This report provides a view into the adoption of digital services in the United Kingdom (UK), the ecosystem participants, their interplay, key challenges and the technology landscape. The report helps in identifying the right service providers that enterprises can partner with for digital transformation. We continue with a detailed assessment of 25 leading service providers offering digital services in the UK. Each profile provides an overview of the service provider, their digital services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovations, and ecosystem development.

Why read this RadarView?

Rapidly evolving customer behaviour and emerging business and operating models have made digital adoption imperative. However, despite being early adopters, UK firms have not been able to scale up their digital transformation initiatives because of a predominantly siloed approach. The role of IT must evolve to meet their strategic needs.

This RadarView helps companies use digital technologies to drive their digital transformation. It also provides information to assist businesses in choosing the right digital service provider in the UK.

Featured Providers

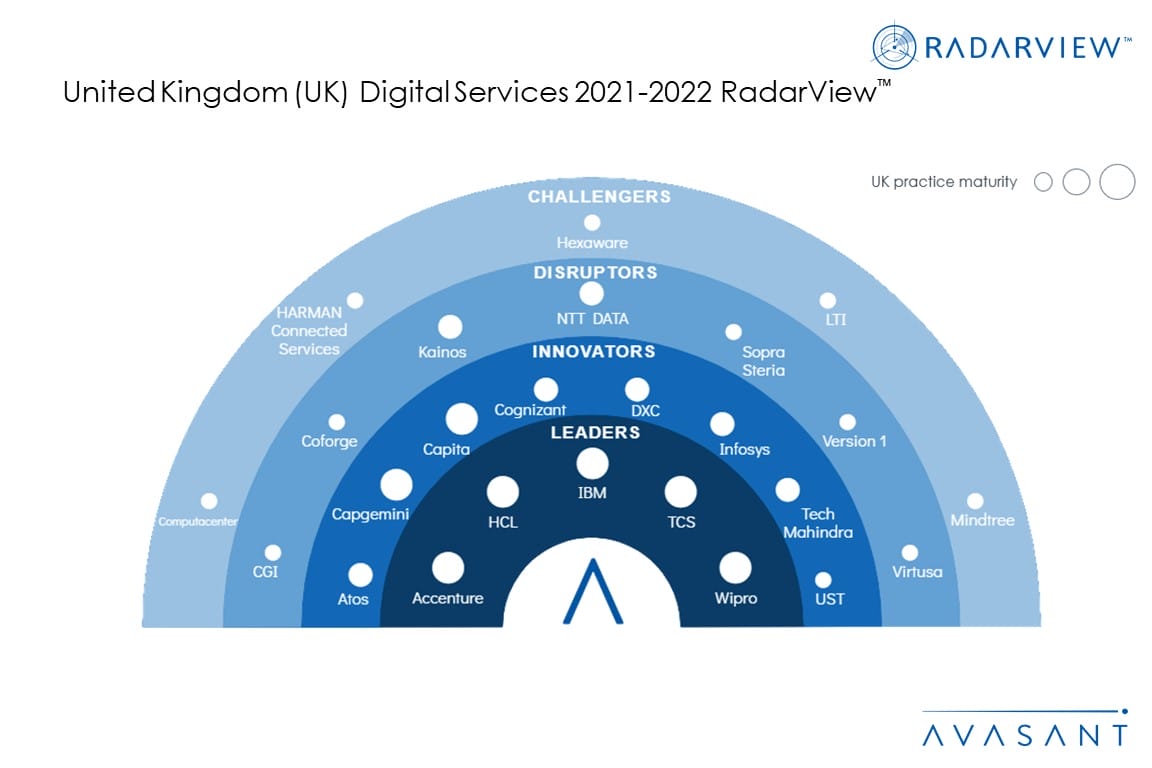

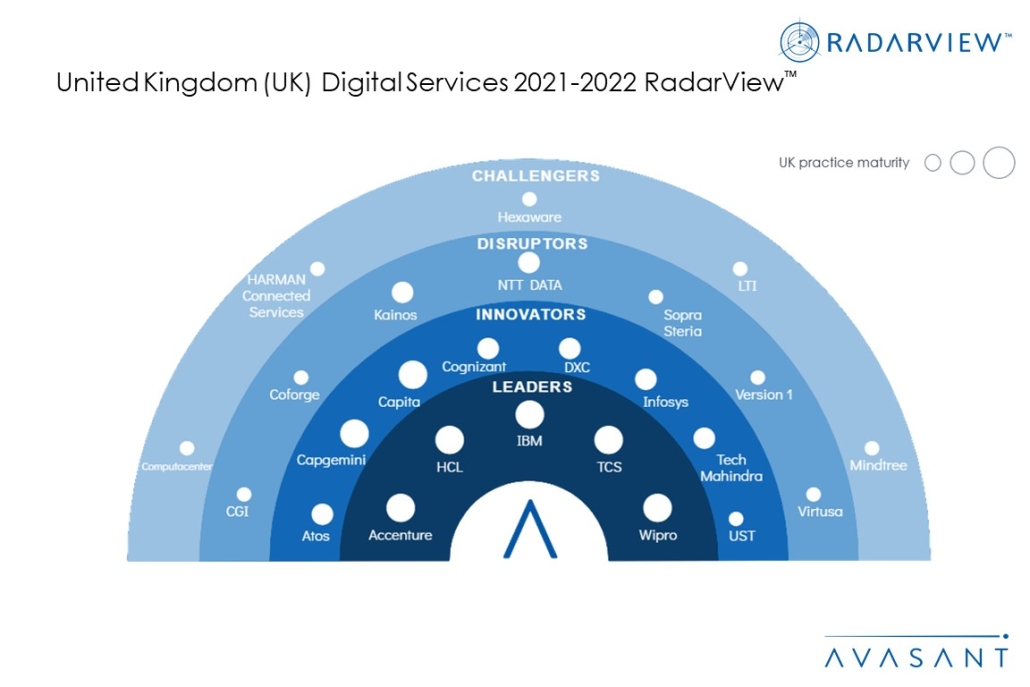

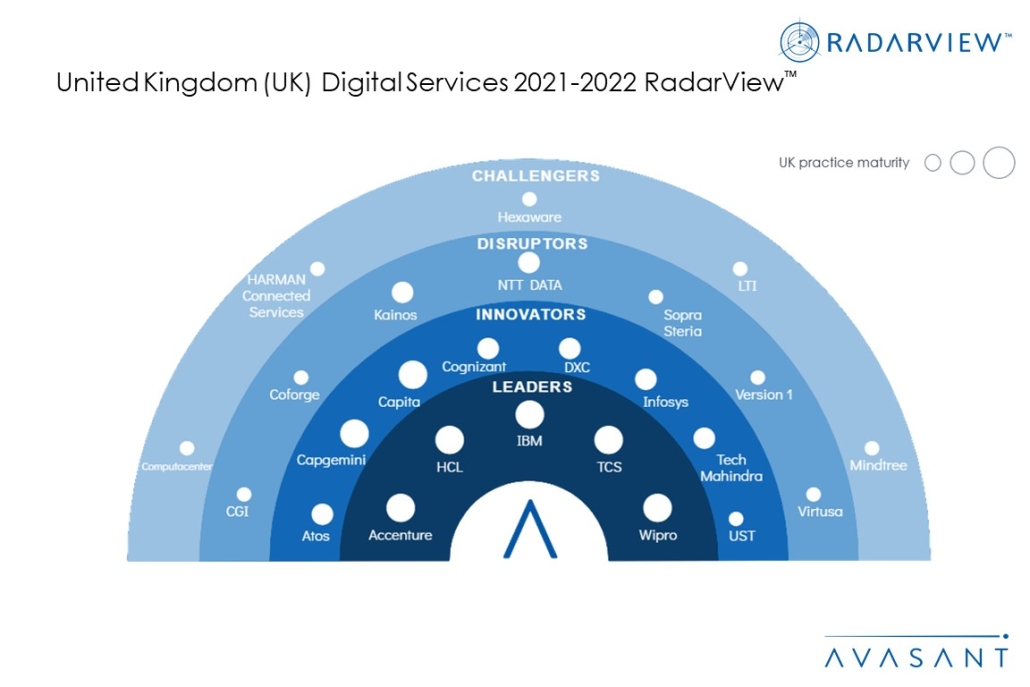

This RadarView includes an analysis of the following service providers in the UK digital services space: Accenture, Atos, Capgemini, Capita, CGI, Coforge, Cognizant, Computacenter, DXC, HARMAN Connected Services, HCL, Hexaware, IBM, Infosys, Kainos, LTI, Mindtree, NTT DATA, Sopra Steria, TCS, Tech Mahindra, UST, Version 1, Virtusa, and Wipro.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and ecosystem development, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

Regional scope of the report (Page 4)

Executive summary (Pages 5–8):

-

- Key trends shaping digital services in the UK

- Key recommendations for UK companies

- Avasant recognizes 25 top-tier vendors supporting the UK in digital transformation

