Manufacturers are under pressure to meet growing customer expectations despite increased production costs, a shortage of skilled workers, and the need to make new investments for Industry 4.0. To alleviate this pressure, they are investing in digital technologies to cut costs, shorten development cycles, reduce human dependency, mitigate risks from supply chain disruptions, and move toward sustainability. They are also working to diversify their business models and increase profitability. As this requires a strong integration of domain and technological expertise, manufacturers are collaborating with service providers for digital transformation.

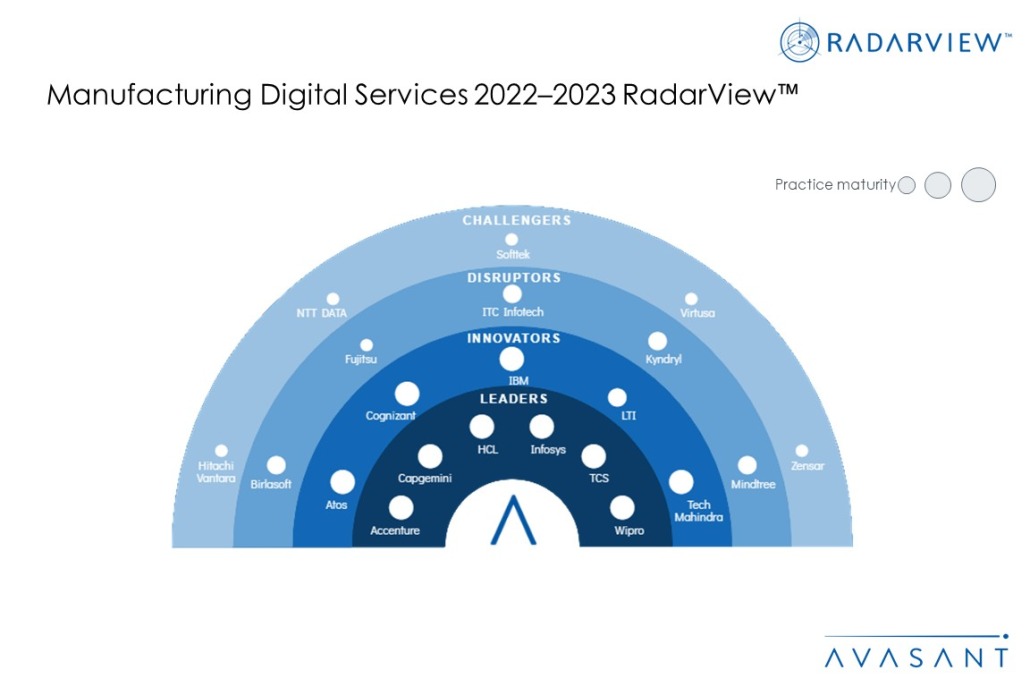

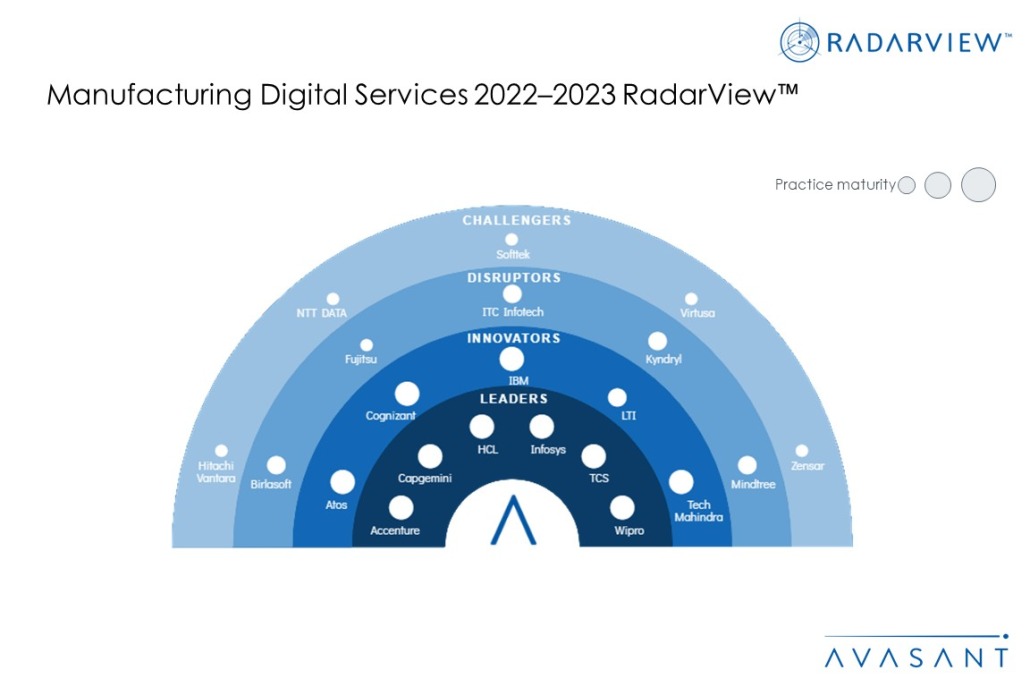

These emerging trends are covered in Avasant’s Manufacturing Digital Services 2022–2023 RadarView™. The report is a comprehensive study of digital service providers in the manufacturing industry, including top trends, analysis, and recommendations., It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

Avasant evaluated 29 providers using three dimensions: . Of the 29 providers, we recognized 21 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, HCL, Infosys, TCS, and Wipro

- Innovators: Atos, Cognizant, IBM, LTI, and Tech Mahindra

- Disruptors: Birlasoft, Fujitsu, ITC Infotech, Kyndryl, and Mindtree

- Challengers: Hitachi Vantara, NTT Data, Softtek, Virtusa, and Zensar

Figure 1 below from the full report illustrates these categories:

“Manufacturers are facing rising costs and supply chain disruptions at the same time customers are becoming more demanding,” said Joe Frampus, Avasant partner. “The only way to solve this dilemma is by investing in new technology to cut production costs and enable new business models.” The full report provides a number of findings, including the following:

-

- Leading manufacturers are responding to financial pressure by accelerating their Industry 4.0 adoption to reduce production and R&D costs as well as focusing on high-margin segments, such as aftermarket services.

- They are making their supply chains more resilient and agile by evaluating nearshoring and reshoring capabilities and experimenting with 3D printing to replace tough-to-procure parts.

- They are reassessing their workforce strategy by automating minor tasks and upskilling/reskilling new-generation workers as well as investing in workforce safety for employees working in hazardous environments.

- They are elevating customer engagement by implementing new business models, such as D2C, to engage directly with customers and provide personalized services via the as-a-service model to minimize capital expenditures.

“The direct-to-consumer model for manufacturers is really quite interesting,” said Praveen Kona, associate research director with Avasant. “It’s a way for manufacturers to cut out the middleman and gather market intelligence directly from end customers.”

The full report also features detailed RadarView profiles of 21 service providers, along with their solutions, offerings, and experience in assisting manufacturing companies in digital transformation.

This Research Byte is a brief overview of the Avasant Manufacturing Digital Services 2022–2023 RadarView™ (click for pricing).