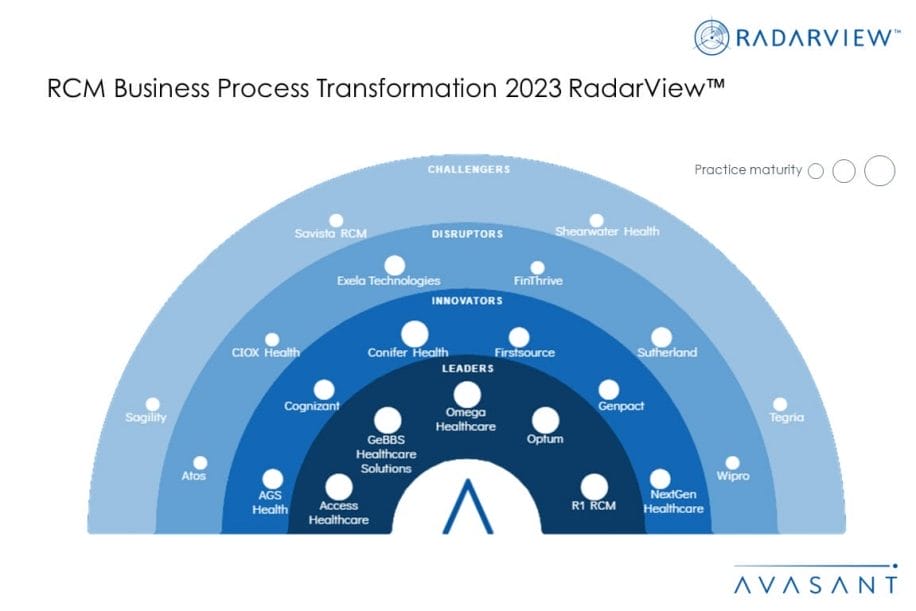

This RadarView provides a view into the leading service providers offering revenue cycle management (RCM) services. It begins by summarizing key trends shaping the market’s supply side. It continues with a detailed assessment of 21 providers offering RCM services. Each profile provides an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

