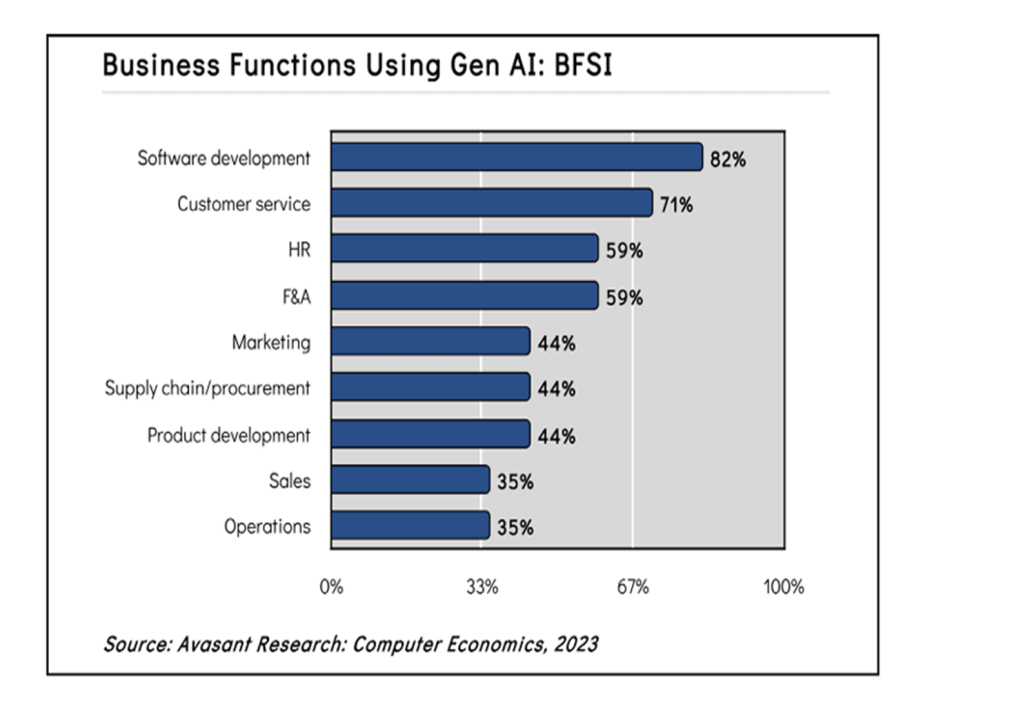

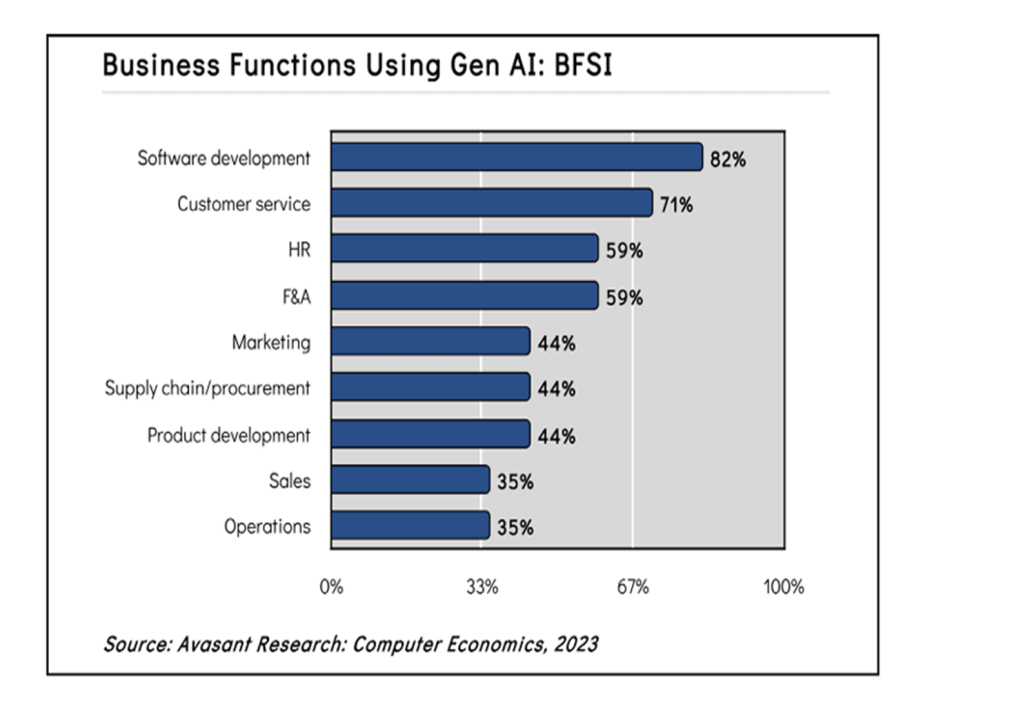

The banking, financial Services, and insurance (BFSI) sector is rapidly adopting AI to optimize operations, enhance customer experiences, and strengthen risk management protocols. AI-powered chatbots and virtual assistants are transforming customer interactions by providing around-the-clock assistance and facilitating real-time query resolution. A notable trend is the transition toward hyperpersonalized financial services. According to the Avasant Generative AI Spending and Adoption Metrics for BFSI 2024, over 70% of banking functions are utilizing Generative AI (Gen AI) to improve customer experience.

