This report provides a view into the changing customer experience landscape, highlights key trends reshaping customer-facing functions, and helps in identifying the right service providers that enterprises can partner with for customer experience (CX) transformation. We continue with a detailed assessment of 22 leading service providers offering digital CX and customer relationship management (CRM) services. Each profile provides an overview of the service provider, their digital CX and CRM services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partnership ecosystem, and investments and innovations.

Why read this RadarView?

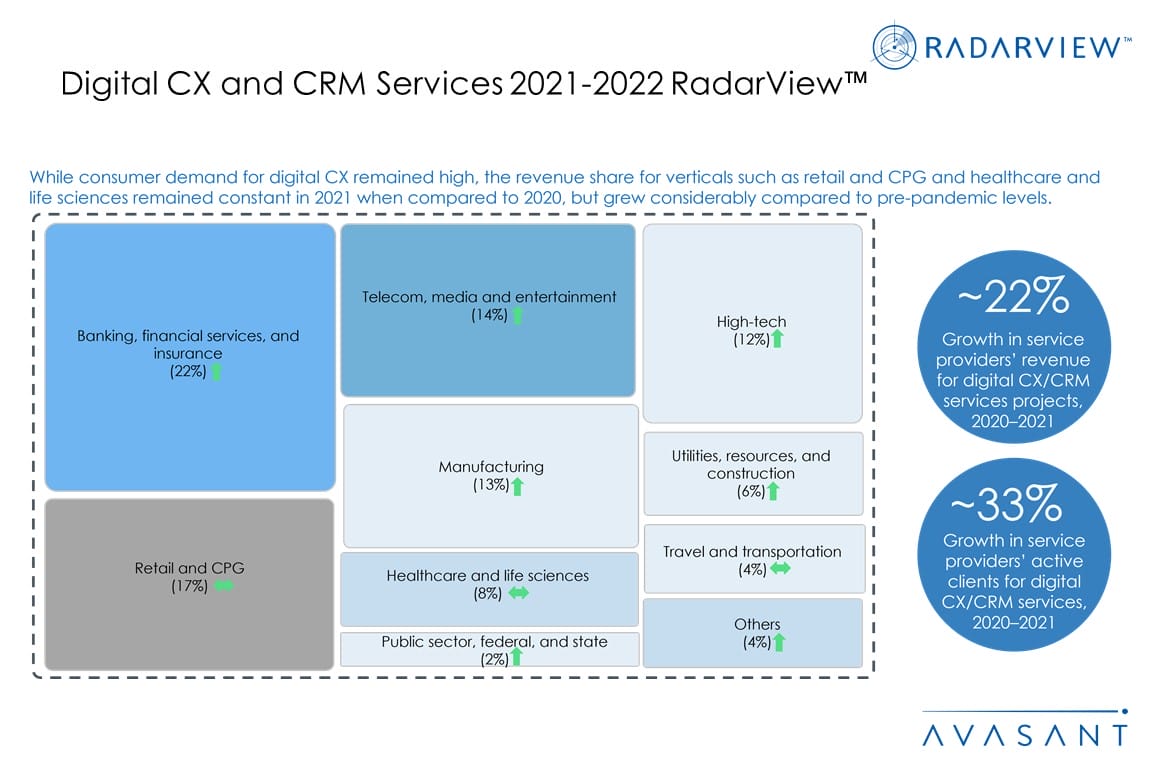

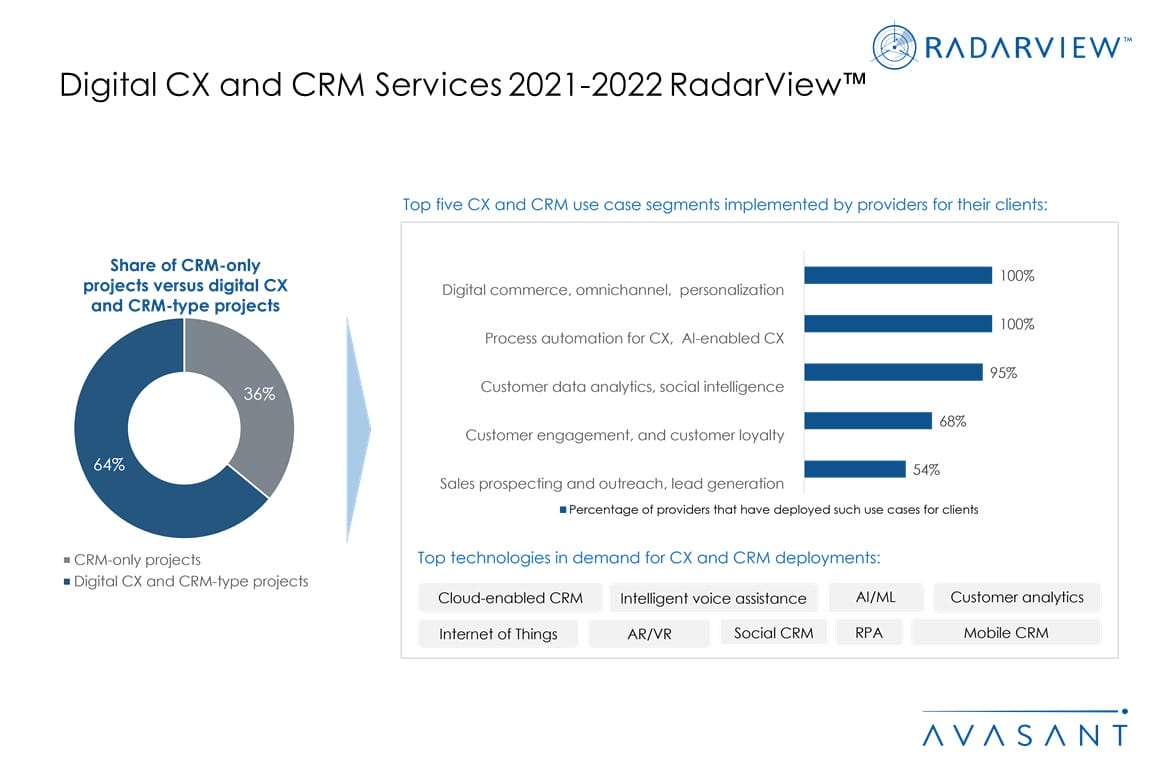

With consumer behavior changing rapidly and the next wave of digitalization impacting customer-facing functions, more companies are exploring new business and delivery models to serve customers. Adapting customer experience with the new normal of the post-COVID-19 world has become critical for enterprises to enable customer engagement models of tomorrow.

This RadarView helps companies use digital CX and CRM technologies to reinvent their customer relationships and strategies and drive their digital transformation. It also provides information to assist businesses in choosing the right digital CX and CRM service provider.

