Traditional banking and payment systems are proving to be too slow to accommodate increasing levels of e-commerce and cross-border transactions. And demands for faster payment processing will only increase as commerce enters the omniverse. This Research Byte outlines the factors driving the need for speed in financial transactions along with possible solutions, including various types of digital currencies and next-generation payment gateways. We take a close look at the benefits as well as the drawbacks of one kind of digital currency—cryptocurrencies—and what the future of money could look like with a combination of digital payment instruments existing alongside traditional currencies. We conclude with recommendations for enterprises to understand and prepare for the future of money.

The Need for Speed in Financial Transactions

As electronic commerce increases, traditional monetary systems are showing themselves to be too slow and inefficient, especially when it comes to cross-border transactions. Trillions of dollars are being moved around the world annually. However, it can take two to five business days[1] to settle international payments, and much liquidity is floating in the system. For large enterprises, this presents a significant drag on cash flow. A single misdirected payment can have a significant impact on a business. Transaction costs are high, often involving a large amount of manual processing. As international trade increases, the volume of cross-border transactions will also increase. Solutions are needed to support the future world of global and virtual commerce.

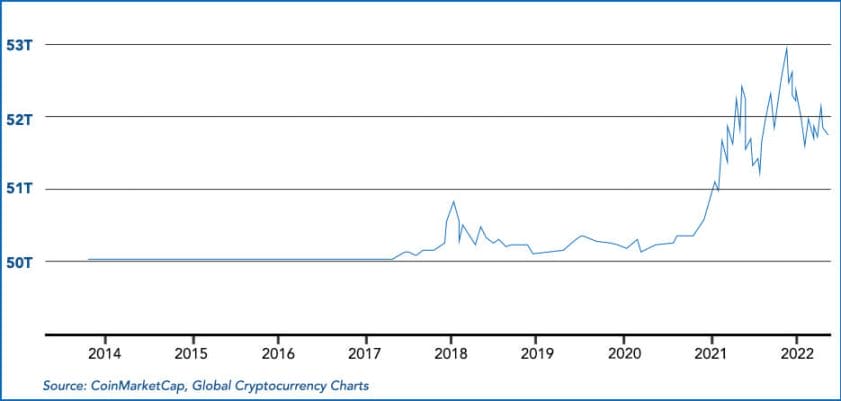

For this and other reasons, digital currencies—and cryptocurrencies, one type of digital currency—are becoming more popular, as shown in Figure 1.

Figure 1. Total cryptocurrency market cap (US trillions)

And, as commerce increases in the virtual world (the metaverse, or, as we prefer, the omniverse), there will be an even greater volume of cross-border transactions. Digital currencies are a better fit for virtual worlds with no borders.

The Potential for Digital Money as the Way Forward

Cryptocurrencies or “cryptos” would seem to be an excellent way to provide speed in trading systems at a low cost. Although cryptos have their advantages, they also have serious drawbacks, as outlined in this section.

The benefits of cryptocurrencies over traditional payment instruments can be grouped into three key areas:

-

- Decentralization: Because cryptos are generally not governed by a central authority, they do not require an intermediary to validate a transaction. They are permissionless, immutable, and free from vulnerabilities such as account seizures and variation in government policies.

- Security and trust: Mature coins are technically impregnable from attackers, as transactions are secured by encryption using advanced blockchain technology. Hackers would need to perform multiple attacks on multiple devices simultaneously due to the high complexity of the system. Bitcoin, for example, is nearly impossible to corrupt or duplicate.

- Intrinsic value: Governments in countries with political and economic instability often choose to print money “out of thin air,” leading to skyrocketing inflation. In such situations, cryptos can be attractive, especially those with a finite quantity, such as Bitcoin, which was designed to allow only 21 million coins to be mined. Other coins use alternative methods to derive their value, such as PAX Gold (PAXG), which is backed by physical gold reserves.

There are, however, several drawbacks to cryptos. These include:

-

- Volatility: Currently, the value of cryptos is much more volatile than fiat currencies. Much of this volatility is driven by the speculative nature of investing in crypto. It is possible, however, that as adoption increases, volatility may subside.

- Lack of Credibility: Unlike fiat currencies, cryptos are not regulated by central authorities or backed by governments. This makes them perceivably less credible than traditional forms of money. Also, just like during the dot-com boom, where only a few internet companies such as Amazon and eBay survived, a large percentage of coins are not expected to make it.

- Environmental impact: The crypto industry consumes an immense amount of energy. One Bitcoin transaction can use up to 2.292.5 kilowatt-hours of electricity, which is more than double the amount used by the average American household per month. It is estimated that Bitcoin mining consumes more power globally every year than in some countries like the Netherlands and Pakistan[2]. This is tied to the proof of work (PoW) validation mechanism that requires significant computing resources to solve mathematical equations before new coins can be mined. But the reward only goes to the first solver, so there is a constant battle amongst miners for the most powerful mining rigs. However, alternative validation methods have emerged, which have a lesser environmental impact, such as proof of stake (PoS)[3], proof of burn (PoB)[4], proof of capacity (PoC)[5], and proof of elapsed time (PoET)[6]. Co-location mining facilities using renewable energy sources can also help reduce carbon emissions.

