Last year, we reported that a majority of companies planned to recruit new IT staff members for the first time in years. Then we were hit with a pandemic, global lockdowns, and in some companies, even layoffs. Unfortunately, you know the story. The recruitment party, like our lives, was interrupted. The good news is that much like all of the weddings, celebrations, and vacations that were rescheduled for this year, so is the hiring. Digital transformation is driving a new era in IT staffing hiring.

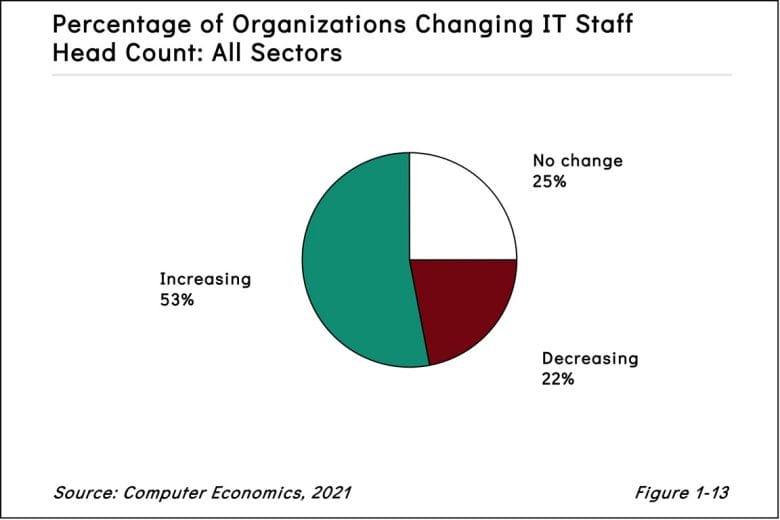

As shown in Figure 1-13 from the free executive summary of our IT Spending and Staffing Benchmarks 2021/2022 study, 53% of respondents plan to increase their IT staff head count. (Though the median increase is a modest 1%, which is not shown in the figure.) Nonetheless, in the cloud era, we have not seen a majority of companies looking to increase head count, with the exception of last year’s interrupted plans.

Why is such a modest hiring increase so important? The biggest reason is that, for many years, IT budgets increased while head count fell or remained steady. IT personnel used to account for half or more of most IT budgets. We have seen that number drop below 40% at the median while budgets on applications, security, and networks drove IT spending. Due to automation, the cloud, and software as a service (SaaS), companies were able to do more with fewer (or the same number of) IT personnel. In some cases, jobs were even removed, as SaaS and cloud providers took over many infrastructure roles. Early cloud projects allowed IT organizations to become more efficient and use the savings to invest in more cloud. Now, increases in hiring may signal that we have reached the logical limit to this efficiency. Instead of merely ripping and replacing, the digital transformation has turned toward innovation and growth.

“We were headed there anyway, but the pandemic was a real catalyst to digital transformation,” said David Wagner, senior research director at Computer Economics, a service of Avasant Research, based in Los Angeles. “Every sector was tested by lockdowns. Almost every company needed to find new sources of revenue, new ways to serve customers. Now they need the budgets, and most importantly, the talent to do it.”

As IT organizations look to transform themselves for the post-COVID economy, many will need to hire developers, project managers, analysts, and other roles to navigate the new normal. IT organizations have a more vital, strategic role to play in the emerging economy. It only makes sense that the hiring will continue.

The Computer Economics IT Spending and Staffing Benchmarks 2021/2022 study is based on a detailed survey of more than 234 IT executives in the US and Canada on their IT spending and staffing plans for 2021/2022. It provides IT spending and staffing benchmarks for small, midsize, and large organizations and for 28 sectors and subsectors. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our report, IT Spending and Staffing Benchmarks 2021/2022. The full 31-chapter report is available at no charge for subscribers. Individual chapters may be purchased by non-subscribers directly from our website (click for pricing).