This report provides enterprises with a view of the supply chain operations services landscape. It begins with a summary of key enterprise and outsourcing trends and identifies the right service providers companies can engage with to reshape their supply chain operations services. We continue with a detailed assessment of 15 service providers offering supply chain operations process transformation services. Each profile provides an overview of the service provider, its key IPs and assets, a list of representative clients and partnerships, and brief case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovation.

Why read this RadarView?

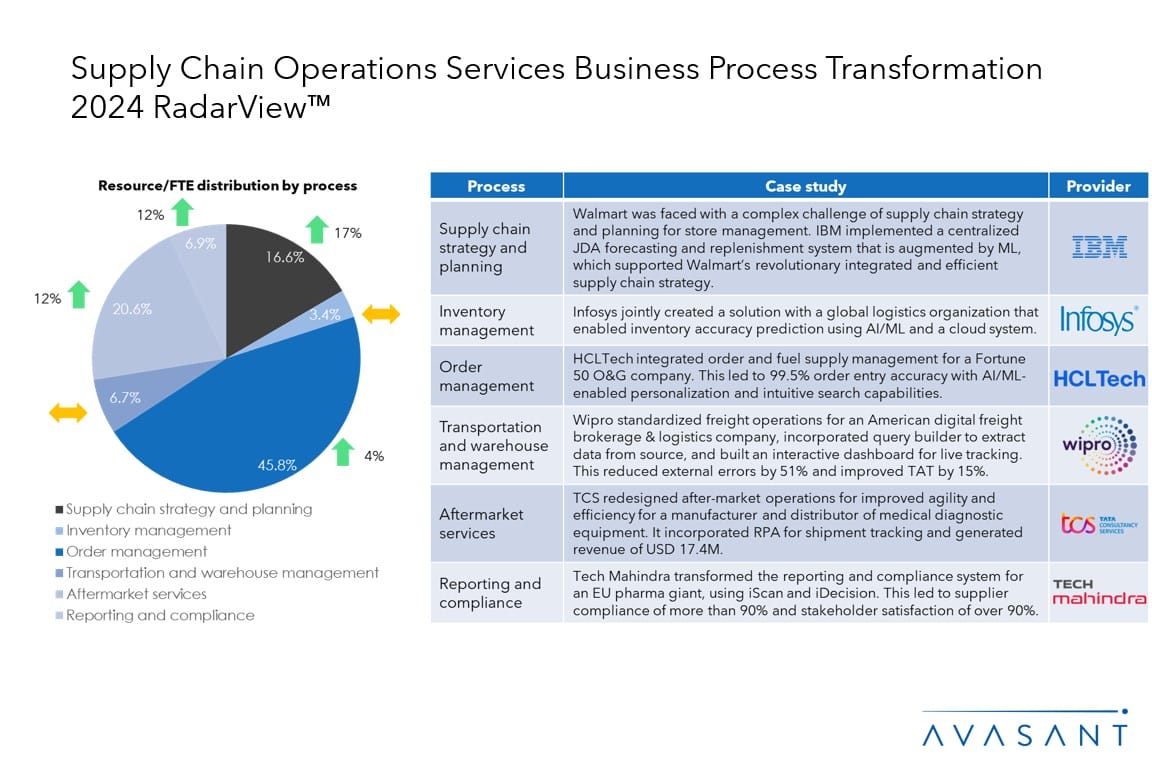

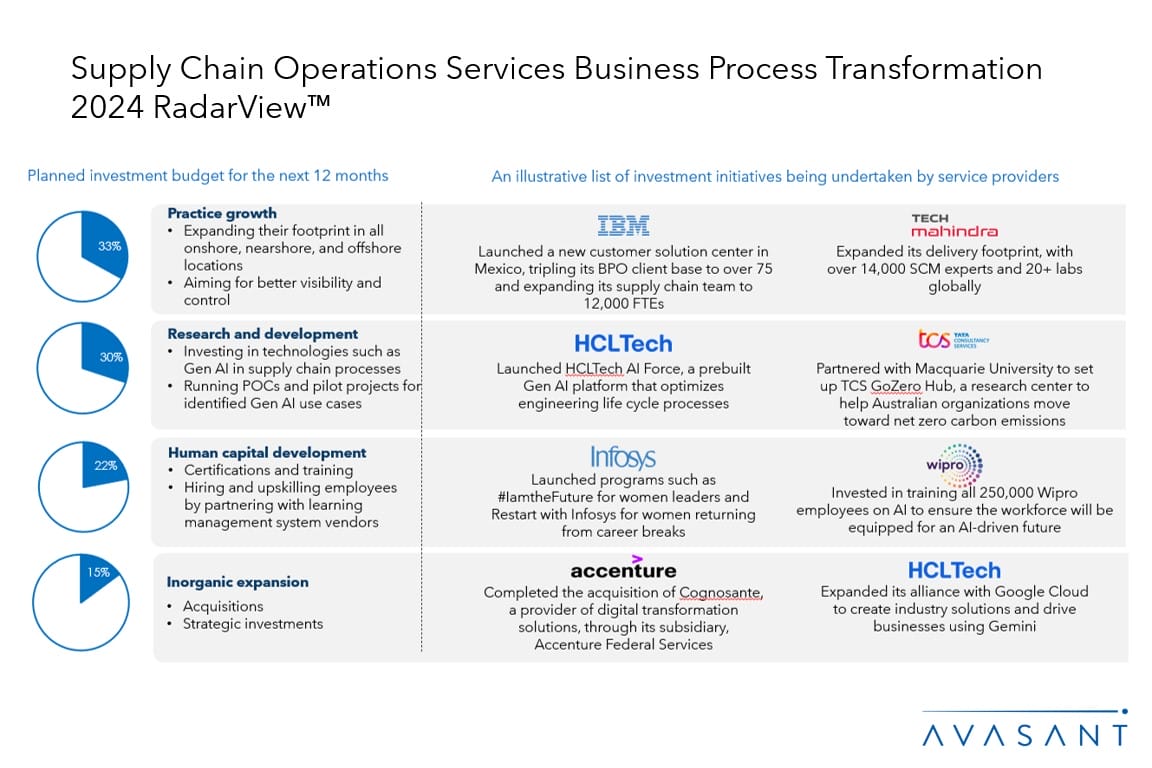

To meet evolving supply chain needs, enterprises are increasingly engaging with supply chain process transformation service providers to leverage their domain and digital expertise. Service providers are investing in emerging technologies such as generative AI by running proof of concepts (POCs) and pilot projects and identifying use cases. Service providers are also expanding their delivery footprint in all onshore, nearshore, and offshore locations to offer a balanced shoring mix to enterprises. Additionally, they are shifting from a time- and resource-based pricing model to output/transaction, outcome/KPI, and hybrid pricing models as they are investing in expanding their delivery footprint and generative AI-based R&D.

