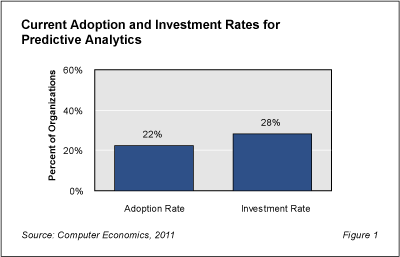

One sign that predictive analytics solutions are gaining traction is that the percentage of companies investing in the technology exceeds the percentage that have the technology in place.

Our study, Predictive Analytics ROI and TCO Experience, finds that 28% of organizations are currently investing in predictive analytics solutions compared to 22% that have the technology in place, as shown in Figure 1.

The adopters and investors are not exclusive. Many of the adopters are also among those that are investing in the technology. Still, the numbers indicate that adoption should rise at a strong pace. We anticipate more than one-third of organizations will include predictive analytics as part of their BI solutions by the end of 2011.

Over the past several years, even as businesses tighten spending, they continued investing in business intelligence solutions. Today, BI solutions are moving beyond monitoring and describing business activity to making predictions about customers, products, and markets. For some, the ultimate objective is to make predictions in real-time so that decisions can be automated to increase customer value, reduce fraud, or achieve myriad other objectives. The more common practice today is geared toward providing decision-makers with richer information.

Predictive analytics is neither new nor especially complicated. It is the use of statistics to identify relationships among a range of data and develop models for making forecasts. Doctors use predictive analytics to determine the risk of patients developing heart disease. Banks use it to determine credit risk. Airlines can use it to determine which customers to upgrade. And, of course, marketers can use it to predict who will respond best to special promotions, avoiding offering discounts to customers who would purchase anyway or investing in acquiring low-value customers.

The quality of forecasts still depends on the quality of the data and the underlying analytic models. But for better or worse, predictive analytics solutions can deliver forecasts on-the-fly to customer- service agents, medical practitioners, marketers, and business executives. Our study indicates adopters are finding outcomes are mostly for the better.

The full study examines adoption trends for predictive analytics, providing data on how many organizations have the technology in place, how many are implementing it, and how many are expanding implementations. To give additional insight, we look at the economic experience of those that have adopted the technology: We examine return on investment (ROI) experience in terms of the percentage of organizations that report positive and break-even ROI within a two-year period. We also balance the potential ROI against the risks, measured in terms of the percentage of organizations that exceed budgets for total cost of ownership (TCO).

This Research Byte is a brief overview of our report on this subject, Predictive Analytics ROI and TCO Experience. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website (click for pricing).