It isn’t as though the cloud or SaaS or any of the related technologies are new at this point. So would it surprise you to discover that, for most companies, they’ve barely started the cloud transition? Modern-day SaaS providers as we know them today have been around since just before the turn of the century. Amazon Web Services and other public cloud services are at least a decade old. But according to the Computer Economics annual IT Spending and Staffing Benchmarks study for 2019/2020, the cloud transition still has a long way to go.

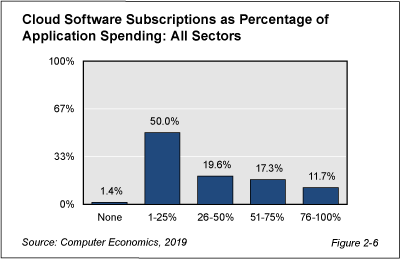

As shown in Figure 2-6 from the composite chapter (chapter 2) of the study , 17.3% of respondents to our survey report that 50-74% of their business applications are cloud subscriptions (compared to only 10.2% last year, and 4.9% in 2017). Another 11.7% report that over 75% of their applications are cloud based (compared to 9.6% in 2018 and 4.2% in 2017). Still, over half have fewer than 26% of their applications in the cloud (though, this number is down from 59.3% in 2018 and nearly two-thirds in 2017).

Bottom line: Even though there is great progress in the move to the cloud, more than two-thirds of companies in our survey haven’t even converted half of their applications to the cloud.

Similar numbers can be found with public cloud infrastructure. At the median, our respondents report that 10% of their operating system instances are in a public cloud, and another 10% are hosted by a service provider. Only a handful of companies taking our survey report that at least 75% of their OS instances are in a public cloud.

“If you are a SaaS or public cloud vendor, this news is probably pretty exciting,” said David Wagner, vice president, research, at Computer Economics, based in Irvine, Calif. “It shows that there is lots of runway for the cloud providers, even though in many cases they already have a greater market share than the legacy software vendors. But from a more practical point of view of enterprise IT, the progress seems rather slow.”

So what is slowing down the cloud transition? First, let’s be clear. Cloud applications were the top priority for new spending in our survey. Cloud infrastructure was second. These two areas have been at or near the top for several years running. So it isn’t that IT organizations are trying to be slow. It is more complicated than that.

The first impediment is the simple reality that organizations can only handle so much change at once. The first applications converted to the cloud were usually the easiest—often departmental solutions. Core systems such as ERP and financial management are often the last systems to be converted. As such, the farther a company gets in its cloud transition, the slower it is likely to go. But even if the IT department is ready to make fast changes, it isn’t merely the IT organization involved in the change. Users need to accept the changes, too. They need to be trained. They need to be assured that the changes make sense. Users experiencing too much change are likely to push back if more change is suggested.

Another issue may be that one of the early strengths of the cloud may turn out to handcuff IT organizations over the long run. Converting software from on-premises to SaaS or moving workloads from internal data centers to the public cloud turned large capital expenditures into operating expenses. However, with on-premises systems, once a server is bought, the IT organization can run it as long as it works, and the license fees are a sunk cost. In other words, once you own it, the cost to keep it is low. SaaS and public cloud fees have lower up-front costs, but they never stop. Over the lifetime of use for a SaaS application, organizations may actually pay more than they would have otherwise, especially if they do not consider the hidden costs of on-premises applications, such as the costs of periodic upgrades, infrastructure costs, and personnel to support the infrastructure. The result is that it is often difficult to build a business case to replace a legacy system that is functioning and is largely a sunk cost.

That said, the cloud transition is continuing, and investment is strong. We are not saying that companies are re-thinking their cloud commitments. We’re simply saying, given the age and maturity of the cloud, adoption is not as far along as many would expect. There is an enormous inventory of legacy systems in use in many organizations, and it will take a long time to displace them. We’ve reached a point where cloud technologies are mature, and enterprises will continue to adopt them. But when you separate the hype from the reality, you see there is a long way to go. The journey to the cloud is a long and winding road.

The Computer Economics IT Spending and Staffing Benchmarks 2019/2020 study is based on a detailed survey of more than 225 IT executives in the U.S. and Canada on their IT spending and staffing plans for 2019/2020. It provides IT spending and staffing benchmarks for small, midsize, and large organizations and for 28 sectors and subsectors. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.