This RadarView offers enterprises a view into the evolving technology and talent-related trends that are changing the enterprise and service provider landscape. It also provides recommendations to service providers on how to cope with the “new normal” and prioritize digital talent. It begins by identifying the right service providers that enterprises can partner with to address the digital talent gap, enabling digital transformation. We continue with a detailed assessment of 20 leading service providers. Each profile provides an overview of the service provider, their digital talent capabilities, and talent acquisition and development initiatives, along with brief client case studies. Each profile concludes with analyst insights on the provider’s digital strategy and talent capabilities, talent transformation, and talent investments and innovations.

Why read this RadarView?

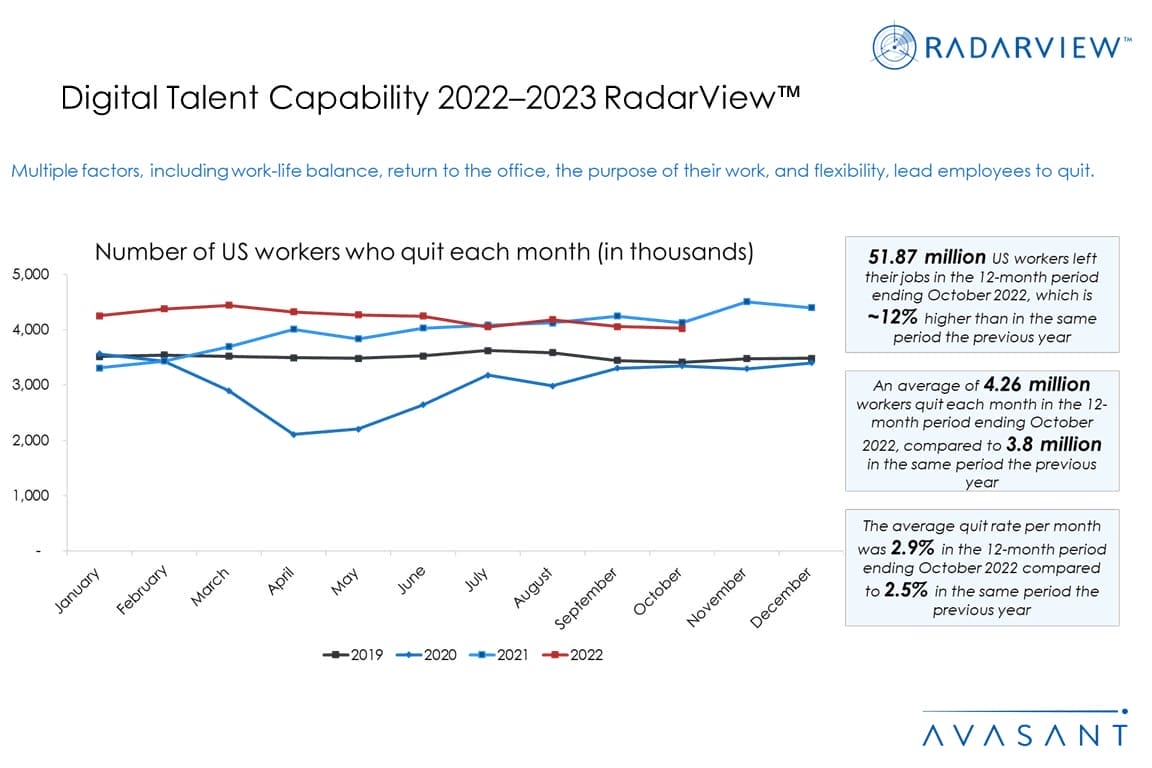

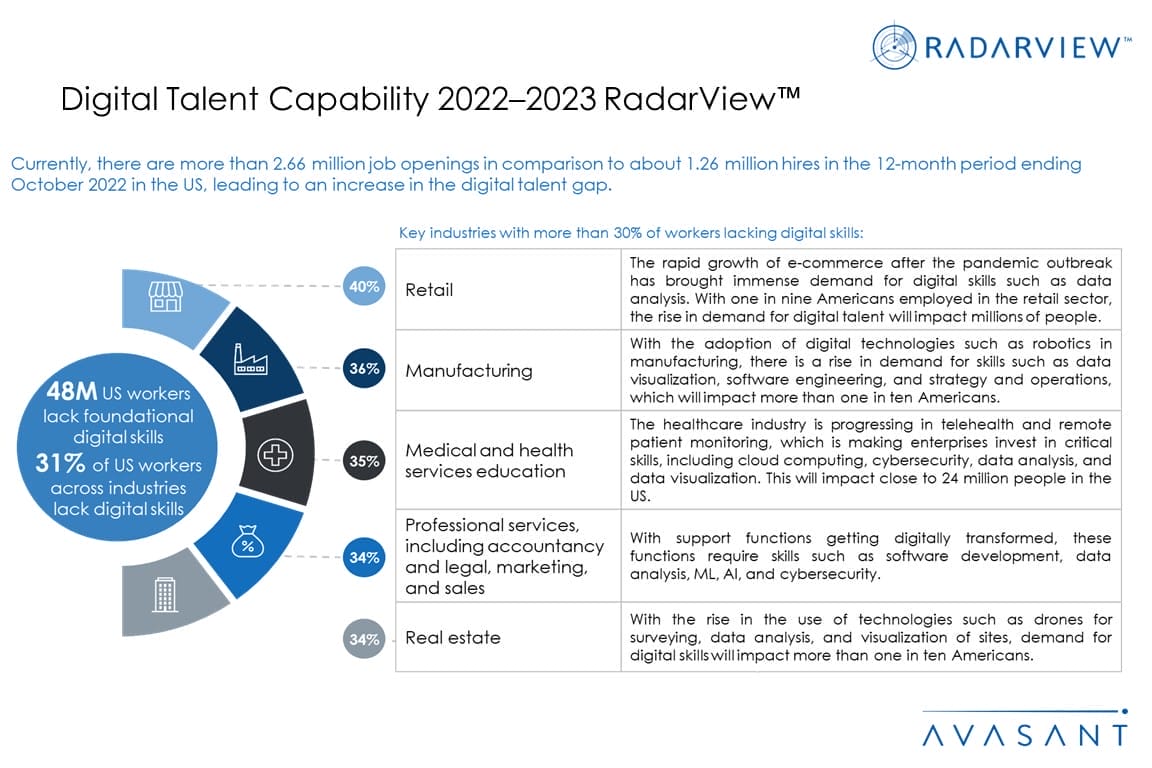

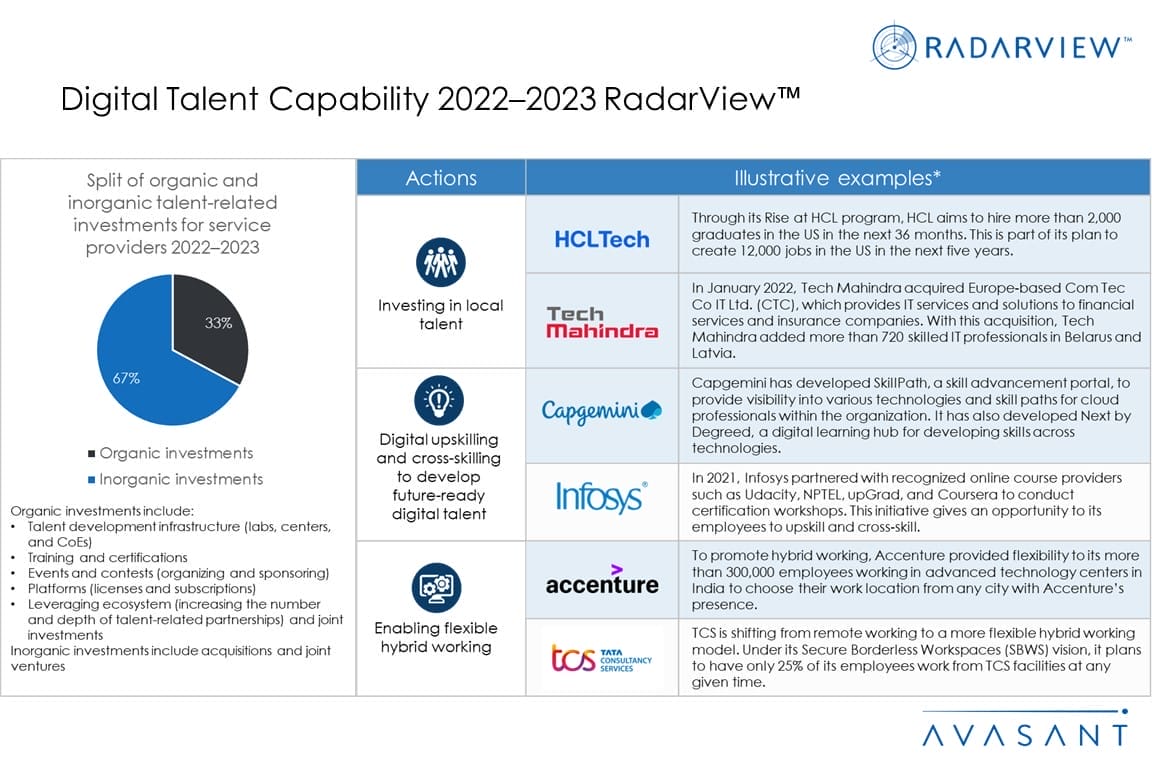