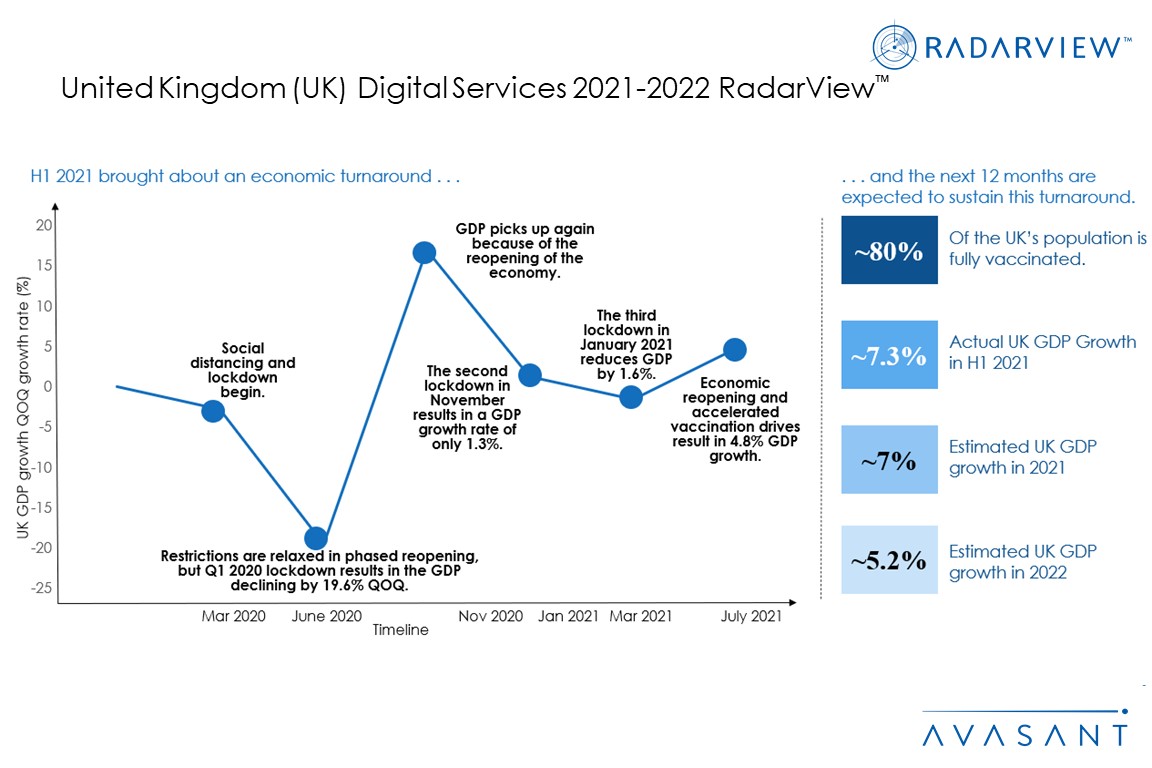

Economic landscape of the UK (Pages 9–12)

-

- Pandemic sending the UK into the worst recession

- Vaccination drives and lockdown removal enabling rapid economic revival

- Unemployment rate and business promotion being curtailed by government-designed schemes

