This RadarView helps enterprises define their approach to modernize legacy applications by utilizing application modernization services. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 23 providers offering application modernization services. Each profile presents an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations.

Why read this RadarView?

Application modernization empowers enterprises to enhance operational efficiency, agility, user experience, and competitiveness. It enables seamless scalability, data-driven decision-making, and cost reduction. Service providers assist enterprises in modernizing applications by offering expertise in assessment, strategy development, technology selection, migration, integration, security, testing, training, and ongoing support. They guide businesses through complex processes, ensure compliance, and enable continuous improvement. Service providers facilitate a smooth transition to modernized applications that align with evolving business needs, driving digital transformation.

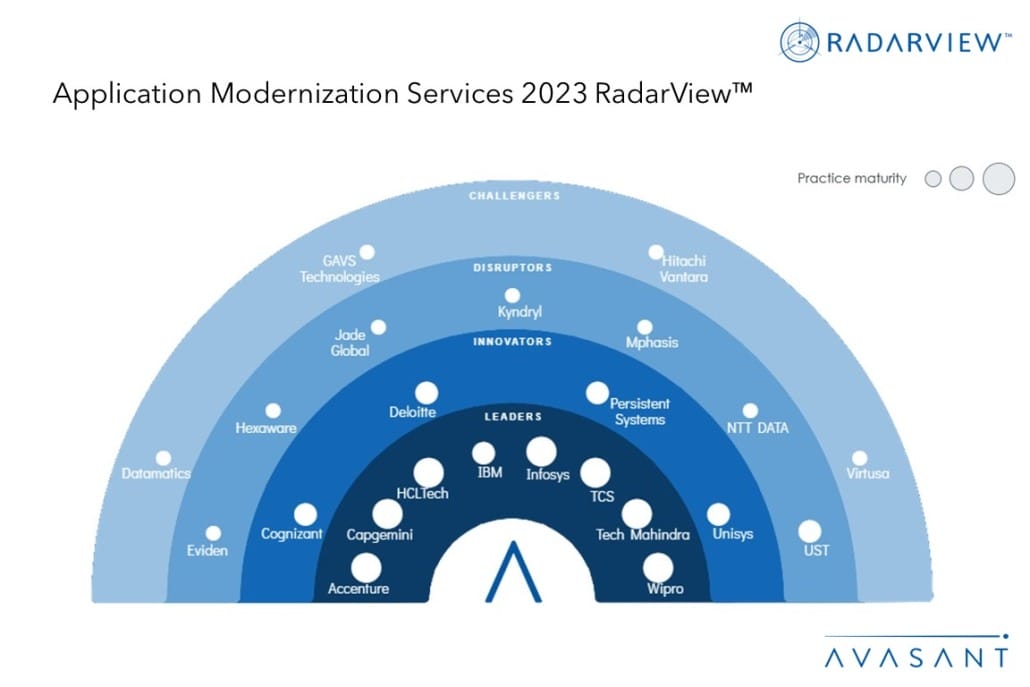

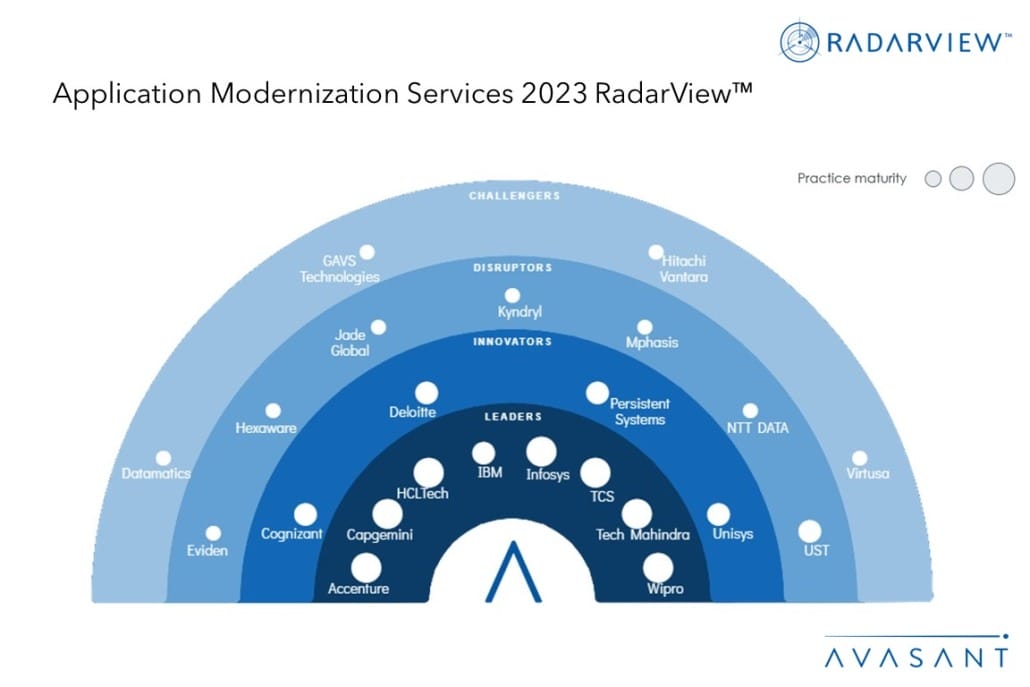

The Application Modernization Services 2023 RadarView™ highlights key supply-side trends in the application modernization space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in adopting application modernization services. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to identify the right strategic partners for modernizing their applications.

