COVID-19 fears continue to grip the world, with a growing number of people infected and dying. In addition to the human tragedy, there is also a massive impact on business. But these effects vary by industry. To truly understand the impact of the Coronavirus on the world’s economy, it is important to view its effects by industry.

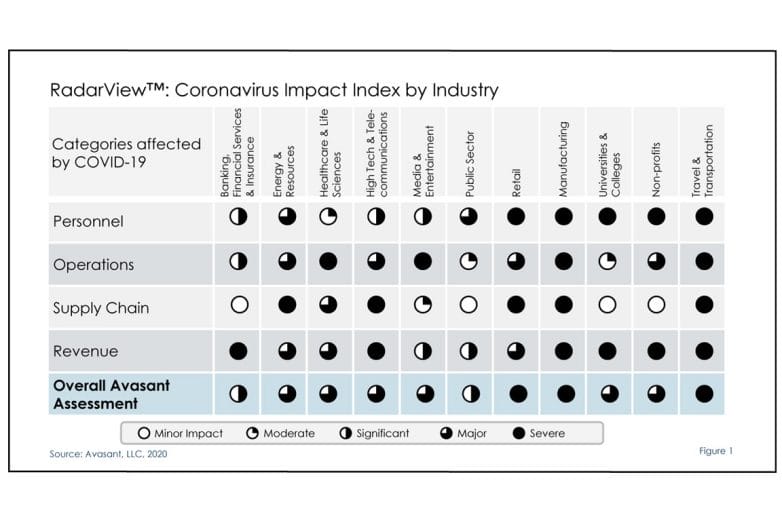

Our Coronavirus Impact Index by Industry, developed in collaboration with our recently-acquired research powerhouse, Computer Economics, is a look at how COVID-19 is affecting 11 major industry sectors, in four dimensions: personnel, operations, supply chain, and revenue. The result is an overall rating of the impact of the current pandemic on that industry. Although our analysis is specifically around the Coronavirus, this approach will be generally useful in analyzing the effect of any pandemic by industry.

The worldwide responses to the Coronavirus pandemic are significant at the time of this writing:

• Governments quarantining millions around the world

• The U.S. restricting travel from Europe

• Thousands of schools closed

• Thousands of planes parked

• Scores of conferences and meetings postponed or canceled

• Supply chains strained, disrupted, or shut down

• India suspending visas for all foreign nationals (with some exceptions)

• Companies such as Google, Microsoft, Amazon, and Facebook directing employees to work from home, if the job can be done remotely

In addition to those developments, COVID-19 is having widespread effects across a wide swath of industries, with direct negative effect on economic performance. For instance, the shutdown of nearly half of manufacturing units in China, which comprises a large percentage of the world’s production capacity, is a drag on revenue globally beyond just the manufacturing industry. These include products such as smartphones, apparel, consumer goods, and medical products. If the decline in the production of such products persists into Q2 and Q3, it will no doubt have a significant impact on GDP growth.

Here’s how COVID-19 is affecting 11 major sectors, in four dimensions, as shown:

Banking, Financial Services, and Insurance

The impact of the pandemic on financial services is easy to see, as public stock markets sink into bear market territory, and individual investors bemoan the effect on their savings and retirement plans.

Stocks in the U.S. plunged in early March 2020, fueled by COVID-19 fears. Lower interest rates are likely to follow, and lending volumes will reduce revenues. Credit losses will rise as a result of weakening economic activity. In addition, revenue from trading activities could be negatively impacted from the declining value of financial assets such as corporate bonds, and credit and interest derivatives. This will lower profitability.

The pandemic has led banks and major institutions to cut their forecasts for the global economy. For instance, the Organization for Economic Cooperation and Development (OECD) has downgraded its 2020 growth forecasts for almost all economies. It has warned that an escalation of the outbreak could cut global GDP growth to 1.5%, half the current projected increase of 2.9%, and send some economies into recession.

Banks are making adjustments. Some banks are offering work-from-home options for their employees. Others are separating employees into different groups to help contain the spread of the virus. Bank of America, Goldman Sachs, and Morgan Stanley are crafting split-operation strategies in which workers take turns being in the office. Banks will likely have to reduce their workforces and leverage more technology and automation-enabled platforms to run their middle and back-office processes.

