Investments in information technology often involve major investments in capital. In fact, in some industries, IT accounts for over half of all capital expenditures. Therefore, if information systems executives want new systems to be approved, they need to understand how executive management expects large capital expenditures to be justified.

This article is an executive summary for our full report, Using Economic Value Added to Justify IT Investments. The full report is available for purchase on our website.

Historically, many IS organizations have not used formal ROI calculations to justify technology investments. There are two main reasons for this. First, in the past, business executives often did not ask for formal justification. It was often good enough for a CIO to quote one or two case histories, or to make general statements about industry best practices. During the run-up to Y2K in the late 1990s and the dot-com boom that followed shortly thereafter, many IT projects were approved with little financial justification at all.

The second reason is that, for many IT investments, the exact correlation between an IT investment and its benefits is not always explicit. For example, a business unit may request a new customer relationship management (CRM) system on the basis that it will improve sales. But that business unit is probably doing many other things at the same time to improve sales. Isolating the increased sales due to the CRM system from other factors—such as more targeted advertising, more aggressive incentive plans, and product improvements—can be difficult.

In spite of the difficulties in quantifying the benefits of IT investments, senior executives are now asking IS leaders much tougher questions about how a proposed technology investment will improve key business and financial metrics.

In order to answer such questions, CIOs must be able to “think like the CEO.†To that end, this article is intended to familiarize the reader with the way in which many large companies think about business performance and to show how it can be used to justify IT investments.

What is Economic Value Added (EVA)?

In measuring corporate performance, executives in recent years have been embracing a concept known as Economic Value Added (which is a registered trademark of Stern Stewart & Co.).

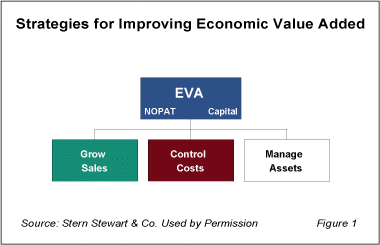

The key concepts of Economic Value Added, or EVA, are shown in Figure 1. Simply put, EVA is calculated by taking net operating profit after tax (NOPAT) and subtracting a charge for the capital used to produce those profits. Therefore, EVA can be improved by generating more profits with the same capital (e.g. inventory, accounts receivable, cash, plants, equipment), or by producing the same level of profits using fewer capital resources—or both. The power of EVA is that it focuses the attention of decision-makers on the things that increase value to shareholders: growing sales, reducing costs, and better managing assets.

The full version of this report provides a simple example of how EVA is calculated at a company-wide basis, using a fictitious company, along with the adjustments that need to be made in order to derive EVA from traditional financial statements.

Evaluating the Value of a Technology Investment

Even if a company has not yet implemented EVA as a corporate performance measurement system, EVA can still be used as a tool to evaluate technology investments.

In evaluating a specific investment, we only need to estimate the change in EVA that would result if management approves the capital investment. Therefore, we can make simple but reasonable assumptions about net profit and the cost of capital, and as long as we are consistent in our assumptions, the impact of the proposed investment on EVA should tell us quite a bit about whether the investment adds to or destroys shareholder value.

The full version of this report shows how the change in EVA can be calculated for a proposed investment in a new IT system. The example identifies benefits of the system that result in an improvement in NOPAT and those that result in an improvement in asset turnover, or reduced capital charge. Finally, it shows how to account for the cost of the system’s initial investment as well as the ongoing operating costs of the system.

Why Asset Turnover is an Important Metric

Without taking an EVA-based approach to investment analysis, decision-makers are likely to focus only on the improvement in net profit without taking into consideration the considerable benefit to shareholders that comes with the improvement in asset turnover.

The full version of this report includes a real life example of the use of EVA in justifying a large enterprise system to a corporate parent, along with the reasons that improved asset turnover is often the best way to improve EVA through new systems. It also explains by example how key metrics for improving EVA vary by industry, and it includes recommendations for technology sellers to use the concept of EVA in presenting the benefits of proposed solutions.

September, 2005

This article is an executive summary of our full report, Using Economic Value Added to Justify IT Investments. Computer Economics subscribers have free access to this report. Non-subscribers may purchase it by credit card at the following link: https://avasant.com/report/using-economic-value-to-justify-it-investments-2005/