This report helps CPG companies craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the consumer goods market and Avasant’s viewpoint on the direction of the industry over the next 18 to 24 months.

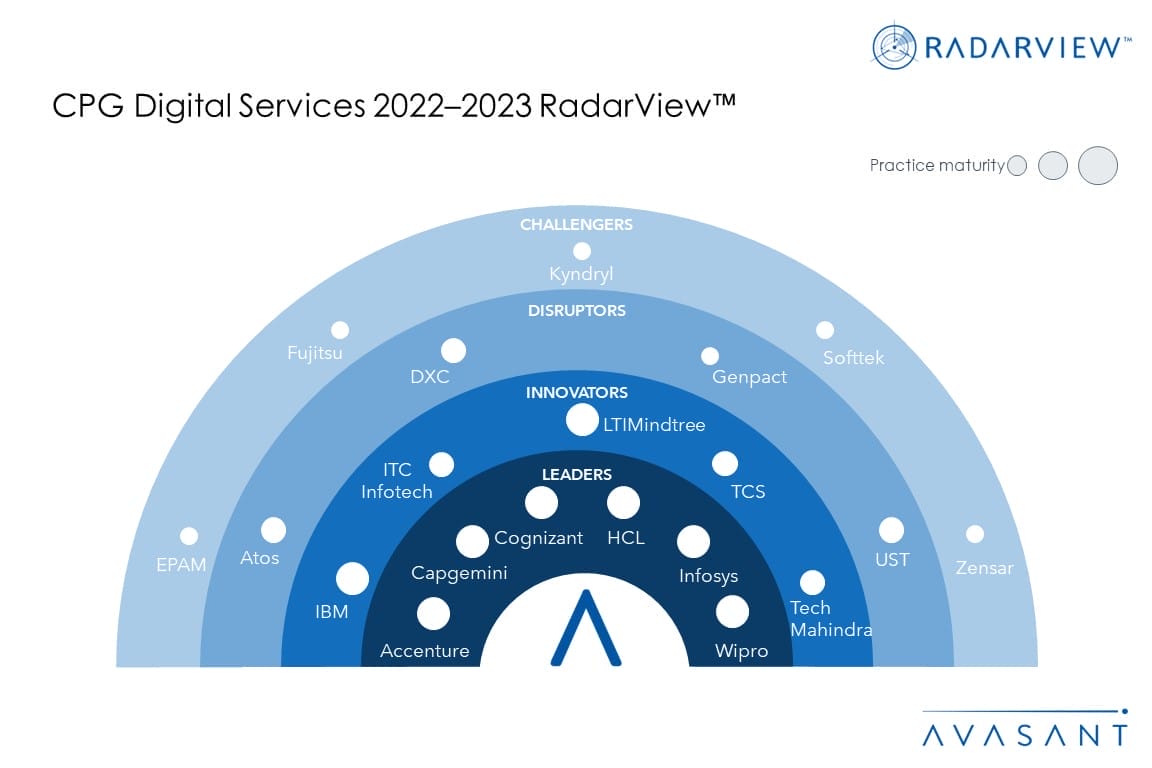

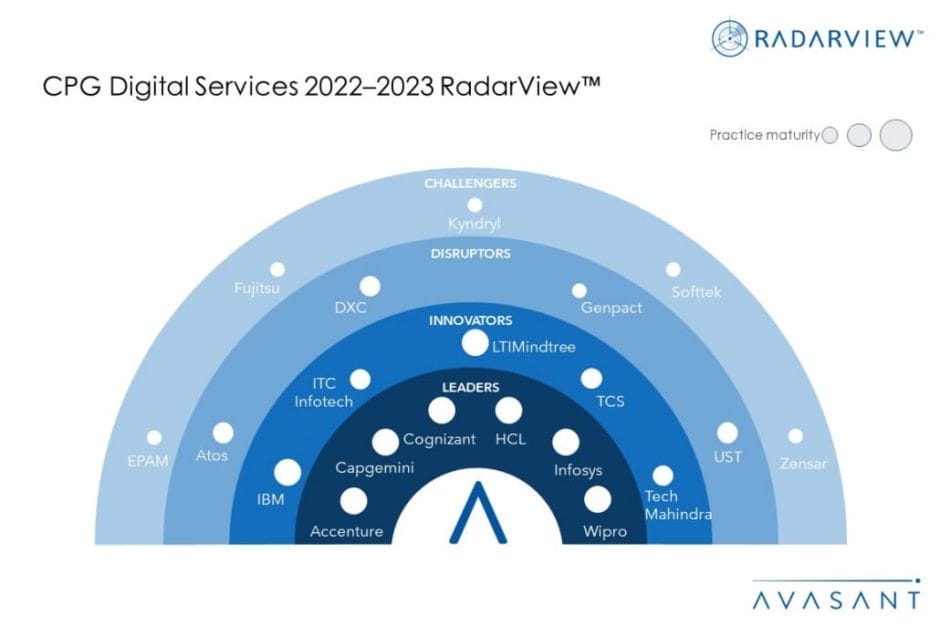

We continue with a detailed assessment of 20 leading service providers. Each profile provides an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovation, and partner ecosystem. The report can aid businesses in identifying the right partners and service providers to support their digital transformation journeys.

Why read this RadarView?

CPG manufacturers have recently enjoyed boom times resulting from the increase in consumer spending since the start of the pandemic. However, they now anticipate shrinking profit margins due to higher inflation and supply chain disruptions. In response, they are investing in digital technologies to meet these challenges, collaborating with service providers for digital transformation to take advantage of their strong domain and technical experience.

Featured providers

This RadarView includes an analysis of the following service providers in the CPG digital services space: Accenture, Atos, Capgemini, Cognizant, DXC, EPAM, Fujitsu, Genpact, HCLTech, IBM, Infosys, ITC Infotech, Kyndryl, LTIMindtree, Softtek, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Scope of the report (Pages 4–5)

Executive summary (Pages 6–8)

-

- Market drivers and enterprise response

- Avasant recognizes 20 top-tier providers supporting the CPG industry in digital transformation

Enterprise trends (Pages 9–15)

