In the face of challenges such as cost pressures, climate compliance needs, labor shortages, and supply chain disruptions, the engineering and construction industry is aggressively pouring digital investments and adopting cutting-edge technologies — generative AI, advanced analytics, digital twin, and virtual reality — to address these challenges. Leveraging connected construction platforms, project management solutions, drone-based inspections, and modular construction, they aim to enhance project efficiency, reduce costs, and prioritize worker safety and technology usability. As this requires strong technological expertise and delivery capabilities, engineering and construction enterprises are collaborating with service providers for digital transformation.

Both demand-side and supply-side trends are covered in our Engineering and Construction Digital Services 2024 Market Insights™ and Engineering and Construction Digital Services 2024 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the engineering and construction industry, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

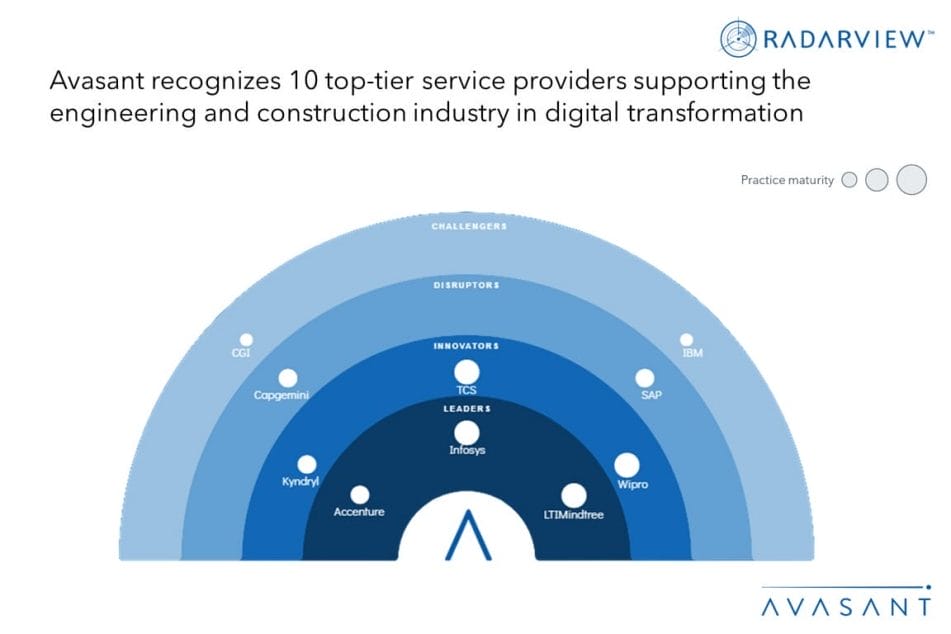

We evaluated 29 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 29 providers, we recognized 10 that brought the most value to the market over the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Infosys, and LTIMindtree

- Innovators: Kyndryl, TCS, and Wipro

- Disruptors: Capgemini and SAP

- Challengers: CGI and IBM

Figure 1 below from the full report illustrates these categories:

“The engineering and construction industry is facing dual challenges of supply chain disruption and talent shortage,” said Michael Wheeler, partner at Avasant. “Firms need to integrate cloud and AI in their operational strategies to manage the surge in construction demand and optimize resource utilization.”

The reports provide several findings, including the following:

-

- The engineering and construction industry is accelerating the adoption of digital platforms and transformative technologies to manage the increasing supply chain risk.

- Construction firms are embracing advanced technologies, such as modular construction, IoT sensors, and drone technology, to mitigate the impact of labor market transitions.

- Climate mandates are compelling engineering and construction enterprises to adopt digital technologies to reduce carbon emissions.

- Construction firms are adopting diverse technologies, such as connected construction platforms, advanced robotics, and enterprise modernization frameworks, to manage project timelines and avoid budget overspends.

- They are capitalizing on generative AI advancements by investing in startups and partnering with niche players.

“With rising global infrastructure investments and regulations, sustainable construction and timely project delivery are becoming table stakes,” said Anubhav Satapathy, lead analyst at Avasant. “Firms must partner with IT service providers to use construction-specific platforms to improve project performance and reduce carbon emissions.”

The RadarView also features detailed profiles of 10 service providers, along with their solutions, offerings, and experience in assisting engineering and construction enterprises in their digital transformation journeys.

This Research Byte provides a brief overview of the Engineering and Construction Digital Services 2024 Market Insights™ and Engineering and Construction Digital Services 2024 RadarView™ (click for pricing).