stalls.

Survey Results Show RFID Adoption Is Stalling

Computer Economics conducted a survey of nearly 200 senior IT managers in all industry sectors for this study. Industry sectors covered include banking/finance, business services, discrete manufacturing, energy/utilities, government, healthcare, insurance, process manufacturing, retail, and wholesale distribution. We also collected some responses in the transportation industry, although the number of respondents was not adequate to report adoption statistics in that sector.

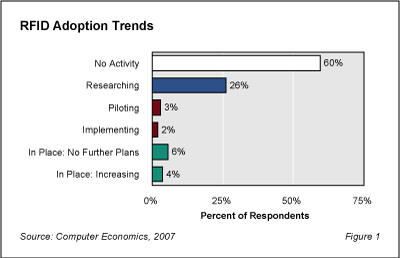

Implementation status of RFID across all industry sectors is shown in Figure 1. In spite of mandates and initiatives in several industries, RFID technology is installed at only 10% of sites in the composite sample, 6% of which have no plans for increasing their RFID investment. A mere 4% are planning additional rollout of the technology. This low level of implementation is indicative of a technology in the “early adopter” stage of development. Only 5% of respondents are in the piloting or implementing stages of adoption. The fact that 26% of the respondents are researching RFID shows that a significant number of organizations show some interest in the potential of the technology, but the bottom line is that the majority of companies (60%) show no activity whatsoever.

The full version of this report provides RFID adoption statistics in the U.S. and Canada by industry sector, and reports the ROI experiences of organizations that have implemented RFID. It also analyzes in detail the following five factors that are contributing to the slow-down in RFID adoption.

- Cost issues

- Technical performance problems

- Conflicting standards

- Security issues

- Privacy concerns

In retrospect, RFID mandates from major players such as Wal-Mart and the U.S. Department of Defense have been a mixed blessing for RFID adoption. On the one hand, such mandates spur use of RFID in organizations that may not have otherwise considered it. On the other hand, mandates force the technology to be used in environments where it does not yet work well and is not cost-justified. Such organizations implement RFID, but only to the extent that they are forced to in order to satisfy the mandate. Their experiences are often not positive, but they justify their RFID investments in terms of customer relations. This leaves them with a bad impression regarding RFID and less willing to consider further rollout of the technology, even when it becomes more mature and equipment prices become more reasonable.

Our research shows that RFID is gaining ground most quickly in certain industry sectors and applications where its benefits are clear. Ironically, the best stories of RFID success are not in industries where customer mandates are forcing adoption. Rather, they are in situations where tangible benefits can be realized within the constraints of today’s RFID costs and performance limitations. The full version of this report highlights where these best opportunities exist.

Like other leading edge technologies such as robotics and artificial intelligence in the 1980s, RFID is promoted with vendor promises and media hype. It is natural that a slow-down in adoption should take place once early adopters encounter the limitations of the technology and the reality of the work involved in adapting business processes to take advantage of the new capabilities becomes apparent. Ultimately, RFID will become even more widespread than bar codes, but it will take longer than its advocates hope for.

February 2007

This Research Byte is a brief overview of our report on this subject, Radio Frequency Identification (RFID) Adoption Stalls. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website at https://avasant.com/report/radio-frequency-identification-rfid-adoption-stalls-2007/ (click for pricing).