Rising healthcare and operational costs pose a challenge to improving patient experience, collections, and provider margins, making them vulnerable to recession. Though physician and provider productivity is increasing as patients continue to reengage and seek care that was put off during the pandemic, there was a 12% YOY increase in median investment/subsidy per provider FTE. To generate savings for healthcare providers and limit healthcare spending, value-based payment models hold the key. Healthcare providers also need to address patients expecting seamless digital interactions, desiring convenience and empowerment in their care journey to improve their experience. In order to support these, they increasingly rely on RCM outsourcing service providers’ expertise through outsourcing. This is evident from a 15%–25% increase in the revenue of RCM outsourcing service providers in 2021–2022.

Both demand-side and supply-side trends are covered in our RCM Business Process Transformation 2023 Market Insights™ and RCM Business Process Transformation 2023 RadarView™, respectively.

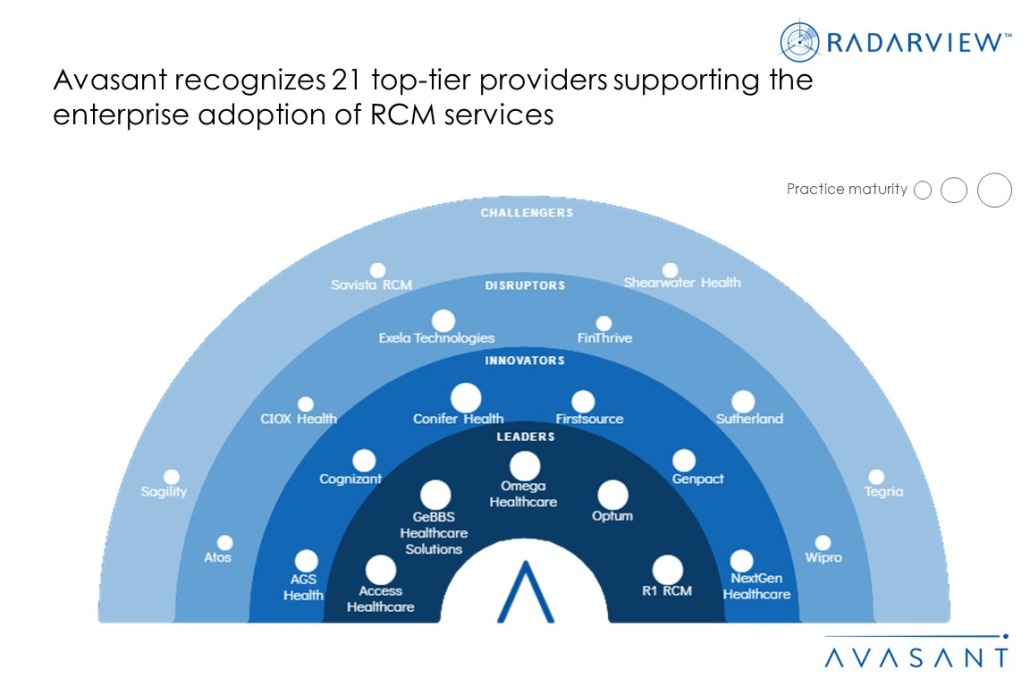

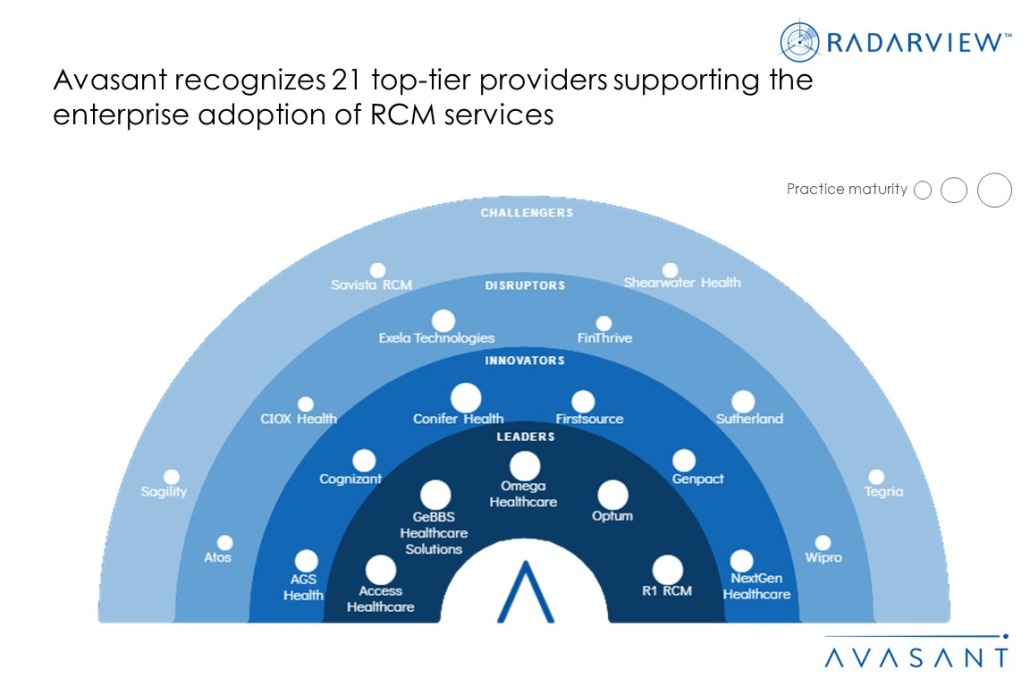

These reports present a comprehensive study of RCM service providers and closely examine market leaders, innovators, disruptors, and challengers.

Avasant evaluated 42 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of the 42 providers, we recognized 21 that brought the most value to the market during the past 12 months.

The RadarView recognizes service providers in four categories:

-

- Leaders: Access Healthcare, GeBBS Healthcare Solutions, Omega Healthcare, Optum, and R1 RCM

- Innovators: AGS Health, Cognizant, Conifer Health, Firstsource, Genpact, and NextGen Healthcare

- Disruptors: Atos, CIOX Health, Exela Technologies, FinThrive (nThrive), Sutherland, and Wipro

- Challengers: Sagility, Savista RCM, Shearwater Health, and Tegria

Figure 1 below from the full report illustrates these categories:

The reports provide several findings, including the following:

-

- Financial distress peaked in 2022. Hospitals’ margins were consistently negative, with December being the only month with a positive margin.

- Labor expenses are primarily driven by significantly high nursing services costs and administrative labor expenses, which rose by 47% in the past year.

- Physicians and other healthcare providers’ productivity is increasing as patients continue to reengage and seek care that was put off during the pandemic. Despite this, there was a 12% YOY increase in median investment/subsidy per provider FTE, twice the rate of inflation.

- To drive value-based care, providers need to engage with patients at a higher level and invest in additional reporting.

- Amidst the challenges faced in maintaining operational margins, healthcare providers are also confronting the growing demand for exceptional patient experiences driven by the rise of consumerism in the healthcare sector.

“The rising pressure on margins is being addressed through innovative solutions,” said Aditya Jain, principal analyst at Avasant. “Alternate value-based payment models, including ACO, bundled payment models, and capitation models, need to be supported along with quality data preparation for reporting to transform healthcare provider outcomes and optimize spending.”

The RadarView also features detailed profiles of 21 service providers, along with their solutions, offerings, and experience in assisting enterprises in their RCM services journeys.

This Research Byte is a brief overview of the RCM Business Process Transformation 2023 Market Insights™ and RCM Business Process Transformation 2023 RadarView™. (click for pricing).