Regarding consumers, as their desire for digital banking services increases, many traditional financial institutions will be forced to fast-track digital innovation efforts. In the wake of COVID-19, mobile and touchless payment options will gain more traction. This increases the need for operational flexibility as banks and financial institutions deal with the double whammy of a weakened economic climate and heightened customer activity. As markets rebound, once the pandemic crisis is diminished, these organizations will need the operational muscle to ramp operations back to full throttle.

In the insurance realm, event-cancellation insurance policy providers are preparing for a flood of claims from promoters. Banks and insurers will increasingly deploy digital virtual agents and chatbots to manage customer interactions without direct personal contact.

The impact on this sector could be moderate or severe, depending on the size of the decline in stock markets and other factors. For now, based on the impact ratings in each dimension, we judge the overall impact on the banking, financial services, and insurance sector as moderate.

Energy and Resources

The pandemic’s impact on energy, utilities, and resources could be quite great, for many reasons.

The oil supply chain has slowed, because less oil and oil-based products are being used and produced. The oil-producing countries of OPEC have called for a deep production cut of 1.5 million barrels per day to support prices that are sagging due to COVID-19 fears. And the price of West Texas Intermediate crude is down approximately 25% year-to-date. However, some of this price drop is due to a price war between the Saudi Kingdom and Russia.

Avasant Partner, Robert Joslin, offers this analysis of how oil consumption could be affected:

“Oil consumption related to transportation in the U.S. is around 28%, and I’d assume is even lower for other countries. Of this 28%, only a small percent is aviation fuel, 10% to 20%, so the impact of the airlines cutting flights is likely not going to be material to the oil industry. Vehicle consumption is closer to 40% of the aforementioned 28%, so that impact could be much more material with more self-quarantines and work-from-home directives. This may even be a longer- term impact. Some organizations that have never experimented with a remote workforce may discover that working remotely actually works effectively for them, and this could start them more aggressively adopting this model even when the pandemic is over.”

Keep an eye on oil platforms, Joslin says.

“The impact to the oil industry could vary by whether it is upstream or downstream. Exploration and production firms are likely going to be less directly impacted in most cases. However, there could be some unique situations. For example, offshore crews work, reside, and travel in close proximity to each other. If a rig crew is impacted it could even potentially shut down an entire platform. It’s a similar situation for a refinery in the downstream world.”

In the utilities arena, Joslin says that critical operations in power plants will need to be managed and maintained. If the situation worsens, operations may need to go into a business continuity plan (BCP) mode and isolate critical teams to ensure operations. Residential power will likely not be directly impacted, since consumption will likely stay the same and potentially increase with more work-from-home users. For example, lights, power, and HVAC will remain in service and not be subject to potential daytime reductions.

At the same time, China’s steel inventories have swelled because of reduced construction following the virus outbreak. This could reduce demand for steel feedstocks such as iron ore, steel hardening alloy manganese, and coking coal. If stainless steel and aluminum inventories grow, inputs such as nickel, alumina, and bauxite will be affected.

At this time, it is unclear how long it will take for the situation to recover. Based on the impact ratings in each dimension, we judge the overall impact on the energy and resources sector as major.

Healthcare and Life Sciences

The impact of the pandemic on this sector will be mixed. Along with challenges in some areas, there will obviously be an increased need for health products and services.

However, with so many raw materials coming from Asia, shortages of medicines are expected in the market in the next few months due to raw material shortage and factory closures in China.

As that is going on, major pharma firms are under pressure to create a vaccine. Multiple companies are advancing vaccines toward human trials, but it could be many months or over a year until a vaccine is ready. And makers of Coronavirus test kits are scrambling to make enough kits.

On the other hand, the outbreak is no doubt increasing the need for hospitals, or the requisitioning of existing buildings (motels, or even convention centers, for instance) if COVID-19 spreads. Remarkably, two hospitals were built in Wuhan, China, since the start of the outbreak. Any similar efforts in other regions will increase demand in the real estate construction industry.

Based on the impact ratings in each dimension, we judge the overall impact on the healthcare and life sciences sector as major, but with a mix of potentially positive and negative economic effects.

High-Tech and Telecommunications

This sector will feel a wide range of effects from the pandemic. Workers will be hurt with all the travel restrictions, but certain software companies could see revenue increases.

Software vendors and their products that provide the ability to work remotely and collaborate, such as Zoom, Slack, GoToMyPC, Zoho Remotely, Microsoft Office365, Atlassian, and others are already seeing increased demand as companies increase their remote-working capabilities.

