This RadarView aims to help enterprises understand the current state of AI and identify opportunities for leveraging this technology to streamline their business workflows. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 22 providers delivering applied AI services. Each profile gives an overview of the service provider, its key IP and assets, and a list of major clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

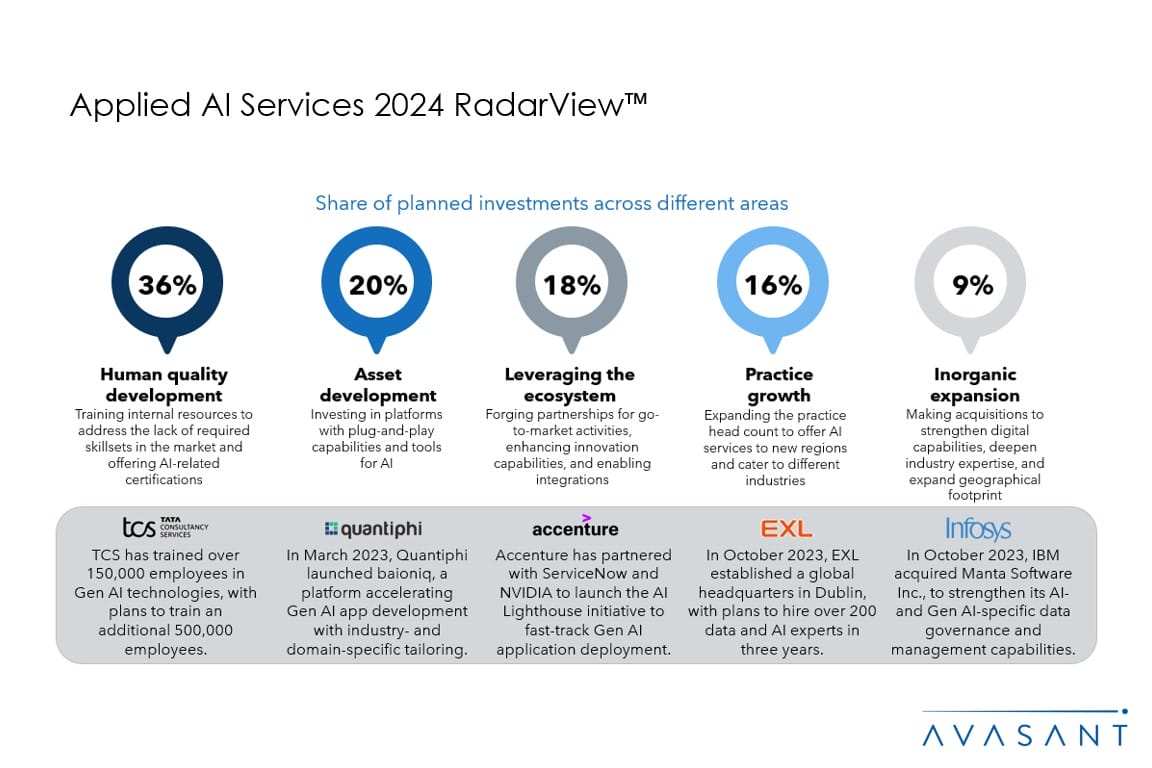

Over the past year, enterprises have moved AI projects from production back to pilot and POC stages, driven by the generative AI (Gen AI) wave in BFSI and retail sectors. This shift, aimed at harnessing Gen AI for customer service, IT, and sales, aligns with global Gen AI regulations. Gen AI’s impact is evident in managed services’ productivity, especially in app development and legacy modernization, and the rise of Gen AI-enabled smart devices for real-time enterprise applications.