- Fraud: Although encryption makes crypto impossible to counterfeit, the systems for storing and exchanging cryptocurrencies are new, and there has been a recent surge in high-profile incidents, or “rug pulls[7],” where investors have seen their accounts emptied by crypto scammers. In 2021, rug pulls accounted for more than $2.8 billion, or 37% of total cryptocurrency scams, compared to just 1% in 2020[8]. The largest rug pull in 2021 came from the Turkish-based Thodex, whose CEO vanished with over two billion worth of cryptocurrency (approximately 90% of all rug pulls in 2021)[9]. Another notorious example is the Canadian Quadriga scandal, which saw over $200 million in investors’ assets locked away forever with the sudden passing of CEO Gerald Cotton in 2018. But it was also discovered a few months after his death that he was moving money from the QuadrigaCX exchange into his personal accounts.

Overall, cryptocurrency fraud[10] reached $14 billion in 2021, up from $7.8 billion in 2020. Hopefully, the cryptocurrency market will mature to the point that safeguards can be implemented to mitigate the risk of fraud.

-

- Difficulty in reversing transactions: The distributed ledger of blockchain makes cryptocurrency transactions immutable, meaning they cannot be undone unless the two parties agree to create a reversing entry to the ledger. In the case of fraud, this would be improbable. Unlike credit card transactions, there is no way to dispute a fraudulent crypto transaction.

- Accounting and tax rules: Despite being over a decade old, the crypto market appears to be far from a clearly-defined set of accounting standards and tax guidelines. For example, in the US, it is not yet clear whether a crypto asset should be classified as a security under the Securities and Exchange Commission (SEC). This could make life very difficult for accountants and financial executives, especially in large corporations. The US Financial Accounting Standards Board is still grappling with how to treat crypto assets at the transactional level. However, the US Generally Accepted Accounting Principles (GAAP) and International Financial Accounting Standards (IFRS) are leaning toward recording cryptos as an intangible asset, like copyrights or trademarks. Regardless, the possibility of significant fluctuations in the value of crypto assets between the time of purchase and payment settlement is a definite concern. There are some work-arounds, though, such as crypto-to-cash payment models or accepting payments at present fiat value.

Can cryptos overcome these challenges and come into widespread adoption as an alternative to fiat currencies? Thousands of cryptos exist today, and new ones are being created yearly. It will take some time for the market to stabilize and for a clear picture to emerge. But other forms of digital money could satisfy the need for speed and low cost in financial transactions without the drawbacks of cryptos.

What Could the Future Look Like?

The most likely outcome is a combination of digital payment instruments arising alongside fiat currencies. Here are some possibilities:

-

- Central bank digital currency (CBDC): A CBDC is a digital form of government-backed fiat money that can be used for contactless transactions. It is not the same as cryptocurrencies. With CBDCs, digital currencies are issued and regulated by a central authority versus the decentralized and unregulated nature of cryptos. They promise to provide a more efficient and cheaper currency management system with greater stability than cryptos (being more widely accepted in the global market). They may, at some point, allow the public to hold accounts directly with the central bank[11]. They can also give disadvantaged populations better access to financial services and streamline the distribution of stimulus money, universal basic income (UBI), and emergency lending programs by governments, according to a recent report by Bank of America[12]. On the downside, since digital currencies would be easy to track, central banks would have complete control over consumer finances, resulting in less privacy for users. The ease of “money drops” to the public could also have inflationary impacts. In a world where central banks can transact more directly and freely with citizens, commercial banks would be displaced, with their role needing to be transformed in the new digital financial system.

A few countries have already launched their CBDCs. These include The Bahamas, Nigeria, and seven states in the Eastern Caribbean, while many others are either in pilot (China, Russia, Ukraine, Sweden, South Korea, UAE, and Jamaica) or playing catch up in the R&D phase (the US, Canada, Mexico, Brazil, India, and Australia). China has the most prominent CBDC project, while the US is furthest behind other nations with a large banking sector. China also has plans to export its CBDC protocol to help laggard countries launch their own digital currencies.

In 2017, the Digital Fiat Currency Institute (DFCI) was established as a registered trade association promoting the adoption of digital fiat currencies. Its members include central banks and financial regulators, financial services institutions and fintech providers, government ministries of information communication technologies (ICT) and telecommunications, and academia.

- Central bank digital currency (CBDC): A CBDC is a digital form of government-backed fiat money that can be used for contactless transactions. It is not the same as cryptocurrencies. With CBDCs, digital currencies are issued and regulated by a central authority versus the decentralized and unregulated nature of cryptos. They promise to provide a more efficient and cheaper currency management system with greater stability than cryptos (being more widely accepted in the global market). They may, at some point, allow the public to hold accounts directly with the central bank[11]. They can also give disadvantaged populations better access to financial services and streamline the distribution of stimulus money, universal basic income (UBI), and emergency lending programs by governments, according to a recent report by Bank of America[12]. On the downside, since digital currencies would be easy to track, central banks would have complete control over consumer finances, resulting in less privacy for users. The ease of “money drops” to the public could also have inflationary impacts. In a world where central banks can transact more directly and freely with citizens, commercial banks would be displaced, with their role needing to be transformed in the new digital financial system.