The travel restrictions are severe, at least temporarily. India has temporarily suspended visas for all foreign nationals, with some exceptions, due to COVID-19 fears. The country will also enforce a 14-day quarantine on all travelers. At the same time, the U.S. is restricting travel from Europe. Speaking of software vendors, scores of high-tech conferences have been postponed or moved to online only, resulting in losses of millions to vendors and other companies that serve their events.

In the online realm, Internet publishers and broadcasters will see increased demand due to fears of the spread of the virus and millions of people staying home and going online. Across the world, companies will need to allocate more resources to those working from home as a result of the virus.

The manufacture of computers, smartphones, and components will be greatly impacted with the closure of factories in China and the quarantining of workers. Major players including Apple and Microsoft have issued warnings of potentially lower-than-expected earnings due to globalized supply chain issues and lower consumer demand in China. At the same time, we are also seeing reports of major companies placing large orders for laptops to support their employees now working from home.

We judge the overall impact of the pandemic on this sector as mixed. Based on the impact ratings in each dimension, we judge the overall impact on the high-tech and telecommunications sector as major.

Media and Entertainment

This sector has been hit hard by the pandemic. In one area, sports, fans are shocked that professional seasons are ending or being suspended.

On the other hand, on the home front, millions of people are staying home, which will likely significantly increase revenue for streaming platforms such as Netflix, Hulu, Amazon, Disney+, YouTube, Apple TV, and others. At the same time, the income for movie studios and cinemas will be reduced as people avoid theaters. Premieres of new movies are being delayed. For instance, the latest James Bond movie, the aptly named “No Time to Die,” was moved from April to November. A major star and his wife, Tom Hanks and Rita Wilson, say they have tested positive while filming a movie in Australia.

As mentioned, major sports leagues are either suspending the rest of their seasons (NBA, NHL, many major soccer leagues worldwide), or delaying the start of their seasons (Major League Baseball.) The NCAA cancelled its March Madness basketball tournament.

The media and entertainment sector will experience pain in some areas, but newfound demand in others, as more people sign up for streaming services and read or watch online news sources. Based on the impact ratings in each dimension, we judge the overall impact on the media and entertainment sector as major.

Public Sector

Governments and other public entities are struggling to cope with the pandemic and the ensuing panic. And, at the same time, they are often being called upon to increase their services to others affected.

Many thousands of schools have closed worldwide, affecting millions of students, teachers, administrators, parents, and businesses that support schools. Online education platforms will gain more traction going forward.

At the same time, large gatherings such as concerts, parades—such as New York City’s huge St. Patrick’s Day Parade—and conferences are increasingly being called off or rescheduled.

At the federal level, the U.S. government is considering tax breaks or a fiscal stimulus package to help businesses weather the storm. In a presidential election year, U.S. political campaign rallies have been canceled or are threatened to be canceled.

Some government bodies have been greatly affected. For instance, eight percent of Iran’s parliament has tested positive for the virus.

Governments will need to act quickly and communicate their actions clearly to ensure that economies face a more certain future. It remains to be seen how COVID-19 will affect this sector over the next few months. Based on the impact ratings in each dimension, we judge the overall impact on the public sector as moderate.

Retail

Retailers’ revenue will be either negatively impacted, or in a few cases positively affected, depending on the situation.

The service industries will be greatly impacted, as employees need to be present to assist customers. And customers must visit their establishments without fear of other customers. COVID-19 will have wide-ranging economic implications here, as the U.S. Bureau of Labor Statistics reported in 2018 that retail salesperson was the largest occupation in the U.S. with more than 4.4 million employees.

Chinese consumers form 38% of global fashion industry, and these buyers have all but disappeared for retailers. Many retail outlets such as Levis and Adidas shut down multiple stores due to decline in revenues. Overall, customers across the globe have started avoiding brick and mortar luxury stores to reduce contact with customers. In fact, COVID-19 could be the final nail in the coffin for several large retailers that have been struggling of late.

On the other hand, online sales have comparatively increased as customers are buying online rather than leaving the house to go shopping. However, online marketplaces such as Amazon are struggling to bring goods into the U.S. from suppliers overseas.

Grocery retail chains such as Walmart and Target have seen an increase in revenues as customers are stocking up on groceries and personal care products. Supermarkets have braced for stockpiling if Coronavirus panic escalates. Makers of food, beverages, and health and personal care products are seeing a bump in sales as consumers stock up on personal care products and emergency food rations.

Apart from online sales, COVID-19 will deal a crushing blow to this sector. It remains to be seen how long it will take to recover. Based on the impact ratings in each dimension, we judge the overall impact on the retail sector as severe.