With enterprises and service providers across industries facing a talent shortage, they are investing in digital technology-related capabilities and initiatives to develop relevant skills in their workforce. To build digital talent along with enabling hybrid work, enterprises and service providers are focusing on digital reskilling by improving talent development infrastructure, talent localization, and inorganic talent acquisition.

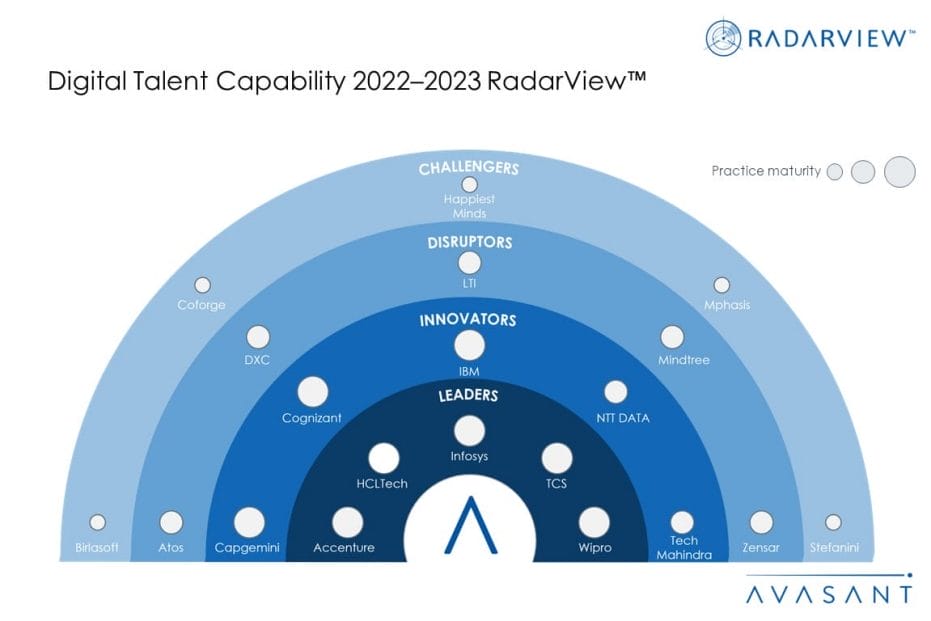

The Digital Talent Capability 2022–2023 RadarView™ helps companies determine the digital skills in demand and provides them insights into how service providers are building a digital talent pool. It also offers detailed information to assist businesses in identifying the right service provider that can drive digital transformation.

Featured Providers

This RadarView includes an analysis of the following service providers in the digital talent capability space: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Coforge, DXC, Happiest Minds, HCLTech, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, Stefanini, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of digital strategy and talent capabilities, talent transformation, and talent investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–7 ):

-

- Defining digital talent capability

- Key enterprise digital talent capability trends

- Avasant recognizes 20 top-tier vendors building digital talent capabilities

Lay of the land (Pages 8–19):

-

- Enterprises are increasing their adoption of digital technologies

- The push for faster digital transformation has forced companies to increase their IT and digital spending

- Enterprises are responding to the shortage of digital skills and related challenges by focusing on training

- Digital talent segments are facing a supply-demand imbalance

- Service providers are leveraging alternate channels to build digital talent

- Talent localization and digital skilling are becoming a top priority

Recommendations for service providers (Pages 20–21):

RadarView overview (Pages 22–27):

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 28–68):

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Cognizant, Coforge, DXC, Happiest Minds, HCLTech, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, Stefanini, TCS, Tech Mahindra, Wipro, and Zensar.

Key contacts (Page 70)

Read the Research Byte based on this report.