This RadarView™ is designed to support enterprises in the UK in developing a resilient digital services strategy by leveraging market outlook, proven practices, and transformation initiatives. It begins with a summary of the key supply-side trends shaping the UK digital services landscape and follows with an in-depth evaluation of 25 leading service providers. Each profile offers an overview of the provider’s capabilities, industry-specific offerings, representative clients and partnerships, and concise case studies. The profiles conclude with analyst insights on practice maturity, investments and innovation, and ecosystem development. This report serves as a guide for businesses to identify the right partners for their digital transformation efforts.

Why read this RadarView?

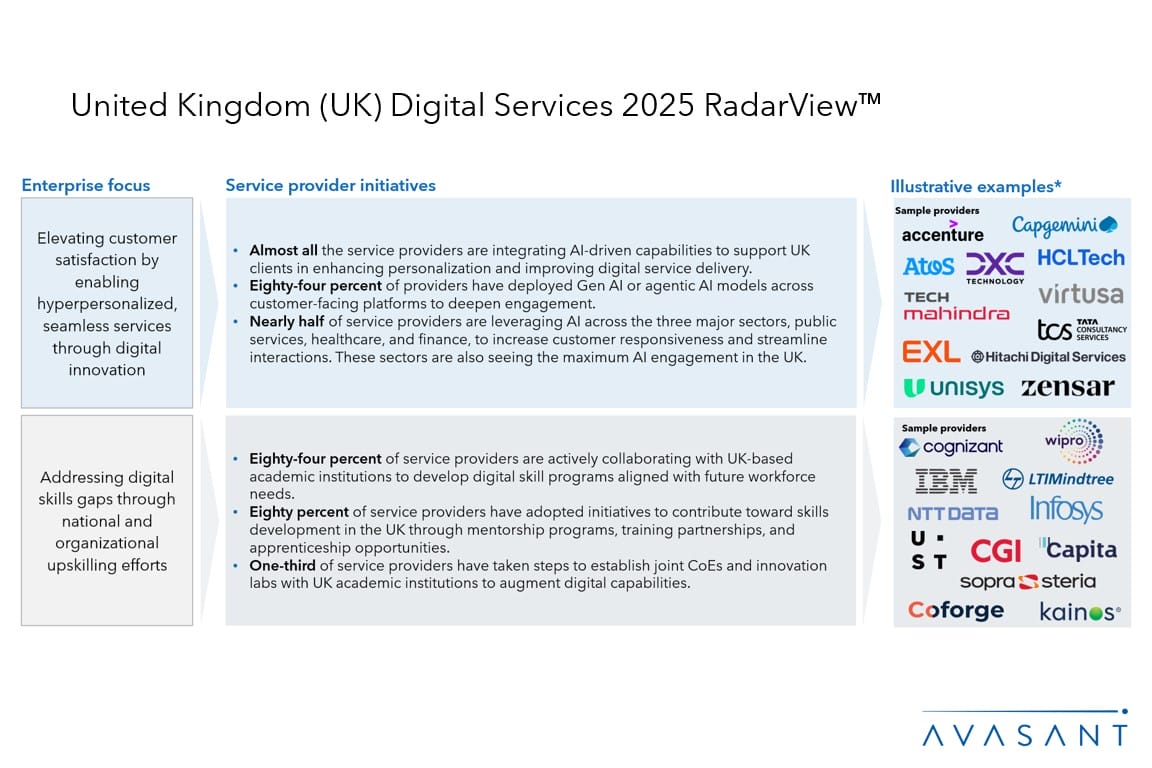

The UK digital services sector is undergoing a strategic shift as enterprises intensify efforts to modernize operations, strengthen cyber resilience, and meet rising consumer expectations. Accelerated by AI adoption, hybrid cloud models, and sovereign data mandates, digital investments are reshaping industry delivery models. At the same time, public sector reforms and national infrastructure initiatives reinforce the push toward compliant and future-ready digital ecosystems, aligning with the ESG frameworks. This evolution reflects the UK’s broader ambition to position itself as a pioneer in secure, innovative, and inclusive digital transformation.

