Over the past year, enterprises have moved AI projects from production back to pilot and POC stages, driven by the generative AI (Gen AI) wave in BFSI and retail sectors. This shift, aimed at harnessing Gen AI for customer service, IT, and sales, aligns with global Gen AI regulations. Gen AI’s impact is evident in managed services’ productivity, especially in app development and legacy modernization, and the rise of Gen AI-enabled smart devices for real-time enterprise applications.

Both demand- and supply-side trends are covered in Avasant’s Applied AI Services 2024 Market Insights™ and Applied AI Services 2024 RadarView™ , respectively. These reports present a comprehensive study of applied AI service providers and closely examine the market leaders, innovators, disruptors, and challengers in this space. They also provide a view of key market trends and developments impacting the applied AI services space.

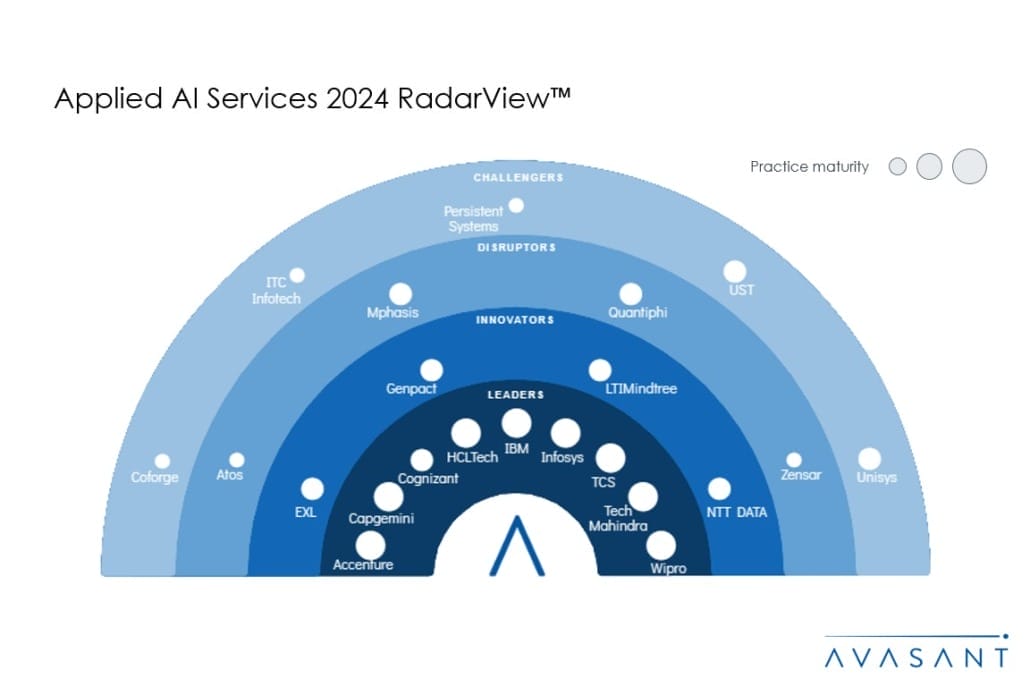

Avasant evaluated 35 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these 35 providers, we recognized 22 that brought the most value to the market over the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCLTech, IBM, Infosys, TCS, Tech Mahindra, and Wipro

- Innovators: EXL, Genpact, LTIMindtree, and NTT DATA

- Disruptors: Atos, Mphasis, Quantiphi, and Zensar

- Challengers: Coforge, ITC Infotech, Persistent Systems, Unisys, and UST

Figure 1 below from the full report illustrates these categories:

“Gen AI is profoundly embedded into the business fabric of diverse industries, promising significant transformative effects on the global economic landscape,” said Anupam Govil, managing partner and digital practice lead at Avasant. “Enterprises that adapt to evolving Gen AI regulations are poised to lead.”

The reports provide a number of findings, including the following:

-

- In three years, pandemic pressures had advanced 70%–80% of applied AI projects to production. However, in 2023, an uptick in Gen AI projects stalling at the pilot and POC stages lowered the rate of applied AI projects progressing to production to 49%, a significant decrease from the earlier levels.

- About 52% of enterprises leverage Gen AI for productivity improvement, focusing on knowledge base search, data summarization, and content creation. Others are exploring revenue growth by offering proprietary LLM-backed services and launching new product features.

- Gen AI has significantly impacted managed services, notably elevating productivity in application development by 20%–28%, beyond the existing 44% automation level.

- Over the past year, there has been a surge in Gen AI-enabled smart devices, including AI companions, smartphones, laptops, wearables, and advanced driver assistance systems (ADAS). These devices benefit from low-latency AI processing, facilitating smooth and instant interactions such as email composition and real-time language translation.

“As enterprises pivot to bespoke LLM applications, sectors such as life sciences and legal with specialized data nuances demand tailored model training,” said Chandrika Dutt, associate research director with Avasant. “In the next six months, providers excelling in domain-specific LLMs will stand out as industry leaders.”

The Applied AI Services 2024 RadarView™ features detailed profiles of 22 service providers, along with an overview of their solutions, offerings, and experience in assisting enterprises in their applied AI journeys.

This Research Byte is a brief overview of the Applied AI Services 2024 Market Insights™ and Applied AI Services 2024 RadarView™ (click for pricing).