Manufacturing

This sector will be one of the hardest hit by COVID-19, though some factories are starting to come back online as of this writing.

The automobile, fast-moving consumer goods, and pharma sectors have been hit badly because of supply issues in China.

There has been a major impact on manufacturing personnel as most employees cannot work from home. For the functioning factories, many employees were told to stay home if they have symptoms or to take care of family members. Millions of workers cannot get to jobs because of quarantines or transportation restrictions.

China-made products make up a significant portion of many markets, including imported motor vehicle parts. Disrupted supply lines could potentially raise the price of after-market components. The automotive industry was already weakened by slow growth rates last year.

Avasant Partner, Robert Joslin has this take on manufacturers:

“The reduction in manufacturing may be a short-term impact due to plant closures. But I expect the consumption will return and could potentially even spike in the short term to catch back up on production demand. This will impact both the consumption of raw materials in the short term, as well as the resulting end products, creating the potential of a short-term drought of end productions and subsequent high demand as manufacturing capabilities come back on line.”

Once the pandemic eases, manufacturers need to get back quickly to full capacity. However, even when workers return, manufactures may find overseas demand slumping for their exports because of worsening COVID-19 epidemics in other countries. Based on the impact ratings in each dimension, we judge the overall impact on the manufacturing sector as severe.

Universities

The higher education sector is aggressively dealing with the pandemic, the effects of which could have implications for years to come.

Beyond efforts to limit the spread of infection on campuses, scores of universities and business schools are switching to online teaching and test taking — after years of slow uptake. For instance, universities such as Stanford, Georgetown, Notre Dame, and UCLA have cancelled classroom lessons for a month or the rest of the semester and will offer exams from home. Harvard has banned all university-related international air travel at least until the end of April 2020.

The pandemic has boosted online teaching platforms. For instance, Duke University has been using Coursera, an online learning platform, to enable classes to continue for students at their Duke Kunshan campus in China.

Long term, universities are preparing for substantial economic fallout, both from less revenue from student tuition and the risk that there will be fewer international—and higher fee-paying—students in their next intake.

Australia could be hard hit. The country has been heavily exposed because of its high level of Chinese students—200,000 attend universities across the country—forcing many institutions to adapt to managing remote learning and pastoral care for those stranded abroad or who have recently returned and are in quarantine. The International Education Association of Australia warned in March 2020 of a AU$6 billion to AU$8 billion hit if Chinese students cannot attend the first term.

This sector could be hard hit by COVID-19, and much depends on how long the effects last and if it compromises the fall term. Based on the impact ratings in each dimension, we judge the overall impact on the universities sector as major.

Nonprofits

The revenue for nonprofits will likely be greatly affected in the wake of COVID-19. Other nonprofits are donating millions to combat the virus.

Charities should start planning for a recession—even though it is not clear yet whether a recession is imminent. Nonprofits should focus on their core missions for now and shelve plans to expand into areas where they do not have expertise.

The Massachusetts Nonprofit Network, which represents about 7,000 nonprofits, is worried that some nonprofits will not be able to maintain their helping missions as the number of fundraising cancellations increase. Nonprofits often operate in a marginal financial position, so cancellations are difficult to absorb. For instance, the CEO of Easter Seals Massachusetts is concerned about the organization’s bottom line, because it canceled its huge Easter Seals’ fundraiser, which could bring in as much as $250,000 to the organization. That is a common story among nonprofits.

Meanwhile, donors and foundations continued to pour money into efforts to fight the coronavirus. Philanthropic funding to combat the coronavirus has topped $1 billion, including $182 million from U.S. sources, according to Candid, a foundation research group.

Many nonprofits are investing in research and development on the coronavirus. For instance, the Coalition for Epidemic Preparedness Innovations (CEPI) is supporting the coronavirus vaccine development of INO-4800 with a $9 million grant.

On the one hand, some nonprofits will receive increased funding to combat the pandemic, but overall, a worldwide recession will most likely cause grants and donations to decline. Based on the impact ratings in each dimension, we judge the overall impact on the nonprofits sector as major.

Travel and Transportation

This sector is one of the hardest hit, and the bad news keeps coming. As panic spreads, governments are taking unprecedented measures.

Thousands of planes have been grounded worldwide—more so now that the U.S. government has partially banned travel to and from the Schengen countries, excluding cargo, with some limitations depending on each country.