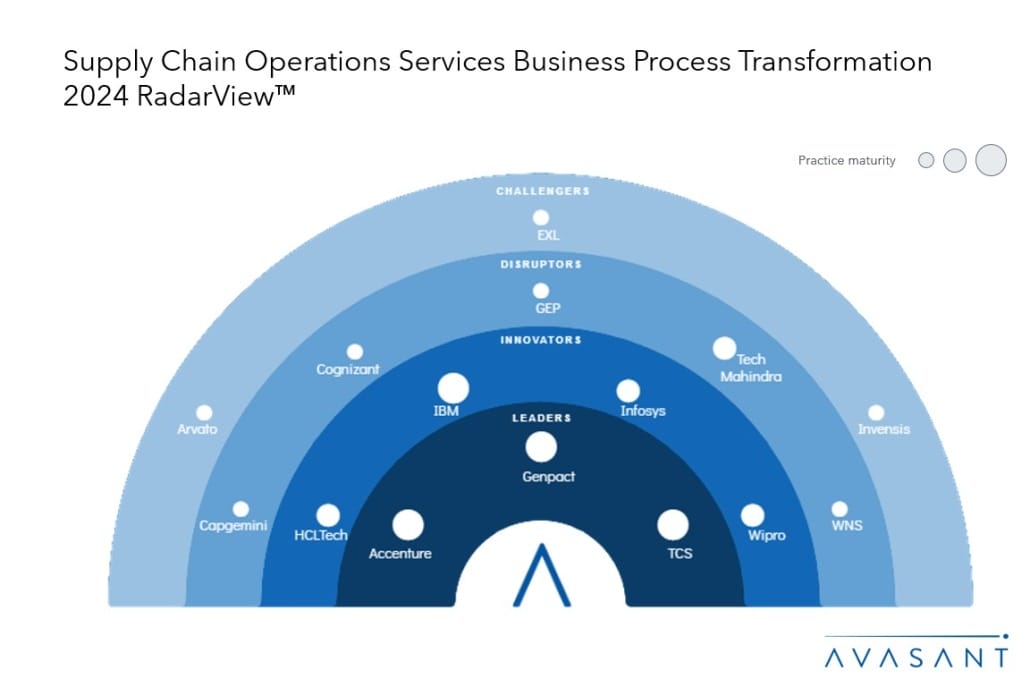

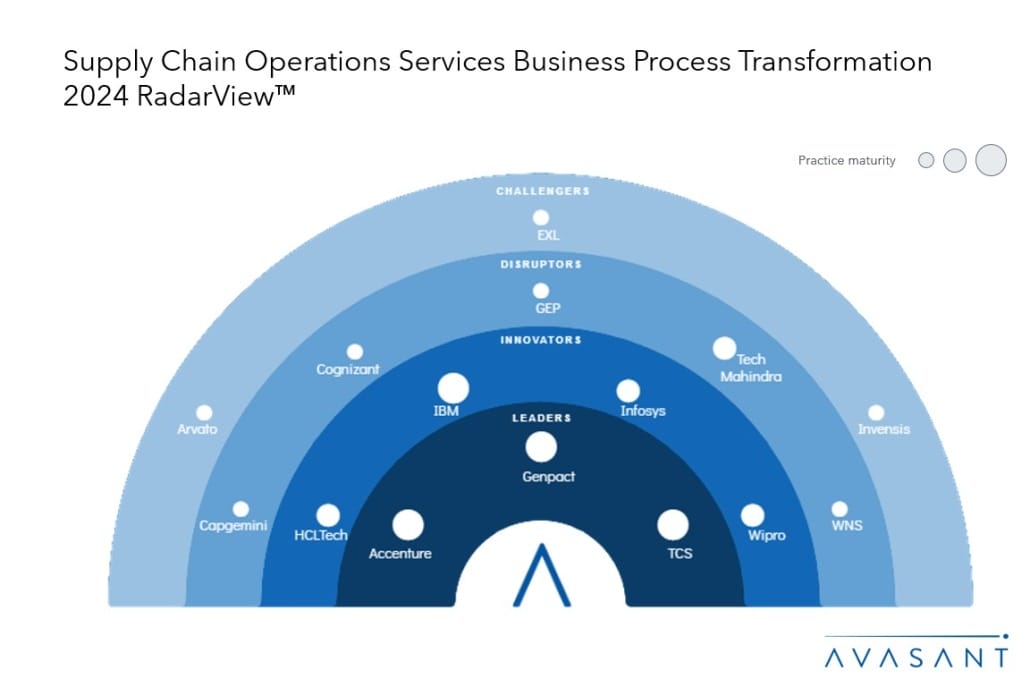

The Supply Chain Operations Services Business Process Transformation 2024 RadarView™ aids companies in identifying top service providers to transform their supply chain operations services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for their supply chain operations services transformation.

