This report provides a view into the adoption of digital services in the banking industry, ecosystem participants, their interplay, key challenges, and the technology landscape. It helps banks identify the right service providers for their digital transformation. We continue with a detailed assessment of 26 service providers offering digital services in the banking industry. Each profile provides an overview of the service provider, its digital services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovations, and partner ecosystem.

Why read this RadarView?

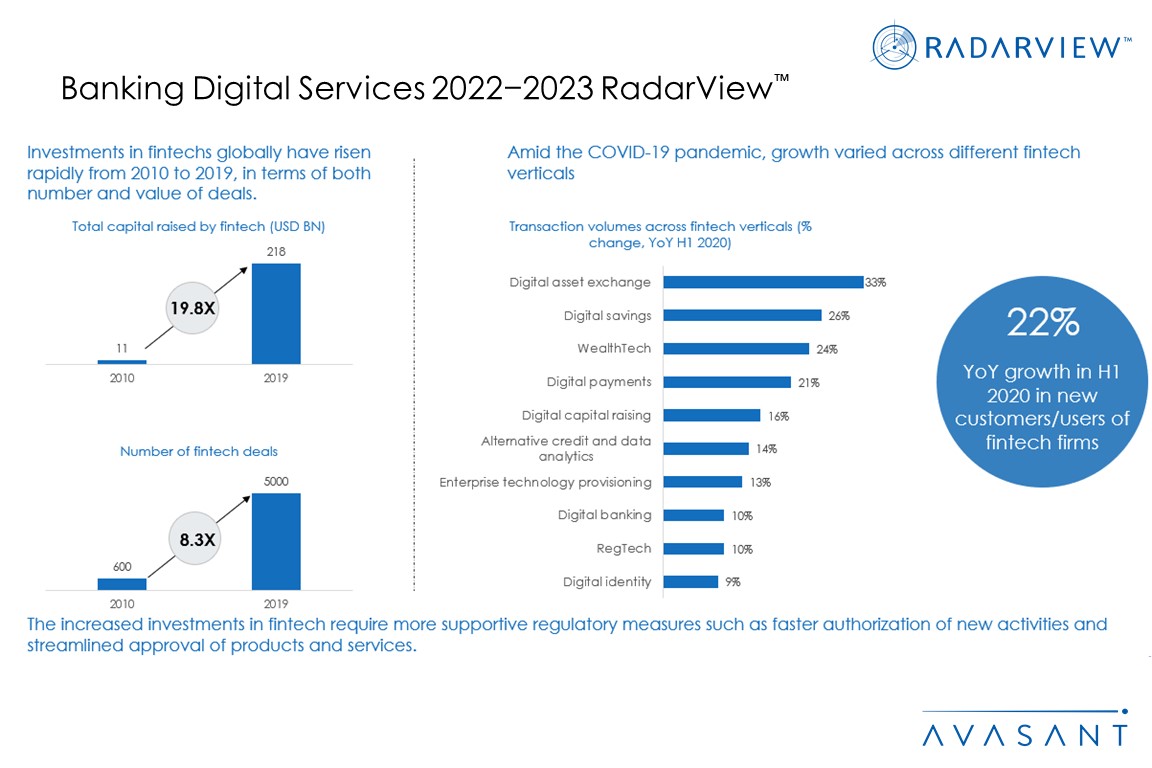

