Despite some economic turbulence, persistent nearby conflicts, and tech layoffs, end-user companies are showing relatively strong IT spending increases. CIOs are investing in a series of new technologies designed to transform the enterprise including AI, data analytics, and even the metaverse. Hiring is also keeping pace, and, for the most part, CIOs have the budget they need to make meet their mission of continued strategic transformation.

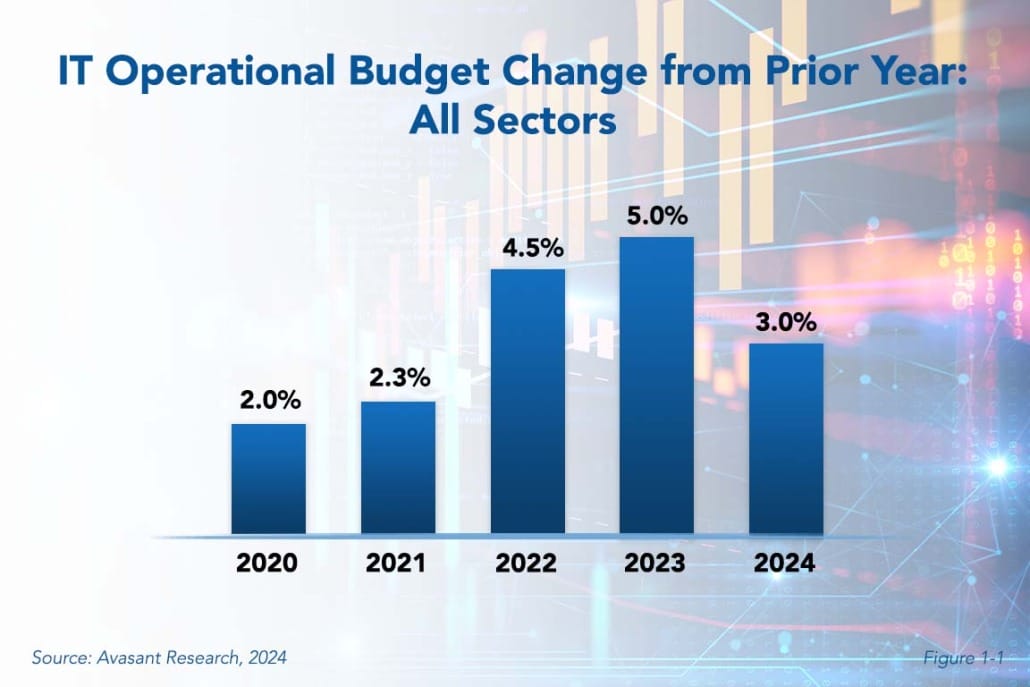

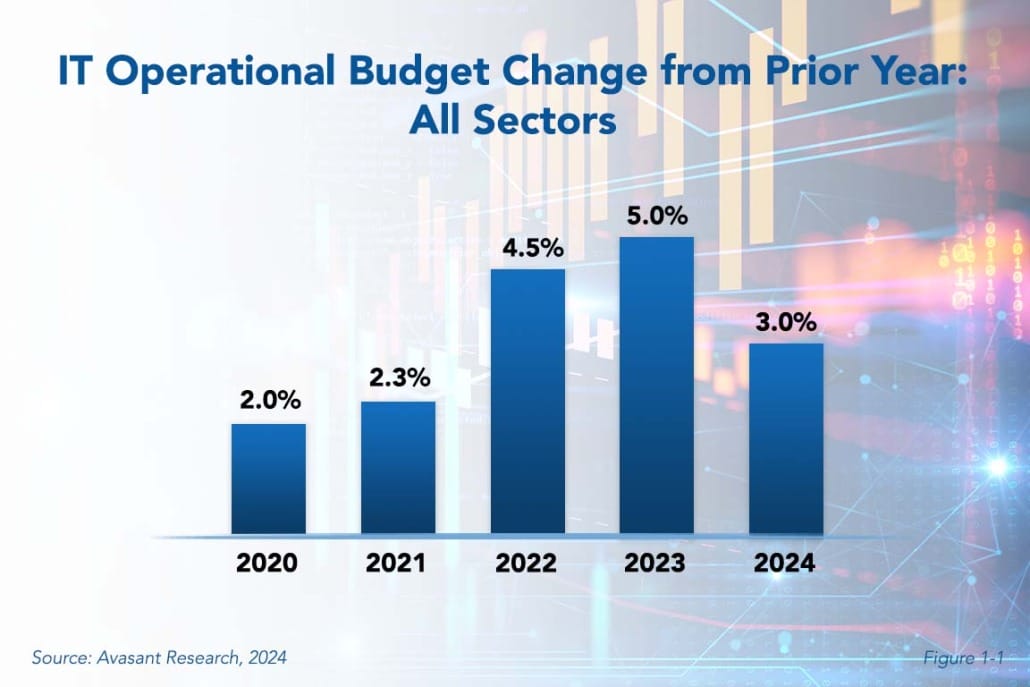

As shown in Figure 1-1 from the free executive summary of our European IT Spending and Staffing Benchmarks 2024/2025 study, IT budgets in Europe are increasing by 3.0% at the median. This number is relatively strong, but it also signals a return to IT spending increases we were used to before two years of unusually high inflation.

About 72% of companies are now reporting that they plan to increase their IT budgets this year, a small increase from 71% last year and the second highest number in the history of the study. As stated above, at the median, those budgets are poised to increase by 3.0%. This is a decrease from the 5.0% we reported at the median for last year. But the decrease is likely due to high inflation in 2023 compared to this year. Prior to the increased inflation of 2022 and 2023, we saw median budget increases around 2.0%.

For the second straight year, 58% of companies in our study plan to increase IT staff head count. However, the median increase is 2.0%. While not a huge increase, the cloud era has been one marked by head count increases of 0% at the median. Of those companies planning an increase in head count, the average increase is 4.2%. End-user companies have been fighting tech companies for talent for years. It appears that they are more than happy to see a larger talent pool, and they are aiming that talent at new projects.

“In both Europe and North America, IT leaders are being tasked with driving the organization forward even if times are still a bit uncertain,” said David Wagner, senior research director at Avasant Research, based in Los Angeles. “CIOs are ready for the challenge.”

Of course, in any economic reality, there are winners and losers. About 21% of the CIOs we surveyed said that they were being tasked with cutting costs over providing improved service. But this is a decrease from 25% last year.

Our European IT Spending and Staffing Benchmarks 2024/2025 study is based on a detailed survey of more than 200 IT executives in Europe on their IT spending and staffing plans for 2024/2025. The study provides IT spending and staffing benchmarks for small, midsize, large, and very large organizations and for 30 sectors and subsectors. These include seven new subsectors, namely, our very large size chapter, media and information services, commercial banking, utilities, hospitals, technical services, and IT services and consulting. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary .

This Research Byte is a brief overview of the findings in our report, European IT Spending and Staffing Benchmarks 2024/2025. The full 32-chapter report is available at no charge for Avasant Research clients. Individual chapters may be purchased by non-clients directly from our website (click for pricing).