Featured providers

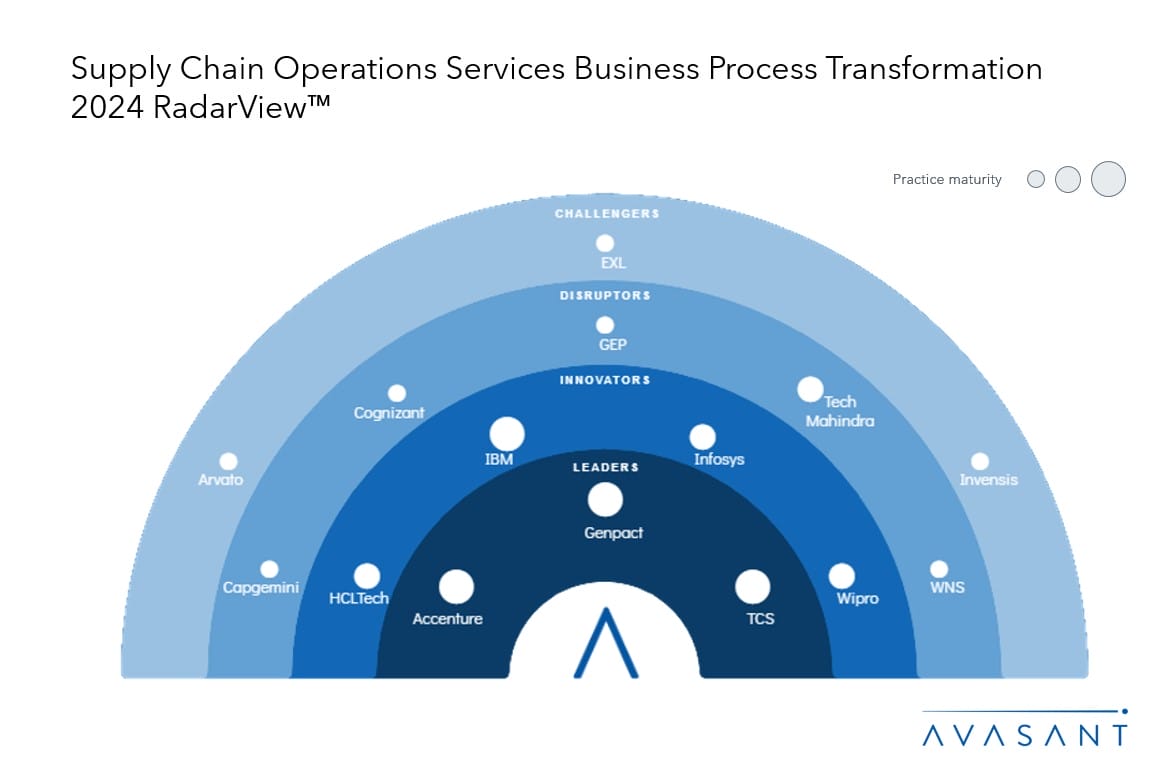

This RadarView™ includes a detailed analysis of the following service providers offering supply chain operations services transformation services: Accenture, Arvato, Capgemini, Cognizant, EXL, Genpact, GEP, HCLTech, IBM, Infosys, Invensis, TCS, Tech Mahindra, Wipro, and WNS.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