-

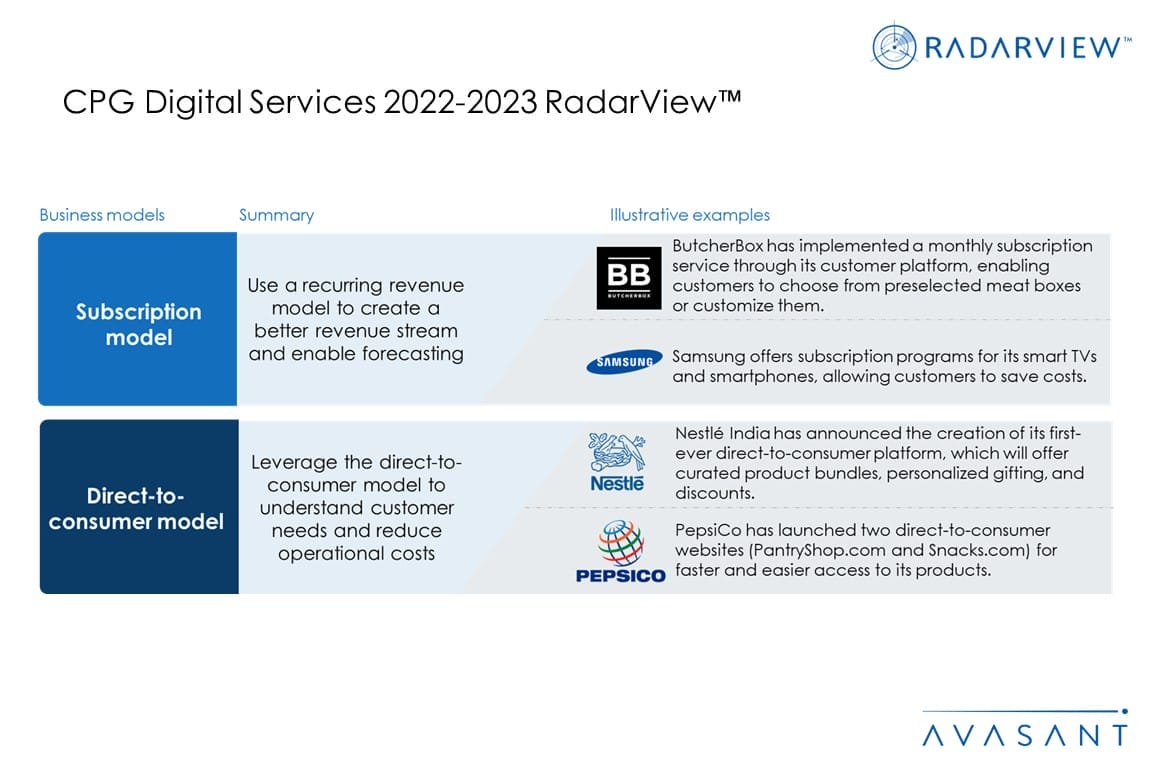

- Firms are achieving digital transformation through multiple business models to reduce costs and increase profitability.

- CPG enterprises are developing customer-centric digital strategies to improve customer experience.

