This RadarView aims to help engineering and construction (E&C) enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 10 providers offering digital services in the engineering and construction industry. Each profile provides an overview of the service provider, its industry-specific solutions, a list of representative clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovation, and partner ecosystem.

Why read this RadarView?

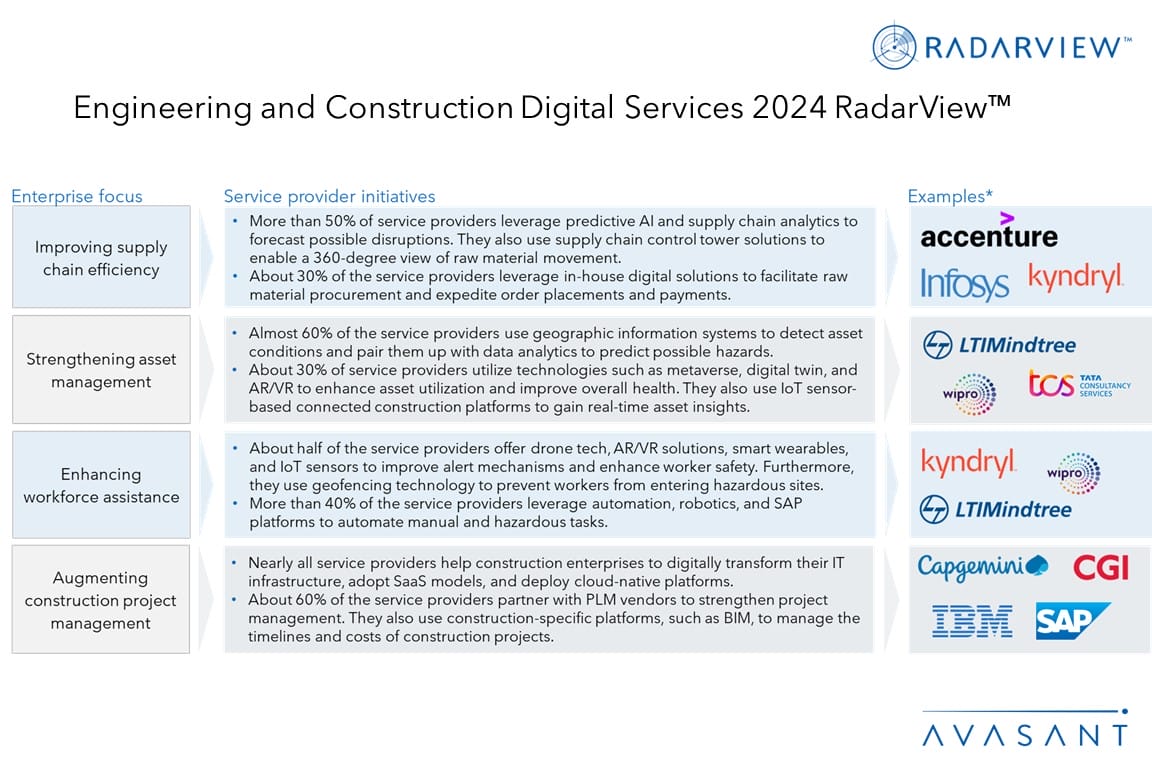

In the face of challenges such as cost pressures, climate compliance needs, labor shortages, and supply chain disruptions, the engineering and construction industry is aggressively pouring digital investments and adopting cutting-edge technologies — generative AI, advanced analytics, digital twin, and virtual reality — to address these challenges. Leveraging connected construction platforms, project management solutions, drone-based inspections, and modular construction, they aim to enhance project efficiency, reduce costs, and prioritize worker safety and technology usability. As this requires strong technological expertise and delivery capabilities, E&C enterprises are collaborating with service providers for digital transformation.

