As the saying goes, it takes money to make money. For IT managers, that translates into finding resources to invest in new initiatives that promise to make operations more efficient while also freeing up resources for business-centric projects.

This Research Byte is a summary of our full report, Top IT Investment Areas for 2008.

According to our study of about 200 IT managers, equally distributed among small, medium, and large organizations, about 30% of IT spending this year will go towards new initiatives (as opposed to ongoing, “keeping the lights on” spending). But where are those new-initiative dollars going?

Our survey asked IT executives to assess their organization’s level of adoption for each of 24 technologies. Possible responses included “no activity,” “considering,” “implementing,” “in place,” and “in place and increasing.” For the purposes of this study, we only consider the percentage indicating that they are implementing a technology for the first time or expanding on their implementations–in other words, spending on new initiatives in the technology area.

Top 10 IT Initiatives by Frequency of Investment

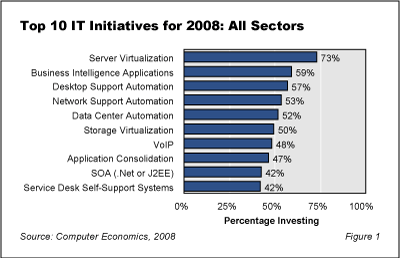

Figure 1 lists the top 10 technologies across all sectors (the composite sample) ranked by the percentage of companies that plan to spend new-initiative dollars in that area. It should be noted that the responses do not indicate anything about the size of investments in dollar terms. Nor would it be possible to create an exhaustive list of technologies, solutions, or IT initiatives. Most of the 24 technologies were selected because we perceived them to be areas of high interest to IT managers. The technologies also need to be mature enough for majority adoption–that is, at a point where the majority of organizations are at least considering adoption.

The technology with the broadest rate of investment is server virtualization. As shown in Figure 1, 73% of organizations are investing in server virtualization, making it the single most popular area for new-initiative spending by a significant margin. Server virtualization is clearly in a state of majority adoption. A year ago, the same survey found that 63% of enterprises were investing in the technology. While server virtualization is being widely adopted, the market is also still in a high-growth phase.

Many businesses are continuing to focus their application layer investments on business intelligence (BI) software, the No. 2 initiative with a 59% investment rate. While organizations are still having difficulty measuring a return on their BI investments and are finding that costs can be higher than anticipated, the perceived value of having timely, in-depth business intelligence appears to be outweighing the risks.

Desktop support, network support, and data center automation tools, with investment rates ranging from 52% to 57%, occupy the next three spots. IT organizations are expanding investments in tools that promise to automate labor-intensive IT processes such as asset discovery, software distribution, and monitoring activities. About half of the organizations are also investing in storage virtualization, which also promises to lower the cost of data management. With data storage requirements increasing, due to regulatory mandates and an explosion in rich media applications, it is no surprise that storage virtualization, which enables data centers to make better use of storage resources, is a popular investment.

The remaining four areas are ongoing investments in VoIP (48%), application consolidation initiatives (47%), service-oriented architecture (SOA) projects involving either .Net or Java EE platforms (42%), and service desk self-support systems (42%), which include systems for resetting passwords and self-help portals.

The full version of this report examines where IT managers are most frequently spending their new-initiative dollars to gain efficiencies, improve service levels, and support business objectives in organizations of various sizes and industry sectors.

Computer Economics Viewpoint

While IT budgets are coming under constraint in the slowing economy, our research indicates that most organizations are continuing to fund a healthy level of investment in new initiatives. Spending 30% of the budget on new initiatives should be sufficient to ensure that an organization stays current and competitive in today’s environment. Organizations that are falling below this median industry benchmark should consider whether their spending priorities are aligned with long-term objectives.

Where companies are investing their new-initiative dollars is also important. While IT managers are not be particularly focused on identifying the latest hot, emerging technologies, they are paying attention to what technologies have the potential to provide a sound return on investment. If an organization’s peers are practicing a high rate of investment in a certain technology, it is generally a good indication that the technology provides solid economic returns.

Our top-line observations: This study provides convincing evidence that every organization should be adopting server virtualization. That is no surprise. A second area of high investment is desktop support. The cost of supporting users in far-flung locations has long been a challenge for IT organizations, and they have found that outsourcing is not the panacea many had hoped for. Organizations today appear to be paying particular attention to automation and self-help applications that promise to lower costs and improve service levels. A third observation is that many IT managers believe automating IT processes in the network and systems administration areas, as well as the service desk area, is providing sound returns on investment.

Other areas with high rates of investment such as BI applications, VoIP, and service-oriented architecture are business initiatives that are likely to increase data center and network administration costs. In short, for IT executives and managers looking for ways to reduce operational costs to free up money for new business initiatives, virtualization and automation technologies are two areas that deserve close attention.

This Research Byte is a brief overview of our report on this subject, Top IT Investment Areas for 2008. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website at https://avasant.com/report/top-it-investment-areas-for-2008/ (click for pricing).