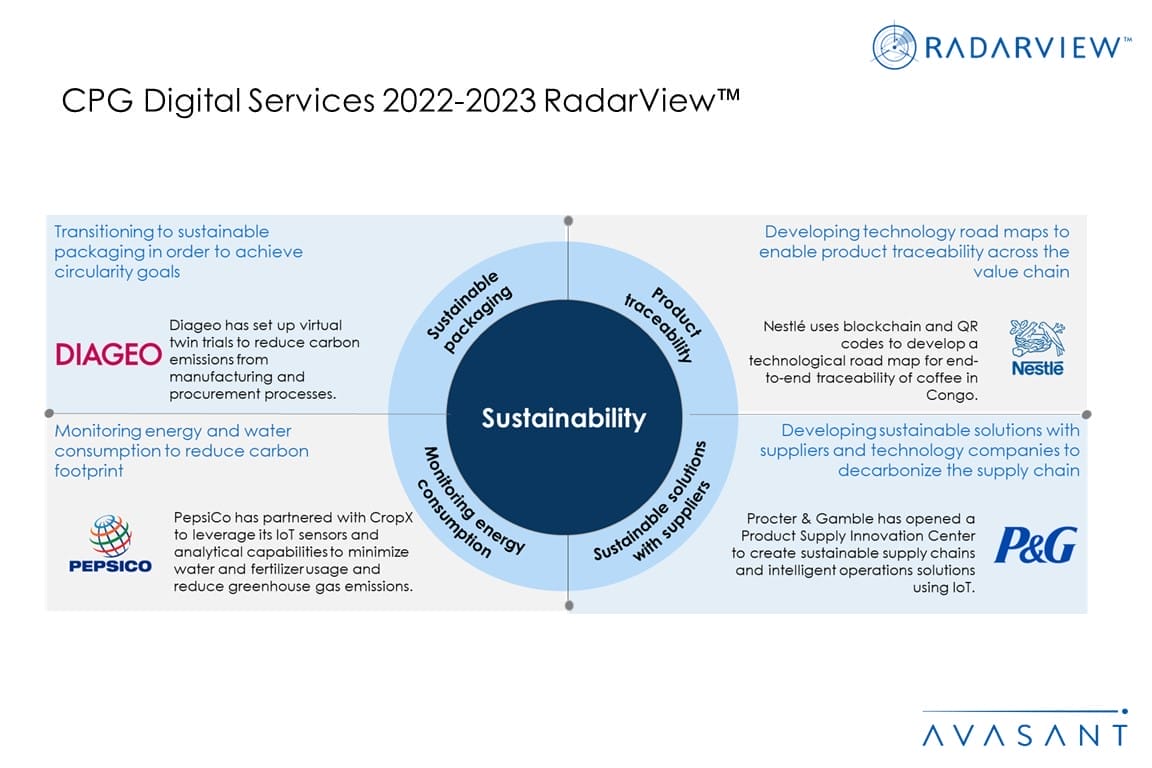

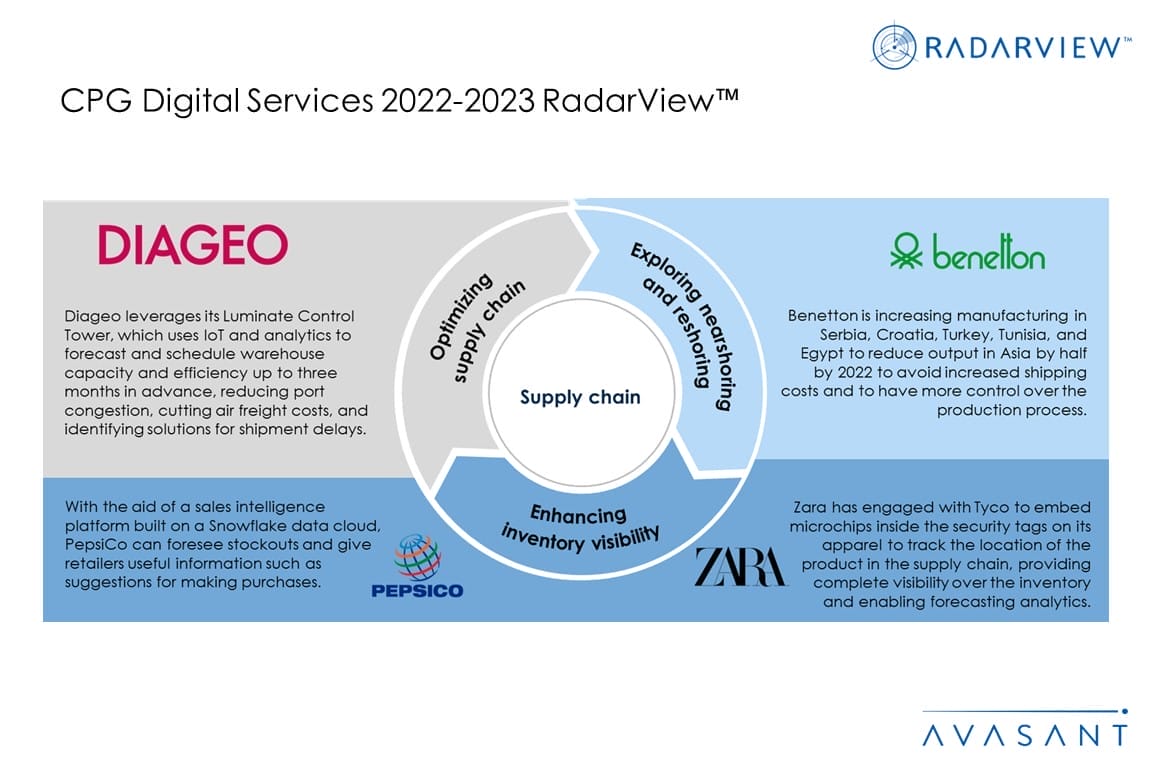

- CPG companies are developing a resilient supply chain using nearshoring and digital platforms such as data cloud and IoT tags.

- CPG enterprises are digital technologies to strengthen Industry 4.0 capabilities.

- CPG enterprises are tackling the labor crisis through initiatives leveraging smart solutions such as AI, IoT, and VR.

Service provider trends (Pages 16-18)

-

- Service providers are investing in emerging technology offerings to support their clients’ transformation.

RadarView overview (Pages 19–24)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 25–85)

-

- Detailed profiles for Accenture, Atos, Capgemini, Cognizant, DXC, EPAM, Fujitsu, Genpact, HCLTech, IBM, Infosys, ITC Infotech, Kyndryl, LTIMindtree, Softtek, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Read the Research Byte based on this report.