The US administration has unveiled sweeping changes to US immigration and foreign worker policies. At the center of this overhaul is a drastic cost increase for H-1B visa holders, who are now subject to a $100,000 one-time charge (non-refundable, even if denied).

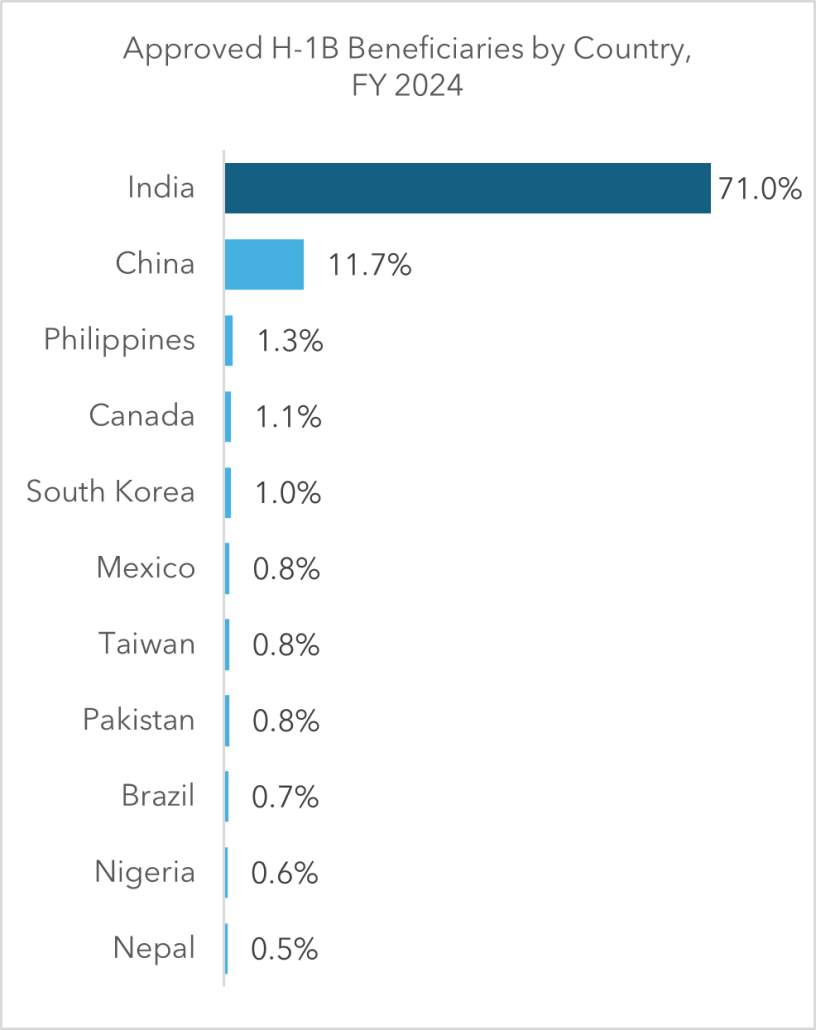

This measure is designed to reshape immigration, reduce perceived wage suppression of US workers, and generate revenue. The implications are profound for countries such as India, which accounts for 71% of H-1B visa holders in tech and related sectors.

Figure 1: H-1B data per US Citizenship and Immigration Services (USCIS), FY 2024

Note: This is not an exhaustive list of countries and industries, but they account for over 90% of the share.

Industry-wise, the professional, scientific, and technical services sector continues to account for almost half of approved H-1B petitions, distantly followed by educational services (12%).

The Fallout

The policy revisions carry significant complications:

-

- Cost barrier and displacement risk: A $100,000 fee makes many H-1B deployments uneconomical, especially for IT services firms that rely on volume staffing.