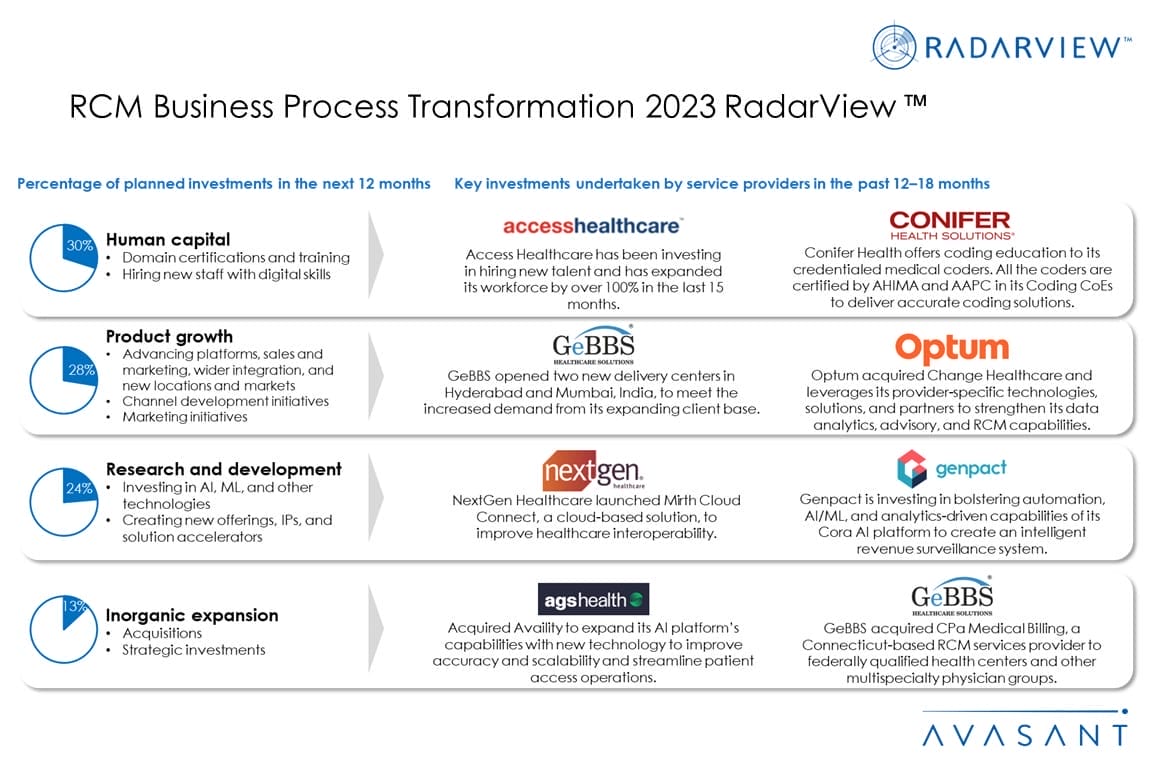

Service providers are enhancing their RCM capabilities and incorporating various services across the value chain. The growing demand for RCM outsourcing services among healthcare providers is due to rising healthcare costs and narrow margins, as well as the demand for patient convenience.

The RCM Business Process Transformation 2023 RadarView™ highlights key supply-side trends in the RCM services space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in outsourcing RCM services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for RCM services.

