This RadarView helps enterprises identify key service providers to implement and manage a digital workplace. It begins with a summary of key trends shaping the market and Avasant’s viewpoint on digital workplace services over the next 12 to 18 months.

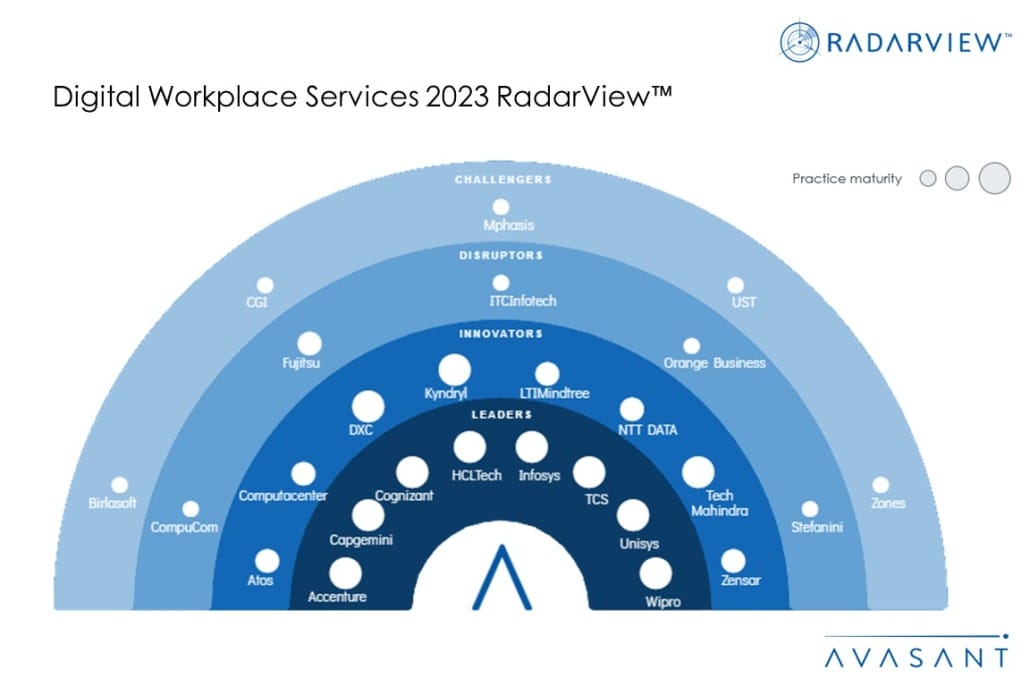

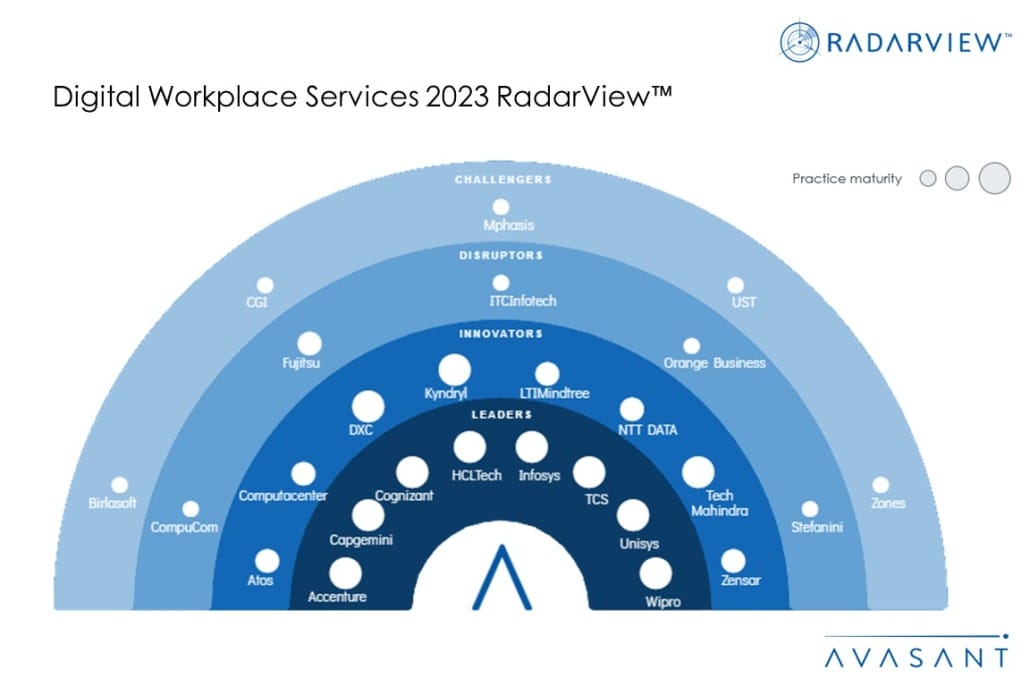

It continues with a detailed assessment of 26 providers offering digital workplace services. Each profile provides an overview of the service provider, its key IP and assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

