This RadarView provides a view into the leading service providers offering clinical services. It begins by summarizing key trends shaping the market’s supply side. It continues with a detailed assessment of 18 providers offering clinical services. Each profile provides an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

Clinical services have become critical when managing complex care delivery and an evolving care management environment. The role of clinical services is pivotal to helping care providers and payers manage their patient outcomes better, reduce costs, and improve service delivery. However, its success depends on various factors, including effective governance, a robust domain ecosystem, and streamlined service delivery.

The Clinical Services Business Process Transformation 2023 RadarView™ highlights key supply-side trends in the clinical services space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in clinical services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for clinical services.

Featured providers

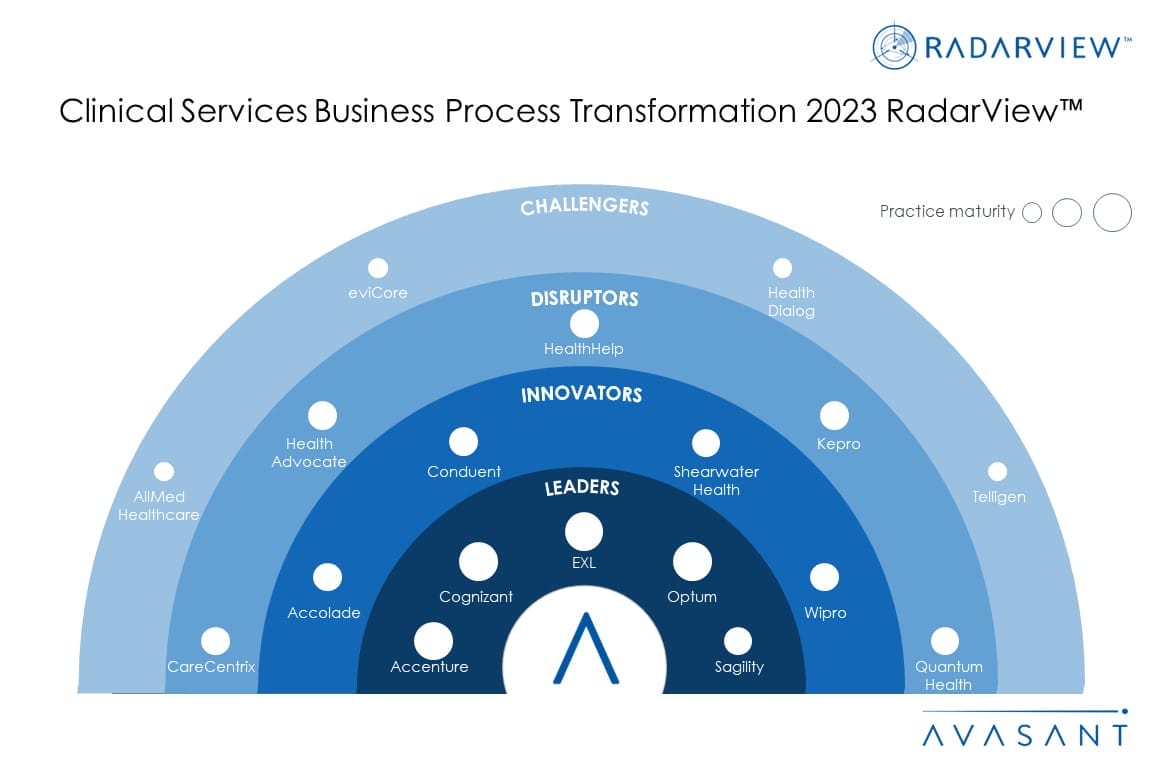

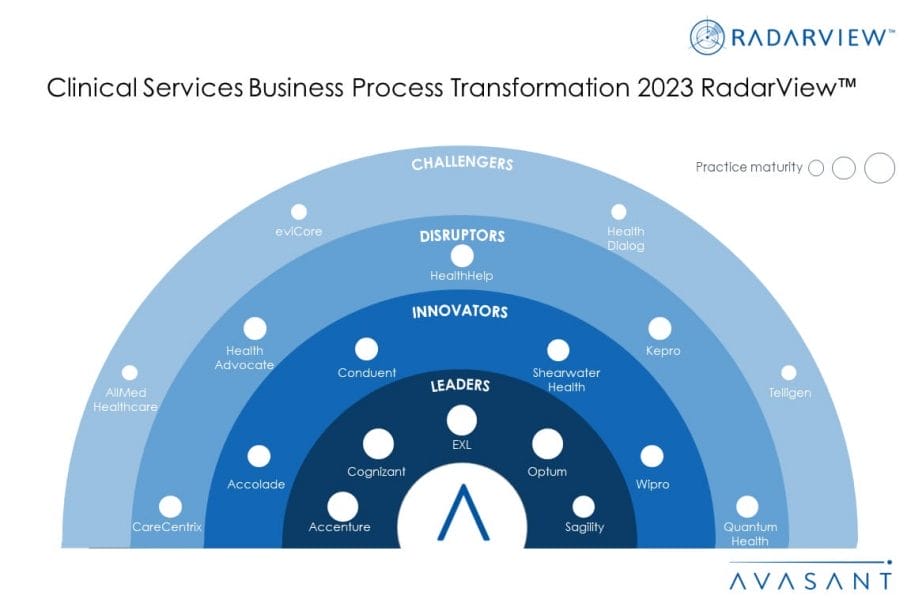

This RadarView includes a detailed analysis of the following clinical service providers: Accenture, Accolade, AllMed Healthcare, CareCentrix, Cognizant, Conduent, eviCore, EXL, Health Advocate, Health Dialog, HealthHelp, Kepro, Optum, Quantum Health, Sagility, Shearwater Health, Telligen, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Defining clinical services

