For the first time, Computer Economics has conducted a study on the IT spending habits of organizations in the U.S. and Canada that are too small to qualify for our annual benchmarks survey. Despite their size, many of these companies have been around for years with sophisticated IT organizations that make use of many of the same technologies that their larger brethren do. We decided to examine the IT spending habits of these “very small organizations” with a dedicated survey to determine their spending habits and priorities, and to provide some metrics that can be used to benchmark their spending. What we found is that many of them are struggling with their IT budgets, largely because they lack economies of scale.

IT Budgets Are Inadequate for Most Very Small Companies

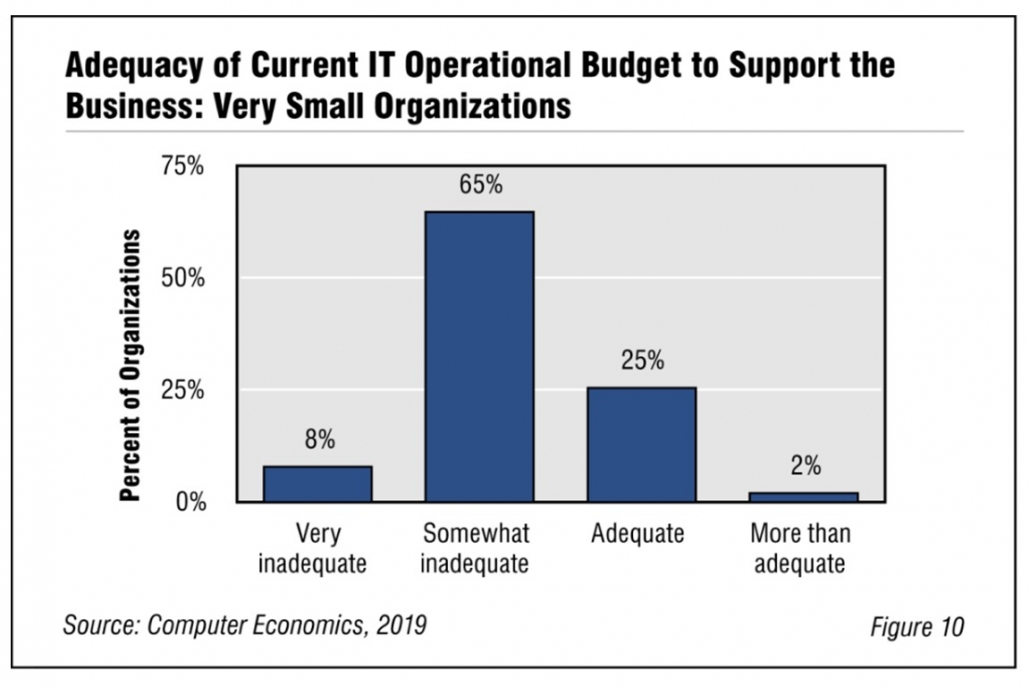

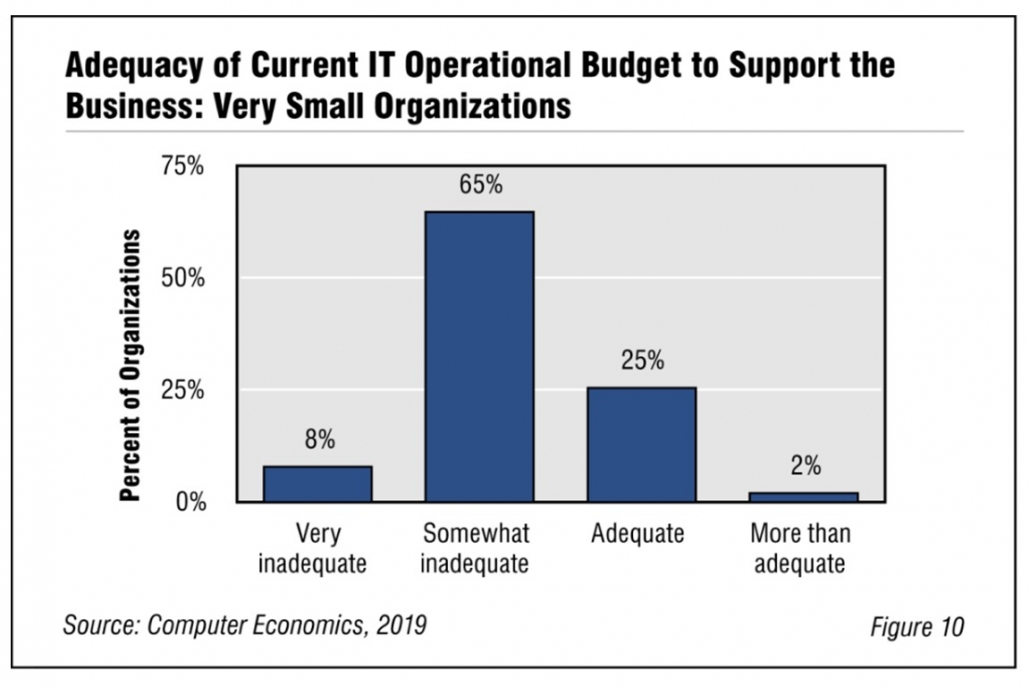

As shown in Figure 10 from the full study, 65% of very small organizations believe their budget is somewhat inadequate, and 8% report that it is very inadequate. It isn’t unusual for CIOs to find their budget inadequate, but for larger companies the picture is more optimistic. Roughly half of larger organizations report that their budgets are enough to get the job done. As a result, very small organizations are spending more on IT as a percentage of revenue than their larger cousins. Unfortunately, they are getting less bang for their buck.