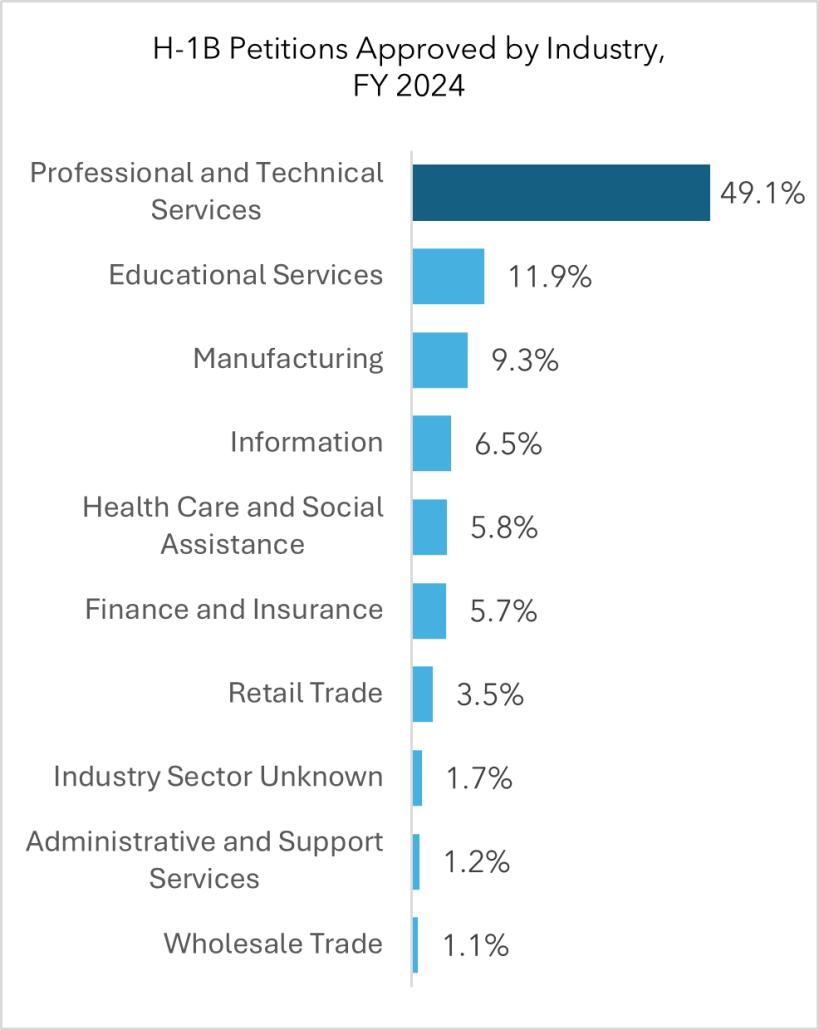

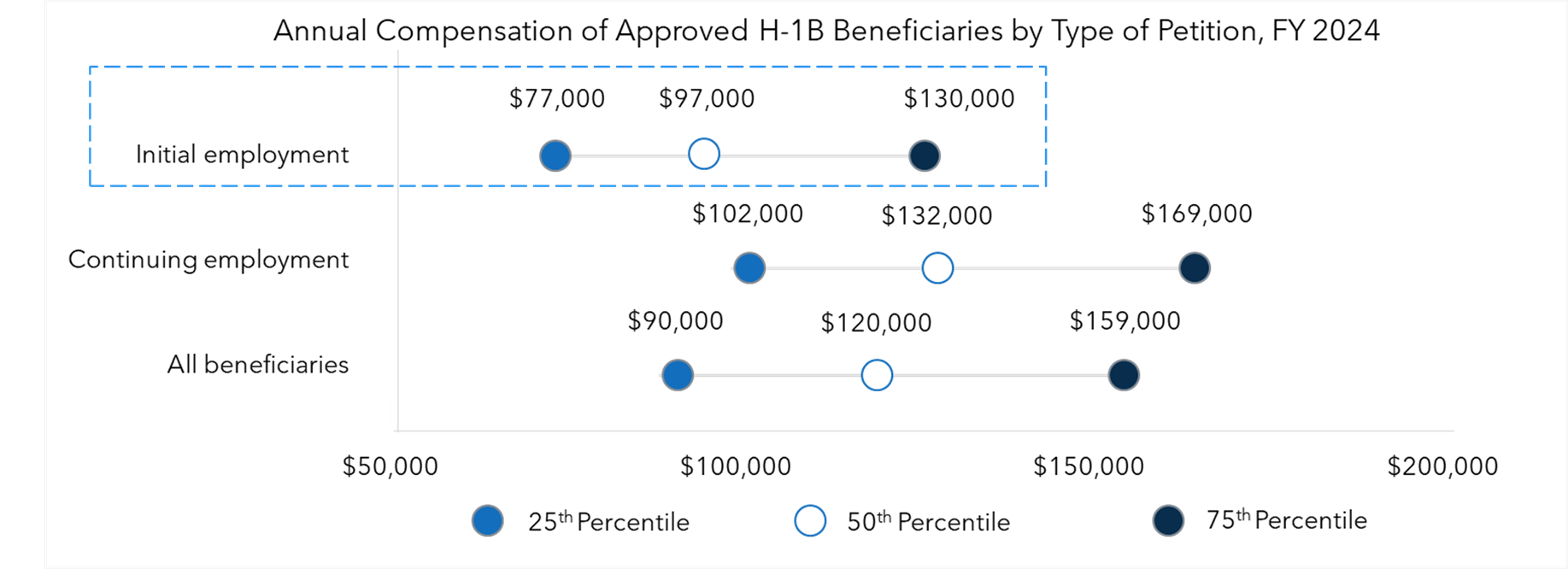

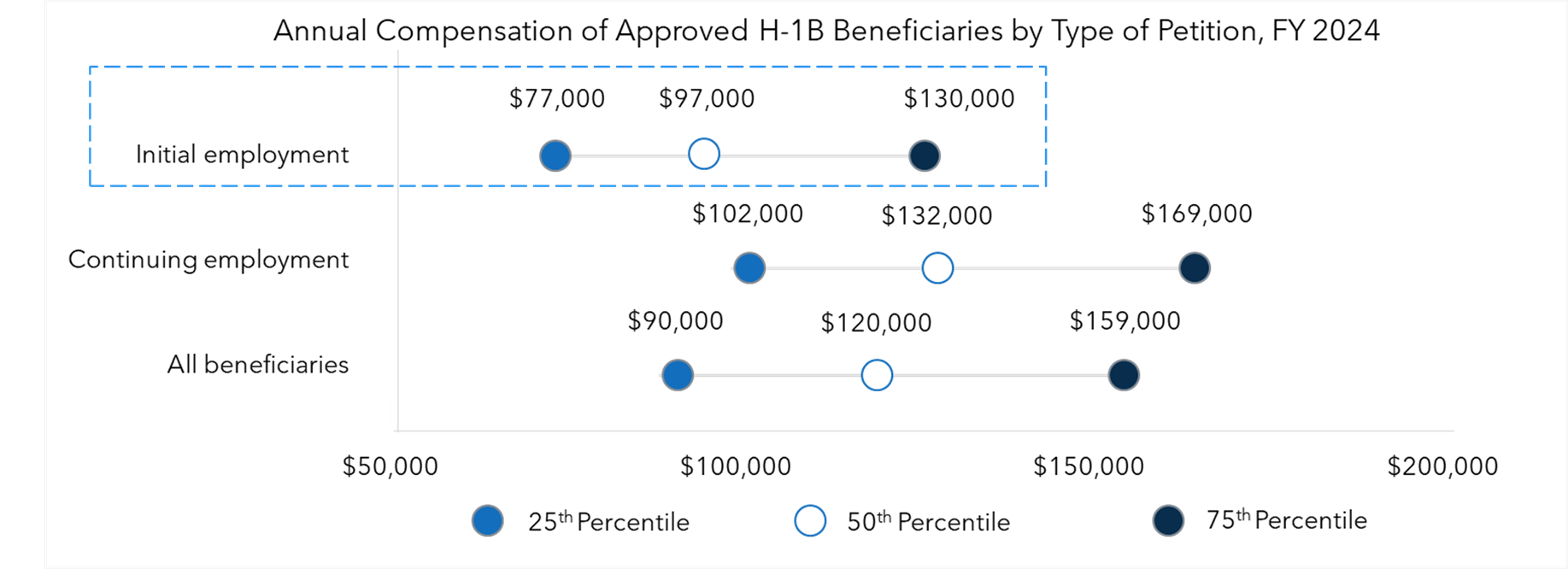

- Wage pressure: The jump in minimum salary from $77,000 to $130,000 makes mid-level hiring under the H-1B program less attractive. Moreover, the median wage of H-1B employees is $97,000, which is below the $100,000 mark (see Figure 2), making many roles fall short of the new threshold.

Figure 2: H-1B data per US Citizenship and Immigration Services (USCIS), FY 2024

-

- Legal and fairness concerns: Fees far above administrative costs may face constitutional challenges and could penalize workers stuck in green card backlogs.

- Uncertainty for businesses: Rules around transition, grandfathering, and responsibility (employer vs. employee) remain unclear, creating operational risk.

-

- Operational squeeze: Mid-career engineers, consultants, and early-stage startup hires — typical H-1B use cases — may no longer be sustainable.

The Big Question

Given these changes, several questions arise, but the core one is:

How will this new H-1B fee reshape labor mobility, competitiveness, and foreign talent inflows, particularly for India, which supplies the majority of skilled workers?

The Likely Outcomes

While full outcomes will depend on implementation and possible legal challenges, we can sketch plausible effects:

-

- Big Tech resilience: Companies like Amazon, Google, Microsoft, and Meta — consistently among the top H-1B sponsors — may selectively absorb the $100,000 fee for strategic hires in AI, cloud, and cybersecurity. Their high margins and focus on innovation allow them to justify the cost for critical roles, though flexibility in mid-level hiring will shrink.

- IT services vulnerability: Firms like TCS, Infosys, and Cognizant depend heavily on volume-based H-1B staffing. For midtier roles, absorbing $100,000 per employee is untenable. The likely outcome is a pivot to offshore delivery, nearshore hubs, and automation. Onshore presence could shrink, and contracts may be renegotiated to reflect higher costs. With some firms sponsoring over 10,000 visas annually, the financial hit could exceed $1B annually.

- Opportunity for US workers: More jobs could open for domestic graduates in computer science, data science, and IT. Wages are expected to rise as the supply of lower-cost foreign talent shrinks. Corporations may finally invest in apprenticeships, reskilling programs, and STEM pipelines.

- Reduced usage: US enterprises relying on outsourcing and consulting talent may see fewer H-1B deployments, as providers and clients weigh cost vs. necessity. This could slow timelines for digital transformation projects.

- Healthcare risks: Nearly one in four US doctors is foreign-trained, and many serve rural and underserved areas. Stricter visa rules and higher costs could exacerbate physician shortages, creating ripple effects in healthcare delivery.

- Global competition intensifies: While the US plays “America First,” China offers seven-figure salaries for AI talent, the Gulf states are building sovereign AI hubs, and Europe is streamlining tech visas. Talent is mobile, and restrictive US policies could redirect global innovation elsewhere.

- Legal pushback likely: The fee, far beyond administrative levels, is expected to face challenges in US courts. Even if softened or delayed, the trajectory points toward higher barriers for H-1B employment.

- Implementation timeline: The fee kicks in with the next round of H-1B applications in March 2026, and allocations are due in October 2026. Therefore, companies have a one-year planning window to prepare and execute mitigations.

Impact in the Short- to Mid-Term

In the near horizon, these changes will drive significant structural shifts:

-

- Higher offshoring: Offshore mix could increase from about 75% to 85%–90%, which is technically feasible given industry experience and capabilities.