The 2–3-day work-from-home model has gained acceptance with the evolution and maturity of hybrid work three years after its inception in 2020. Enterprises now prioritize monitoring, managing, and enhancing employee experiences at all workplace touchpoints, encompassing devices, applications, and physical locations. This shift has led to a greater focus on outcome-based engagements, with enterprises emphasizing experience-level agreements (XLAs) and the use of digital technologies such as AI/ML, IoT, and automation, fostering a work environment that promotes productivity, collaboration, and employee satisfaction.

The Digital Workplace Services 2023 RadarView™ aids companies in identifying top service providers to assist them in implementing and managing a digital workplace. It also offers an analysis of each service provider’s capabilities, enabling organizations to identify the right strategic partners for their workplace transformation.

Featured providers

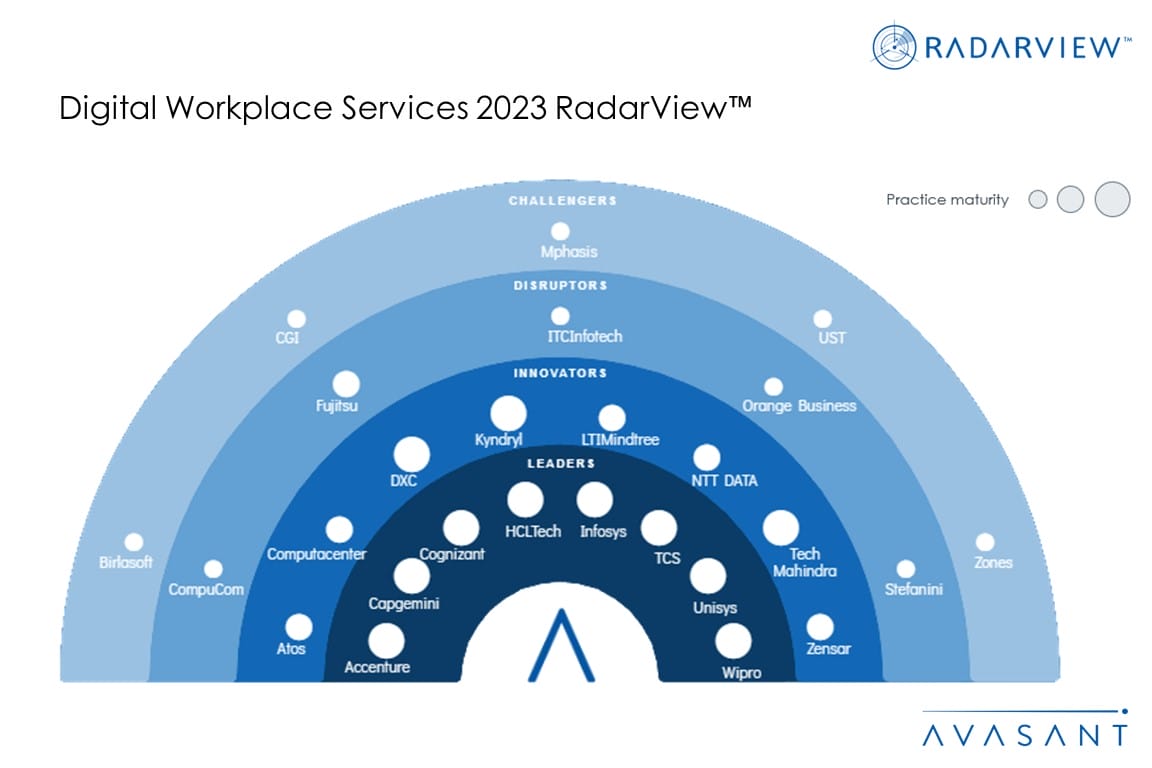

This RadarView includes a detailed analysis of the following digital workplace services providers: Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, CompuCom, Computacenter, DXC, Fujitsu, HCLTech, Kyndryl, Infosys, ITC Infotech, LTIMindtree, Mphasis, NTT DATA, Orange Business, Stefanini, TCS, Tech Mahindra, Unisys, UST, Wipro, Zensar, and Zones.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

