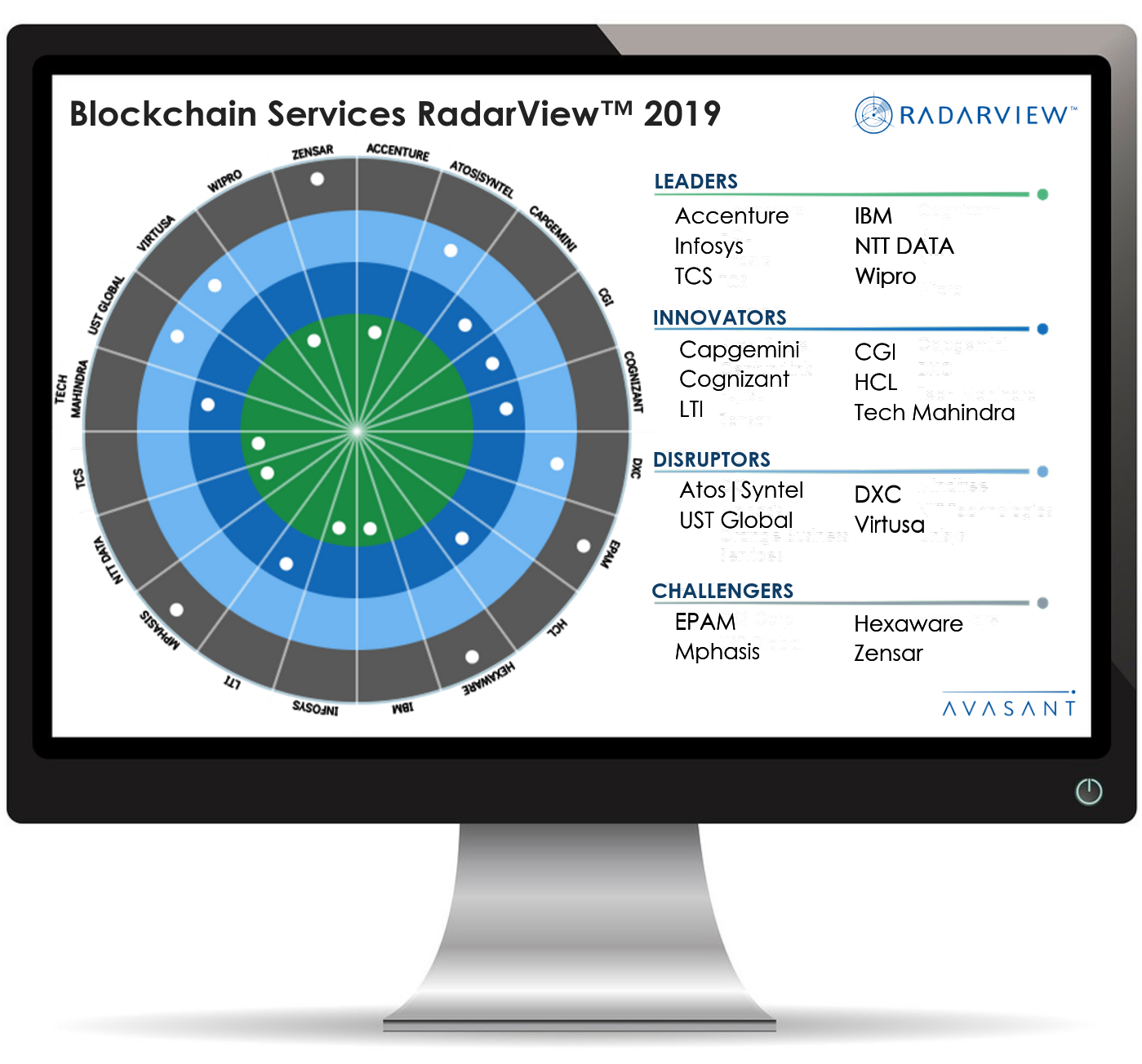

CGI recognized as an Innovator in Avasant’s Blockchain Services 2019 RadarView™ Report

Among endless service provider options, novel and disruptive mechanics in innovation brings recognition as an Innovator for Blockchain Services 2019.

Read the Avasant report

“Strong focus on IP development. High growth in client engagements. Blockchain solutions focused around trade finance and US Federal.”

AVASANT ANALYST INSIGHTS

Practice Maturity

- CGI started its blockchain practice in 2015 and identified blockchain as one of the key technologies in its global emerging technologies portfolio. It has experienced massive growth since last year in targeted industries of BFSI, healthcare, utilities, and the public sector.

- Since 2016-17, it has been aggressively involved in educating about blockchain by conducting a set of blockchain programs. Now, in addition to the blockchain education, it is engaged in full-service partnerships with its enterprise clients.

- With a platform and technology-agnostic approach, it has a strong portfolio of IPs and assets. With its trade finance platform, Trade360, it has been a successful trade finance technology partner for various banks, including Bank of Montreal, Royal Bank of Canada, and Mitsubishi UFJ Financial Group.

- It has emphasized expanding its blockchain ecosystem through various partnerships that not only involve start-ups such as CyberStratus and NuBorders, but also platform providers such as Ripple and Corda.

Investments and Innovation

- CGI has established 11 innovation centers and labs around the globe and continues to invest strategically in developing and delivering IPs. With the advent of GDPR, it has built 2 GDPR-compliant IPs: Boxchain and Data360. In addition to asset development, half of its planned investments is allotted for human capital development. It has collaborated with educational institutions, labs, non-profit organizations, and partner companies such as R3, Ripple, DAH, etc., to hire talent.

- It is actively looking for inorganic investment opportunities under its “Build and Buy” strategy. Blockchain capabilities are one of the many evaluation factors in its global M&A targeting process.

Ecosystem Development

- Embracing the blockchain, CGI has a lot of thought leadership content on its website in the form of blog posts and white papers focused on trade finance, blockchain storage requirements, blockchain energy consumption, and government blockchain.

- It continues to collaborate with different platform providers and banks to build trade finance applications. In 2017, it created a PoC by integrating its trade finance platform Trade 360 with Skuchain, a blockchain platform to enable 19 banks to provide trade finance services. It has also collaborated with R3 and 13 global banks to build a trade finance application on the Corda platform.

Featured Resources

2019 SD-WAN Managed Services RadarView Report

2019 Digital Masters RadarView™ Report

2019 Cybersecurity RadarView™ Report

2019 Applied AI and Advanced Analytics RadarView™ Report

2019 Internet of Things Services RadarView™ Report

2018 Hybrid Enterprise Cloud Services RadarView™ Report

2018 Intelligent Automation Services RadarView™ Report

2018 Blockchain Services RadarView™ Report

CGI’s Blockchain Practice

DISCLAIMER:

This graphic was published by Avasant LLC as part of a larger research document and should be evaluated in the context of the entire document. The document is available upon request from Avasant website. Avasant does not endorse any provider, product or service depicted in its research publications, including RadarViewTM, and does not advise users to select only those providers recognized in these publications. Avasant’s research publications are based on information from best available sources and Avasant’s opinion at the time of publication, and their contents should not be construed as statements of fact. Avasant disclaims all warranties, expressed or implied, with respect to this research, including and warranties of merchantability or fitness for a particular purpose.