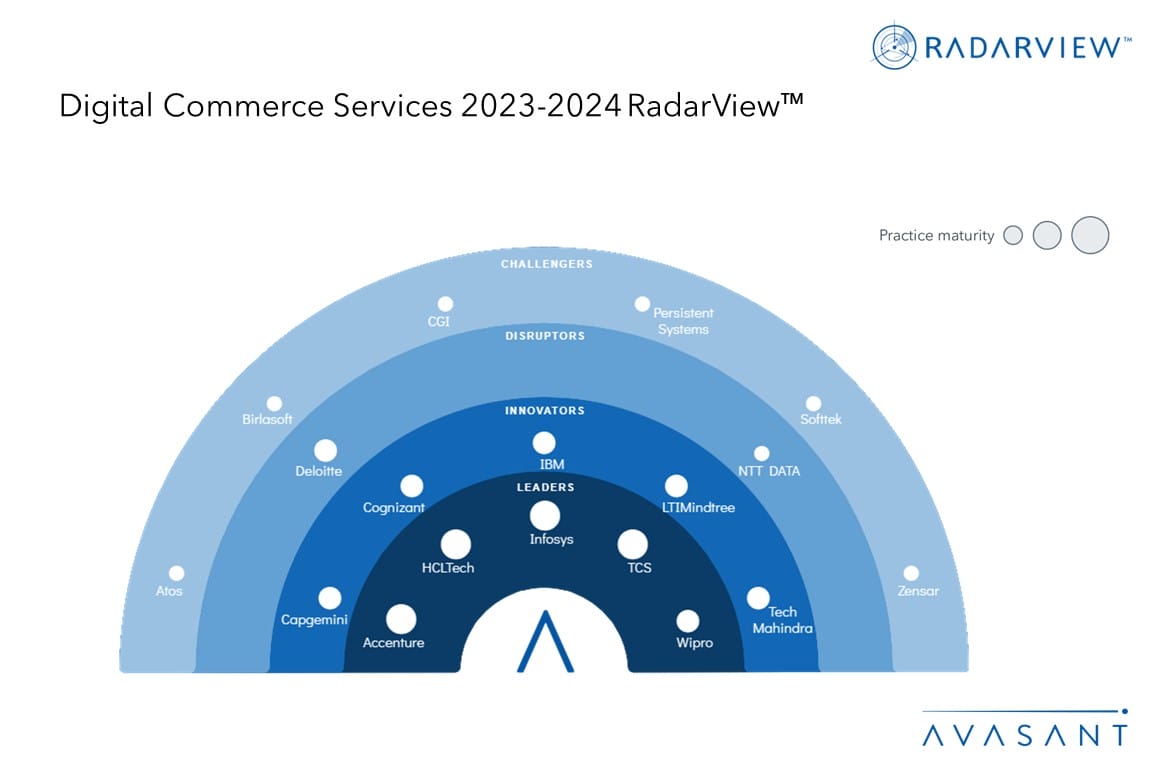

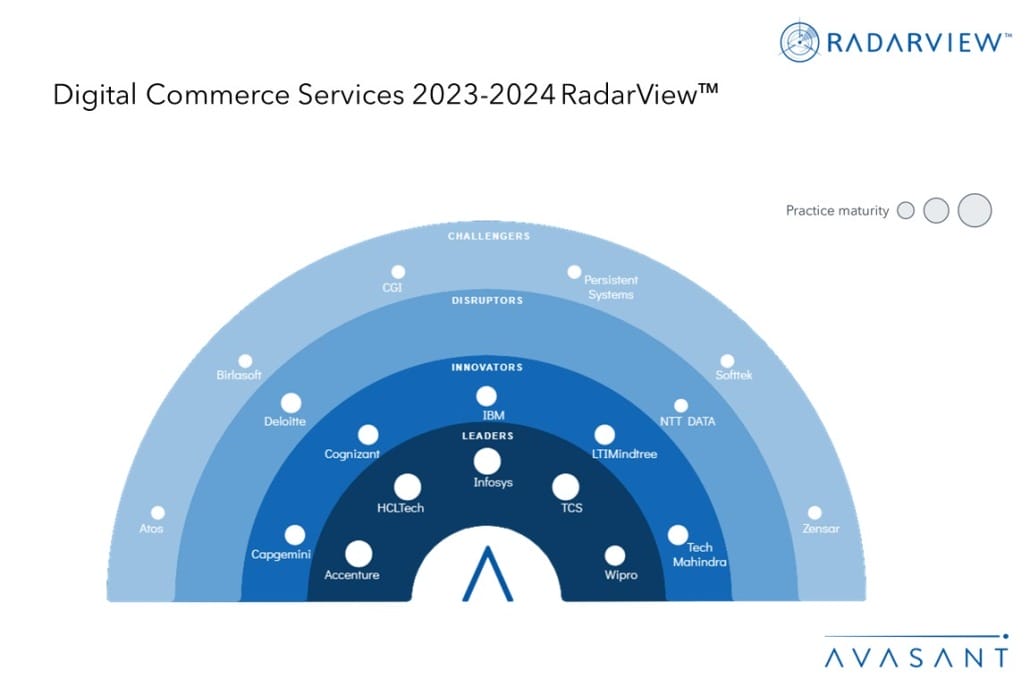

This RadarView provides a view into the changing landscape of digital commerce and highlights key developments and best practices in this space. It also aids in identifying the right service providers that enterprises can partner with to reshape and implement their digital commerce strategies.

It continues with a detailed assessment of 18 leading service providers. Each profile provides an overview of the service provider, its digital commerce services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

