Engineering and manufacturing enterprises have always had complex IT and OT environments and faced integration challenges. Concerns about security, connectivity, and customization hindered their digitalization efforts. However, due to cost pressures, changing customer demands, and rising product complexity, companies are now actively transforming their processes. This requires digitalizing IT and OT operations and investing in product and software engineering skills. To accelerate their digital transformation, enterprises are engaging with digital engineering service providers, leading to a 15% growth in manufacturing smart industry deals between December 2021 and December 2022.

Both demand- and supply-side trends are covered in Avasant’s Manufacturing Smart Industry Services 2023 Market Insights™ and Manufacturing Smart Industry Services 2023 RadarView™, respectively. These reports present a comprehensive study of manufacturing smart industry service providers and closely examine the market leaders, innovators, disruptors, and challengers. They also provide a view into key market trends and developments impacting the smart industry space.

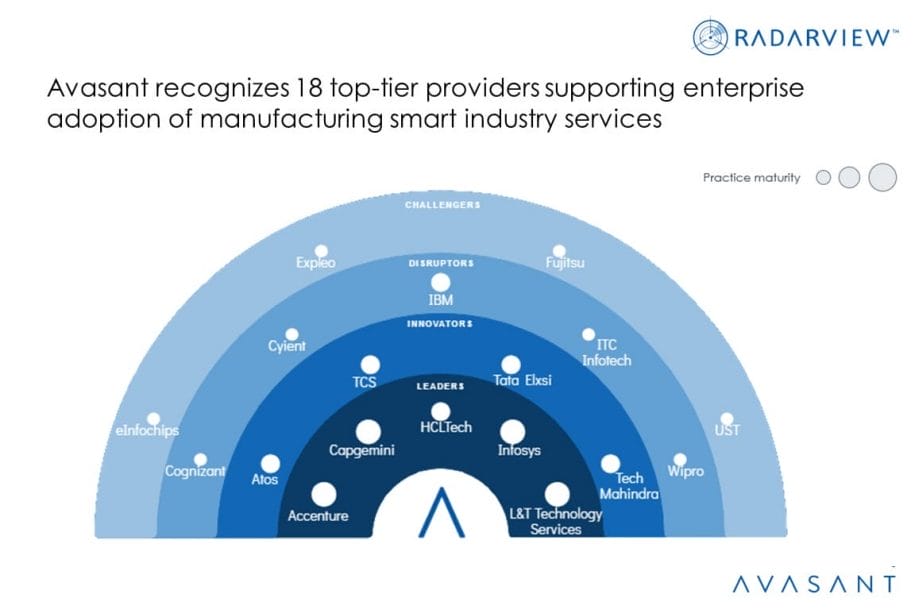

We evaluated 34 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 34 providers, we recognized 18 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, HCLTech, Infosys, and L&T Technology Services

- Innovators: Atos, TCS, Tata Elxsi, and Tech Mahindra

- Disruptors: Cognizant, Cyient, IBM, ITC Infotech, and Wipro

- Challengers: eInfochips, Expleo, Fujitsu, and UST

Figure 1 below from the full report illustrates these categories:

“As products become more connected and complex and cost pressures continue, companies need better R&D and an integrated view of systems and processes,” said Avasant Managing Partner Joe Frampus. “Enterprises want digital solutions that integrate and streamline IT and OT environments while keeping costs under control.”

The reports provide several findings, including the following:

-

- The traditional hesitation against technology adoption is fading away. Nearly 40% of smart industry deals include IT and OT operations integration as enterprises build an integrated design and production ecosystem.

- To meet the needs of digital engineering, enterprises are investing in engineering talent with advanced digital skills. Nearly 60% of service provider investments are directed toward R&D and the talent ecosystem.

- Automotive and industrial equipment and machinery enterprises account for nearly 40% of smart industry services revenue.

- Service providers are expanding their global footprint as smart industry services demand grows beyond North America. Nearly 55% of these providers’ revenue comes from North America, followed by 30% from Europe.

“Enterprises need automated IT and OT integration and product and software engineering convergence to build new-age products and adapt to the evolving ER&D dynamics,” said Ritika Nijhawan, senior research analyst with Avasant. “ER&D service providers bringing digital expertise in product and software design and manufacturing have an edge in this space.”

The Manufacturing Smart Industry Services 2023 RadarView features detailed profiles of 18 service providers, along with their solutions, offerings, and experience in assisting enterprises in their smart industry journeys.

This Research Byte is a brief overview of the Manufacturing Smart Industry Services 2023 Market Insights™ and Manufacturing Smart Industry Services 2023 RadarView™ (click for pricing).