On April 4, 2022, Dubai promulgated a new law mandating the provision of digital services in Dubai. The law obligates government entities, judicial authorities, and private entities in Dubai to offer digital services, which it defines as services provided to customers through digital channels such as websites, smart applications, and other electronic media.

The specific categories of digital services are not defined in the law. Those will be defined in a resolution yet to be issued, along with the entities to be covered and various rules and procedures for each phase of implementation. Once the implementation phases of the new law are determined, all organizations in Dubai must comply within one year, based on their implementation phase and without imposing any extra fees on those they serve.

The law also places obligations on individual customers (that is, consumers), including a requirement to update their personal information with each entity with whom they access digital services. Digital signatures are also covered under the law.

The law specifically allows entities to outsource provision, management, and operations of digital services to a public or private company approved by Dubai’s General Secretariat and the Department of Finance (DOF). Digital services must comply with the cybersecurity and data protection standards adopted by Dubai Electronic Security Center and the digital payment methods adopted by the DOF and should be made available in Arabic and English languages with accessibility features for disabled individuals.

Avasant believes this new law is a natural progression to the structural reforms and national programs introduced by the United Arab Emirates (UAE) government in the recent past in its efforts to build a future-ready economy. The UAE government has put a strategic focus on adopting technologies such as artificial intelligence (AI), blockchain, and the cloud through initiatives such as the Service 360 policy (March 2022), the Emirates Blockchain Strategy 2021 (April 2018), and the National Artificial Intelligence Strategy 2031 (February 2018). Such initiatives are aimed to attract foreign investment, modernize the business environment, and diversify the UAE’s revenue sources, with an aim to minimize its economic dependency on oil. As a result, the UAE has moved to the forefront of digital adoption in the region, contributing over 74% of cloud and 60% of AI projects in the Gulf Cooperation Council (GCC) region, as noted in our GCC Region Digital Services 2020–2021 RadarView™. The new law furthers the digital narrative by building a dynamic and integrated government system that pursues continuous development to best serve Dubai’s citizens and residents and elevate their experiences. This also encourages entities in Dubai to adopt digital technologies and stay globally competitive.

However, at the same time, the new law has forced organizations in Dubai to revisit their business models and uplift their digital quotient to provide digital services to their customers in a cost-optimal manner. This implies the need for organizations to actively begin investing in processes, people, and technology, either organically or in collaboration with technology service providers.

This culminates into two significant implications for organizations: designing a strategy for developing or acquiring the digital talent for executing such large transformational projects within one year and scouting for the right technology partner.

Talent Strategy for Meeting the One-Year Timeline

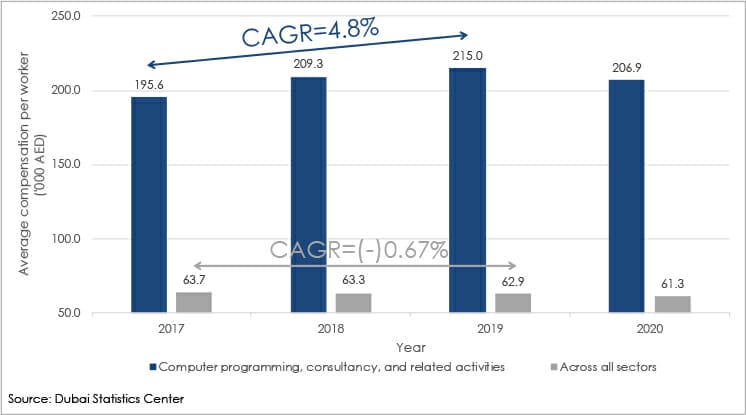

As the adoption of digital technologies accelerates across the GCC region, digital skills are likely to become scarce. The chart below shows that, before the economic slowdown in 2020 due to the COVID-19 pandemic, the average compensation for computer programmers and consultants in the UAE grew at a compounded annual growth rate (CAGR) of 4.8%, as against a 0.67% decline in the average compensation across all the sectors until 2019. This indicates the gap between supply and demand for talent in the region. We believe this new law will make the war for talent even more aggressive.

Figure 1: Comparison of average compensation per computer programmer or consultant with average compensation per worker in the UAE

Over the past two years, the UAE government has introduced a series of measures to address the industry pain point around talent and a specialized workforce:

-

- In November 2020, the UAE opened its economy to all nationalities by amending the foreign ownership rules for commercial companies. This amendment was a welcome move for the majority of technology providers as it also dissuaded concerns related to partnering with the local players.

- To boost the availability of skilled resources, the UAE government introduced a new labor law, effective February 2022. The highlight is the shift from unlimited-term contracts to fixed-term contracts, regulation of non-compete clauses, the addition of new types of leave policies, and allowing workers to stay for longer periods during in-between jobs.