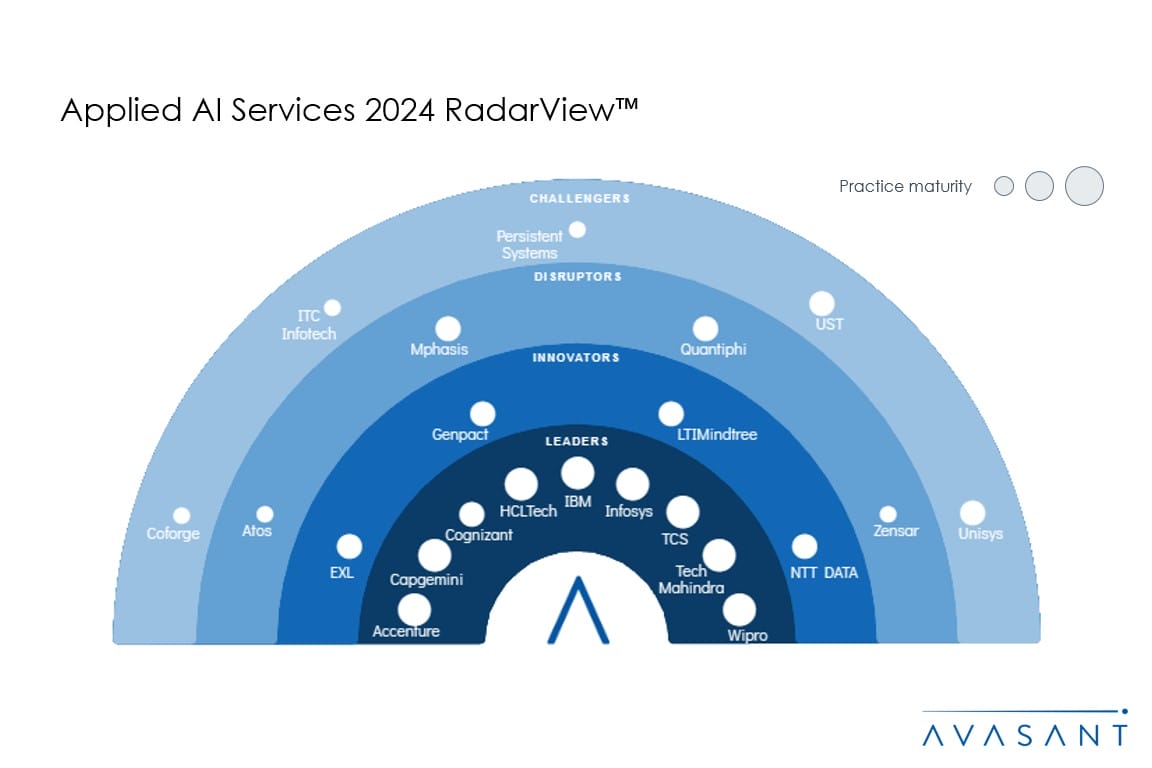

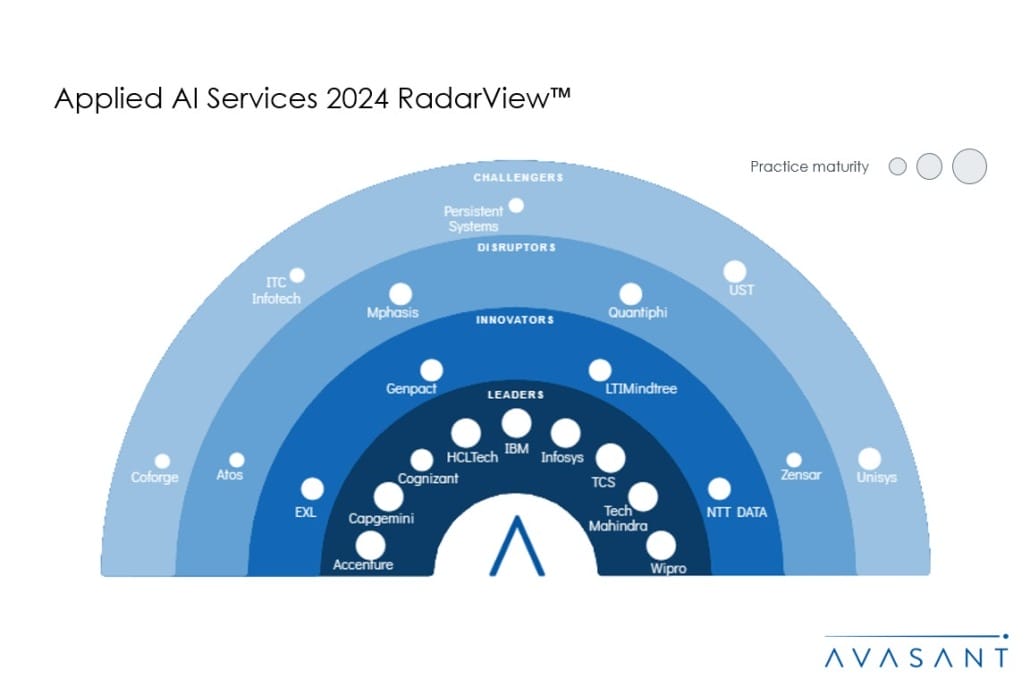

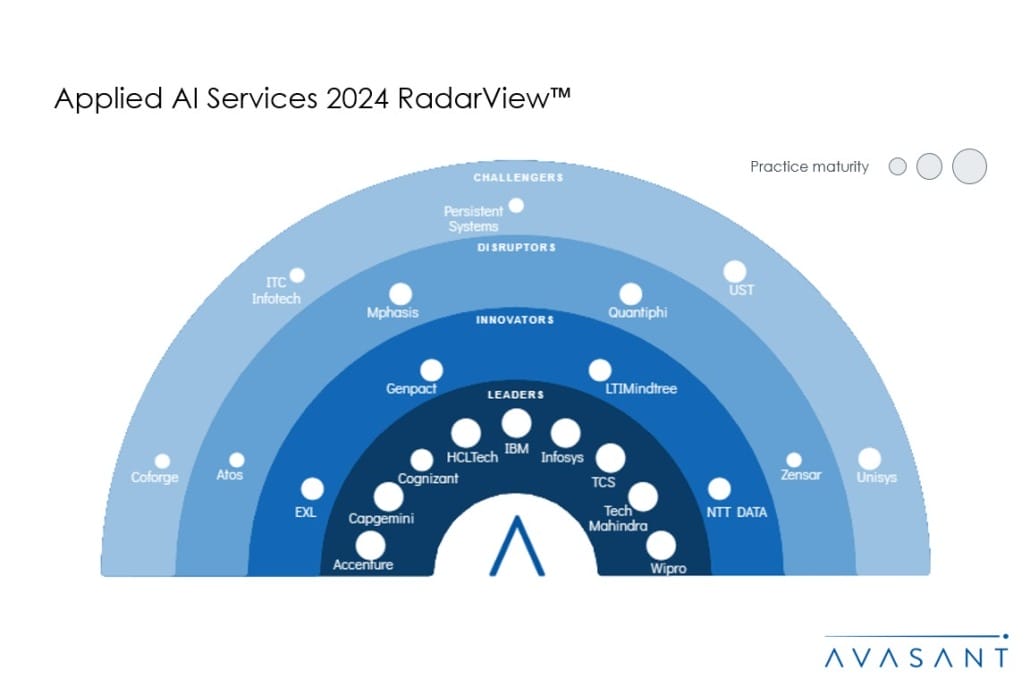

The Applied AI Services 2024 RadarView™ highlights key supply-side trends in this space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in their applied AI journeys. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners to implement.

