Corporate communications systems have become more complex, particularly during the coronavirus pandemic, as companies struggle to make it possible for large chunks of the workforce to work remotely. Nevertheless, despite the growing complexity, the number of IT specialists who support communications systems has stabilized in the past few years.

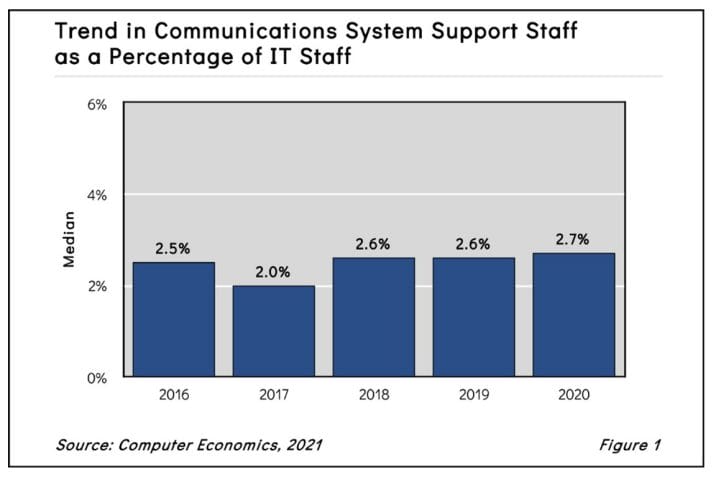

As shown in Figure 1 from our full report, Communications Support Staffing Ratios, the ratio of communications support staff to the total IT staff appears to have plateaued. It was 2.7% in 2020, where it has been, relatively speaking, since 2018.

The skyrocketing increase in remote workers that occurred in 2020 has had wide-ranging effects on communications. As COVID-19 forced millions to shelter in their home offices, many traditional business systems had to adapt. In March and April 2020, many companies quickly learned that office communication applications were lacking. Companies were forced to connect their employees, sometimes overnight, in ways they never had before.

“Two competing factors are buffeting this IT staffing ratio,” said Tom Dunlap, director of research for Computer Economics, a service of Avasant Research, based in Los Angeles. “Companies had to adapt to millions working in their PJs in 2020—many of them going remote for the first time. But at the same time, new web-based systems, such as Google Meet or Microsoft Teams, require less administrative support. So, while the demand for communications has increased, their support requirements are actually easier.”

Another challenge for these support personnel revolve around consumerization. Employees expect the same level of service and ease of use at work that they have at home. When that service is not up to snuff, they are likely to turn to their own solutions. That puts IT and company data in a vulnerable position.

One factor that should be noted is that the data for this staffing report comes from a survey conducted from January to May 2020. Because the survey straddled the start of the pandemic, we may not have fully captured what might become a need for more communication support personnel. Research that we conducted later in 2020, in the August to September timeframe, shows that IT leaders expect remote work to continue at some level, even after the pandemic subsides. We expect many of the trends driving corporate communications to continue. As such, we anticipate that the demand for this role will increase.

The personnel who comprise the communications system support staff include engineers, analysts, specialists, and administrators, who manage email, texts, telephony, videoconferencing, unified communications, and other communications systems. We place this support staff within a broader classification of the Network and Communications Group.

The full report helps IT managers determine whether their organization is keeping pace with changes in communications systems by comparing their support staff against industry benchmarks. The study uses three metrics to make that assessment: communications system support staff as a percentage of the IT staff; percentage of support staff in relation to organization size; and communications support staff spending per user. We provide benchmarks for the composite sample and by organization size and sector. We also provide a benchmark for the larger network and communications group, which includes personnel engaged in supporting network and web infrastructure and security personnel. We conclude with recommendations for optimizing the productivity of communications system support personnel.

This Research Byte is a brief overview of our management advisory on this subject, Communications Support Staffing Ratios. The full report is available at no charge for Avasant Research subscribers, or it may be purchased by non-subscribers directly from our website (click for pricing).