Traditionally, banks have been offering generalized, one-size-fits-all products. In contrast, contemporary AI models can analyze consumer spending behavior, transaction histories, and even non-traditional data sources, such as social media activities, to design customized financial products. Furthermore, the incorporation of machine learning within fraud detection systems has markedly enhanced the capability to identify and mitigate risks in a timely manner. Within the competitive BFSI landscape, the integration of AI transcends mere technological enhancement; it constitutes a strategic necessity to drive innovation, improve operational efficiency, and address evolving customer expectations.

This theme was effectively highlighted during the recently concluded HCLTech BFSI Analyst Day Event, which took place on February 11, 2025, at HCLTech’s Bengaluru campus. Srinivasan Seshadri, chief growth officer at HCLTech, underscored the company’s commitment to fostering growth and innovation within the BFSI sector through AI. As a leading global provider, HCLTech has been employing Gen AI in BFSI service areas, including mainframe modernization, platform implementation, and cloud transformation. It has established over 60 digital and Gen AI laboratories and identified more than 77 use cases relevant to the BFSI sector, leveraging over 20 intellectual properties that it has developed.

In conjunction, HCLTech’s Financial Services (FS) business vertical reported annual revenues of $2.9 billion for FY 2024, accounting for 21% of the organization’s overall revenue. With a workforce of 50,000 employees, including 5,000 subject matter experts, HCLTech is making noteworthy progress within the BFSI sector as economic concerns related to the global election year appear to be subsiding and investments are increasing.

In terms of key clients and projects, HCLTech demonstrated an ‘agile @scale @pace’ approach that prioritizes scalability, speed, and efficiency, aligning with its broader strategy to deliver transformative solutions to its clientele. The firm is collaborating with 11 of the top 25 fintech companies, leveraging its profound expertise in Agile methodologies and infrastructure services. As part of its future initiatives, HCLTech is concentrating on wealth management, financial crime compliance (FCC), retirements, payment and cards services.

The Avasant Financial Services Market Insights 2024 report also highlights trends around these areas and states that the ‘great wealth transfer’ from baby boomers to younger, tech-savvy investors is driving demand for smarter advisory services among rising mass affluents seeking sophisticated, analytics-driven financial advisory experience. Also, compliance efforts, such as the move to the T+1 settlement cycle, centralized clearing for the US Treasury, and the Digital Operational Resilience Act (DORA), are driving financial services firms to adopt regulatory technology (RegTech) solutions to meet compliance requirements efficiently.

HCLTech has introduced numerous AI offerings, such as AI Force for services transformation, AI-Labs for co-innovation with partners and clients, AI Engineering for full stack services and AI Foundry for the creation of industry-focused, repeatable intellectual property, particularly in financial services. Its BPO 3.0 initiative represents a pivotal approach to business process outsourcing, utilizing advanced technologies like automation, AI, and analytics to enhance operational efficiency and customer satisfaction.