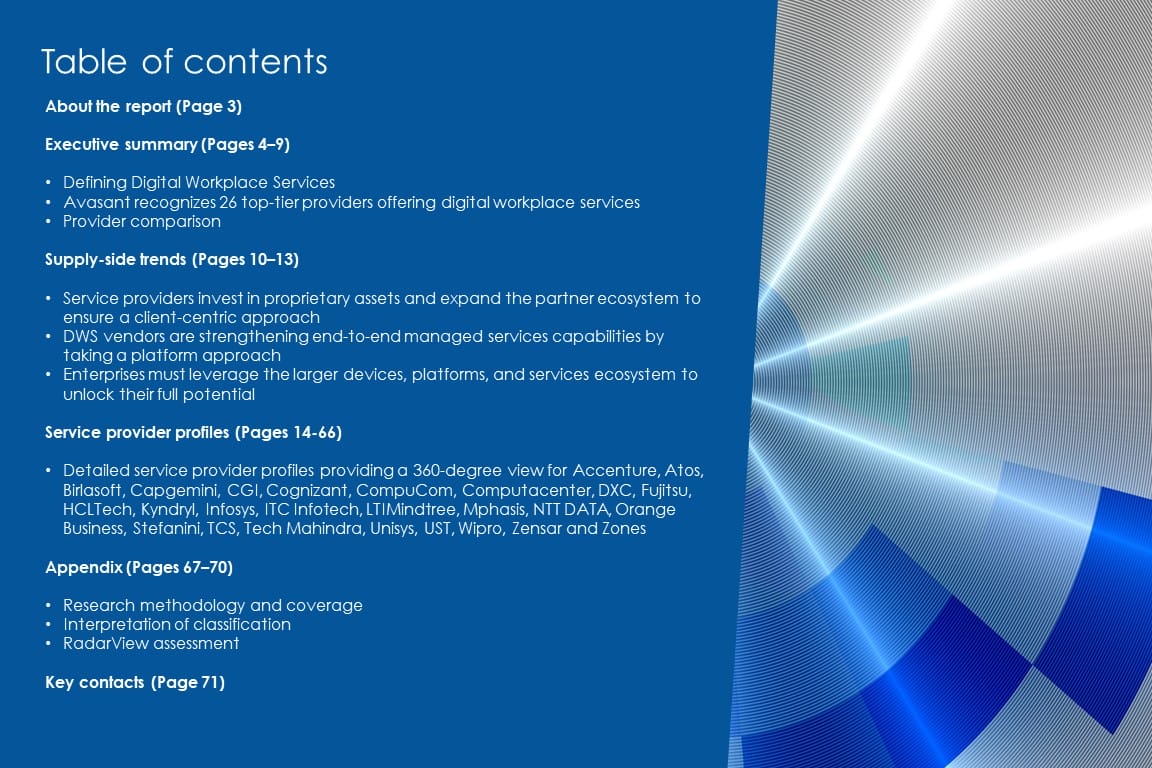

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining digital workplace services

- Avasant recognizes 26 top-tier providers offering digital workplace services

- Provider comparison

Supply-side trends (Pages 10–13)

