The banking process transformation market is positioned for continued evolution as emerging technologies mature and demonstrate clear business value. Generative AI (Gen AI) adoption is moving beyond experimental phases toward production implementations with measurable ROI. The demand for enhanced customer experience is driving significant investment in digital capabilities and multichannel integration. Service providers are leveraging AI and analytics to enable hyper-personalization and improve customer journey optimization.

Both demand- and supply-side trends are covered in Banking Process Transformation 2025 Market Insights™ and Banking Process Transformation 2025 RadarView™, respectively. These reports present a comprehensive study of banking outsourcing service providers and closely examine the market leaders, innovators, disruptors, and challengers.

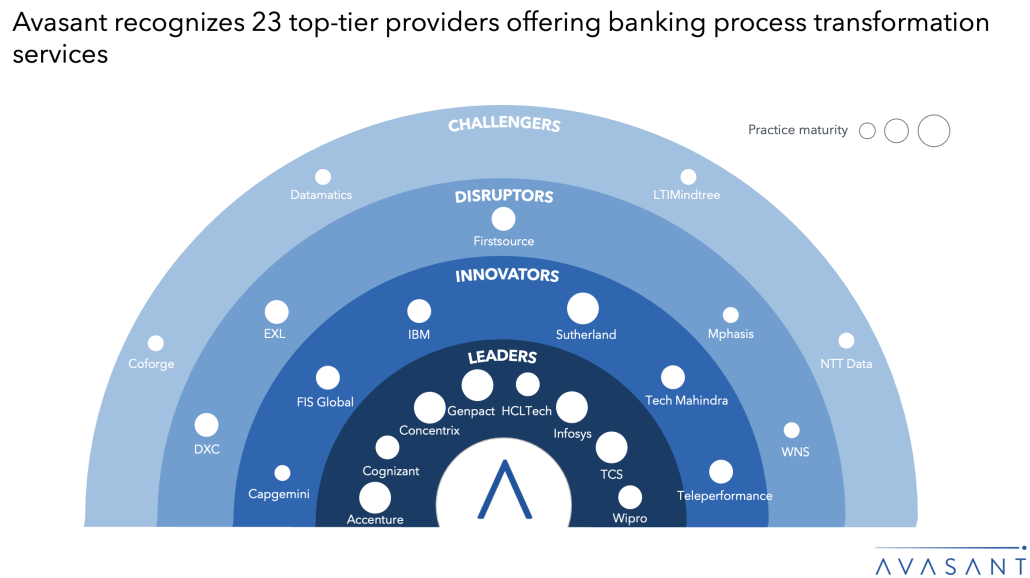

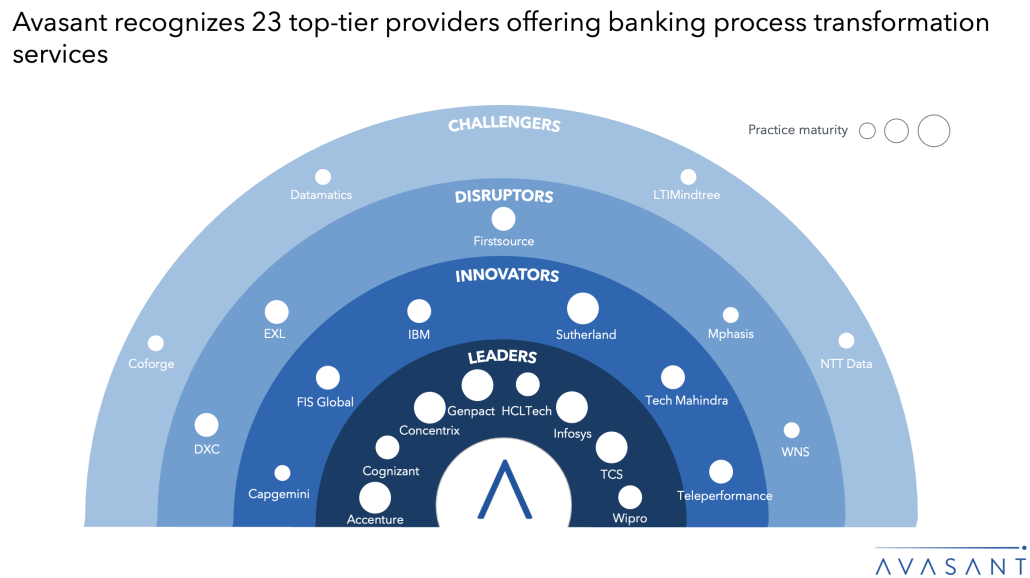

Avasant evaluated 40 providers using three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of these providers, we recognized 23 that brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Cognizant, Concentrix, Genpact, HCLTech, Infosys, TCS, and Wipro

- Innovators: Capgemini, FIS Global, IBM, Sutherland, Tech Mahindra, and Teleperformance

- Disruptors: DXC, EXL, Firstsource, Mphasis, and WNS

- Challengers: Coforge, Datamatics, LTIMindtree, and NTT DATA

The following figure from the full report illustrates these categories:

“Narrowing interest margins and strict regulatory compliance are catalyzing the integration of AI and RPA into banks’ core processes,” said Praveen Kona, associate research director at Avasant. “To stay profitable, they must use AI chatbots, automate compliance workflows, and apply predictive analytics to improve the customer journey.”

The full report provides several findings and recommendations, including the following:

-

- Mobile banking apps are the primary banking channel for 60% of millennials, 57% of Gen Z, and 52% of Gen X users. Service providers are focusing on streamlining digital self-service journeys.

- Banks are leveraging strategic partnerships with fintech, hyperscalers, and technology providers to scale their solutions for a global customer base.

- There is approximately 16% growth in the workforce of banking outsourcing service providers, indicating an increase in demand for these services.

- Nearly 60% of the revenue is generated from time-based pricing models. However, outcome-based and hybrid pricing models are gaining traction.

- Service providers are investing in R&D to create new offerings, enhance their technology solutions, and foster innovation through emerging technologies such as Gen AI.

“As banking processes evolve through advanced technologies, there is increased focus on digital self-service and hyper-personalization,” said Aditya Jain, research leader at Avasant. “Service providers are partnering to deploy unified AI platforms that streamline KYC, synchronize cross-channel interactions, and deliver custom insights.”

The RadarView also features detailed profiles of the top 23 service providers, including their solutions, offerings, and experience assisting enterprises in their banking process transformation journeys.

This Research Byte briefly overviews Avasant’s Banking Process Transformation 2025 Market Insights™ and Banking Process Transformation 2025 RadarView™. (Click for pricing.)