Avasant Partner, Carlos Hernandez, said the disruption is creating severe consequences for the global economy and extreme financial and operational pressures for the airlines, which employ some 2.7 million people and are facing more than $113 billion of lost revenue globally as they continue to cut capacity and take emergency measures to reduce costs. Several airline executives have taken pay cuts due to the dramatic drop in air travel. Hiring has been frozen, and layoffs could be next.

Along with all the postponed conferences, tens of thousands of business trips and vacations have been canceled. Many cruise ships have been quarantined in ports, and the U.S. State Department advised citizens to avoid cruises during the pandemic, particularly those individuals with underlying health conditions.

China has closed some transportation systems, and cities such as New York are contemplating curtailing or temporarily closing the subway system.

Based on the impact ratings in each dimension, we judge the overall impact on the travel and transportation sector as severe.

Computer Economics Viewpoint

If the OECD projections are right, and the coronavirus continues to spread, the global business community could eventually lose billions of dollars. Many industries on this list will be hard hit.

As mentioned above, the OECD says the pandemic could potentially cut the year’s global growth by half, to 1.5 percent for the year instead of the 2.9 percent that the research group had forecast before the pandemic took off. Global output was about $86.5 trillion in 2019, so that means $1.5 trillion of economic activity could be lost in the wake of COVID-19.

In the face of these dire scenarios, a robust business continuity plan is a must. And, in fact, a business continuity plan that includes scenarios for surviving a pandemic is even more important, although not enough enterprises include pandemic scenarios in their continuity plans. Computer Economics recently published a report on the subject.

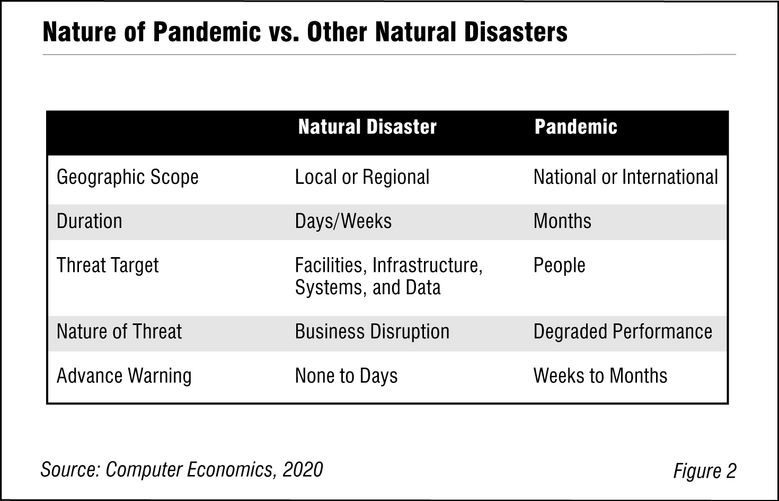

Pandemics such as COVID-19 present special challenges for IT risk managers. Most large organizations and many smaller ones have comprehensive business continuity and disaster recovery plans that provide contingency plans in the event of natural or man-made disasters, such as hurricanes, floods, earthquakes, or long-term power outages. In recent years, risk managers have refined those plans to take into account additional issues surrounding general or targeted terrorist attacks.

Although most business continuity plans do a good job of planning for these types of disasters, they are generally not adequate to deal with the entirely different type of threat that is posed by a pandemic. Figure 2 illustrates the primary differences between the threat of a natural disaster and the threat of a pandemic.

To provide a framework for planning, it is helpful to consider at least three scenarios for a potential pandemic. For example:

- A low-impact case, such as a limited outbreak that impacts 10% to 20% of the personnel in the primary data center but leaves personnel in the secondary data center location unaffected. There are no restrictions on business travel outside of the area with the outbreak.

- An intermediate-impact case, such as an outbreak that causes a quarantine to be imposed in the area of the primary data center and also causes some unavailability of personnel at the secondary data center. There are some restrictions on business travel.

- A worst-case scenario, such as an outbreak that is nationwide or international and affects 30% of personnel in all locations (up to 40% in worst hit locations), with quarantines imposed extensively and severe restrictions on travel.

As can be seen from this analysis, the current COVID-19 pandemic is already having significant impacts on the worldwide economy, but specifics vary according to industry sector. Business leaders should evaluate this impact and what they can do to mitigate risks to their own organizations, as well as to their communities and the world at large. Although many organizations do not address pandemic scenarios in their business continuity plans, the current situation is now compelling many to do so. Although the length of the pandemic is not known, the lessons learned now will make such plans much more robust in the future.