The Engineering and Construction Digital Services 2024 RadarView™ highlights key supply-side trends in the E&C industry and Avasant’s viewpoint. It aids companies in identifying top service providers to assist them in the digital transformation of their offerings for this sector. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to identify the right strategic partners.

Featured providers

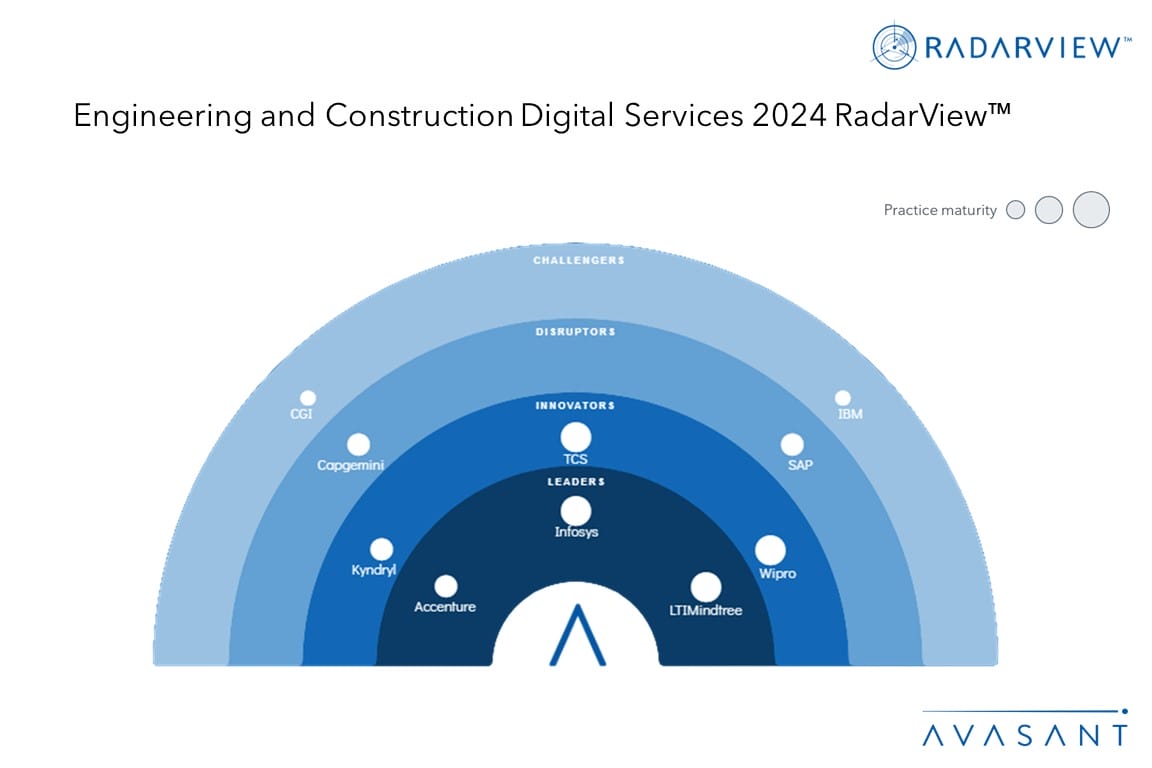

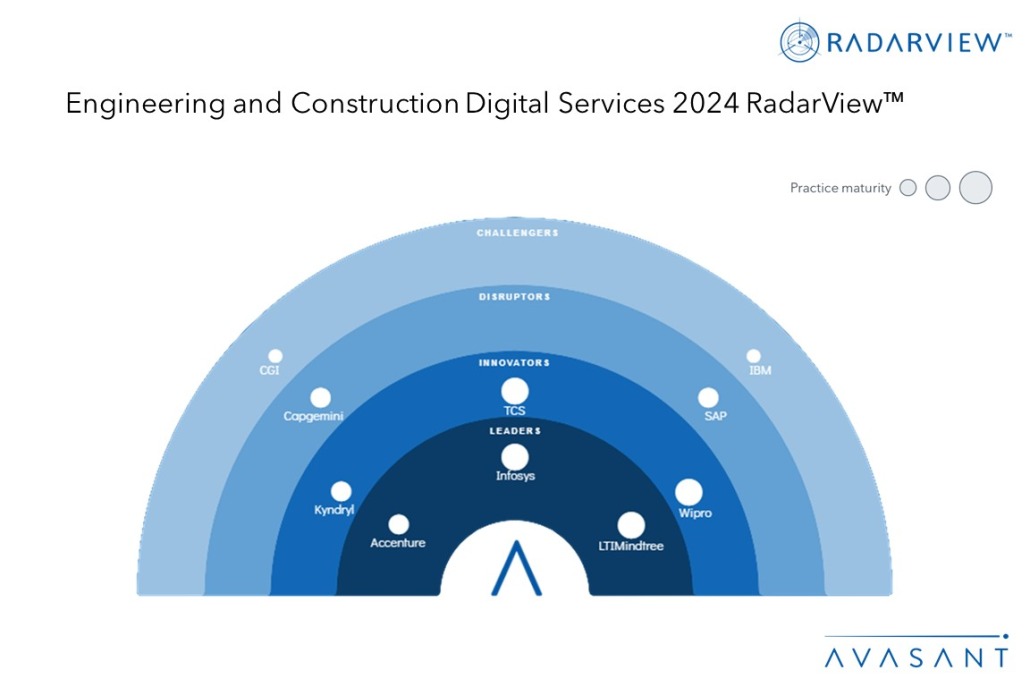

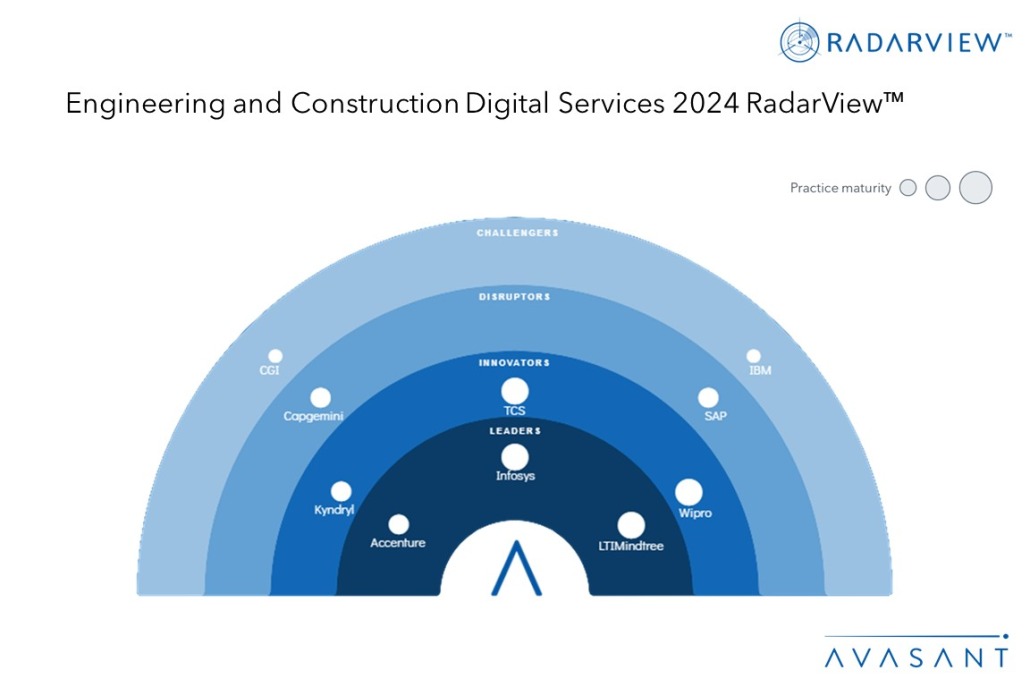

This RadarView includes a detailed analysis of the following service providers: Accenture, Capgemini, CGI, IBM, Infosys, Kyndryl, LTIMindtree, SAP, TCS, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