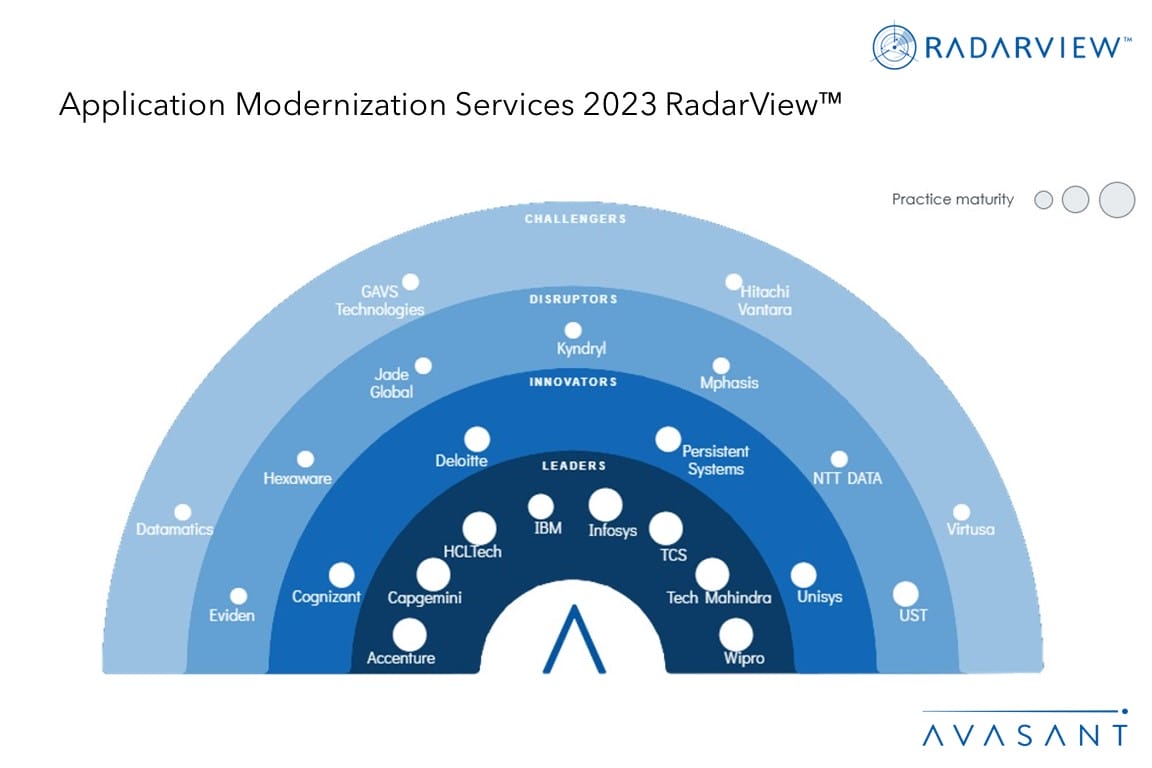

Featured providers

This RadarView includes a detailed analysis of the following application modernization service providers: Accenture, Capgemini, Cognizant, Datamatics, Deloitte, Eviden, GAVS Technologies, HCLTech, Hexaware, Hitachi Vantara, IBM, Infosys, Jade Global, Kyndryl, Mphasis, NTT DATA, Persistent Systems, TCS, Tech