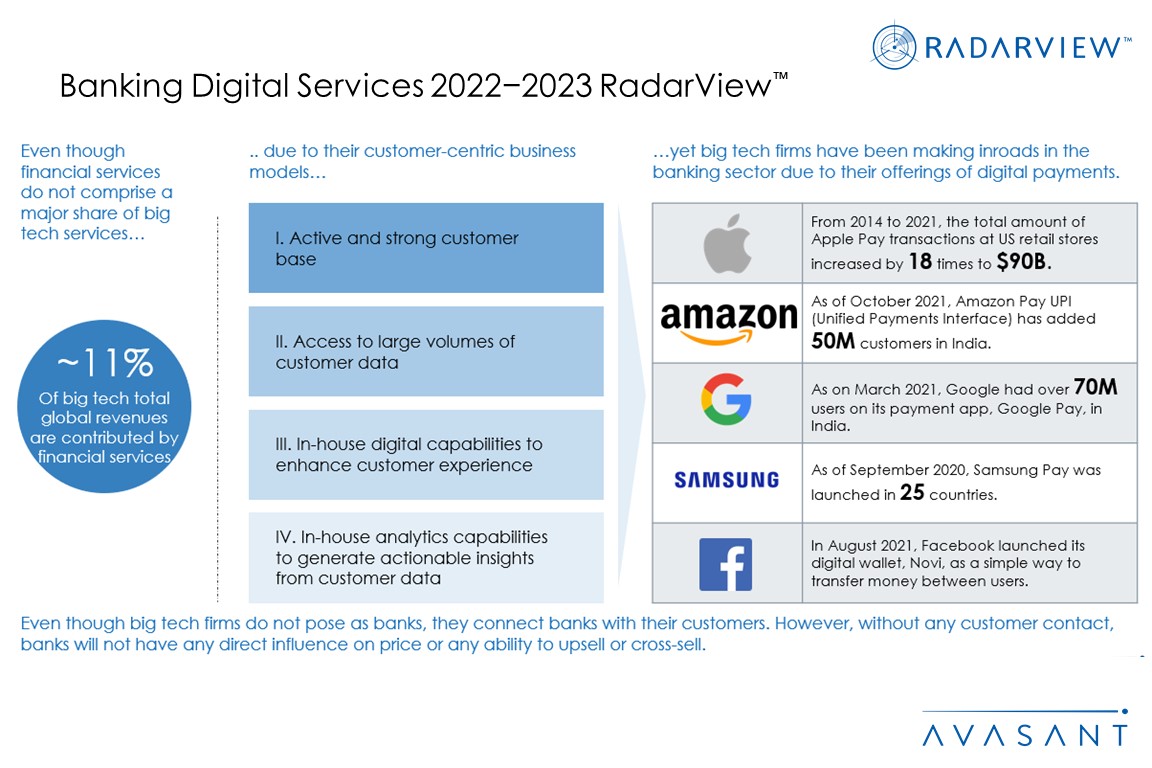

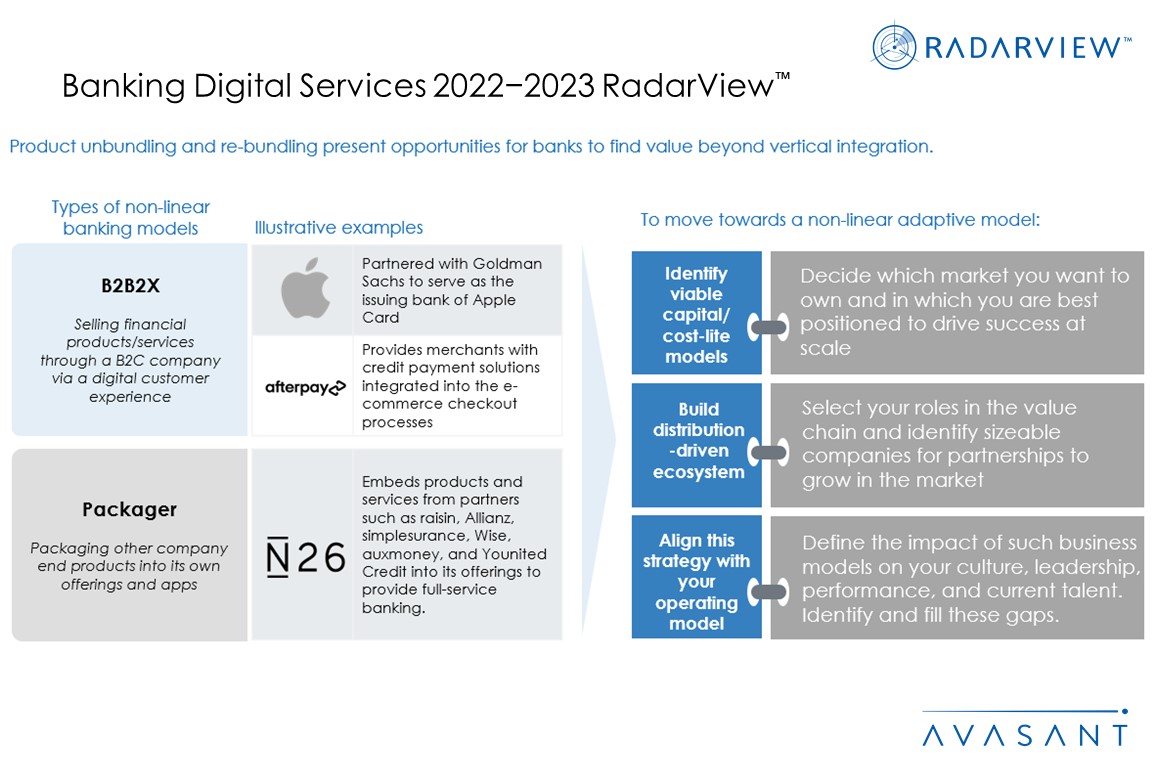

Macroeconomic factors such as volatile interest rates, financial and geopolitical crises, and lower GDP growth forecasts among advanced economies; the rise of fintech and digital-only banks; and competition from big tech firms have put significant pressure on banks, forcing them to explore differentiated business and operating models.

This RadarView helps banks understand emerging digital services to design and drive their digital transformation journeys. It also provides information to assist banks in choosing the right digital service provider.

