Because of perceived issues with security and control over data, it took a while for companies to fully embrace infrastructure as a service (IaaS),. But now, growth in the use of public cloud infrastructure is steady and strong. At this point, more than half (56%) of the companies we surveyed have adopted IaaS to some extent, with growth expected to continue. But there is one cautionary tale in the growth and adoption of IaaS—after years of high ROI and predictable cost of ownership, the economic experience with IaaS has suddenly weakened.

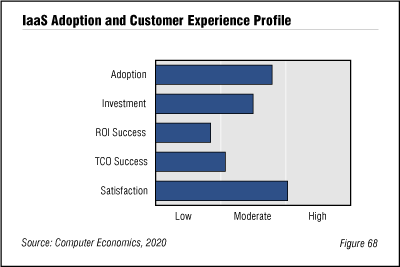

As shown in Figure 68 of the Computer Economics Worldwide Technology Trends study, IaaS has adoption on the high side of moderate, and investment is also moderate, when compared to other technologies in the study. Satisfaction is actually high (if barely). These mirror the findings from last year’s study. What has changed is the ROI and TCO success. Whereas last year, IaaS was in second place in both ROI and TCO, this year, TCO is barely moderate, and ROI is actually low.

Infrastructure as a service is the use of service providers for computing resources such as storage and processing without concern about the technical infrastructure. Our definition of IaaS only counts the use of public cloud IaaS providers, not the use of cloud infrastructure in an organization’s own internal data centers. Likewise, we do not count deployment of hosted or SaaS applications within this category.

IT organizations make use of IaaS for a variety of reasons, such as systems development and testing; production systems, internal or customer-facing; disaster recovery; big data storage; archival of inactive data; and accommodating spikes in demand for storage or computing resources. As these uses have grown, clearly success has been harder to come by.

Just as one example: In 2019, 38% of respondents that used IaaS reported a positive ROI within 24 months. This year, only 18% of respondents reported a positive ROI. Similarly, in 2019, only 16% of public cloud adopters reported that total cost of ownership was higher than they budgeted. In 2020, 26% reported going over budget.

“While this might be surprising at first, we’ve seen this pattern with other technologies,” said David Wagner, vice president for research at Computer Economics, an IT research firm based in Irvine, Calif. “Early adopters of most technologies typically have a well-defined use-case for the technology. As they expand the use of that technology or others jump aboard the bandwagon, the low-hanging fruit has already been picked and the economic case is not as strong for new use-cases.”

There are other reasons that likely contribute. For one, many of the first contracts for use of the public cloud are expiring. There have definitely been reports of companies finding that renewal prices have risen significantly and without much explanation. Companies are sometimes willing to pay the renewal just to avoid moving their workloads. And even when they do not, there is a cost (at least in people time) associated with moving to another provider. Another issue is that billing is not always clear. Companies with poor management of service-level agreements (SLAs) may find themselves paying more than expected when workloads scale up. This points to the need to pay attention in negotiating contracts, to ensure price increases are restricted upon renewal.

This is not to say that using the public cloud is no longer the economical option it once was. Organizations still see benefit in divesting of their infrastructure both in terms of simplifying their data centers and in reducing support staff. And companies that know how to comparison shop and manage SLAs can still get a good deal. But just like with any maturing technology, the market is changing. And the use cases are also less clear. With that in mind, companies looking to use the cloud to reduce their infrastructure burden need to manage carefully.

The full study is designed to give business leaders insight into the staying power of 15 technologies that are currently top of mind for many companies. It provides a glimpse into how quickly an emerging technology is being adopted, how deeply more-established technologies are penetrating the market, and how positive the customer experience is with each technology. The study also delves into the specific types of solutions under consideration.

By understanding the adoption trends, investment activity, and customer experience, business leaders are in a better position to assess the potential risks and rewards of investing in each of these technology initiatives. They also can gain insight into just how aggressively competitors and peers are investing in these initiatives.

The full study also takes a quick look at an additional 18 early adopter and future technologies. These include blockchain, digital currencies, digital assistants, drones, autonomous vehicles, virtual reality, augmented reality, quantum computing, 5G, no-code/low-code, electronic tattoos, microchip implants, smart dust, 3-D printing, 4-D printing, self-healing systems, volumetric displays/holograms, and digital twins. The study evaluates whether IT decision makers are familiar with these, whether they see a potential use for them, and whether they have already implemented them or have them installed.

Sample pages from the full study are available for free download.

This Research Byte is a brief overview of our study, Technology Trends 2020. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website (click for pricing).