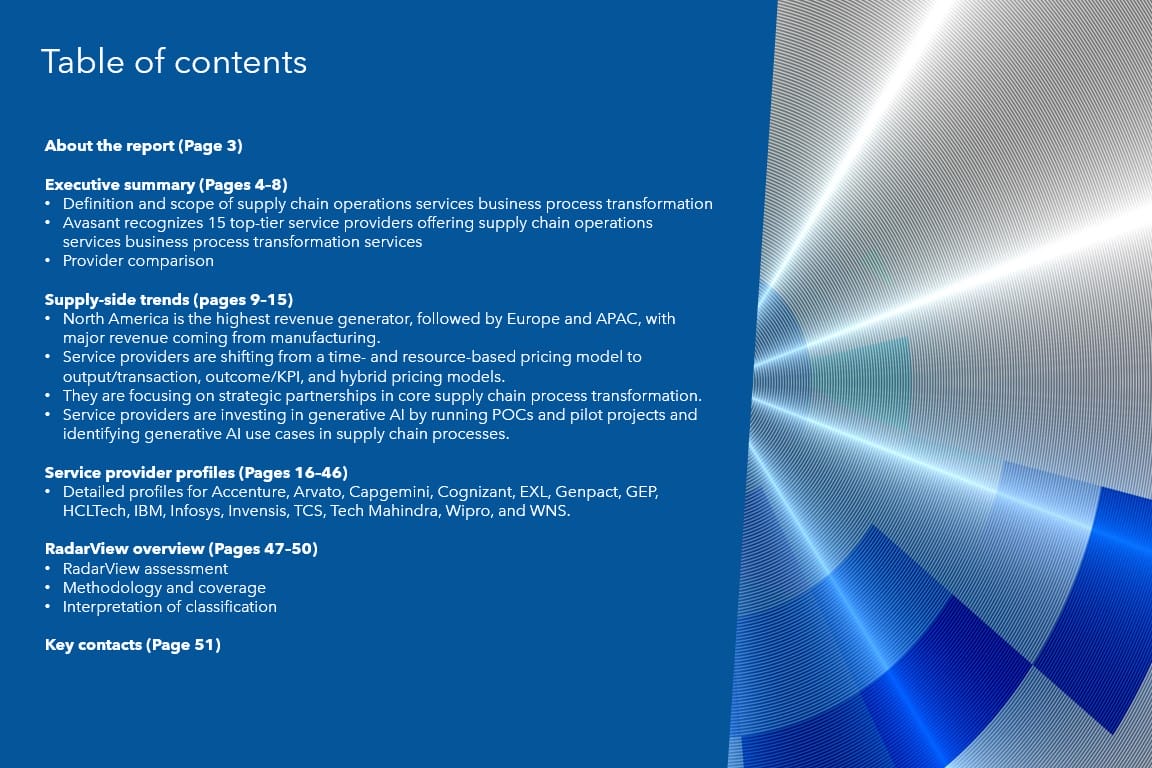

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Definition and scope of supply chain operations services business process transformation

- Avasant recognizes 15 top-tier service providers offering supply chain operations services business process transformation services

- Provider comparison

Supply-side trends (Pages 9–15)

-

- North America is the highest revenue generator, followed by Europe and APAC, with major revenue coming from manufacturing.

- Service providers are shifting from a time- and resource-based pricing model to output/transaction, outcome/KPI, and hybrid pricing models.

- They are focusing on strategic partnerships in core supply chain process transformation.

- Service providers are investing in generative AI by running POCs and pilot projects and identifying generative AI use cases in supply chain processes.

Service provider profiles (Pages 16–46)

- Detailed profiles for Accenture, Arvato, Capgemini, Cognizant, EXL, Genpact, GEP, HCLTech, IBM, Infosys, Invensis, TCS, Tech Mahindra, Wipro, and WNS.

RadarView overview (Pages 47–50)

-

- RadarView assessment

- Methodology and coverage

- Interpretation of classification

Key contacts (Page 51)

Read the Research Byte based on this report.

Please refer to Avasant’s Supply Chain Operations Services Business Process Transformation 2024 Market Insights™ for detailed insights on demand-side trends.