This report helps freight and logistics companies craft a robust strategy for digital transformation based on the industry outlook and best practices. It begins with a summary of key trends shaping the freight and logistics industry, followed by the industry outlook over the next 18–24 months. We continue with a detailed assessment of 12 leading service providers offering freight and logistics digital services. Each profile provides an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovations, and partner ecosystem. The report can aid businesses in identifying the right partners and service providers to support their digital transformation journeys.

Why read this RadarView?

The freight and logistics industry is seeing accelerated demand since the pandemic, and the market outlook remains strong, augmented by the eCommerce boom and altered customer expectations. However, enterprises are identifying new avenues for growth through digitalization and entering partnerships to offset operational costs with process efficiencies.

This report assists freight and logistics enterprises in charting their action plan. It also identifies key service providers and system integrators that can help businesses accelerate their digital adoption.

Featured providers

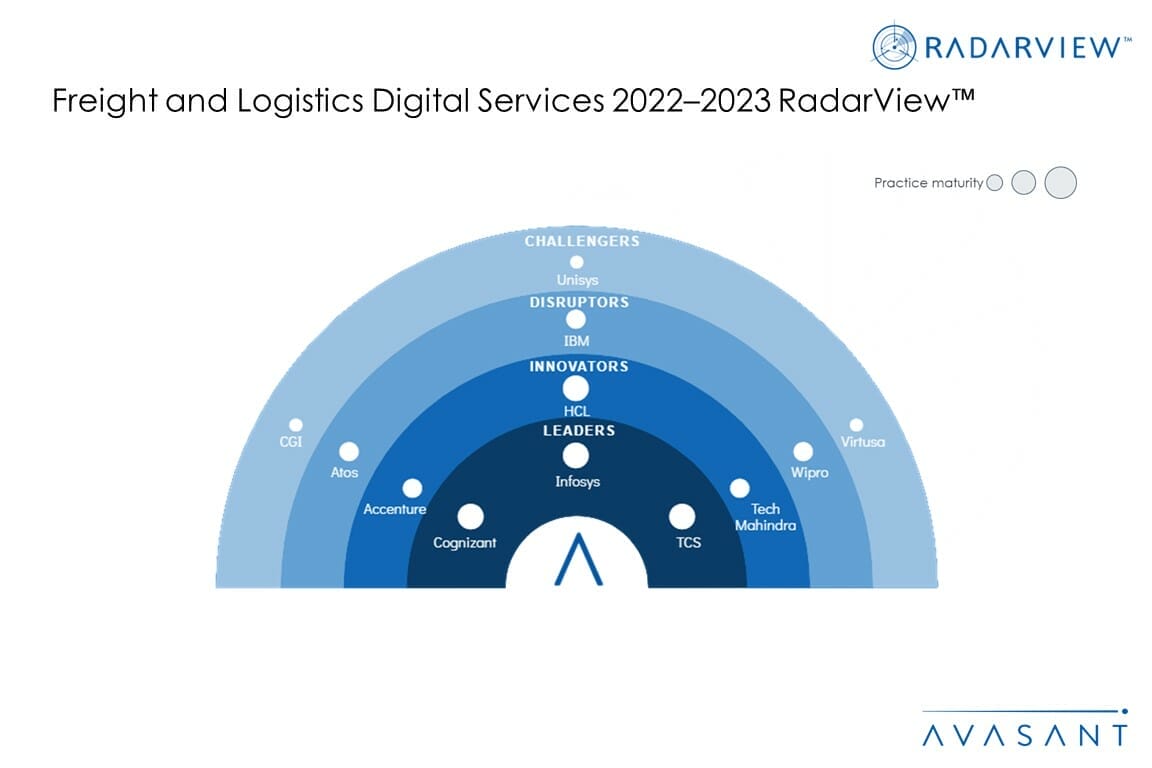

This RadarView includes an analysis of the following service providers in the freight and logistics digital services space: Accenture, Atos, CGI, Cognizant, HCL, IBM, Infosys, TCS, Tech Mahindra, Unisys, Virtusa, and Wipro.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Scope of the report (Page 4–5)

Executive summary (Pages 6–8):

-

- Key recommendations for freight and logistics companies

- Avasant recognizes 12 top-tier service providers supporting the freight and logistics industry in digital transformation