Featured providers

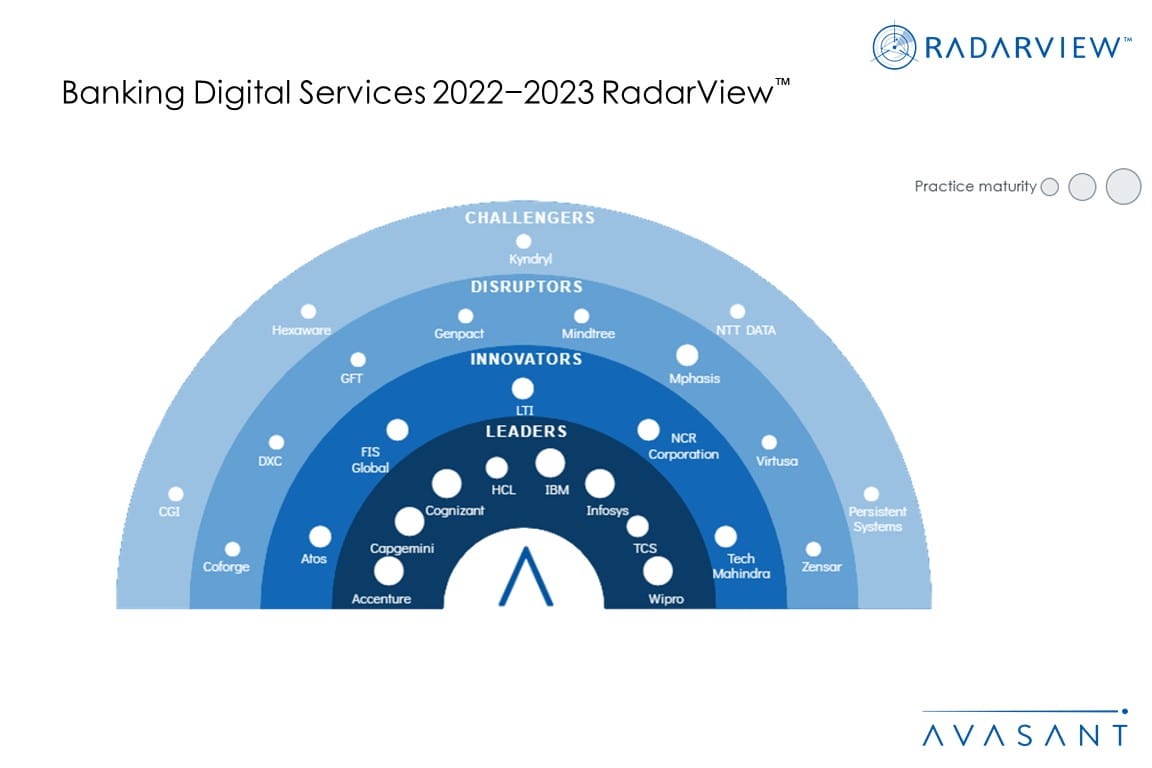

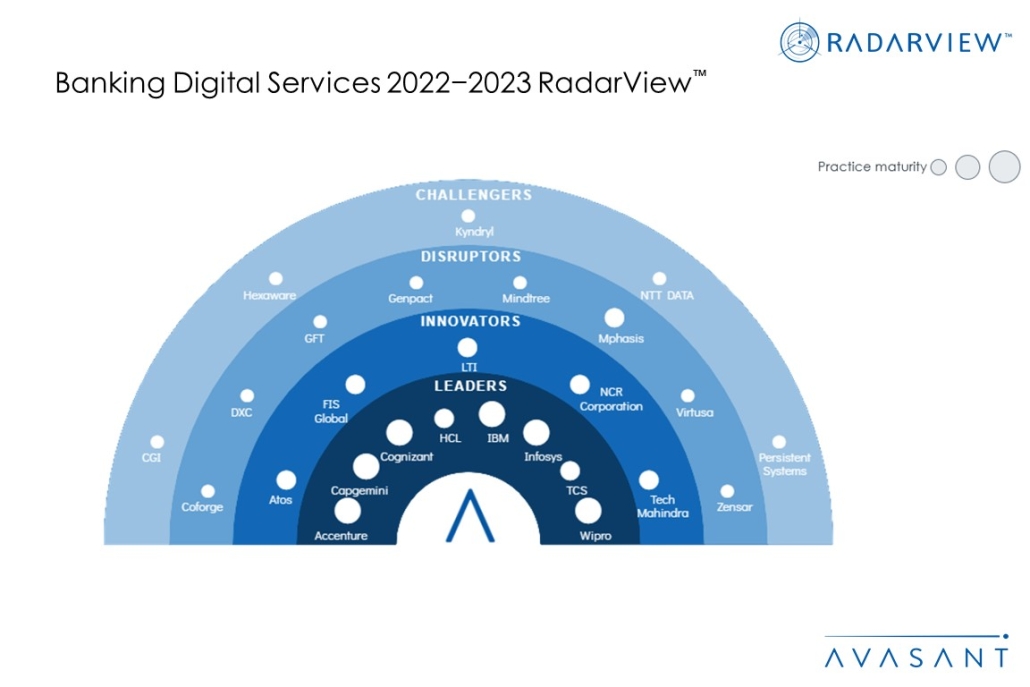

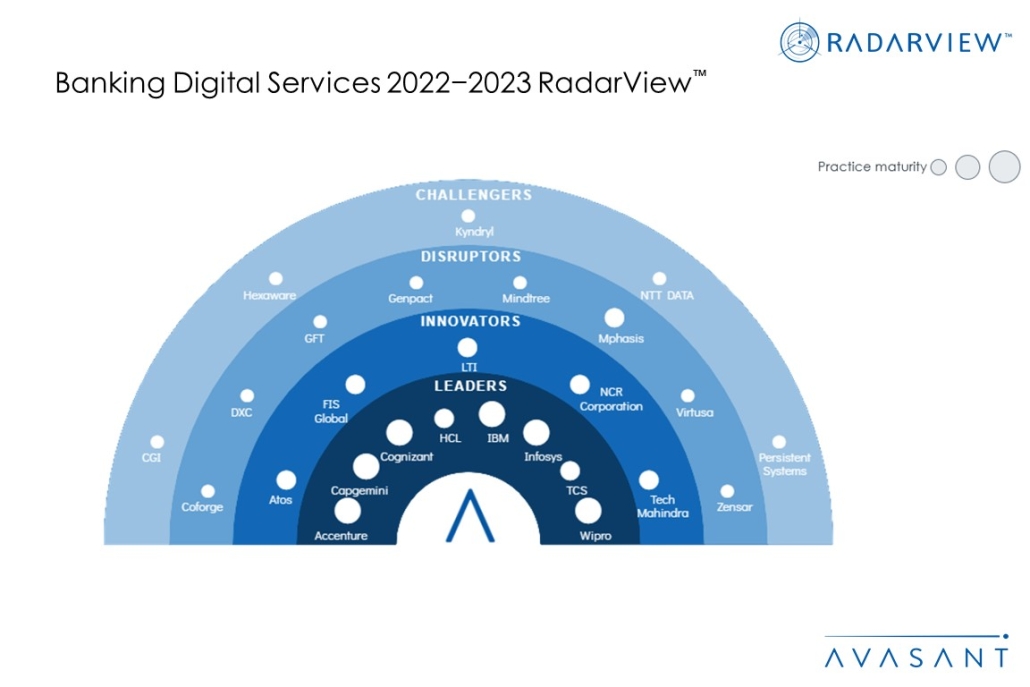

This RadarView includes an analysis of the following service providers