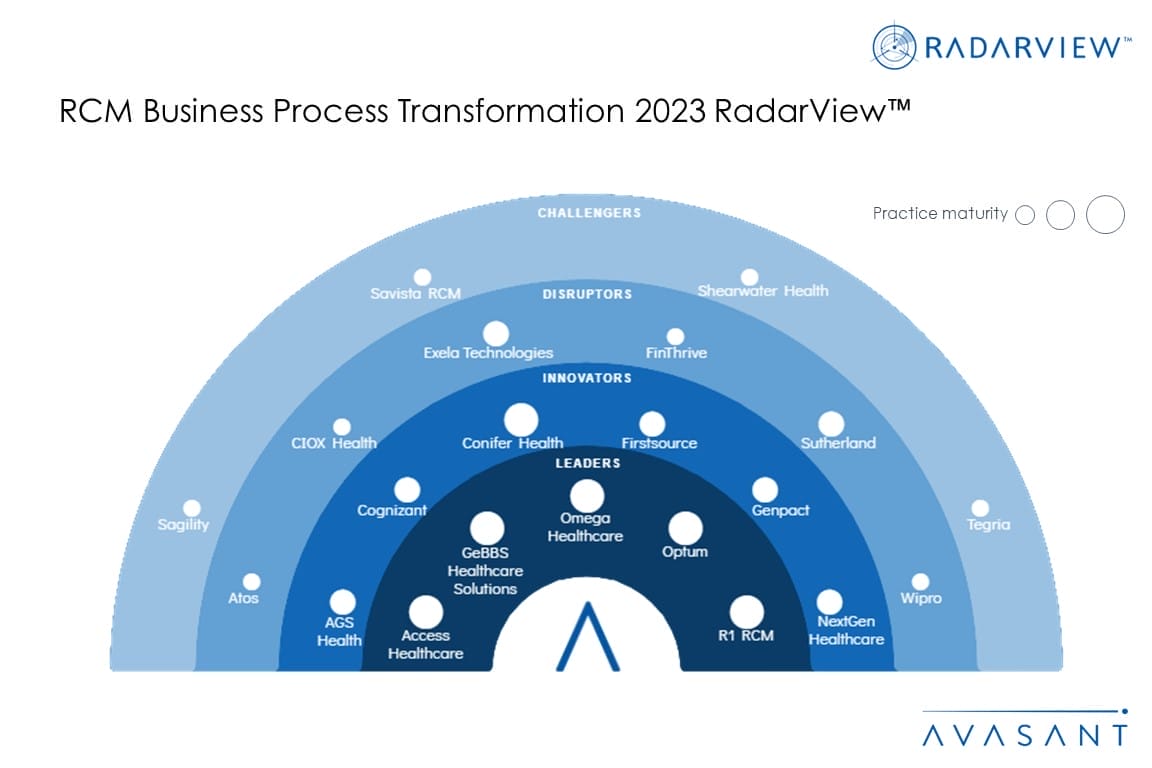

Featured providers

This RadarView includes a detailed analysis of the following clinical service providers: Access Healthcare, AGS Health, Atos, CIOX Health, Cognizant, Conifer Health, Exela Technologies, FinThrive, Firstsource, GeBBS Healthcare Solutions, Genpact, NextGen Healthcare, Omega Healthcare, Optum, R1 RCM, Sagility, Savista RCM, Shearwater Health, Sutherland, Tegria, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

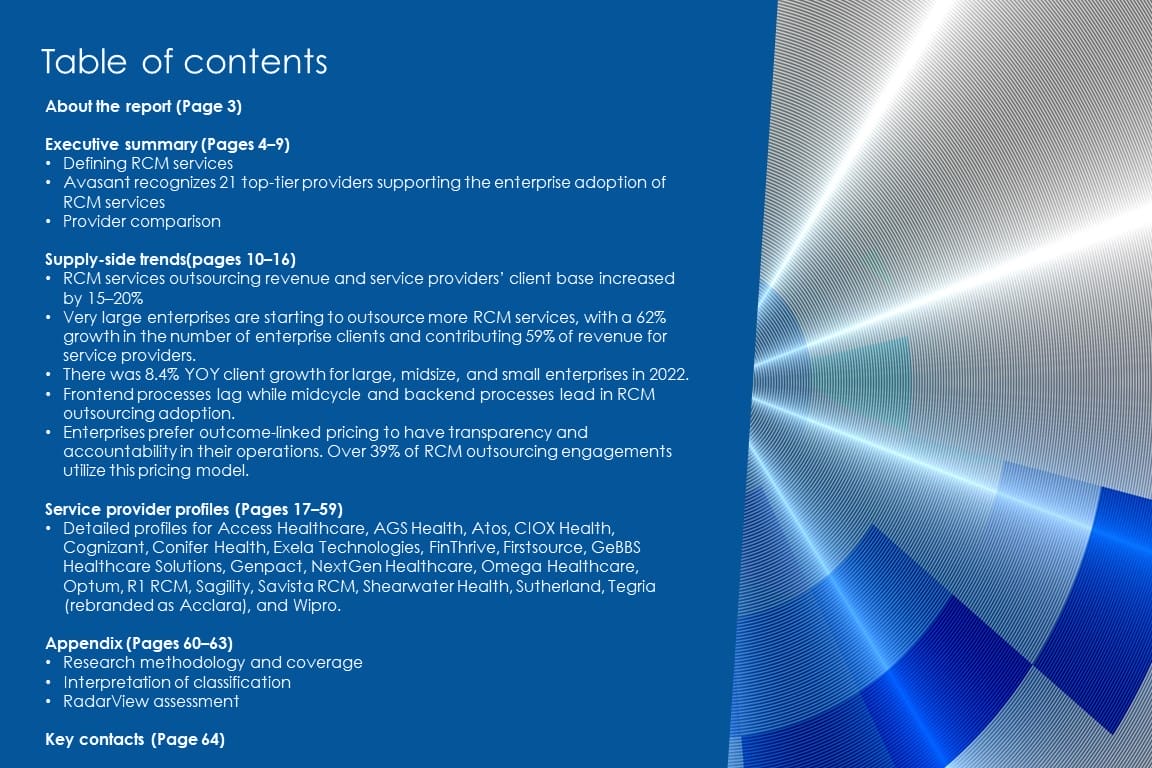

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining RCM services

- Avasant recognizes 21 top-tier providers supporting the enterprise adoption of RCM services

- Provider comparison

Supply-side trends (Pages 10–16)

-

- RCM services outsourcing revenue grew nearly 20%, and service providers’ client base increased by about 16%.

- Very large enterprises are starting to outsource more RCM services, with a 62% growth in the number of enterprise clients and contributing 59% of revenue for service providers.