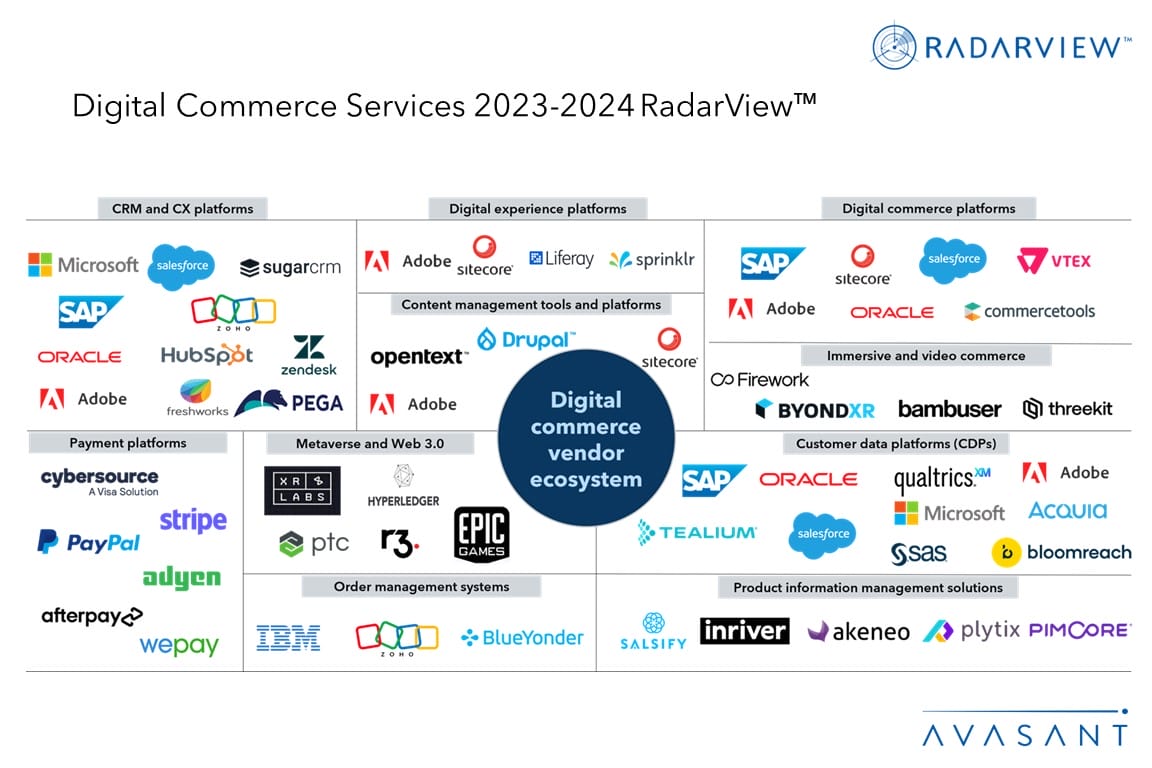

With the rising consumer expectations, digital commerce is being reshaped by the emergence of digital channel complexities and improvements in payment and service delivery. This, in turn, is shifting enterprise preferences to partner solutions and services that help deliver new value and experiences. Service providers are expanding their digital commerce portfolios by focusing on a broader spectrum of services and developing expertise in the next-generation commerce space. They are strengthening offerings and capabilities by partnering with new ecosystem vendors and maximizing their investments by focusing on practice growth.