Mahindra, Unisys, UST, Virtusa, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining application modernization services

- Avasant recognizes 23 top-tier providers supporting the enterprise adoption of application modernization services

- Provider comparison

Supply-side trends (Pages 10–14)

-

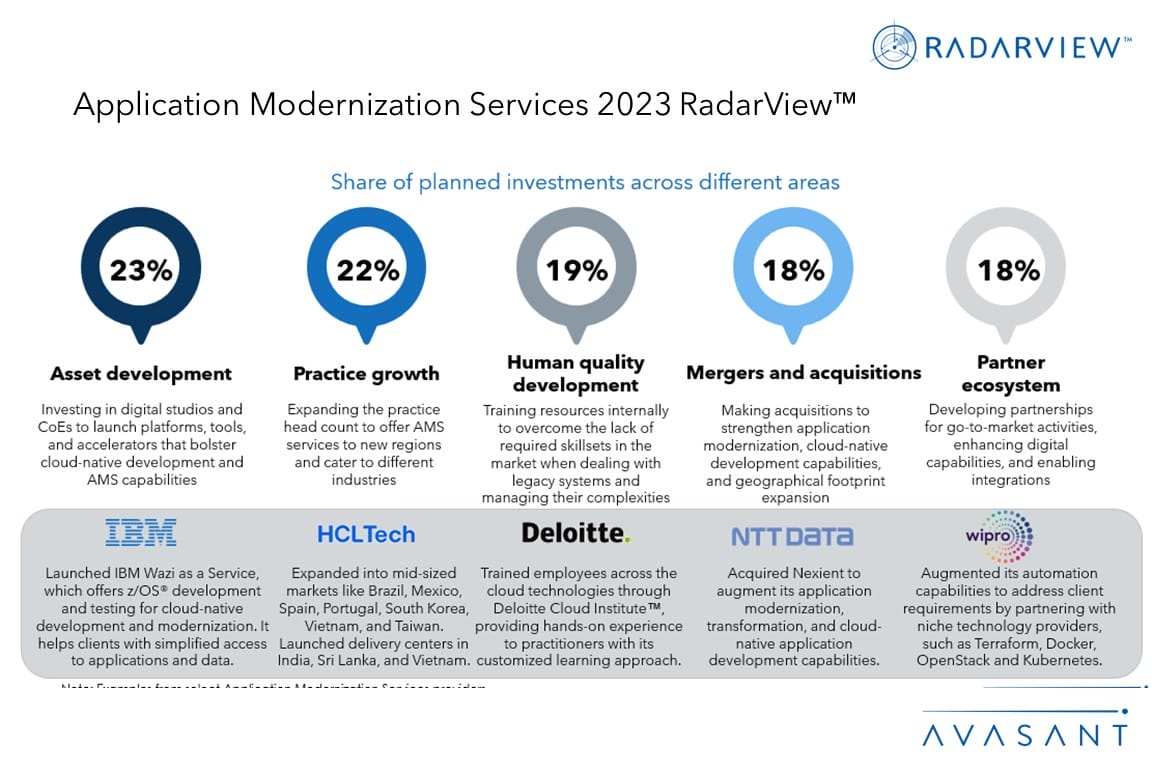

- Providers are scaling their offerings, showing an increased interest in asset development and practice growth