Lay of the land (Pages 9–16)

-

- Challenges faced by the freight and logistics industry

- Key trends shaping the freight and logistics industry

- Rise of digital freight marketplaces to enable a more connected shipper-carrier ecosystem

- The e-commerce boom has led to a rise in online orders and customers demanding faster delivery

- Increasing M&A activity in the freight and logistics industry to diversify businesses and further strengthen the services portfolio

- Freight and logistics companies are increasingly partnering to expand their presence and address industry challenges

- Enterprises from other industry segments pose serious competition to traditional freight and logistics companies

The road ahead (Pages 17–24)

-

- Chart a detailed investment plan to prioritize and plan for business and digital strategies

- Define a strategic road map to achieve sustainability

- Expand investments in startups to acquire specialized digital and industry capabilities that align with specific business needs

- Manage customer expectations by leveraging intelligent infrastructure

- Increase supply chain resiliency

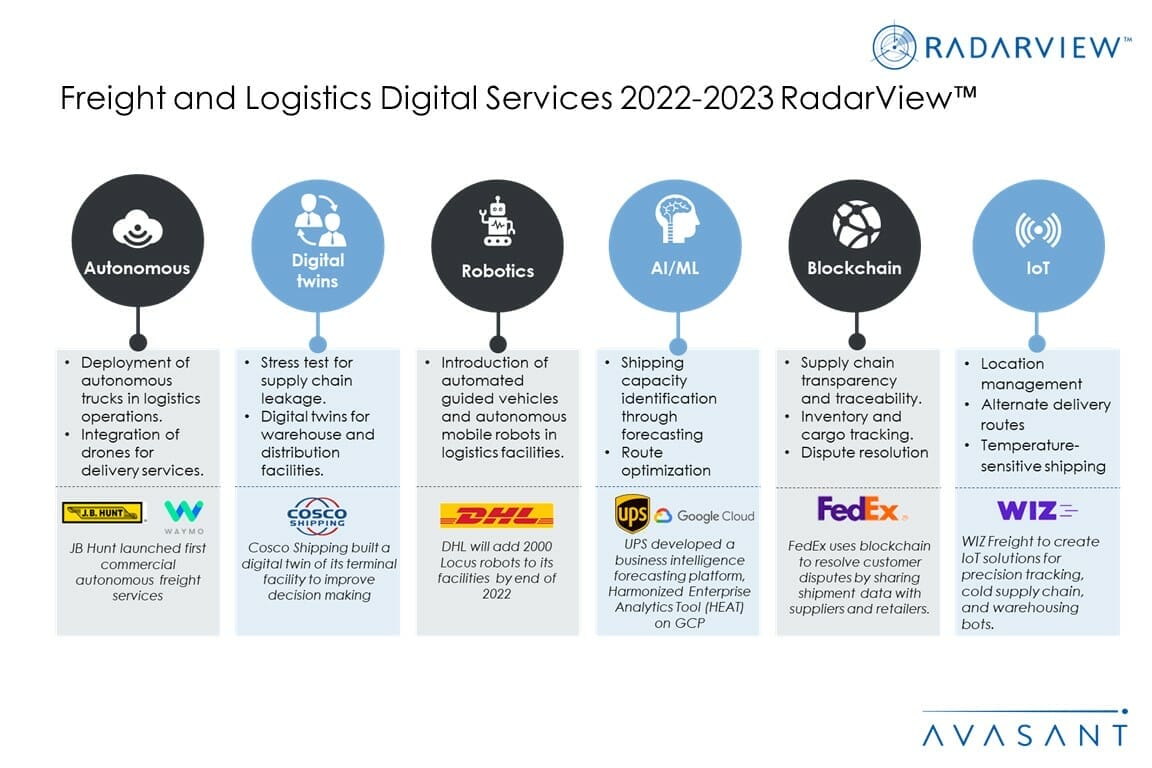

- Accelerate deployment of digital technologies for business transformation

- Partner with service providers to prioritize digital projects

RadarView overview (Pages 25–30)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 31–68)

-

- Detailed profiles for Accenture, Atos, CGI, Cognizant, HCL, IBM, Infosys, TCS, Tech Mahindra, Unisys, Virtusa, and Wipro.

Read the Research Byte based on this report.