- Greater GCC growth: More roles will be consolidated into Global Competency Centers (GCCs), with companies centralizing offshore delivery or adopting Build-Operate-Transfer (BOT) models.

- Boost to nearshore destinations: Countries such as Canada and Mexico stand to gain, leveraging bilateral trade agreements and time zone proximity to take over functions previously onshore in the US.

- Catalyst for AI adoption: Expect accelerated adoption of AI to augment/replace human functions in IT operations, software development, and product engineering.

Further, the bigger risk is the uncertainty and operational instability this creates for US companies seeking to remain competitive in volatile markets. If the administration builds on this by introducing additional deterrents to offshore labor, it could lead to non-tariff barriers against offshoring.

The rollout of such measures risks planting fear among global talent aspiring to move to the US for education, research, or innovation careers. Even if courts delay or strike down the fee, the obfuscation and confusion seeded by the policy may have long-term consequences, including shifting the fulcrum of future tech advances to other nations.

Four Major Loopholes Blunting Ecosystem Impact

While the policy is sweeping, four major loopholes soften its near-term ecosystem impact:

-

- Applies only to new H-1Bs: The fee targets new entrants outside the US. Those already in the country filing for a three-year extension remain exempt. This preserves a massive existing workforce of nearly 700,000 H-1B visa holders.

- Exemption for F-1 to H-1B transitions: Foreign students at US universities changing from F-1 student visas to H-1B or J-1 visas are exempt. With around 400,000 foreign graduates in 2024 under Optional Practical Training (OPT)/Curricular Practical Training (CPT), this pool is three times larger than new H-1B issuances (141,205 per USCIS).

- Industry exemptions: Certain “essential industries” will be carved out — though the list is not yet published, it could shield critical sectors.

- National interest clause: Employers can argue their H-1B projects are of “national interest,” a loophole especially relevant for sectors such as healthcare, banking, insurance, and aerospace.

Remedial Actions for IT Service Providers

For Indian heritage IT firms, the challenge is existential, but so are the opportunities to adapt. Recommended mitigation strategies include:

-

- Invest in US-based delivery hubs: Establish and expand centers in Tier II and Tier III US cities with lower costs of living, often anchored around universities. This strengthens local hiring pipelines while containing costs.

- Leverage university partnerships: Build structured programs with US universities for internships, apprenticeships, and reskilling to offset reduced H-1B inflows.

- Accelerate nearshore/offshore balance: Expand delivery hubs in Canada, Mexico, and Latin America, while expanding automation investments.

- A pivot to tech-enabled services: This is the opportunity for service providers to bite the bullet and invest in tech-platform-driven services that de-link people from service delivery and allow better control of margins and outcomes. Reengineering services by embedding agentic AI across ITOps, application management services, and product engineering will drive higher client adoption and margin attainment in the long term.

- Shift client engagement models: Reprice and redesign contracts to focus on value delivery rather than head count-based staffing. A holistic adoption of AI across the service delivery chain will allow value-based pricing models, which de-risk against staffing and geopolitical barriers.

- Position projects under national interest: Where possible, classify work in industries such as healthcare, banking, insurance, and aerospace as highly important for national interests, using policy exemptions to maintain US-based delivery.

By starting execution now, with a 12–18-month runway before the fee rule takes effect, IT service providers can soften the shock and realign their delivery and talent models.

The Road Ahead

This policy is more than immigration reform. It is a reset of the industrial strategy. For American workers, it’s an opportunity to capture a bigger share of the tech economy. For corporations, it’s a forcing function to rebuild domestic talent pipelines. For policymakers, it’s a high-stakes gamble: protect jobs today without undermining tomorrow’s innovation.

The outcome will hinge on whether the US and its partners can adapt quickly. To sustain competitiveness in the global talent race, they must align education, reskill the existing workforce, and rethink industrial priorities.

By Anupam Govil, Managing Partner, Akshay Khanna, Managing Partner, and Gaurav Dewan, Research Director