Enterprises are focused on driving secure digital transformation, transitioning to proactive risk management. They are aiming to leverage AI/ML models to automate various aspects of compliance management, risk assessment, fraud detection, data privacy, and disaster recovery services. Service providers are developing solutions to not just mitigate security risks but also help enterprises govern the use of technology safely across their IT infrastructure, given the pace and complexity of modern business operations.

Both demand-side and supply-side trends are covered in our Risk and Compliance Services 2023 Market Insights™ and Risk and Compliance Services 2023 RadarView™, respectively. These reports present a comprehensive study of risk and compliance service providers and closely examine market leaders, innovators, disruptors, and challengers.

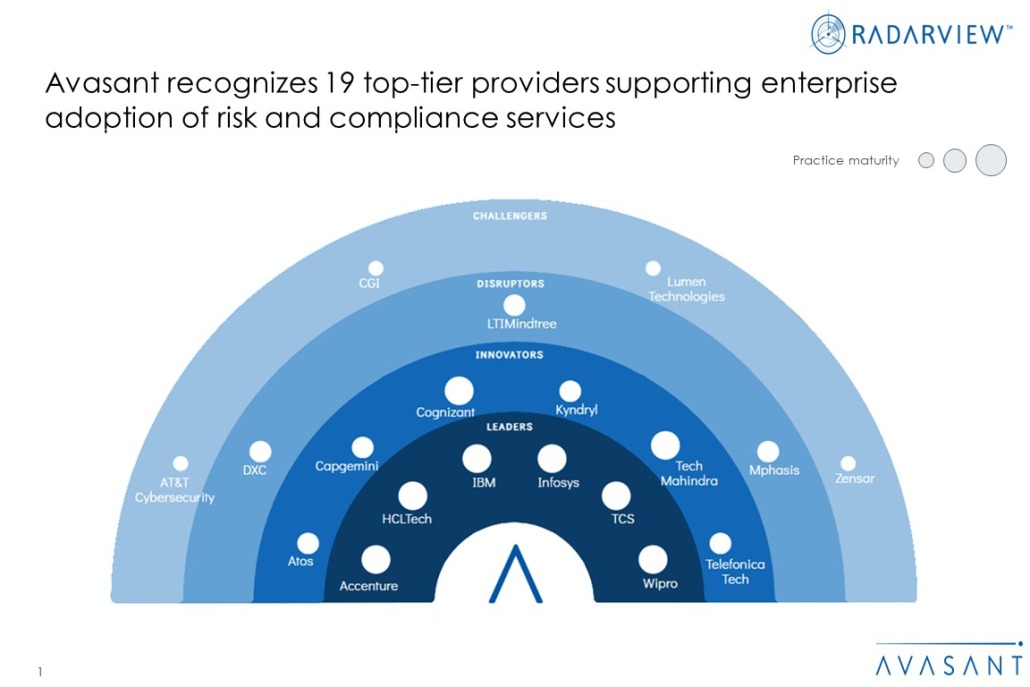

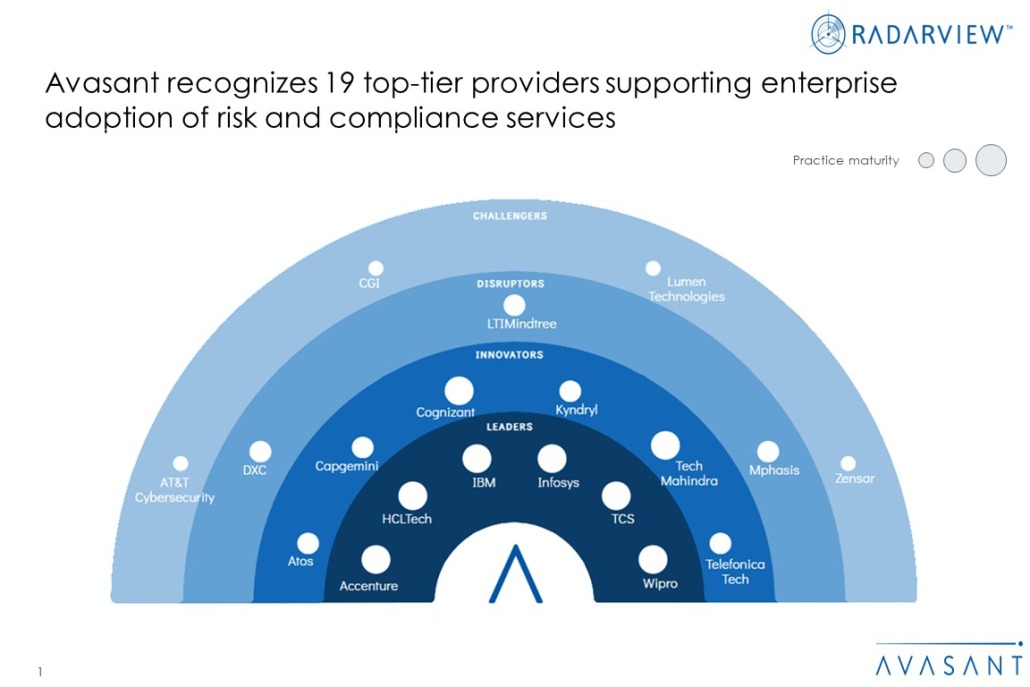

Avasant evaluated 30 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 30 providers, we recognized 19 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, HCLTech, IBM, Infosys, TCS, and Wipro

- Innovators: Atos, Capgemini, Cognizant, Kyndryl, Telefónica Tech, and Tech Mahindra

- Disruptors: DXC, LTIMindtree, and Mphasis

- Challengers: AT&T Cybersecurity, CGI, Lumen Technologies, and Zensar

Figure 1 below from the full report illustrates these categories:

“The push toward mandatory ESG compliance and reporting calls for an integrated ESG approach in business processes,” said Mark Gaffney, Avasant senior director. “Providers must work with their clients to establish a coordinated ESG strategy aligned with service delivery and driven by GRC processes for effective ESG reporting and monitoring.”

The reports provide several findings, including the following:

-

- More than 50% of risk and compliance services revenue comes from healthcare and the BFSI sectors. Notably, the healthcare sector has shown a growth in demand for risk and compliance services due to increased automation and digitization while adhering to global and regional regulations.

- Service providers plan to invest over 60% of their risk and compliance investment budget in practice growth and asset development. These investments include developing new solution offerings with automation capabilities, training resources to meet the required digital skill sets, and expanding business to new locations.

- Businesses are contending with escalating compliance costs amid evolving regulatory landscapes due to siloed and disconnected processes, making it hard to adopt the technology advancements for optimizing the governance, risk, and compliance (GRC) processes.

- Enterprises are taking multiple measures to align their GRC services with environmental objectives and with business outcomes. It includes enhancing internal controls for sustainability reporting, managing third-party ESG risks, integrating ESG with enterprise risk management, and providing regulatory compliance and audit support for ESG.

“The rise of generative AI underscores the growing importance of AI governance,” said Avasant Research Director Gaurav Dewan. “To ensure effective AI risk mitigation while fully capitalizing on the significant value AI offers, businesses need to adopt a structured GRC approach encompassing AI governance and architectural considerations.”

The RadarView also features detailed profiles of 19 service providers, along with their solutions, offerings, and experience in assisting enterprises in their risk and compliance journey.

This Research Byte is a brief overview of the Risk and Compliance Services 2023 Market Insights™ and Risk and Compliance Services 2023 RadarView™. (click for pricing).