- Avasant recognizes 18 top-tier providers supporting the enterprise adoption of clinical services

- Provider comparison

Supply-side trends (Pages 9–14)

-

- Enterprises outsourcing clinical services grew around 28% YOY because it allows them to reduce costs, improve patient outcomes, and boost revenues

- Large enterprises drive revenue, but small and midsize enterprises remain major outsourcers of clinical services

- Leveraging certified offshore resources such as those based out of the Philippines is key to cost-effective service delivery

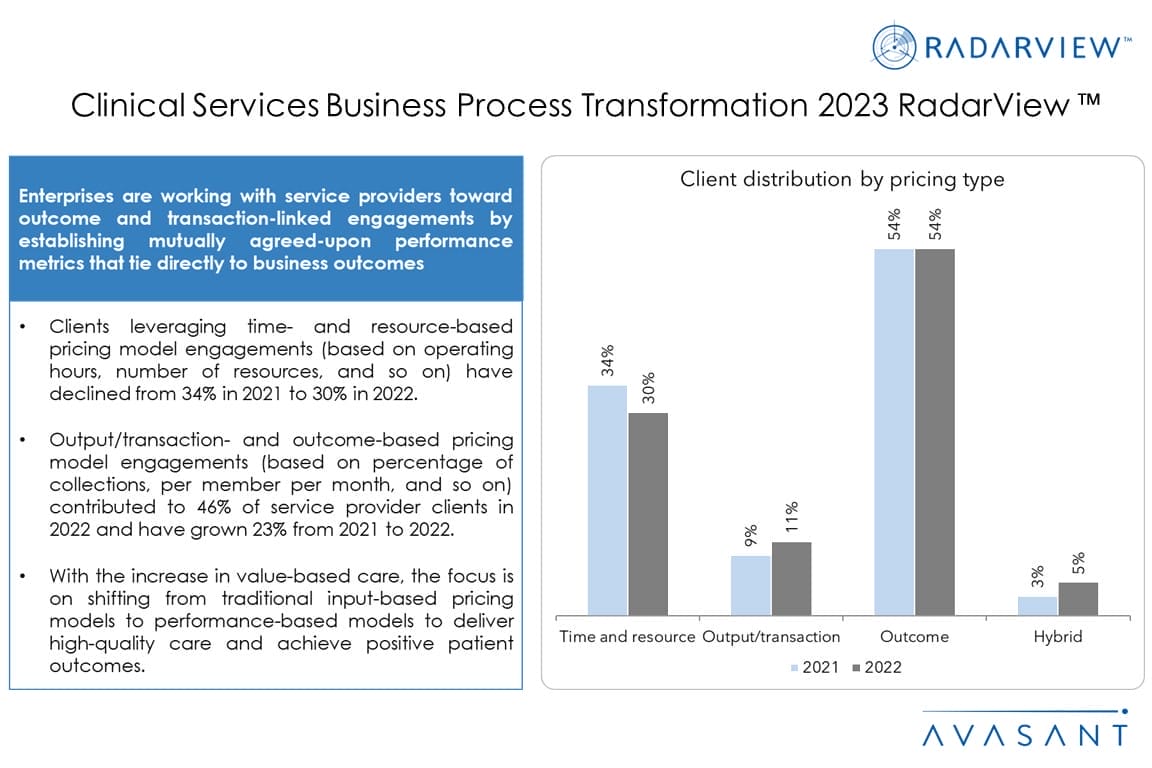

- Enterprises prefer transaction and outcome-linked pricing to get transparency and accountability in their operations. Over 65% of clinical services engagements utilize at least one of the two pricing models above.

- Clinical service providers are making significant investments to support, augment, and expand their clinical services offering portfolio.

Service provider profiles (Pages 15)

-

- Detailed profiles for Accenture, Accolade, AllMed Healthcare, CareCentrix, Cognizant, Conduent, eviCore, EXL, Health Advocate, Health Dialog, HealthHelp, Kepro, Optum, Quantum Health, Sagility, Shearwater Health, Telligen, and Wipro.

Appendix (Pages 52–57)

-

- Research methodology and coverage

- Interpretation of classification

- RadarView assessment

Read the Research Byte based on this report.

Please refer to Avasant’s Clinical Services Business Process Transformation 2023 Market Insights™ for detailed insights on the demand-side trends.