-

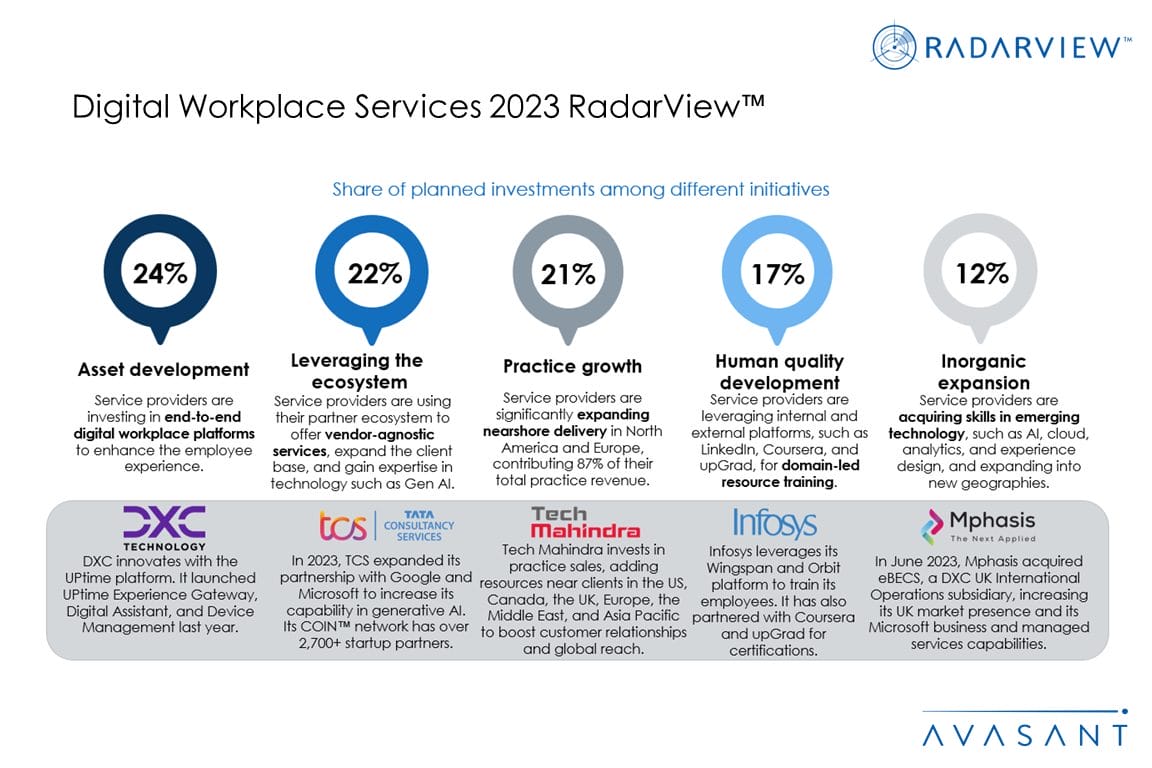

- Service providers invest in proprietary assets and expand the partner ecosystem to ensure a client-centric approach

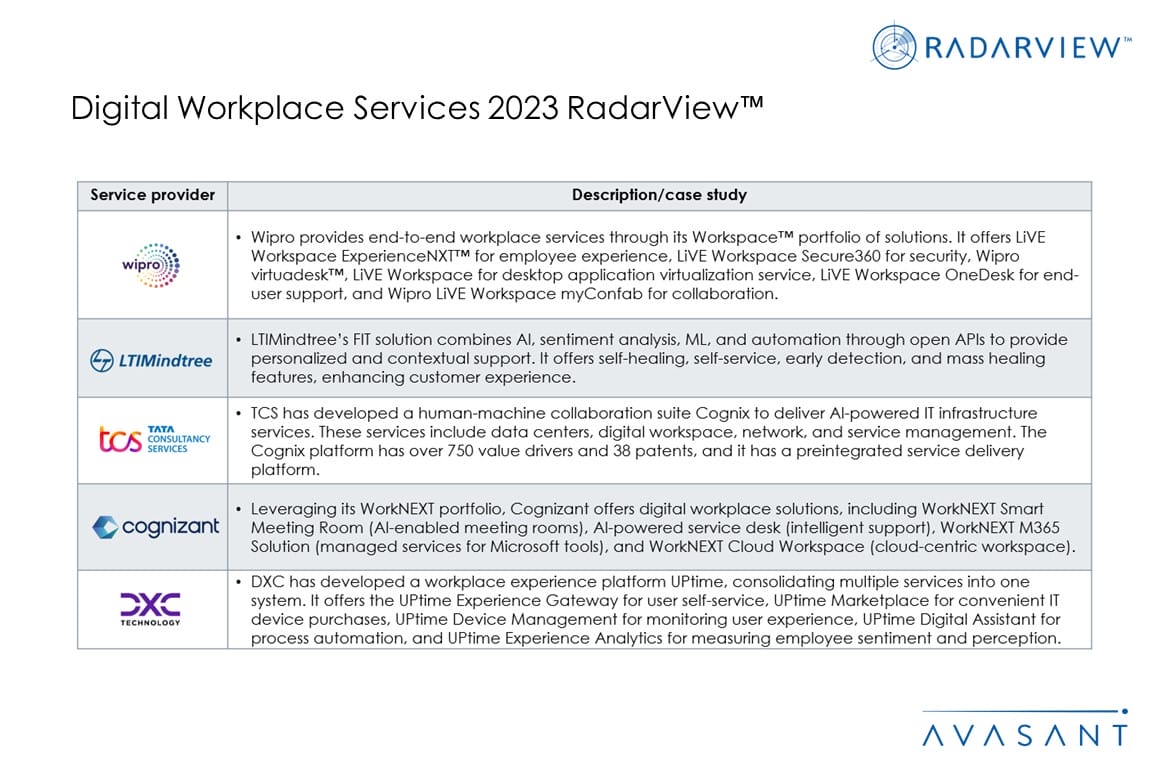

- DWS vendors are strengthening end-to-end managed services capabilities by taking a platform approach

- Enterprises must leverage the larger devices, platforms, and services ecosystem to unlock their full potential

Service provider profiles (Pages 14–66)

-

- Detailed service provider profiles providing a 360-degree view of Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, CompuCom, Computacenter, DXC, Fujitsu, HCLTech, Kyndryl, Infosys, ITC Infotech, LTIMindtree, Mphasis, NTT DATA, Orange Business, Stefanini, TCS, Tech Mahindra, Unisys, UST, Wipro, Zensar, and Zones

Appendix (Pages 67–70)

-

- Research methodology and coverage

- Interpretation of classification

- RadarView assessment

Key contacts (Page 71)

Read the Research Byte based on this report.

Please refer to Avasant’s Digital Workplace Services 2023 Market Insights™ for demand-side trends.