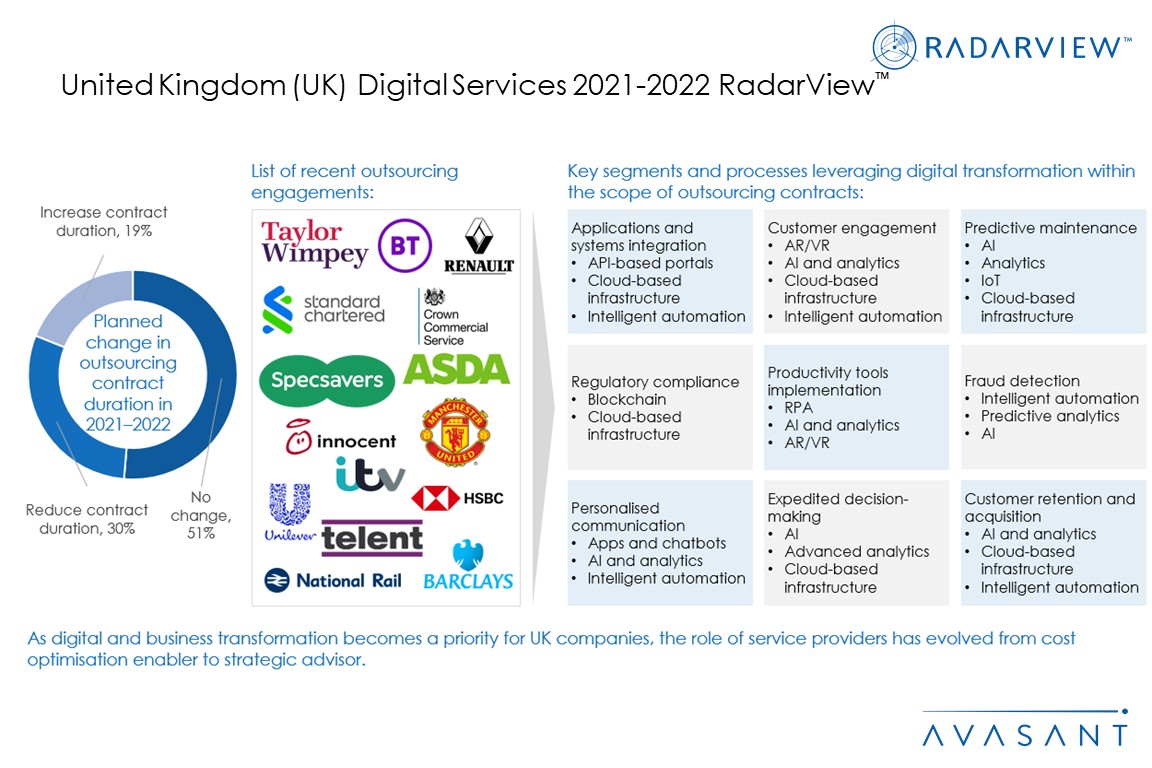

Lay of the Land (Pages 13-24)

-

- Government initiatives to accelerate digital adoption

- Digital transformation to continue across industries

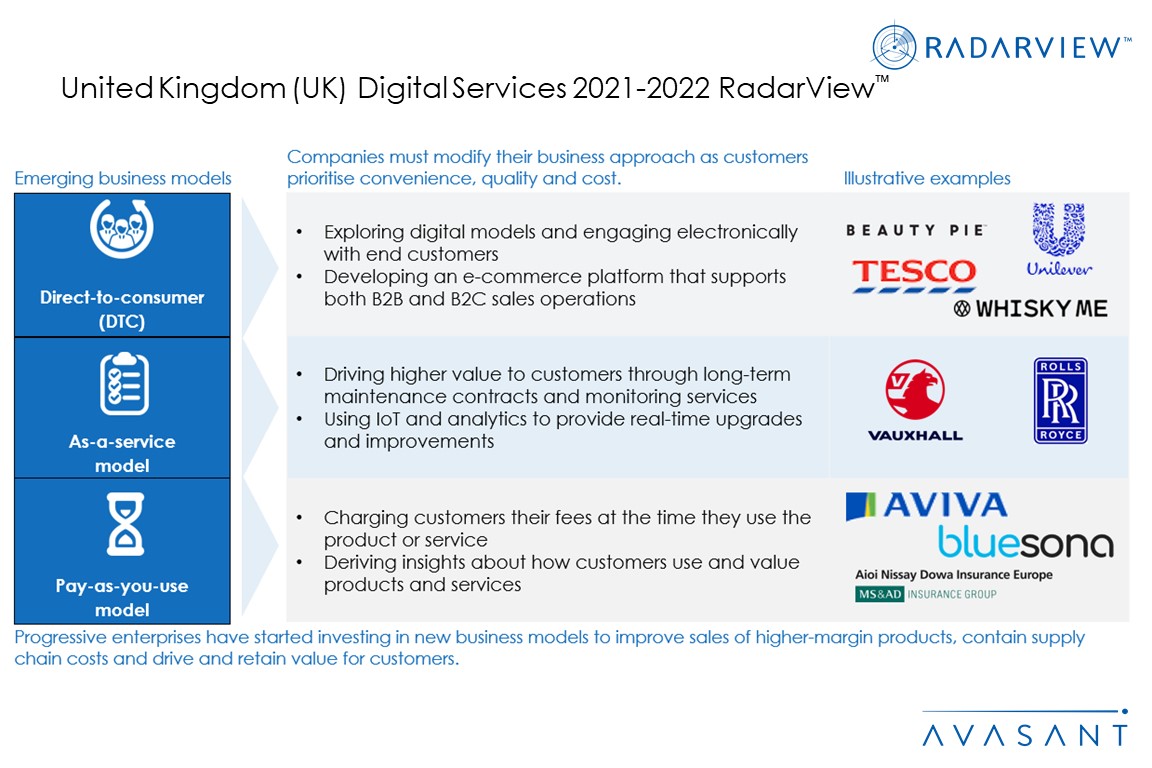

- Evolving customers’ expectations drive adoption of new business models

- Hybrid working models facilitate the new norm

- Global service providers expand their local delivery presence

The road ahead (Pages 25-31)

-

- Enabling data-driven customer experience and hyper-personalisation

- Evolving roles of CIO and IT function

- Booming startup ecosystem

- Working remotely raises importance of cybersecurity

RadarView assessment (Pages 32-37)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 38–113)

-

- Detailed profiles for Accenture, Atos, Capgemini, Capita, CGI, Coforge, Cognizant, Computacenter, DXC, HARMAN Connected Services, HCL, Hexaware, IBM, Infosys, Kainos, LTI, Mindtree, NTT DATA, Sopra Steria, TCS, Tech Mahindra, UST, Version 1, Virtusa, and Wipro.

Read the Research Byte based on this report.