In the full study, we present IT benchmarks for 51 very small organizations. To qualify as very small for the purposes of this study, a company had to be either under $50 million in annual revenue or under $1 million in IT operational spending. The reason for this two-sided definition is that size alone does not drive the level of IT spending. The industry sector drives IT spending to an even greater degree. Therefore, we cannot define the definition of “very small” based on size alone. For some IT-intensive sectors, such as financial services, companies with revenue as low as $20 million could easily have IT budgets over $1 million. But for some less- intensive sectors, such as manufacturing, companies could easily have revenue over $50 million and still not reach $1 million in IT spending. Had we not done it this way we would have had trouble finding very small organizations across all sectors. The smallest company in our sample has $1 million in revenue.

“Very small organizations can still be very sophisticated and mature,” said David Wagner, vice president, research, at Computer Economics, based in Irvine, Calif. “Unfortunately, some technologies are still out of their price range. SaaS is bringing some enterprise technology within the reach of smaller organizations, but AI, machine learning, and automation are probably still mostly out of their reach. As such they likely have more manual processes and informal systems which are less cost-effective.”

Here are some of the other key findings of the study for very small organizations:

-

- IT Operational Budgets Flat: As mentioned above, for very small organizations, IT operational budgets are flat at the median. This could be due, in part, to the fact that they are already spending more as a percentage of revenue than their small-organization cousins. But given the relative strength of the economy, flat budgets are unexpected. There have been some predictions of recession in the next 12 months so perhaps very small organizations are being conservative about increases in light of impending economic headwinds.

- Outsourcing Is a Way of Life: Very small organizations outsource at a much higher rate than their larger cousins. At the median, very small organizations spend 16.7% of their budget on outsourcing, compared with just 9.1% for small organizations. Even larger companies spend less on outsourcing at the median. It is not surprising that the smallest companies outsource the most. Very small organizations usually do not have enough IT staff members to cover all needed skills.

- Security/Privacy Top Budget Priority: Companies of all sizes are making IT security a priority. So it is not a surprise to see very small organizations doing the same. A net of 57% of respondents report that they are increasing their spending in this area. This was the largest net percentage of companies increasing any budget category.

- Cloud Applications Are Top Strategic Priorities: Cloud applications are top of mind when it comes to strategic spending. A net of about 67% of all very small IT organizations are increasing funding for this area. Systems/data integration is second at 58%, and updating legacy systems is third at 42%.

Bottom line: Very small organizations spend more on IT as a percentage of revenue than larger organizations simply because economies of scale and access to cost-saving technology are out of their reach for now. However, all technology eventually gets less expensive. We expect at some point to see very small organizations change their spending as more of the technology of the cloud and digital transformation reaches them. As this study continues in future years, we will have a better sense of how quickly this transformation will happen.

List of IT Spending Metrics for Very Small Organizations

The full study provides many metrics that can be used to benchmark IT spending for very small companies, as follows.

Demographics:

-

- Organization-size demographics: revenue, number of employees, and revenue per employee

- IT spending demographics: total IT spending, IT capital budget, and IT outsourcing budget

- Key metrics of IT intensity: ratio of users to employees, PCs per user, percentage of users with tablets, percentage of users with smartphones, outsourcing as a percentage of IT spending, and percentage of IT spending outside the IT budget

IT Planning and Budgeting Priorities:

-

- Net trend for spending by budget area

- Outsourcing trend

- Net trend for spending by IT initiative

- Importance of lower costs vs improving service

IT Operational Spending Metrics

-

- Trend in IT operational budgets

- Change in IT operational budgets

- Adequacy of current IT operational budget

- IT operation spending as a percentage of revenue

- IT operational spending per user

- IT operational spending per PC

- IT operational spending metrics by sector: for manufacturing, retail, and wholesale distribution sector; professional/technical services sector; and financial services sector.

- Percentage of IT operational budget charged back to users

- Users per IT staff member

IT Staffing Metrics

-

- Users per IT staff member

- Users per IT staff member by sector: for manufacturing, retail, and wholesale distribution sector; professional/technical services sector; and financial services sector.

This Research Byte is a brief overview of the findings in our report, IT Spending Benchmarks for Very Small Organization Benchmarks 2019/2020. The full report is available at no charge for Avasant Research subscribers, or it may be purchased by non-subscribers directly from our website (click for pricing).