While ERP software is attracting more IT investment than any other technology in the enterprise today, the technology that is rising the fastest in the enterprise is mobile applications, according to the Computer Economics Technology Trends 2011/2012 study.

In the study, we assess the maturity level of 16 technologies, providing a glimpse into how quickly emerging technologies are being adopted and how deeply more-established technologies and strategies are penetrating the market. This study is based on a survey of 253 organizations worldwide with annual revenue of at least $50 million, conducted during the second quarter of 2011.

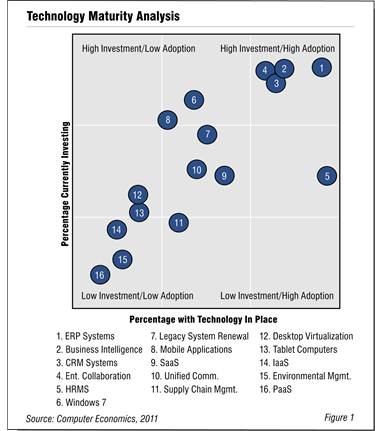

Our technology maturity analysis, as illustrated in Figure 1, compares the technologies along two parameters: the current investment rate and the current adoption rate. This provides an assessment of how widely each technology is deployed, along with an assessment of how many organizations are currently investing in the technology.

The horizontal axis labeled “Percentage with Technology in Place” represents the current adoption rate. The higher the adoption rate, the farther the technology moves to the right in the chart. The vertical axis is labeled “Percentage Currently Investing,” representing the current investment rate. The greater the percentage of organizations currently investing in a technology, the higher it rises on the chart.

Note that the scale on each axis is defined by the lowest and highest values in the study. As such, in this analysis, the words “low” and “high” are relative to the technologies in this study. We report actual investment and adoption rates for each technology in the full study.

As is evident from examining Figure 1, the technologies fall roughly along the diagonal line from the low-investment, low-adoption sector to the high-investment, high-adoption sector. We deem initiatives closest to the upper right-hand corner as more “mature” than technology initiatives farther away. We rank the initiatives from 1 to 16 based on their relative maturity, with 1 being the initiative that is closest to the upper-right corner.

The chart is divided into nine sectors, representing low, moderate, and high current investment rates and low, moderate, and high current adoption rates. Each of the initiatives falls into one of the nine sectors as follows:

- High Investment/High Adoption: Four technologies fall into the high-investment, high-adoption sector: ERP (enterprise resource planning) systems (1) are not only the most widely deployed technology initiative in the study, but organizations are investing in ERP at a higher rate than any other technology in the study. While somewhat less widely deployed than ERP, business intelligence systems (2), CRM systems (3), and enterprise collaboration (4) round out the most mature technology initiatives. They all have high adoption and high investment rates relative to the other initiatives in the study.

- Moderate Investment/High Adoption: Human resource management systems (HRMS) rank No. 5 in maturity. A common companion to ERP applications, these systems have a high adoption rate but the current investment rate is only moderate. One could make the case that these systems are actually the most mature as they are changing more slowly than the higher-ranking technologies in the study.

- High Investment/Moderate Adoption: When the investment rate outpaces the adoption rate, a technology is growing quickly. The one technology in this sector, Windows 7 (6), has that distinction as it continues its rollout. It is on a trajectory to reach a high adoption level but is not quite there yet.

- Moderate Investment/Moderate Adoption: Technologies in this category are progressing at a slow and steady pace. This sector includes three technology initiatives: legacy system renewal (7), software as a service (SaaS) (9), and unified communications (10). In the current environment, modest investment activity is still bullish, but that does not mean these initiatives are on the same course: the renewal of legacy systems is a technology initiative that has been ongoing for some time and will likely remain in the moderate-adoption category, given that not all organizations have legacy systems. SaaS and unified communications, on the other hand, could enjoy near-universal adoption at some point in the future.

- High Investment/Low Adoption: Only one technology initiative has the unique attribute of growing so quickly that it ranks high in investment despite having a still-low low adoption rate. Mobile applications (8) for enterprise systems has become a high priority for many organizations, enabled at least in part by the success of smartphones and tablets in the consumer market.

- Low Investment/Moderate Adoption: No technologies fall into the low-investment, high-adoption category, largely because we have chosen to not assess any technologies that are in their sunset years. One technology is in the low-investment/moderate-adoption category, however. Investment in supply chain management (11) systems has to some degree stalled, but that does not mean it is in decline. The integration of various elements of the supply chain is an ambitious undertaking that requires further development. As technologies such as RFID improve, supply chains will become ever more integrated. Moreover, the moderate adoption rate reflects that the fact not all industry sectors are strong markets for supply chain management, which is most heavily deployed in manufacturing, distribution, and retail sectors.

- Low Investment/Low Adoption: While an emerging technology may show promise, high costs and a limited track record cause organizations to shy away from implementation until the technology matures. In this study, five technologies fall into the low-low category: desktop virtualization (12), tablet computers (13), infrastructure as a service (IaaS) (14), environmental management solutions (15), and platform as a service (Paas) (16). These technology initiatives are immature, but they have potential.

Enterprises today are investing in their bread-and-butter ERP systems at a high rate. That is not surprising as ERP has become the platform for integrating many of the other technologies covered in this study, such as business intelligence, CRM, and mobile applications. Cloud computing initiatives such as SaaS and mobile applications are also gaining traction. While applications are moving to the cloud, however, the use of cloud computing for infrastructure and system development platforms remains a still-emerging trend.

The full study examines adoption trends and economic characteristics of each of the 16 selected technologies and technology initiatives. The profiles on each initiative provide information on how widely the initiative is adopted, how many organizations are currently investing in it, and prospects for future adoption. In addition, we provide analysis of the economic experiences of organizations that adopt these technologies. We describe economic experience using two measures: return on investment (ROI) experience and total cost of ownership (TCO) experience.

This Research Byte is a brief overview of our report on this subject, Technology Trends 2011/2012. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website (click for pricing).