The insurance services industry has seen significant changes due to digital disruption, evolving customer expectations, and economic pressures. Technologies such as AI, automation, and cloud-based solutions have helped insurers optimize processes and improve service delivery. This has led to a 15%–20% YOY increase in revenue from insurance business process services and a 20%–25% growth in revenue from customer management services. Increased regulatory scrutiny, economic uncertainty, climate risks, inflationary pressures, and rising cyber threats have pushed insurers to develop products such as cyber insurance and parametric insurance.

Both demand- and supply-side trends are covered in Insurance Business Process Transformation 2024 Market Insights™ and Insurance Business Process Transformation 2024 RadarView™, respectively. These reports present a comprehensive study of insurance service providers and closely examine the market leaders, innovators, disruptors, and challengers.

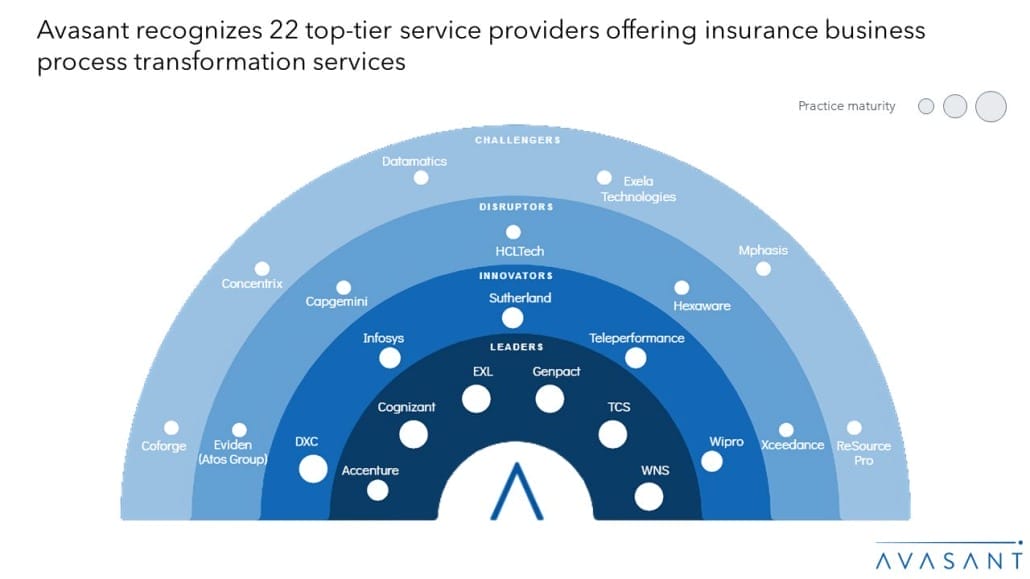

Avasant evaluated 43 providers using three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of these providers, we recognized 22 that brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Cognizant, EXL, Genpact, TCS, and WNS

- Innovators: DXC, Infosys, Sutherland, Teleperformance, and Wipro

- Disruptors: Eviden (Atos Group), Capgemini, HCLTech, Hexaware, and Xceedance

- Challengers: Coforge, Concentrix, Datamatics, Exela Technologies, Mphasis, and ReSource Pro

The following figure from the full report illustrates these categories:

“Amid a complex landscape marked by escalating costs and economic uncertainty, the insurance industry is seeking innovative solutions,” said Robert Joslin, managing partner at Avasant. “Insurers are leveraging technologies such as AI and analytics to streamline operations, boost efficiency, and elevate customer experience.”

The full report provides several findings and recommendations, including the following:

-

- Insurance services continue to see growth driven by the need for digital transformation, growing competition, and enhanced customer service capabilities.

- Service providers are leveraging generative AI to automate claims processing and improve underwriting using data analytics.

- Outsourcing of customer management services continues to increase, with revenue generated by customer management increasing by 20%–25% YOY.

- The insurance industry faces significant market pressures due to a combination of factors, including a global economic slowdown and rising inflation.

- North America continues to lead the insurance services market, while Europe and APAC continue to grow.

“Insurance companies are evolving rapidly due to technological advancements and shifting customer expectations,” said Aditya Jain, research leader at Avasant. “Adopting digital solutions is crucial for insurers to enhance operational efficiency and improve personalization in an increasingly competitive market.”

The RadarView™ also features detailed profiles of the top 22 service providers, including their solutions, offerings, and experience assisting enterprises in their business process transformation journeys.

This Research Byte briefly overviews Avasant’s Insurance Business Process Transformation 2024 Market Insights™ and Insurance Business Process Transformation 2024 RadarView™. (Click for pricing)