The United Kingdom (UK) Digital Services 2025 RadarView™ highlights key supply-side trends in the UK region’s digital services market and Avasant’s viewpoint on them. It aids UK enterprises in identifying top service providers to assist them in digitalizing their services. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for the UK region.

Featured providers

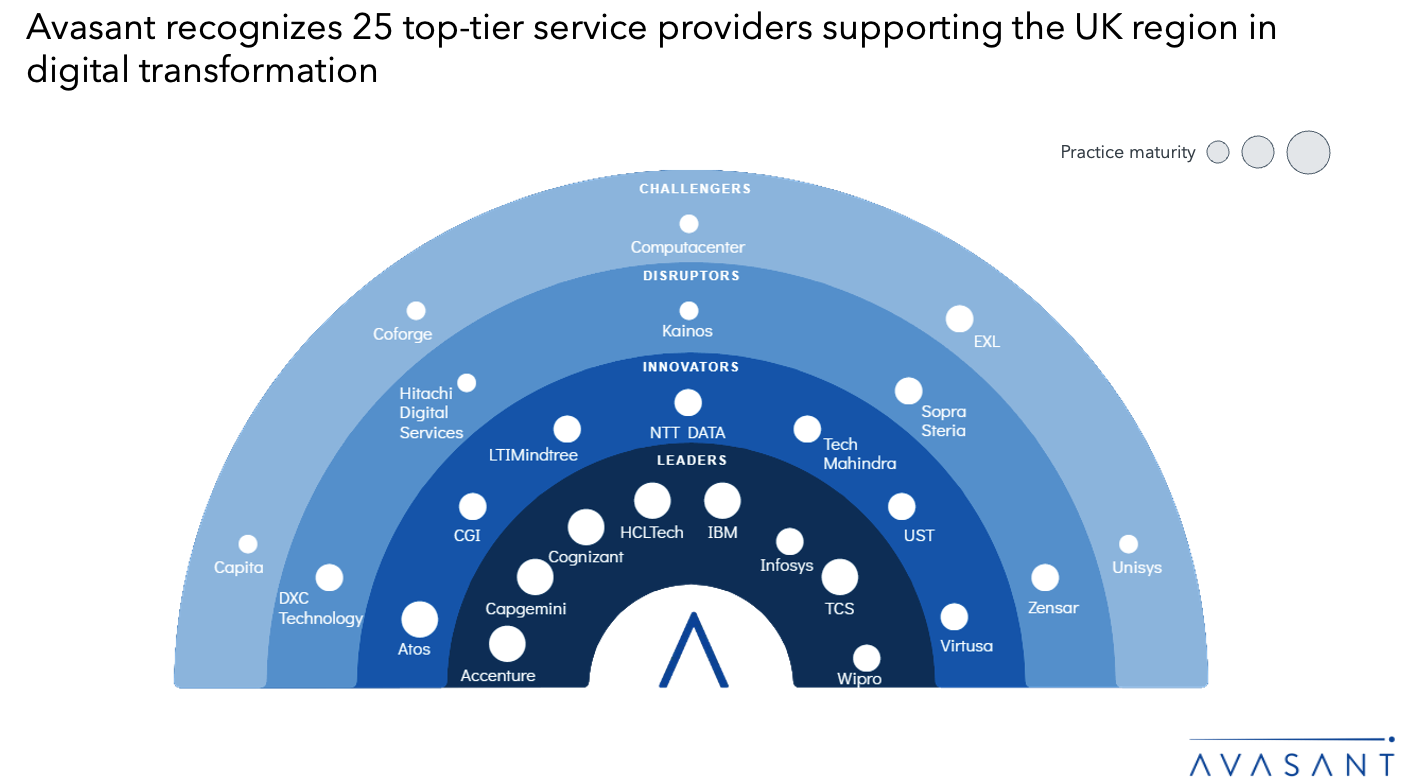

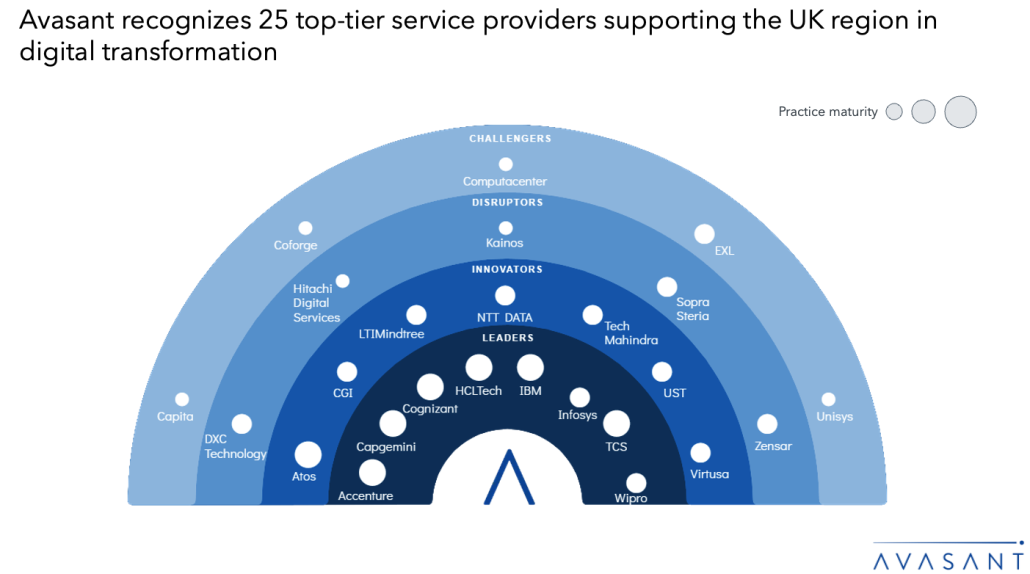

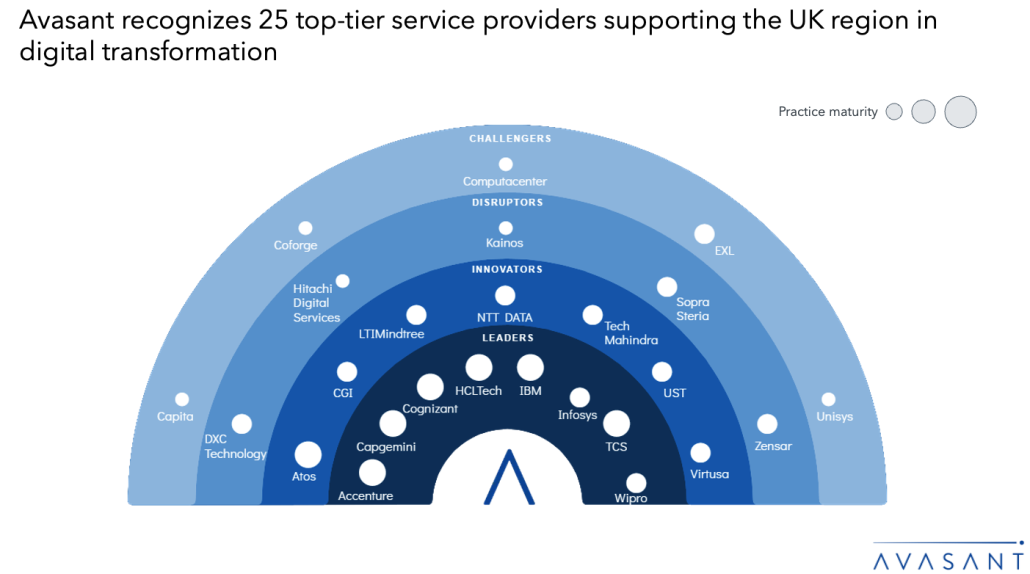

This RadarView includes an analysis of the following service providers in the UK region’s digital services space: Accenture, Atos, Capgemini, Capita, CGI, Coforge, Cognizant, Computacenter, DXC Technology, EXL, HCLTech, Hitachi Digital Services, IBM, Infosys, Kainos, LTIMindtree, NTT DATA, Sopra Steria, TCS, Tech Mahindra, Unisys, UST, Virtusa, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across three dimensions of practice maturity, investments and innovation, and ecosystem development, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