- With a large migrant population, the UAE also introduced new visa policies, including the Golden Residence visa, to attract and retain global talent.

All the above modifications to ownership laws, labor laws, and visa policies coupled with the new digital services law will encourage healthy competition and lateral hires, leading to almost a forced pyramid refresh. This means a refresh at lower levels based on skills so that fresh ideas and skills are injected into the people pool instead of long tenures, lack of documentation, and over-reliance on people rather than a process for UAE entities.

Hence, we recommend organizations to induce skills/pyramid changes to counter the talent gap by:

-

- Promoting periodic refreshes to the talent pool to drive the organizational change management

- Offsetting a single point of failure in the organization due to reliability on particular internal personnel

Last but not the least, these policies also help make the UAE an attractive off-shoring option with proximity to the global system integrators based out of India and independent software vendors and startup community in Egypt, Turkey, and Israel.

Hence, enterprises can now seriously consider collaborating with the right technology providers to solve some of their talent gap challenges.

Identifying the Right Technology Partner

Progressive enterprises need to carefully evaluate the capability and compatibility of service providers to ensure projects are delivered within the stipulated budget, and they can comply with the deadline as stated by the law. To get the best returns from their investments in technology, organizations should focus on IT service delivery based on business requirements instead of as a support function. Partnering with a service provider who can offer a delivery model with a combination of onshore, nearshore, and offshore resources can help optimize the total cost of ownership of technological infrastructure.

Organizations should look for the following characteristics in a service provider while outsourcing the development and management of the said digital services:

-

- The service provider should possess the required skill in terms of experience in working with the organization’s industry vertical and delivering a project at a required scale within the timeline. The provider should also help enterprises identify skill gaps and provide the necessary change management services to onboard employees.

- The service provider should have a well-established cybersecurity practice with governance, risk, and compliance capabilities and have developed a partner ecosystem comprising leading cloud and security platform providers. This will help comply with the region- and industry-specific regulation requirements.

- Engaging with the service provider having a local presence and a global network of delivery centers can help ensure the availability of required technical support round the clock with the optimum level of personalization in the services. A delivery model combining onshore and offshore resources can also help minimize the cost of transformation while maintaining the required quality of services.

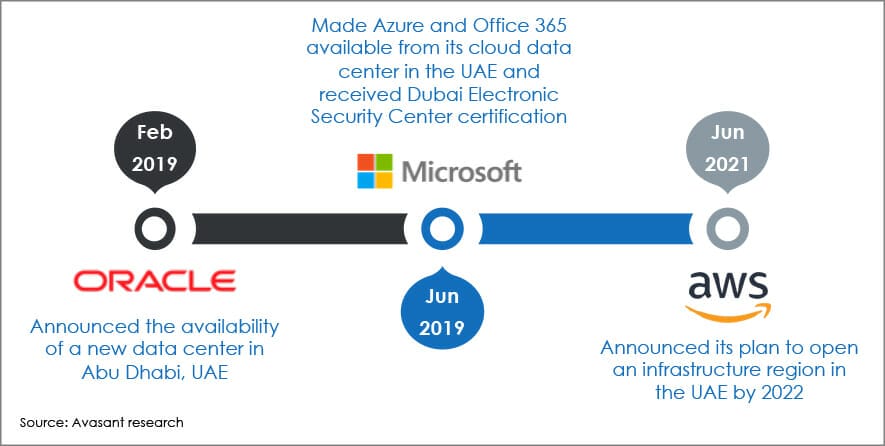

- The service provider should have developed partnerships with prominent cloud service providers in the region. This would enable the enterprises to ensure the privacy and security of their customer data and allow them to quickly comply with the current and upcoming legal regulations around data protection and privacy. Many cloud service providers including Microsoft, Oracle, and AWS have already opened up data centers in the UAE region. The figure below represents the timeline for data centers opened in the UAE by different cloud platform providers.

Figure 2: Timeline of data centers established in the UAE by the global cloud service providers

Conclusion

The new law has forced government and private entities in Dubai to push boundaries further to adopt digital technologies. To comply with this law, enterprises need to integrate digital services into their existing operations within a short, one-year time span in a cost-optimal manner.

As the demand for digital talent will see a sudden spike in the region, engaging with a technology service provider becomes paramount to accelerate the entire process. Service providers can leverage the offshore delivery centers and resources to support the digital transformation agenda for the enterprises and also help them prepare for the disruption coming their way.

By Gaurav Dewan, Associate Research Director, and Premal Shah, Senior Analyst, Avasant