Enterprises are accelerating the adoption of generative AI (Gen AI) to achieve measurable productivity gains, fueling growth in large-scale transformations and managed service deals. At the same time, many are developing proprietary large language models (LLMs) to enhance contextual accuracy, regulatory compliance, and data sovereignty. While automation-led functions are scaling rapidly, compliance-heavy areas continue to advance cautiously. In parallel, national investments in sovereign AI are strengthening domestic compute and data ecosystems, reinforcing the foundation for enterprise-grade AI maturity.

Both demand-side and supply-side trends are covered in our Generative AI Services 2025 Market Insights™ and Generative AI Services 2025 RadarView™, respectively. These reports present a comprehensive study of Gen AI service providers and closely examine market leaders, innovators, disruptors, and challengers. They also provide a view into key market trends and developments impacting the Gen AI services space.

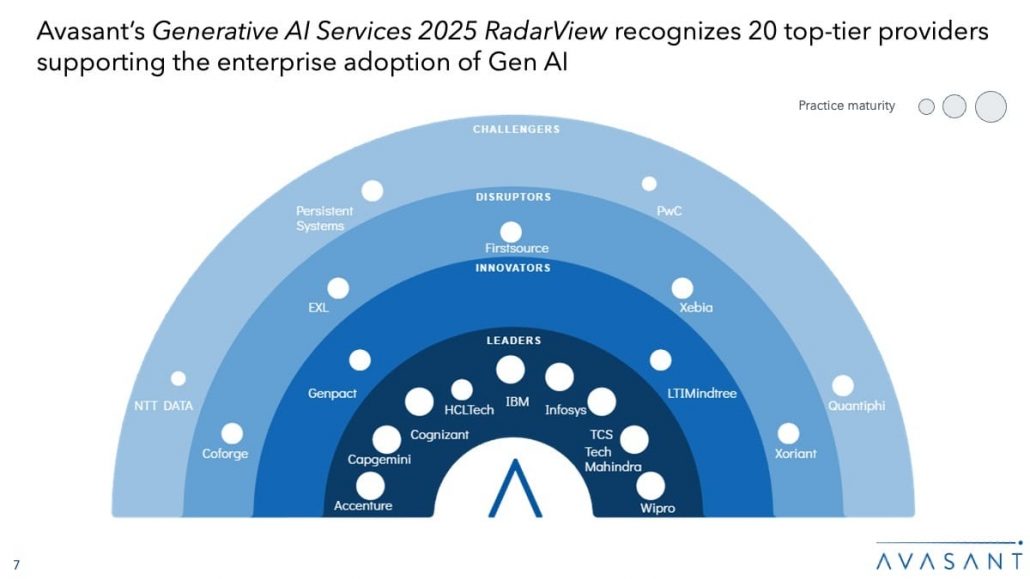

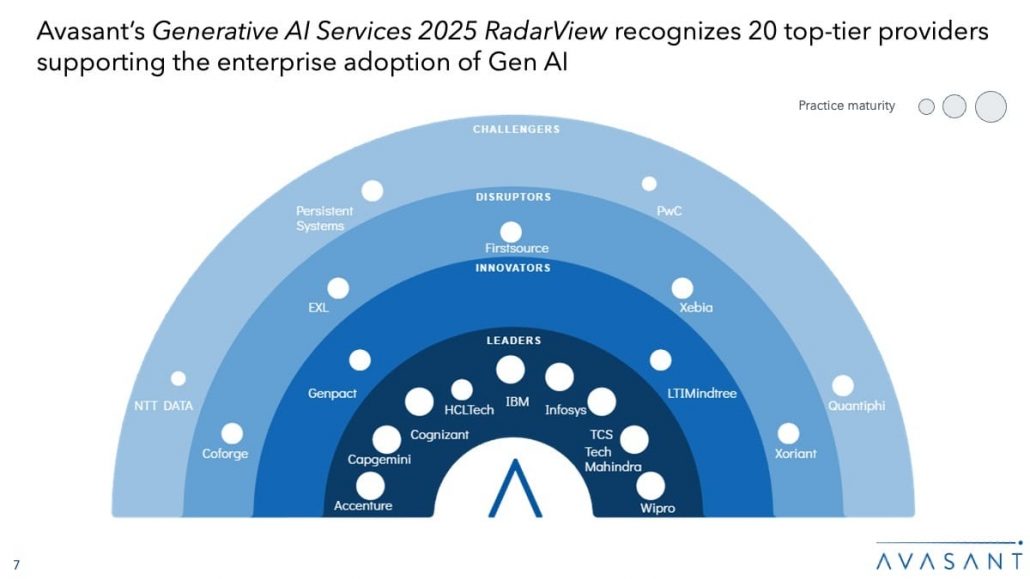

Avasant evaluated 48 providers using three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these, we recognized 20 providers who brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCLTech, IBM, Infosys, TCS, Tech Mahindra, and Wipro

- Innovators: Genpact and LTIMindtree

- Disruptors: Coforge, EXL, FirstSource, Xebia, and Xoriant

- Challengers: NTT DATA, Persistent Systems, PwC, and Quantiphi

The following figure from the full report illustrates these categories:

“As AI matures, firms are starting to scale it organization-wide, emphasizing contextual intelligence, centralized governance, and AI-first business models,” said Anupam Govil, managing partner and digital practice lead at Avasant.“This evolution is creating new revenue streams for providers across agentic architecture, AI stack orchestration, and AI-native infrastructure.”

The findings in the reports include the following:

-

- The number of large deals involving Gen AI and agentic AI has increased by 61% over the last year, reflecting robust enterprise demand for AI-native transformation. In the same period, the share of managed service contracts explicitly itemizing Gen AI productivity gains rose by 29%, highlighting a growing focus on clear Gen AI ROI.

- High-tech and telecom lead Gen AI adoption at 20%, followed by BFS at 13%. These industries are deploying LLMs and AI agents to accelerate application deployment, improve multimodal data processing, and enhance omnichannel customer engagement.

- Nations are advancing sovereign AI through targeted investments in compute, data, and foundational models to strengthen self-reliance and strategic AI leadership.

- Providers are enabling enterprise-scale AI transformation through integrated investments in governance, talent, data, infrastructure, and change management.

“As businesses embed Gen AI and agentic systems deeper into their operations, rising inference loads and model retraining cycles are straining compute efficiency,” said Abhisekh Satapathy, principal analyst at Avasant. “This has made sustainable AI computing a design priority, driving advances in carbon-aware infrastructure and energy-optimized inferencing.”

The RadarView also features profiles of the 20 service providers, including their solutions, offerings, and experience in assisting enterprises with Gen AI adoption.

This Research Byte is a brief overview of Avasant’s Generative AI Services 2025 Market Insights™ and Generative AI Services 2025 RadarView™. (click for pricing)