- There was 8.4% YOY client growth for large, midsize, and small enterprises in 2022.

- Frontend processes lag while midcycle and backend processes lead in terms of RCM outsourcing adoption.

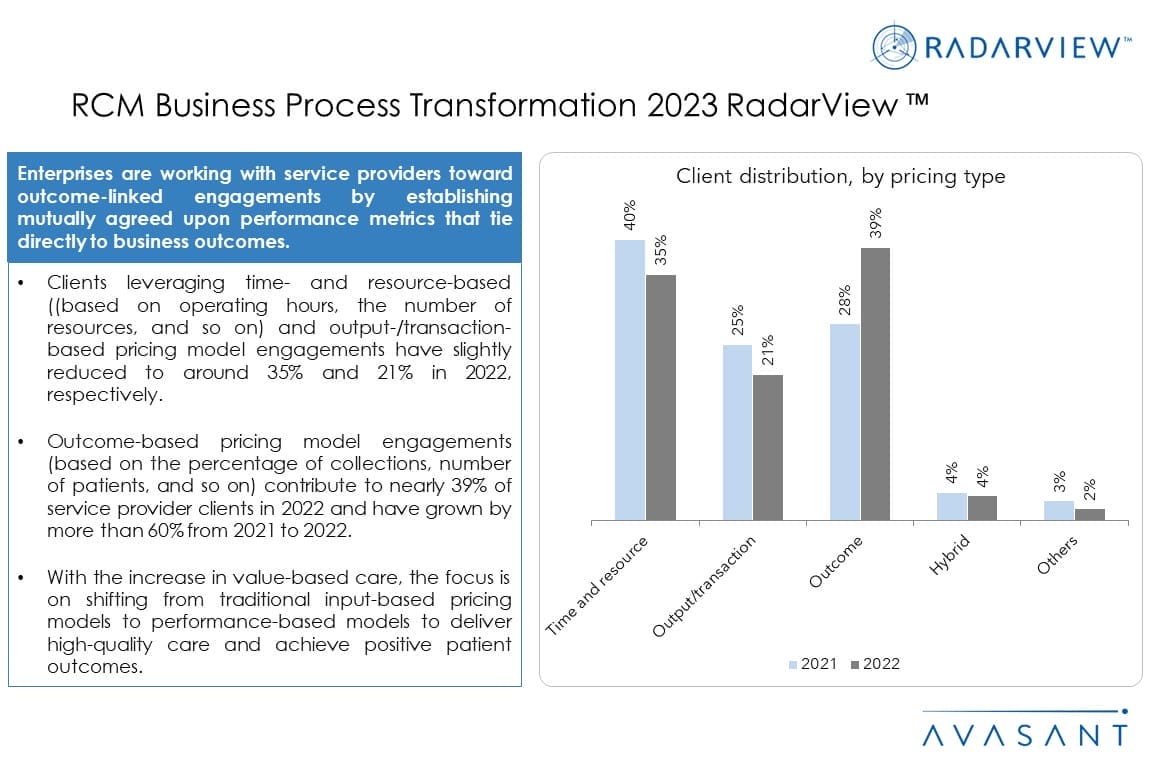

- Enterprises prefer outcome-linked pricing to have transparency and accountability in their operations. Over 39% of RCM outsourcing engagements utilize this pricing model.

Service provider profiles (Pages 17–59)

-

- Detailed profiles for Access Healthcare, AGS Health, Atos, CIOX Health, Cognizant, Conifer Health, Exela Technologies, FinThrive, Firstsource, GeBBS Healthcare Solutions, Genpact, NextGen Healthcare, Omega Healthcare, Optum, R1 RCM, Sagility, Savista RCM, Shearwater Health, Sutherland, Tegria (rebranded as Acclara), and Wipro.

Appendix (Pages 60–63)

-

- Research methodology and coverage

- Interpretation of classification

- RadarView assessment

Read the Research Byte based on this report.

Please refer to Avasant’s RCM Services Business Process Transformation 2023 Market Insights™ for detailed insights on the service providers and supply-side trends.