Technology spending by business and governmental organizations in the U.S. and Canada was strong in the first half of 2007, but IT managers must now predict how an uncertain economy will impact their budgets in the year ahead.

As shown in our most recent IT Spending, Staffing, and Technology Trends study, published in June, IT operational budgets increased by a healthy 5% this year over 2006 levels. But how is actual IT spending for 2007 shaping up against original budgets, and what are the expectations for IT spending growth next year? To answer these questions, Computer Economics conducted a survey in September and October of 125 IT decision-makers in the U.S. and Canada.

Our survey found that IT spending levels in 2007 have held up well against original budgets, but expectations for IT spending increases in 2008 are quite modest, especially among larger organizations. This article summarizes the results of the survey.

2007 Actual IT Spending vs. Budgets

We asked our respondents to predict whether their actual IT operational spending for 2007 will come in under or over their original budgets. Throughout this study, “IT spending” refers to IT operational spending, which includes all current-year expenses related to IT. It does not include capital investments.

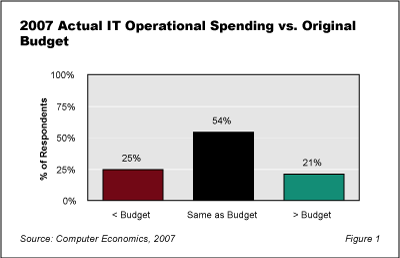

As shown in Figure 1, the majority (54%) indicate that their actual IT spending for 2007 will be about the same as budgeted. Of the remaining respondents, 25% are spending less than the amount budgeted and 21% are spending more. This shows a slight trend in the composite sample toward a pullback in IT spending levels this year.

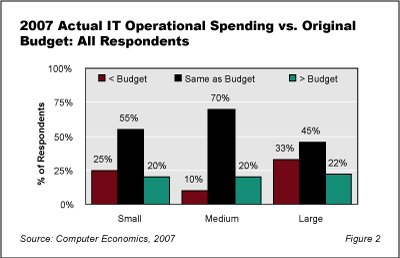

When we analyze the data by organization size, we see that spending restraint is most pronounced among large organizations. (In our study, large organizations are defined as those with annual revenues greater than U.S. $750 million. Medium organizations are those with $250-750 million, and small organizations have less than $250 million in annual revenue. (For the purposes of this study, we did not include any respondents with less than $30 million in revenue.)

As shown in Figure 2, 33% of large organizations indicate that their 2007 IT spending levels will be less than originally budgeted–a significantly greater number than the 22% who say their actual spending will exceed their budgets. The trend among medium organizations is the opposite: 20% expect actual spending to be greater than the budgeted amount, and only 10% expect it to be less. Small organizations fall somewhere in between medium and large organization. One-fourth expect actual spending to come in under budget, while 20% expect to overspend.

Expected Change in IT Spending Levels for 2008

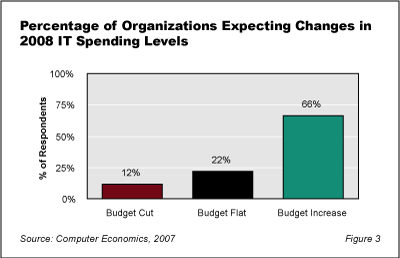

Turning to expectations for 2008, we see that the majority of organizations expect their IT spending levels to increase next year, as shown in Figure 3. Nearly two-thirds of respondents expect their IT budgets to increase in 2008, while only 12% expect budget cuts.

Once again, however, large organizations show a more conservative outlook. Among large companies, only 60% expect their IT budgets to increase, while 16% are actually expecting budget cuts, as shown in Figure 4. Only 10% of small organizations and 7% of midsize organizations expect budget cuts.

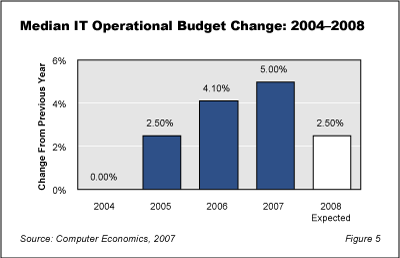

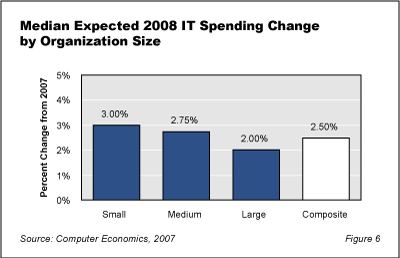

We have seen that the majority of respondents expect budget increases in 2008. But how large an increase do they expect? As shown in Figure 5, the median percentage increase for the composite sample is 2.5%. Though positive, these expectations are conservative and well below the 5% increase we saw in 2007 budgets over the previous year. In fact, if these expectations are accurate, 2008 will show the lowest level of IT spending increase since 2004.

Figure 6 shows that once again, large organizations have the most conservative expectations. Large organizations at the median expect IT spending to increase by only 2%. Midsize organizations expect a 2.75% increase, while small organizations are projecting a 3% increase at the median.

Outlook for 2008 IT Spending

The ability to fund increases in IT spending levels next year will depend primarily on the overall health of the economy. Therefore, a review of current economic conditions is helpful in understanding the outlook for 2008.

In the third quarter of 2007, U.S. GDP growth increased at a very strong 4.9% clip, according to the revised estimate from the U.S. Department of Commerce. This follows an increase of 3.8% in the second quarter. These two quarters demonstrate a rebound from the weak 0.6% growth rate logged in the first quarter. Because of the economic rebound in the second and third quarters, it is not surprising that the vast majority of organizations report actual IT spending this year at or above budgeted levels.

The outlook for IT spending in 2008, however, depends on management expectations for economic growth in the coming year. Here, there are already signs of trouble:

- The widely reported weaknesses of the housing sector and credit markets are already leading to softness in consumer spending.

- Risk of inflation and a weak dollar may restrict the U.S. Federal Reserve from further lowering interest rates, which could hinder economic growth. Although a weak dollar may provide a temporary boost to the U.S. export market, in the long run it makes goods more expensive to U.S. consumers and businesses, leading to higher costs.

- In October, the U.S. Labor Department reported that temporary jobs were down 70,000 from a year ago–that’s the largest decline in five years. Although businesses added 110,000 full-time jobs during the same period, the pullback in temporary positions could be the first sign of a weakening employment picture, as temporary jobs are generally the first to be cut.

Although these problems have not yet noticeably affected business investment (of which IT spending is a part), they could be precursors to slowing growth–if not outright recession–in 2008.

Our survey data indicates that IT executives have already scaled back their expectations for IT spending increases in 2008. If economic conditions do worsen, we expect that median IT spending increases in 2008 will be flat compared to 2007. We do not yet, however, see widespread IT spending cuts in 2008.

We will reexamine these metrics again in the first quarter of 2008, when we conduct our annual IT Spending, Staffing and Technology Trends survey.

Computer Economics has been tracking IT spending and budgeting trends since 1990. For more information, including current benchmarks by organization size and industry sector, please see our 2007/2008 IT Spending, Staffing, and Technology Trends study.