Featured providers

This RadarView includes a detailed analysis of the following applied AI service providers: Accenture, Atos, Capgemini, Coforge, Cognizant, EXL, Genpact, HCLTech, IBM, Infosys, ITC Infotech, LTIMindtree, Mphasis, Persistent Systems, Quantiphi, NTT DATA, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

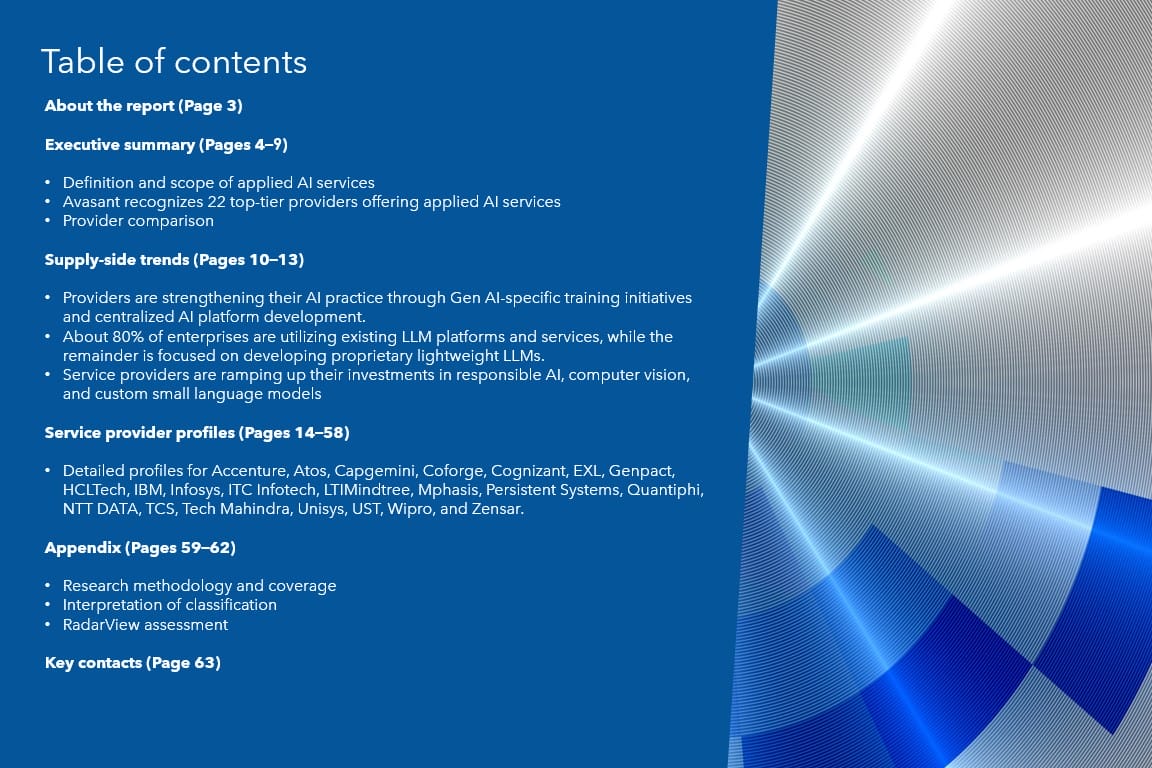

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Definition and scope of applied AI services

- Avasant recognizes 22 top-tier providers supporting the enterprise adoption of applied AI services

- Provider comparison

Supply-side trends (Pages 10–13)

-

- Providers are strengthening their AI practice through Gen AI-specific training initiatives and centralized AI platform development.

- About 80% of enterprises are utilizing existing LLM platforms and services, while the remainder is focused on developing proprietary lightweight LLMs.

- Service providers are ramping up their investments in responsible AI, computer vision, and custom small language models.

Service provider profiles (Pages 14–58)

-

- Detailed profiles for Accenture, Atos, Capgemini, Coforge, Cognizant, EXL, Genpact, HCLTech, IBM, Infosys, ITC Infotech, LTIMindtree, Mphasis, Persistent Systems, Quantiphi, NTT DATA, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Appendix (Pages 59–62)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 63)

Read the Research Byte based on this report.

Please refer to Avasant’s Applied AI Services 2024 Market Insights™ for demand-side trends.