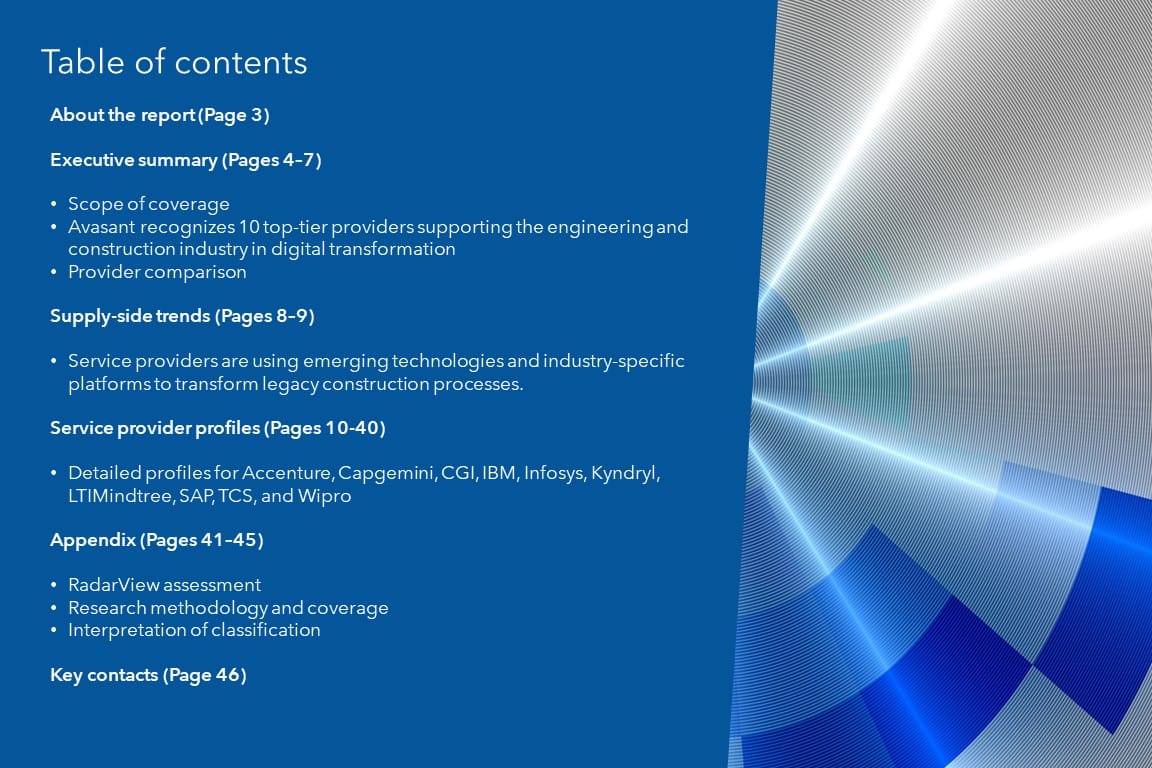

About the report (Page 3)

Executive summary (Pages 4–7)

-

- Scope of coverage

- Avasant recognizes 10 top-tier providers supporting the engineering and construction industry in digital transformation

- Provider comparison

Supply-side trends (Pages 8–9)

-

- Service providers are using emerging technologies and industry-specific platforms to transform legacy construction processes.

Service provider profiles (Pages 10–40)

-

- Detailed profiles for Accenture, Capgemini, CGI, IBM, Infosys, Kyndryl, LTIMindtree, SAP, TCS, and Wipro

Appendix (Pages 41–45)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 46)

Read the Research Byte based on this report.

Please refer to Avasant’s Engineering and Construction Digital Services 2024 Market Insights™ for demand-side trends.