in the banking digital services space: Accenture, Atos, Capgemini, CGI, Coforge, Cognizant, DXC, FIS Global, Genpact, GFT, HCL, Hexaware, IBM, Infosys, Kyndryl, LTI, Mindtree, Mphasis, NCR Corporation, NTT DATA, Persistent Systems, TCS, Tech Mahindra, Virtusa, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

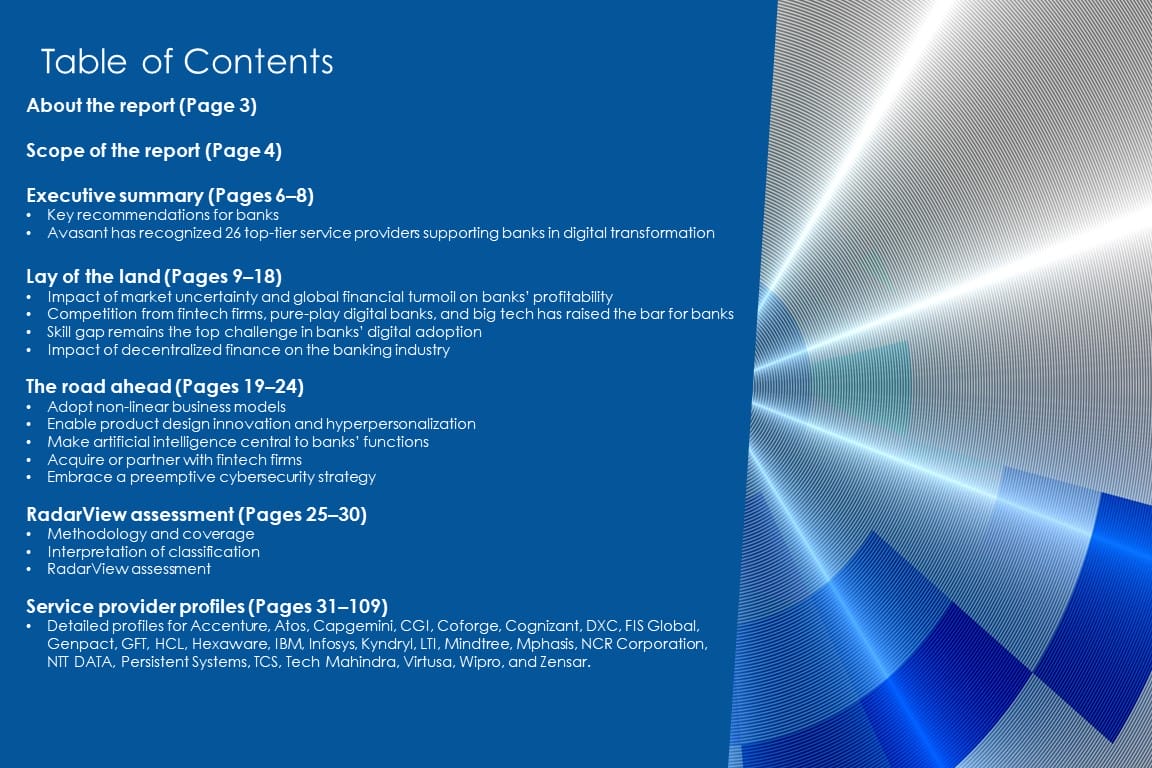

Table of contents

About the report (Page 3)

Scope of the report (Page 4)