-

- Next-generation, cross-border payment systems: In July 2019, SWIFT launched its enhanced Global Payments Innovation (gpi) messaging system to enable faster, more traceable, and transparent cross-border payments between multinational corporations and their banking partners. JPMorgan Chase is also a major player through its peer-to-peer, blockchain-based network, Liink, which, as of September 2021, connected over 25 of the world’s largest banks and potentially over 400 of the world’s leading financial institutions[13]. Other cross-border payment networks include Paypal, Wise, OFX, and many others, although most only provide service between certain countries.

Preparing for the Future

With digital currencies almost certainly part of the future global financial system, how should business leaders prepare? Here are three ways to get started:

-

- Assess opportunities and threats. Digital money marketplaces are changing rapidly. Establish a standing committee to continually monitor new developments to determine which forms of digital currencies appear most stable and appropriate to hold as assets or whether they should be used simply to facilitate payments. Understand emerging platforms for payment processing. Look for both positive and negative case studies and experiences from other organizations, whether in your industry or others. Learn from the experiences of others.

- Develop a strategy and road map. Should digital currencies be held as an asset on the balance sheet or only implemented to conduct transactions and converted to fiat money as soon as the transaction is complete? There may be regulatory issues, depending on the region or country. Hence, consulting with a financial advisor will be a necessary step. The overall strategy will depend on the risk tolerance of the business.

- Gain experience. Adopting digital currencies can be a daunting task, especially since the market is still in a nascent stage. One way to gain experience is to learn by doing. For example, find some limited applications of cryptocurrencies, perhaps offering them as a form of payment or using them to pay for a limited scope of products or services. Purchase of digital advertising may be one such opportunity. Selling services as micropayments may be another. See what systems and processes will need to be changed to accommodate the use of digital money.

The staying power of digital money in some form appears likely when you take the Lindey Effect into account, meaning that the longer something has survived (usually more than 10 years), the higher the probability of its existence in the future. Bitcoin, in particular, has survived for almost 13 years, suggesting that digital money, in some form, is here to stay. To stay ahead of the game, enterprises need to figure out their overall strategy for the future of money in a world of increasing virtual commerce and cross-border transactions.

By David Romeo, Senior Consultant, Avasant

- Emerchantpay. August 13, 2021. ”Everything you need to know about cross-border payments [2021 Update].” https://www.emerchantpay.com/insights/cross-border-payments/

- Bogna, John. January 8, 2022. “What Is the Environmental Impact of Cryptocurrency?” https://www.pcmag.com/how-to/what-is-the-environmental-impact-of-cryptocurrency

- Proof of stake involves the use of cryptos already owned by miners to gain proportional access to mining rights.

- Proof of burn is a mix of proof of work and proof of stake in that coins are removed from circulation (or burned) to allow faster mining.

- Proof of capacity is based on available storage space on the hard drive of the mining device.

- Proof of elapsed time is essentially a lottery-type permission, which randomly assigns wait times to network participants.

- Chainalysis. February 2022. The 2022 Crypto Crime Report: Page 5. https://go.chainalysis.com/rs/503-FAP-074/images/Crypto-Crime-Report-2022.pdf

- Ferber, Lisa. April 19, 2022. “How Crypto Investors Can Avoid the Scam That Captured $2.8 Billion in 2021.” https://time.com/nextadvisor/investing/cryptocurrency/protect-yourself-from-crypto-pump-and-dump/#:~:text=Also%20known%20as%20%E2%80%9Crug%20pulls,from%20crypto%20data%20firm%20Chainalysis

- Chainalysis. February 2022. The 2022 Crypto Crime Report: Page 5. https://go.chainalysis.com/rs/503-FAP-074/images/Crypto-Crime-Report-2022.pdf

- Chainalysis. February 2022. The 2022 Crypto Crime Report: Page 3. https://go.chainalysis.com/rs/503-FAP-074/images/Crypto-Crime-Report-2022.pdf.

- Federal Reserve Bank of Philadelphia. August 2020. “Central Bank Digital Currency: Central Banking For All.” https://www.philadelphiafed.org/consumer-finance/payment-systems/central-bank-digital-currency-central-banking-for-all

- Dantes, Damanick. April 2, 2021. “Central Bank ‘Money Drops’ With Digital Currencies Could Fuel Inflation: Bank of America.” https://www.nasdaq.com/articles/central-bank-money-drops-with-digital-currencies-could-fuel-inflation%3A-bank-of-america

- JPMorgan Chase & Co. “Transforming how payment-related information moves.” https://www.jpmorgan.com/onyx/liink.htm