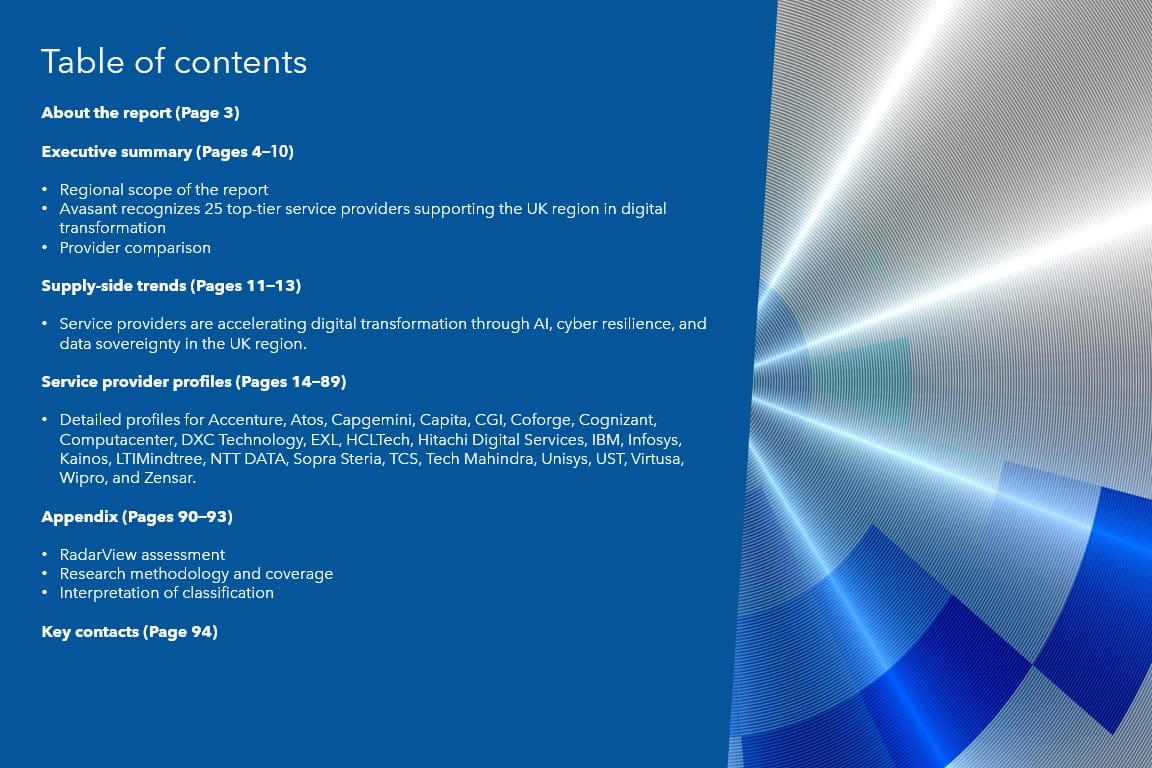

About the report (Page 3)

Executive summary (Pages 4–10)

-

- Regional scope of the report

- Avasant recognizes 25 top-tier service providers supporting the UK region in digital transformation

- Provider comparison

Supply-side trends (Pages 11–13)

-

- Service providers are accelerating digital transformation through AI, cyber resilience, and data sovereignty in the UK region

Service provider profiles (Pages 14–89)

-

- Detailed profiles for Accenture, Atos, Capgemini, Capita, CGI, Coforge, Cognizant, Computacenter, DXC Technology, EXL, HCLTech, Hitachi Digital Services, IBM, Infosys, Kainos, LTIMindtree, NTT DATA, Sopra Steria, TCS, Tech Mahindra, Unisys, UST, Virtusa, Wipro, and Zensar.

Appendix (Pages 90–93)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 94)

Read the Research Byte based on this report. Please refer to Avasant’s United Kingdom (UK) Digital Services 2025 Market Insights™ for demand-side trends.