- Service providers are striking a balance in managing high and low-disruptive application modernization projects

- Project-based and input-based pricing models are being adopted in nearly 70% of client engagements

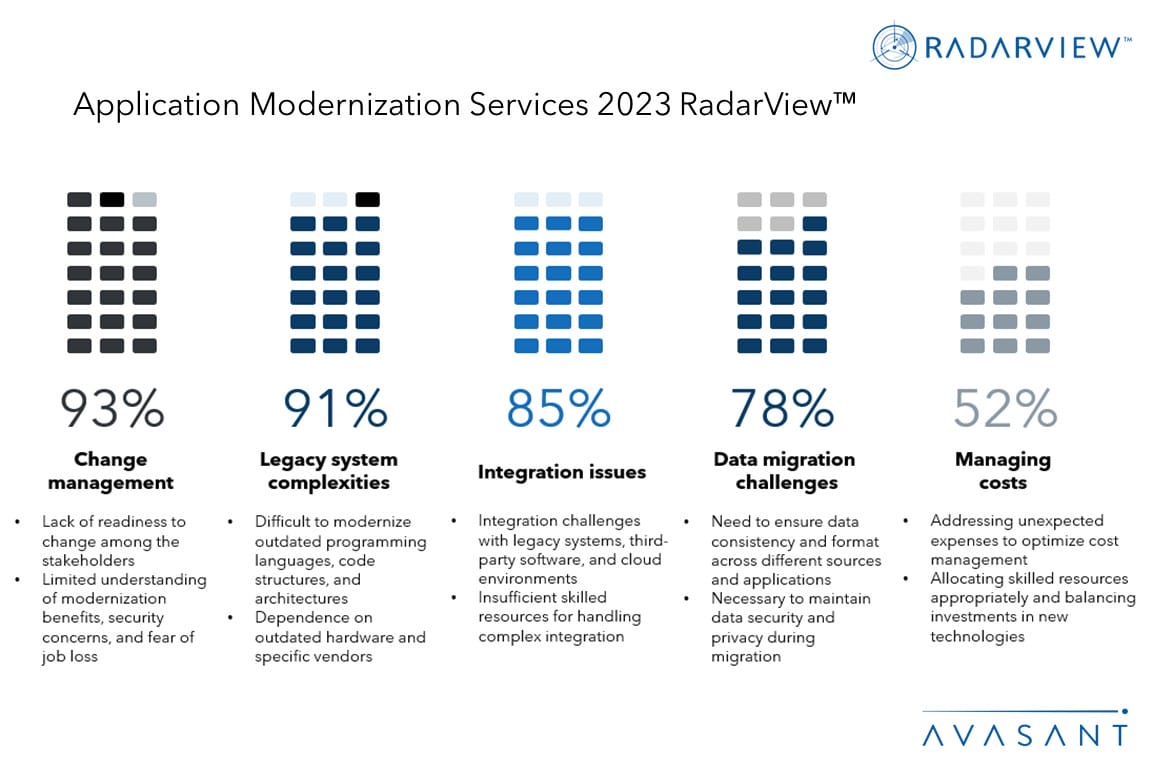

- The top challenges confronting providers are stakeholders’ reluctance to change and legacy system complexities

Service provider profiles (Pages 15–61)

-

- Detailed profiles for Accenture, Capgemini, Cognizant, Datamatics, Deloitte, Eviden, GAVS Technologies, HCLTech, Hexaware, Hitachi Vantara, IBM, Infosys, Jade Global, Kyndryl, Mphasis, NTT DATA, Persistent Systems, TCS, Tech Mahindra, Unisys, UST, Virtusa, and Wipro.

Appendix (Pages 62–65)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Pages 66)

Read the Research Byte based on this report.

Please refer to Avasant’s Application Modernization Services 2023 Market Insights™ for demand-side trends.