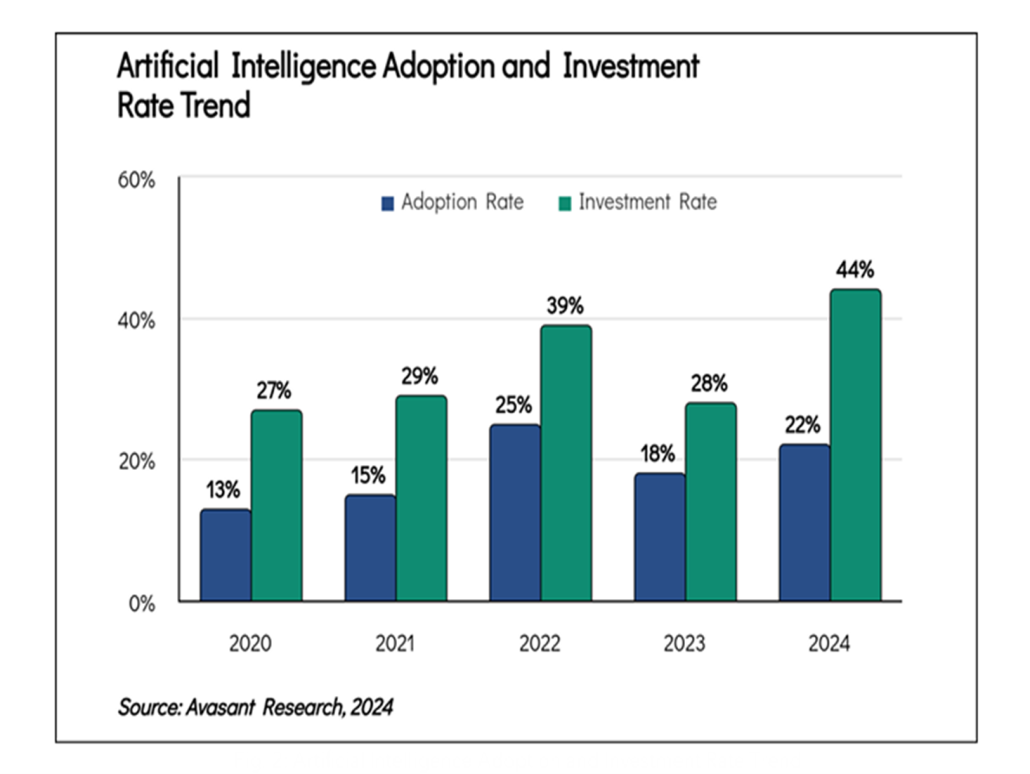

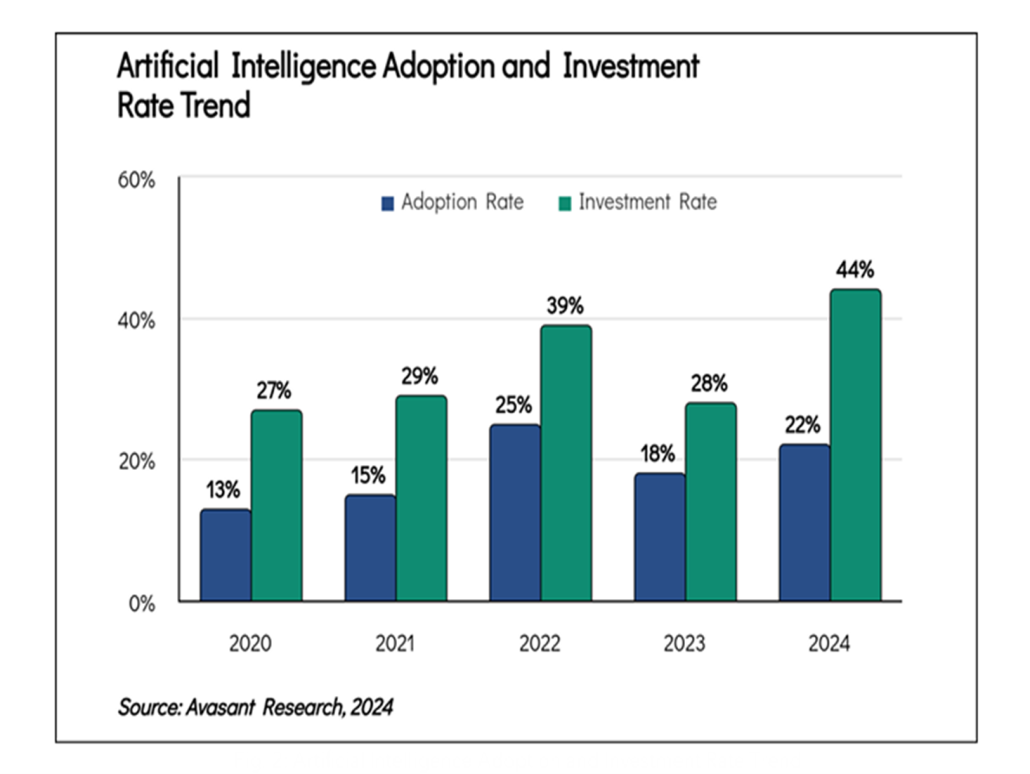

The transformative role of AI across various industries, including BFSI, is increasingly apparent. According to the Avasant AI Adoption Trends And Customer Experience 2024 report, the trend in both AI adoption and investment rates is on the rise from 2020 to 2024. While investment in AI has consistently outpaced adoption, both have shown steady growth. Notably, the investment rate surged from 27% in 2020 to 44% in 2024, indicating strong confidence in AI’s future potential.

Conclusion

The HCLTech BFSI Analyst Day 2025 showcased the organization’s capabilities within the BFSI sector. With emphasis on AI offerings, customer-centric platform services such as Avaloq, Temenos and strategic investments including the acquisition of Confinale, HCLTech is well-positioned to deliver comprehensive financial solutions to clients.

As investments in AI continue to increase within the BFSI sector, leading global providers like HCLTech should focus on key areas such as data security and fraud prevention through AI modeling. Additionally, strengthening offerings to enhance process efficiencies in the BFSI sector using agentic AI, along with its real-time monitoring and control, should be a key focus area. By making strategic investments and developing industry-specific AI offerings, HCLTech is poised to capitalize on upcoming opportunities in the BFSI sector.

By Praveen Kona, Associate Research Director, Avasant