Facing rising material costs, labor shortages, supply chain disruptions, and stricter ESG demands, engineering and construction enterprises are accelerating their digital transformation. Companies are turning to modular construction, AI-powered procurement, and robotics to boost efficiency and strengthen operational control. Fragmented systems are being replaced by integrated platforms that improve data coordination and support more informed decisions. As sustainability moves from optional to essential, firms are deploying carbon tracking tools, digital twins, and life cycle assessments to meet regulatory and investor expectations. To scale these initiatives effectively, industry leaders are partnering with digital service providers to drive innovation across the value chain.

Both demand-side and supply-side trends are covered in our Engineering and Construction Digital Services 2025 Market Insights™ and Engineering and Construction Digital Services 2025 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the engineering and construction industry, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

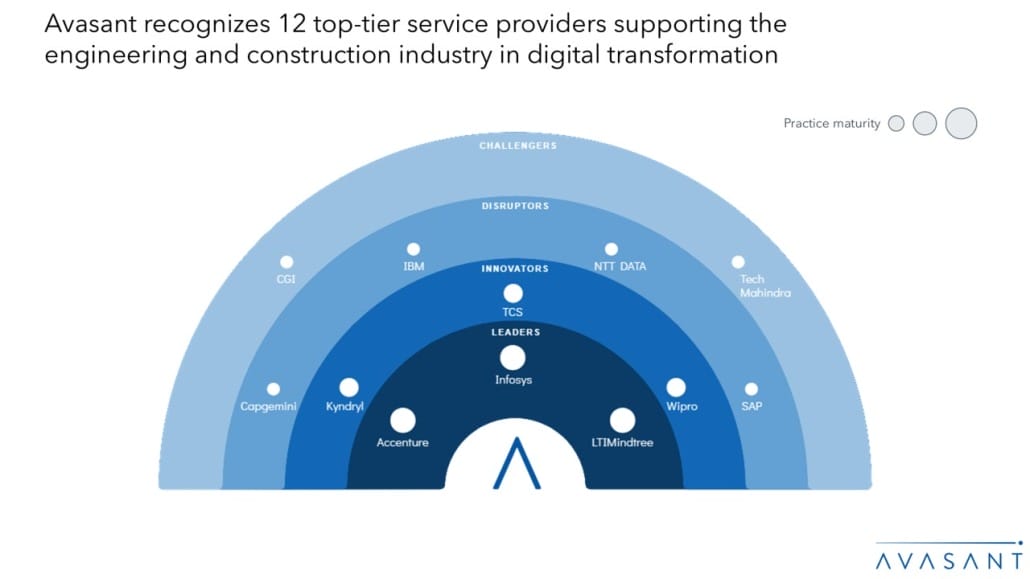

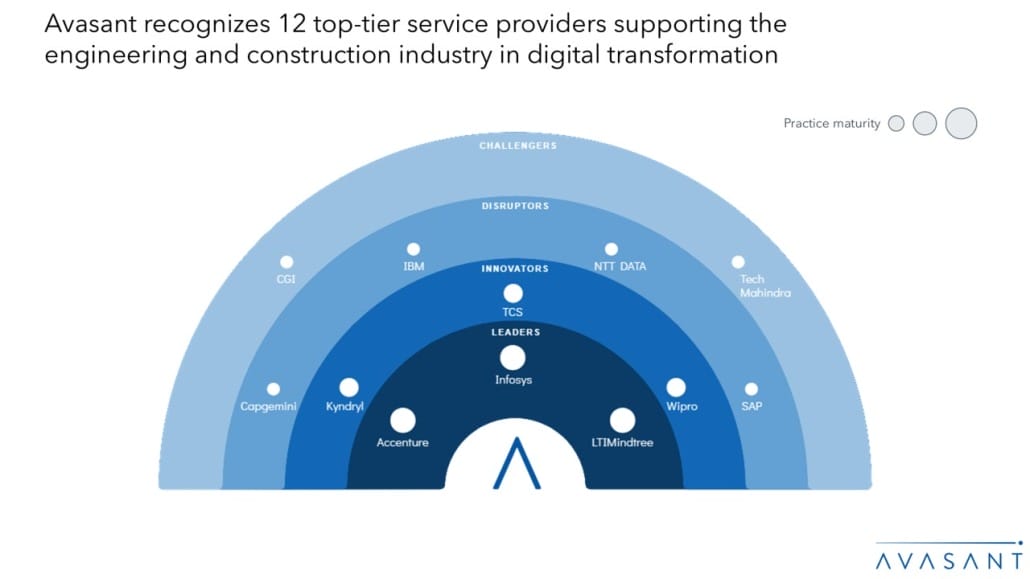

We evaluated 27 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 27 providers, we recognized 12 that brought the most value to the market over the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Infosys, and LTIMindtree

- Innovators: Kyndryl, TCS, and Wipro

- Disruptors: Capgemini, IBM, NTT DATA, and SAP

- Challengers: CGI and Tech Mahindra

Figure 1 below from the full report illustrates these categories:

“The engineering and construction sector faces soaring costs, labor shortages, and mounting demand,” said Michael Wheeler, partner at Avasant. “To remain competitive, firms must adopt modular design, leverage AI-powered sourcing, and deploy robotics to improve productivity and efficiency.”

The reports provide several findings, including the following:

-

- Construction firms are turning to modular construction, IoT sensors, building information modeling (BIM), and advanced design platforms to speed up delivery and improve coordination.

- Robotics, drones, AI-integrated field tools, and smart wearables are being deployed to enhance productivity, automate workflows, and improve safety on job sites.

- Sustainability regulations are driving the adoption of digital twins, carbon tracking systems, and life cycle assessment tools across the project life cycle.

- Companies are replacing fragmented legacy systems with integrated environments to support real-time decision-making and operational efficiency.

- To scale these efforts, firms are partnering with digital service providers to accelerate transformation and strengthen competitive advantage.

“The engineering and construction industry is being reshaped by labor shortages, disconnected data, and growing ESG pressures,” said Sahaj Kumar, associate research director at Avasant. “Firms must embrace automation, integrated platforms, and sustainability tools to stay compliant, productive, and competitive.”

The RadarView also features detailed profiles of 12 service providers, along with their solutions, offerings, and experience in assisting engineering and construction enterprises in their digital transformation journeys.

This Research Byte provides a brief overview of Avasant’s Engineering and Construction Digital Services 2025 Market Insights™ and Engineering and Construction Digital Services 2025 RadarView™ (click for pricing).