The Digital Commerce Services 2023–2024 RadarView™ highlights key supply-side trends in the digital commerce space and Avasant’s viewpoint on them. It also offers detailed information to assist businesses in identifying the right service provider to reshape and implement their digital commerce strategies.

Featured providers

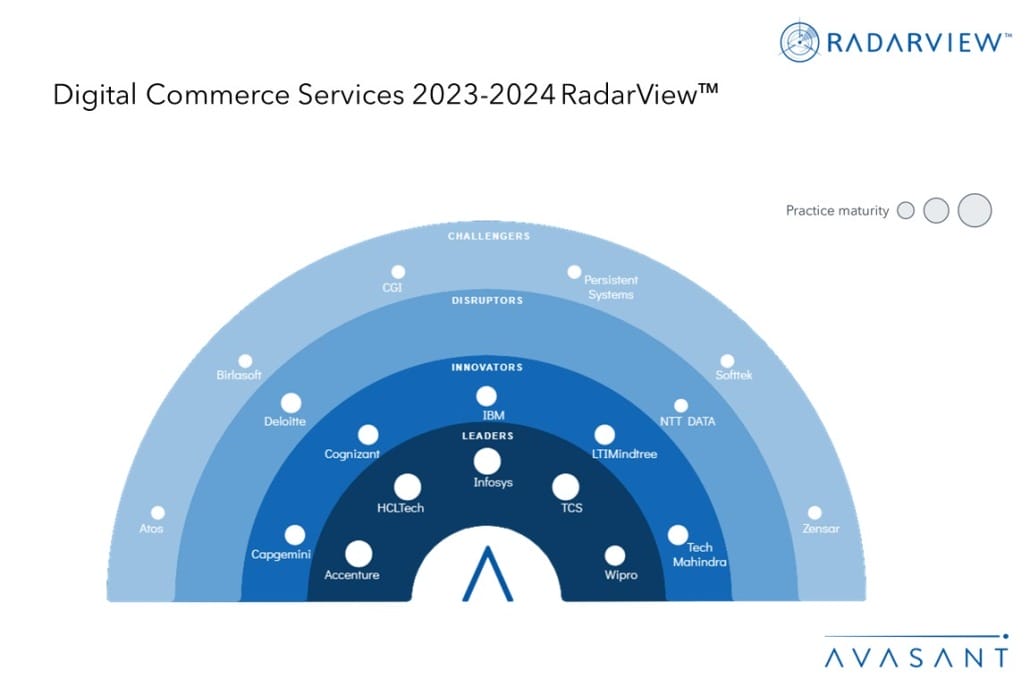

This RadarView includes an analysis of the following service providers in the digital commerce services space: Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, Deloitte, HCLTech, IBM, Infosys, LTIMindtree, NTT DATA, Persistent Systems, Softtek, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