Executive summary (Pages 6–8):

-

- Key recommendations for banks

- Avasant has recognized 26 top-tier service providers supporting banks in digital transformation

Lay of the land (Pages 9–18)

-

- Impact of market uncertainty and global financial turmoil on banks’ profitability

- Competition from fintech firms, pure-play digital banks, and big tech has raised the bar for banks

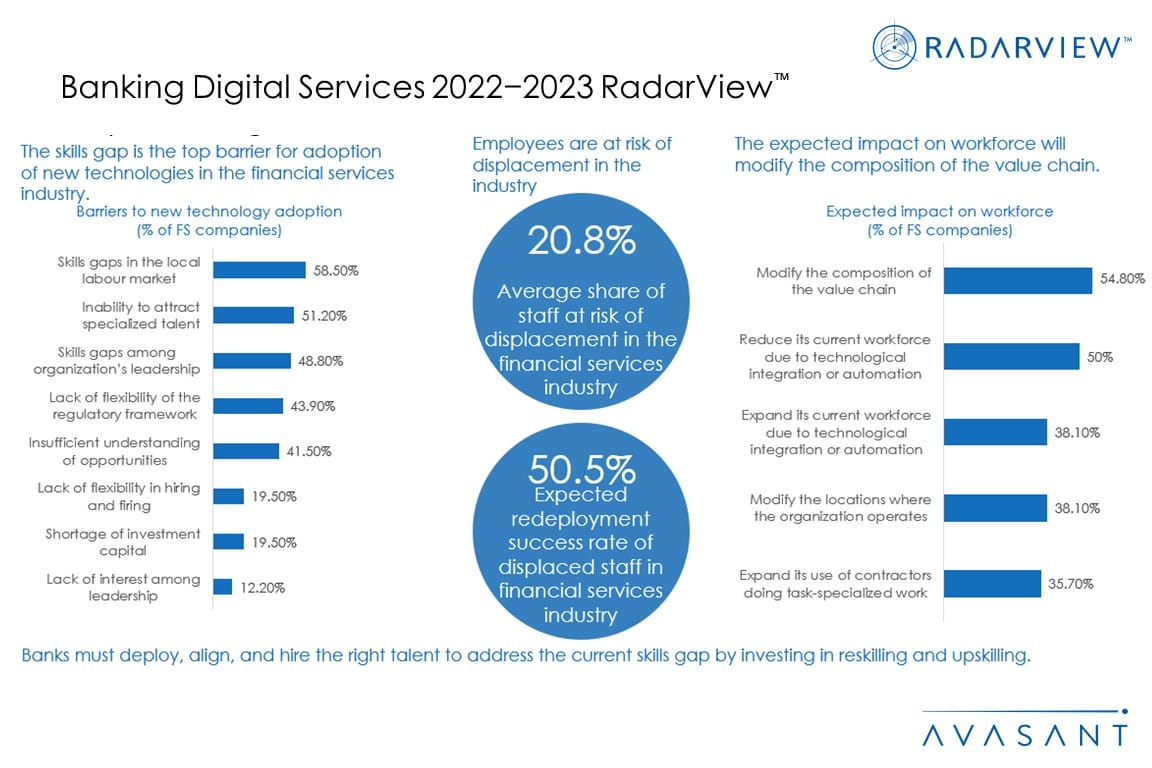

- Skill gap remains the top challenge in banks’ digital adoption

- Impact of decentralized finance on the banking industry

The road ahead (Pages 19–24)

-

- Adopt non-linear business models

- Enable product design innovation and hyperpersonalization

- Make artificial intelligence central to banks’ functions

- Acquire or partner with fintech firms

- Embrace a preemptive cybersecurity strategy

RadarView assessment (Pages 25–30)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 31–109)

-

- Detailed profiles for Accenture, Atos, Capgemini, CGI, Coforge, Cognizant, DXC, FIS Global, Genpact, GFT, HCL, Hexaware, IBM, Infosys, Kyndryl, LTI, Mindtree, Mphasis, NCR Corporation, NTT DATA, Persistent Systems, TCS, Tech Mahindra, Virtusa, Wipro, and Zensar.

Read the Research Byte based on this report.