Featured providers

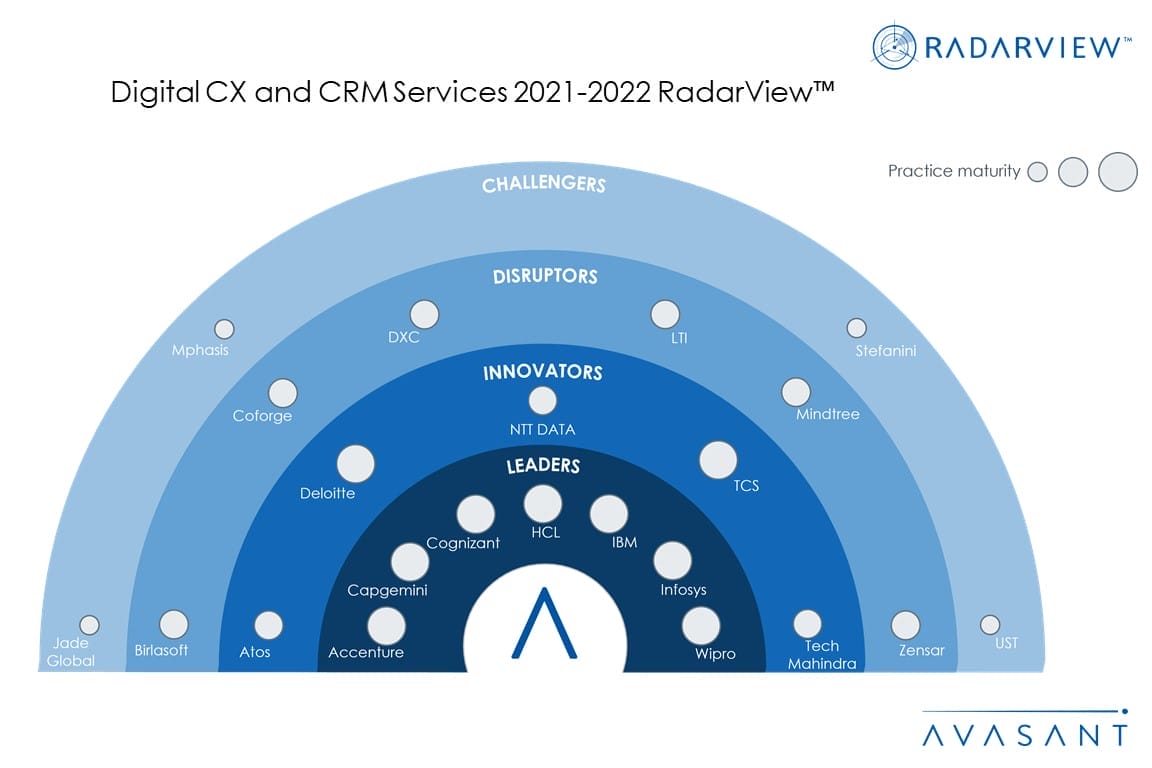

This RadarView includes an analysis of the following service providers in the digital CX and CRM services space: Accenture, Atos, Birlasoft, Capgemini, Coforge, Cognizant, Deloitte, DXC, HCL, IBM, Infosys, Jade Global, LTI, Mindtree, Mphasis, NTT DATA, Stefanini, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partnership ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

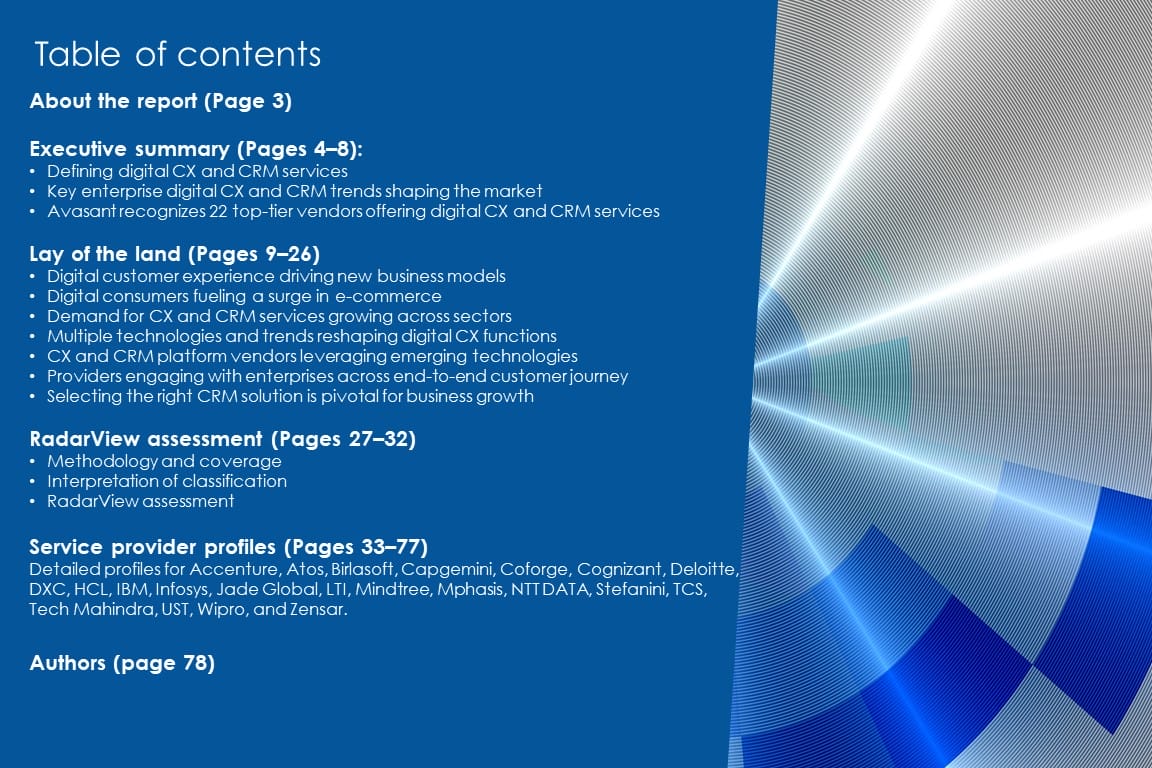

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8):

-

- Defining digital CX and CRM services

- Key enterprise digital CX and CRM trends shaping the market

- Avasant recognizes 22 top-tier vendors offering digital CX and CRM services

Lay of the land (Pages 9–26)

-

- Digital customer experience driving new business models

- Digital consumers fueling a surge in e-commerce

- Demand for CX and CRM services growing across sectors

- Multiple technologies and trends reshaping digital CX functions

- CX and CRM platform vendors leveraging emerging technologies

- Providers engaging with enterprises across end-to-end customer journey

- Selecting the right CRM solution is pivotal for business growth

RadarView assessment (Pages 27–32)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 33–77)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Coforge, Cognizant, Deloitte, DXC, HCL, IBM, Infosys, Jade Global, LTI, Mindtree, Mphasis, NTT DATA, Stefanini, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Read the Research Byte based on this report.