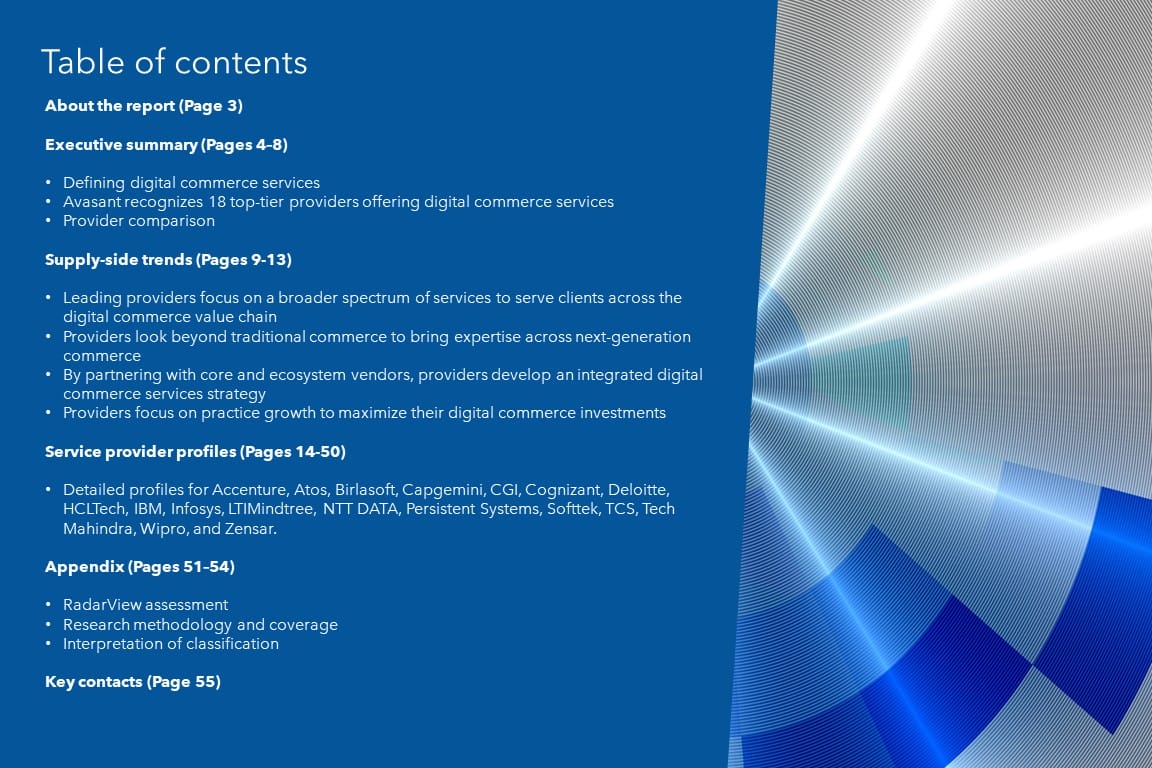

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Defining digital commerce services

- Avasant recognizes 18 top-tier providers offering digital commerce services

- Provider comparison

Supply-side trends (Pages 9–13)

-

- Leading providers focus on a broader spectrum of services to serve clients across the digital commerce value chain.

- Providers look beyond traditional commerce to bring expertise across next-generation commerce.

- Providers focus on practice growth to maximize their digital commerce investments.

Service provider profiles (Pages 14–50)

-

- Detailed service provider profiles providing a 360-degree view of Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, Deloitte, HCLTech, IBM, Infosys, LTIMindtree, NTT DATA, Persistent Systems, Softtek, TCS, Tech Mahindra, Wipro, and Zensar

Appendix (Pages 51–54)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 55)

Read the Research Byte based on this report.

Please refer to Avasant’s Digital Commerce Services 2023–2024 Market Insights™ for demand-side trends.